If you're a small tradesman or tradeswoman, managing your accounting can often be a daunting task. Keeping track of receipts, expenses, and financial transactions is crucial for the success of your business, but it can also be time-consuming and complicated. Fortunately, there are many accounting software solutions available designed specifically for tradesmen, offering features that simplify and streamline your financial management.

One of the key features to look for in accounting software for tradesmen is the ability to easily create and send professional invoices. This not only saves you time but also helps you maintain a professional image and ensure prompt payment for your services. Additionally, the software should offer advanced reporting capabilities, allowing you to generate customizable reports that provide a clear overview of your business's sales, expenses, and profitability.

Taxes are another important aspect of financial management for tradesmen. The right accounting software should be able to handle tax calculations and generate accurate tax reports, saving you the headache of manually calculating and reporting your taxes. Some software even offer integration with tax filing platforms, further streamlining the process.

Cloud-based accounting software is gaining popularity among businesses of all sizes, including tradesmen. With a cloud-based solution, you can access your financial data from anywhere, anytime, using any device with an internet connection. This allows you to stay on top of your finances and make informed decisions on the go. In addition, cloud-based software often offers automatic data backup and secure storage, ensuring the safety and integrity of your financial information.

Finally, payroll management is another important feature to consider when choosing accounting software for your trade business. The software should be able to handle payroll calculations, generate payslips, and keep track of employee records. This not only saves you time and effort but also ensures compliance with tax and employment regulations.

Overall, finding the best accounting software for tradesmen can greatly simplify your financial management, allowing you to focus on what you do best: running and growing your business. Consider your specific needs and requirements, and choose a software that offers the features and functionality that align with your goals and objectives.

Best Accounting Software for Tradesmen

As a tradesman, managing your bookkeeping and financial accounting can be a daunting task. However, with the right accounting software, you can streamline your financial management and stay on top of your taxes, expenses, and transactions.

One of the key features to look for in accounting software for tradesmen is the ability to handle invoicing and expenses efficiently. The software should allow you to create and send invoices to your clients, track your expenses, and manage your receipts.

Another important aspect is the software's reporting capabilities. A good accounting software should provide you with detailed reports on your sales, expenses, and taxes. These reports will help you gain insights into your business's financial performance and make informed decisions.

Payroll management is another crucial feature to consider. If you have employees, the software should allow you to manage their salaries, deductions, and taxes. This will save you time and ensure accuracy in your payroll calculations.

Cloud-based accounting software is becoming increasingly popular among tradesmen. With cloud software, you can access your financial data from anywhere, at any time. This flexibility is especially useful for tradesmen who are constantly on the go.

In conclusion, when choosing the best accounting software for tradesmen, look for features such as efficient invoicing, expense tracking, reporting, payroll management, and cloud accessibility. By selecting the right software, you can streamline your financial management and focus on growing your small business.

Overview and Importance of Accounting Software

Accounting software plays a crucial role in the sales, accounting, and tax management of businesses, especially those run by tradesmen. It allows small businesses to efficiently handle their financial transactions, track income and expenses, and automate bookkeeping processes. Traditionally, tradesmen had to rely on manual methods to keep track of their financial records, including receipts and invoices, and calculate tax obligations. However, with the advent of accounting software, these tasks can now be streamlined and managed more effectively.

One of the key advantages of accounting software for tradesmen is its ability to handle tax-related tasks. It simplifies the process of calculating and filing taxes, ensuring accurate and timely submissions. The software can generate tax reports, calculate tax liabilities, and even provide reminders for upcoming tax deadlines. This not only saves time and effort for tradesmen, but also minimizes the risk of errors and potential penalties for non-compliance.

Accounting software also provides essential functions for financial management, such as payroll processing. Tradesmen can easily track employee hours, calculate wages, and generate paychecks or direct deposits. Additionally, the software can handle other financial tasks like invoicing, expense tracking, and financial reporting. These features help tradesmen gain better control over their financial operations and make informed business decisions.

Cloud-based accounting software has become increasingly popular among tradesmen due to its flexibility and accessibility. It allows tradesmen to access their financial data and perform accounting tasks from anywhere, as long as they have an internet connection. This eliminates the need for physical storage of documents and simplifies collaboration with accountants or other stakeholders. Additionally, cloud-based software often offers automatic updates and backups, ensuring the security and integrity of financial data.

In conclusion, accounting software is a vital tool for tradesmen as it simplifies tax management, improves financial control, and streamlines bookkeeping processes. Adopting the right software can greatly enhance a tradesman's ability to manage their business efficiently and make informed financial decisions. Whether it's for tax purposes, expense tracking, payroll processing, or financial reporting, investing in accounting software is crucial for the success and growth of tradesmen businesses.

How accounting software can benefit tradesmen

Accounting software can provide numerous benefits for tradesmen. With the help of accounting software, tradesmen can streamline their financial management and improve their overall business efficiency.

Financial reporting: Accounting software allows tradesmen to easily generate various financial reports, such as profit and loss statements, balance sheets, and cash flow statements. These reports provide valuable insights into the financial health of the business and help tradesmen make informed decisions.

Small business taxes: Accounting software simplifies the process of preparing and filing taxes for tradesmen. It automatically calculates the tax liabilities, tracks deductible expenses, and generates tax forms, saving tradesmen time and reducing the risk of errors.

Cloud storage: Cloud-based accounting software enables tradesmen to access their financial data from anywhere, at any time, using any device with an internet connection. This flexibility allows tradesmen to stay on top of their financials even when they are on the go.

Receipt and invoice management: Accounting software allows tradesmen to easily track and categorize their receipts and invoices. It eliminates the need for manual data entry and reduces the risk of losing important financial documents.

Bookkeeping and expense management: Accounting software automates bookkeeping tasks, such as recording income and expenses, reconciling bank transactions, and managing accounts payable and receivable. This saves tradesmen time and ensures accurate financial records.

Payroll management: Accounting software can handle payroll processing, including calculating employee wages, withholding taxes, and generating pay slips. This simplifies the payroll process for tradesmen and ensures compliance with payroll regulations.

Improved sales management: Accounting software allows tradesmen to track their sales and monitor their revenue streams. It provides real-time insights into the profitability of different products or services, helping tradesmen identify their most profitable lines of business.

Overall, accounting software is an essential tool for tradesmen that can greatly simplify their financial management and help them run their businesses more efficiently. Whether it's tracking expenses, generating invoices, managing payroll, or staying compliant with tax regulations, accounting software provides tradesmen with the necessary tools to stay organized and focused on growing their businesses.

The importance of accurate financial record keeping

Accurate financial record keeping is crucial for businesses, especially for tradesmen who need to handle their finances effectively. With the help of accounting software, tradesmen can easily track their expenses, invoices, sales, and other financial transactions. This software enables them to maintain accurate and up-to-date records of all their financial activities.

One of the key benefits of using accounting software is the ability to easily manage taxes. Tradesmen can input their tax information and the software will calculate their tax liability automatically. This saves them the time and effort of manually preparing their tax returns and ensures that they are always compliant with tax regulations.

Cloud-based accounting software is particularly advantageous for tradesmen as it allows them to access their financial records from anywhere, at any time. This flexibility is especially useful for tradesmen who are constantly on the move and need to access their financial information on the go.

Accurate financial record keeping also plays a crucial role in proper expense management. With accounting software, tradesmen can easily track and categorize their expenses, making it easier to monitor and control their spending. This helps them make informed financial decisions and ensures that they are not overspending.

In addition to expense management, accounting software also provides valuable reporting features. Tradesmen can generate reports that provide insights into their business performance, such as profit margins, cash flow, and sales trends. These reports help tradesmen assess the financial health of their business and make informed decisions for its growth and success.

Accurate financial record keeping also simplifies the process of generating invoices and managing payroll. Tradesmen can easily create professional-looking invoices and send them to clients, improving their cash flow and reducing the risk of delayed payments. Additionally, accounting software allows tradesmen to manage their payroll efficiently, ensuring that employees are paid accurately and on time.

Overall, accurate financial record keeping is essential for tradesmen and all businesses. It enables them to stay organized, make informed financial decisions, and ensure compliance with tax regulations. By using accounting software, tradesmen can streamline their bookkeeping processes and focus on growing their business.

Key Features to Look for in Accounting Software

When searching for the best accounting software for small tradesmen businesses, there are several key features to consider:

- Expense Tracking: Look for accounting software that allows you to easily track and categorize your expenses. This feature will help you keep a close eye on your business expenditures.

- Invoicing: An accounting software with an invoicing feature will save you time and ensure that you can easily generate and send professional-looking invoices to your clients.

- Transaction Management: The ability to manage and reconcile your business transactions is an important feature to look for in accounting software. This will ensure that you have an accurate and up-to-date record of all financial activities.

- Cloud Integration: Opt for accounting software that offers cloud integration. This will allow you to access your financial data from anywhere at any time, making it convenient for you to manage your finances on the go.

- Payroll Management: If you have employees, it's crucial to have accounting software that includes payroll management features. This will help you accurately calculate and manage your employees' wages.

- Tax Reporting: Look for accounting software that has robust tax reporting features. This will simplify the process of preparing and filing your business taxes, saving you time and reducing the chances of errors.

- Bookkeeping: A good accounting software should have strong bookkeeping capabilities. Look for features such as automatic bank feeds, bank reconciliations, and general ledger management to make bookkeeping tasks easier and more accurate.

- Sales Management: If tracking and managing your sales is important to your business, choose accounting software that has robust sales management features. This will help you keep track of your sales performance and customer information.

By considering these key features, you can find the perfect accounting software for your tradesmen business, which will streamline your financial processes and help you stay on top of your business finances.

Simple interface and ease of use

When choosing accounting software for tradesmen, it's important to prioritize a simple interface and ease of use. Running a small business involves various tasks, from tax management to bookkeeping, and having software that is intuitive and user-friendly can make these processes much smoother.

The right accounting software should provide an easy-to-navigate platform that allows tradesmen to efficiently manage their financial data. This includes tracking expenses, generating invoices, and managing sales transactions. With a simple interface, tradesmen can easily input and review their financial information without the need for extensive training or technical knowledge.

Additionally, the software should offer features that streamline tasks such as payroll management and tax reporting. Tradesmen can save time and effort by using software that automates calculations and generates reports, eliminating the need for manual calculations and reducing the potential for errors.

Cloud-based accounting software is particularly beneficial for tradesmen. With cloud technology, tradesmen can access their financial data from any device with an internet connection. This allows for greater flexibility and convenience, especially for tradesmen who are frequently on the go.

In conclusion, choosing accounting software with a simple interface and ease of use is crucial for tradesmen. By streamlining tasks such as tax management, bookkeeping, and financial reporting, tradesmen can save time and focus on growing their business.

Invoicing and payment tracking capabilities

When it comes to managing the financial aspects of your small tradesmen business, having a reliable accounting software with invoicing and payment tracking capabilities is essential. A good accounting software allows you to easily create and send invoices to your clients, keeping track of all your sales and expenses. With the ability to generate professional-looking receipts and invoices, you can ensure that your business transactions are well-documented and organized.

Additionally, an accounting software with strong invoicing and payment tracking capabilities can help you manage your business taxes more efficiently. It can automatically calculate and keep track of your tax obligations, making it easier for you to file your tax returns accurately and on time. This not only saves you time but also reduces the risk of errors that could lead to penalties or audits from tax authorities.

A cloud-based accounting software is particularly useful for tradesmen businesses as it allows you to access your financial data from anywhere, anytime. This means you can easily generate invoices and track payments even when you're on the go or at a job site. Furthermore, a cloud-based accounting software often includes additional features such as payroll management and financial reporting, giving you a comprehensive solution for all your bookkeeping needs.

In conclusion, having an accounting software with invoicing and payment tracking capabilities is crucial for tradesmen businesses. It streamlines the process of creating and sending invoices, tracks payments, and ensures accurate tax calculations. Consider investing in a cloud-based accounting software to enjoy the convenience of accessing your financial data anytime, anywhere, while also benefiting from additional features such as payroll management and financial reporting.

Expense tracking and reporting

Managing expenses is an essential part of accounting for tradesmen. With the right software, tradesmen can easily track and report their expenses, helping them stay organized and compliant with tax regulations.

Cloud-based accounting software offers an efficient and convenient way for tradesmen to keep track of their expenses. This software allows tradesmen to easily capture and upload receipts, invoices, and other financial documents, ensuring that all expenses are properly accounted for.

By using accounting software, tradesmen can categorize their expenses according to specific tax codes, making it easier to calculate and report their tax obligations. This in turn helps tradesmen save time and effort when it comes to tax preparation and filing.

Expense tracking and reporting software also enables tradesmen to generate detailed expense reports that provide a clear overview of their financial transactions. These reports can be customized to include information such as total expenses by category, sales by client, or even tax deductions.

Furthermore, the software can generate graphs and charts that visually represent expense data, making it easier for tradesmen to analyze their spending patterns and identify areas for cost savings. This level of financial management and bookkeeping helps tradesmen make more informed decisions about their business and maximize profitability.

In summary, expense tracking and reporting software is essential for tradesmen to effectively manage their expenses, stay compliant with tax regulations, and make informed business decisions. With the right software, tradesmen can streamline their accounting processes, reduce administrative burdens, and focus on growing their business.

Top Accounting Software for Tradesmen

When it comes to managing the financial aspects of your tradesman business, having the right accounting software is essential. From generating invoices to tracking expenses and managing taxes, a good accounting software can streamline your bookkeeping process and save you valuable time and effort.

One of the top choices for tradesmen is cloud-based accounting software. With this type of software, you can access your financial data from anywhere, anytime, and collaborate with your team in real-time. It also offers automatic data backup and security features, ensuring that your important financial information is always safe.

Effective management of receipts is another important feature to consider. The best accounting software for tradesmen allows you to easily upload and categorize receipts, making it simple to track expenses and generate accurate financial reports. Some software even has OCR (Optical Character Recognition) technology, which automatically extracts data from your receipts and saves you from manual data entry.

When it comes to tax management, accounting software can be a lifesaver for tradesmen. It can calculate and generate tax forms, keep track of tax deadlines, and help you stay compliant with tax regulations. With a few clicks, you can generate reports that show your sales, expenses, and tax liabilities, making it easier to file your taxes accurately.

Payroll management is another crucial aspect for tradesmen with employees. Accounting software can automate the payroll process, calculate wages, taxes, and deductions, and generate pay stubs for your employees. This saves you time and ensures that your employees are paid accurately and on time.

In conclusion, the right accounting software can greatly simplify the financial management of your tradesman business. From automated bookkeeping and expense tracking to tax management and payroll, there are various software options available to suit the needs of small businesses in the trades industry.

Xero

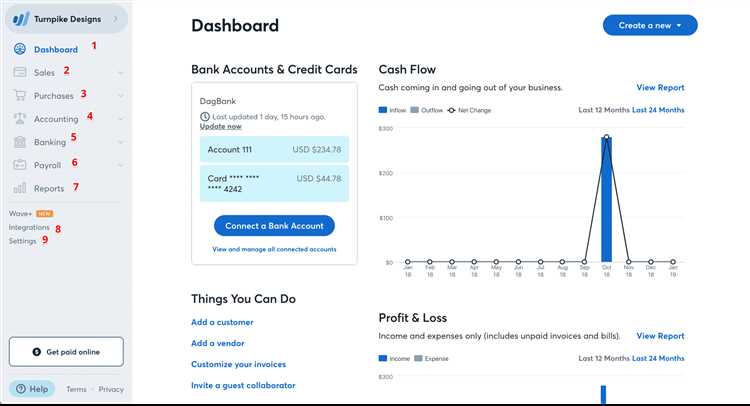

Xero is a popular cloud-based accounting software that is designed for small businesses. It offers a range of powerful features to streamline bookkeeping, sales, and financial management.

With Xero, businesses can easily track their income and expenses, generate real-time financial reports, and manage their tax obligations. The software also makes it easy to create and send professional invoices, manage outstanding invoices, and keep track of customer payments.

One of the key advantages of Xero is its easy integration with third-party apps. This allows businesses to automate tasks such as payroll, inventory management, and receipt tracking. Xero also offers a comprehensive payroll feature that allows businesses to manage employee wages, taxes, and benefits.

Another great feature of Xero is its ability to handle multiple currencies, making it ideal for businesses that operate internationally. The software also allows for easy reconciliation of bank transactions, helping businesses stay on top of their finances.

In conclusion, Xero is a powerful accounting software that offers a range of features to help businesses manage their financials. Its cloud-based nature and extensive integrations make it a flexible and scalable solution for businesses of all sizes.

QuickBooks Online

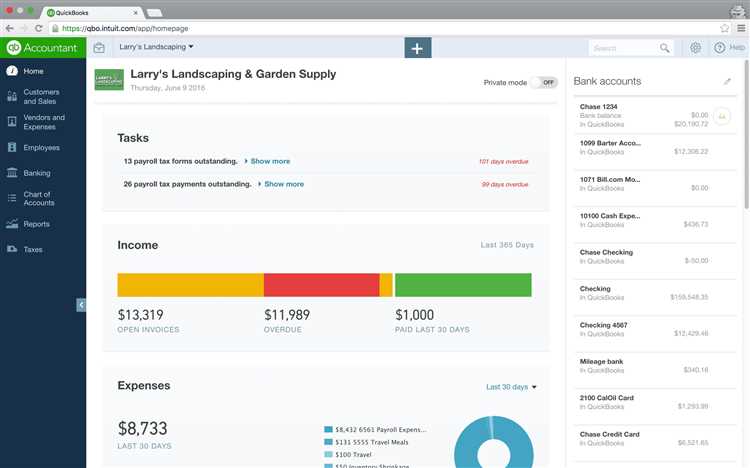

QuickBooks Online is a small business accounting software that is perfect for tradesmen. It offers a wide range of features to help manage finances, track expenses, and streamline bookkeeping processes.

With QuickBooks Online, tradesmen can easily keep track of their taxes and invoices. The software allows users to generate professional invoices and send them to clients directly from the platform. It also offers tools for managing and organizing financial transactions, such as sales and expenses.

One of the benefits of using QuickBooks Online is its cloud-based approach. This means that tradesmen can access their financial data from anywhere, at any time, as long as they have an internet connection. This is particularly useful for those who are always on the move and need to stay on top of their finances.

Another useful feature of QuickBooks Online is its payroll management capabilities. Tradesmen can easily track and manage employee hours, calculate payroll taxes, and generate pay stubs. This simplifies the process of paying employees and ensures compliance with tax regulations.

In addition to its financial management features, QuickBooks Online also provides robust reporting capabilities. Tradesmen can generate and customize various financial reports, including profit and loss statements, balance sheets, and cash flow reports. This allows for a comprehensive understanding of business performance and helps in making informed financial decisions.

Overall, QuickBooks Online is a powerful accounting software for tradesmen. Its cloud-based nature, advanced features, and user-friendly interface make it an ideal choice for small businesses looking to streamline their bookkeeping processes and manage their finances more efficiently.

FreshBooks

FreshBooks is a popular accounting software that is well-suited for tradesmen and small businesses. It offers a range of features to simplify and streamline financial management tasks.

With FreshBooks, tradesmen can easily track expenses and keep organized records of receipts. The software also helps with tax preparation, making it easy to calculate and file taxes accurately.

Accounting tasks such as recording transactions and managing invoices are made simple with FreshBooks. Users can create professional-looking invoices and send them to clients with just a few clicks. The software also offers options for automatic payment reminders and recurring invoices.

One of the key advantages of FreshBooks is its cloud-based nature. This means that tradesmen can access their financial data from anywhere and on any device with an internet connection. This makes it easy to stay on top of finances and manage bookkeeping tasks, even on the go.

In addition to accounting and financial management, FreshBooks also offers payroll services. Tradesmen can easily calculate and manage employee wages, ensuring accurate and timely payments. The software also helps with tax calculations related to payroll, saving time and reducing the risk of errors.

Reporting is another important feature of FreshBooks. The software provides a variety of customizable reports, allowing tradesmen to gain valuable insights into their business performance. These reports can be used to analyze profitability, track expenses, and make informed financial decisions.

In conclusion, FreshBooks is a comprehensive accounting software solution for tradesmen and small businesses. It offers a range of features for expense tracking, tax preparation, invoice management, payroll, and reporting. Its cloud-based nature makes it convenient and accessible, while its user-friendly interface ensures ease of use for non-accounting professionals.

Comparison of Accounting Software

When it comes to managing the financial aspects of your business, choosing the right accounting software is essential. Here is a comparison of some popular accounting software options available for tradesmen:

- QuickBooks: This software offers comprehensive features for sales, tax, and expense management. It also provides reporting capabilities to track your business performance and generate financial statements.

- Xero: Xero is a cloud-based accounting software that provides tools for bookkeeping, invoicing, and managing payroll. It also offers robust reporting options to analyze your business finances.

- FreshBooks: This software is designed specifically for small businesses and offers features like invoicing, expense tracking, and financial reporting. FreshBooks also allows you to easily manage your clients and track their payments.

- Wave: Wave is a free accounting software that provides basic features for small businesses. It includes invoicing, financial reporting, and expense tracking. However, it does not offer payroll management.

- Zoho Books: Zoho Books is a cloud-based accounting software that offers features like invoicing, expense tracking, and bank reconciliation. It also provides tax management tools to help you stay compliant with tax regulations.

Each of these accounting software options has its own strengths and weaknesses, so it's important to consider your specific business needs and budget when making a decision. Whether you need basic bookkeeping features or advanced financial reporting capabilities, there is a software that can meet your requirements.

Pricing and subscription options

When considering accounting software for tradesmen, it's important to take into account the pricing and subscription options available. Different software providers offer various pricing models, so you can choose the one that best suits your business needs.

Some software solutions charge a monthly subscription fee, while others offer a one-time payment option. It's essential to consider your budget and the features included in each plan. Keep in mind that additional fees may apply for certain functionalities, such as tax management or payroll processing.

For small businesses, it's crucial to find an accounting software that allows you to track expenses, sales, and invoices easily. Look for a solution that provides comprehensive financial reporting, as well as tools for bookkeeping and expense management.

Cloud-based software is becoming increasingly popular among tradesmen due to its flexibility and accessibility. With cloud accounting software, you can access your financial data from anywhere at any time, as long as you have an internet connection. This can be especially beneficial for tradesmen who are constantly on the move.

Some accounting software also offers advanced features, such as automated tax calculation and reporting. These features can save you time and ensure that you comply with tax regulations. Make sure to choose a software that has a user-friendly interface and provides clear instructions on how to manage your taxes efficiently.

- Consider your budget and business needs when choosing pricing and subscription options.

- Look for comprehensive financial reporting and expense management tools.

- Cloud-based software provides flexibility and accessibility.

- Advanced features like automated tax calculation can save time and ensure tax compliance.

Available integrations and add-ons

When choosing a financial software for your tradesmen business, it is important to consider the available integrations and add-ons that can enhance your accounting experience. Many accounting software options offer a range of integrations with other business tools and platforms, allowing for seamless integration of financial data and streamlining your workflow.

One common integration is with invoicing software. By integrating your accounting software with an invoicing tool, you can easily generate and send professional invoices to your clients, track payments, and manage your accounts receivable. This integration can save you time and ensure accurate and efficient billing processes.

Another important integration is with cloud storage solutions. By integrating your accounting software with a cloud storage platform, you can securely store and access your financial data from anywhere, at any time. This provides flexibility and peace of mind, as your important financial documents and records are safely backed up and easily accessible.

Payroll integration is also a valuable feature for many tradesmen businesses. By integrating your accounting software with a payroll tool, you can automate the process of managing employee wages, taxes, and benefits. This can save you time and reduce the risk of errors in calculating payroll.

Expense tracking is another area where integrations can be valuable. By integrating your accounting software with an expense tracking tool, you can easily record and categorize your business expenses, track receipts, and generate expense reports. This integration can help you stay organized and ensure accurate reporting of your business expenses.

Lastly, many accounting software options offer integrations with popular tax software. By integrating your accounting software with tax software, you can streamline your tax preparation processes, ensure accurate calculation of taxes, and generate tax reports. This integration can save you time and reduce the risk of errors in your tax filing.

In conclusion, when choosing an accounting software for your tradesmen business, consider the available integrations and add-ons that can enhance your financial management. Look for integrations with invoicing, cloud storage, payroll, expense tracking, and tax software to streamline your workflow and improve accuracy in your financial processes.

Customer support and training resources

When choosing the best accounting software for tradesmen, one important factor to consider is the availability and quality of customer support and training resources. As a tradesman, you want to make sure that you have access to a reliable support team that can help you with any issues or questions that may arise while using the software.

Look for software providers that offer 24/7 customer support through phone, email, and live chat. This ensures that you can get assistance whenever you need it, whether it's troubleshooting a technical problem or getting help with a specific feature.

In addition to customer support, training resources are also crucial for tradesmen who may not have extensive experience with accounting software. Look for software providers that offer comprehensive training programs, such as video tutorials, user guides, and webinars.

These resources can help you get up to speed quickly and ensure that you are using the software to its full potential. Some software providers even offer personalized training sessions where you can learn how to set up payroll, manage expenses, and generate financial reports specific to your tradesman business.

By choosing accounting software that offers robust customer support and training resources, you can be confident that you will have the assistance and knowledge necessary to effectively manage your business's financial transactions, bookkeeping, tax filings, and reporting. This can save you time and headache, allowing you to focus on what you do best – serving your customers and growing your tradesman business.

Pros and Cons of Using Accounting Software

Accounting software offers several benefits to small businesses and tradesmen when it comes to financial management. Here are some of the pros and cons of using accounting software:

- Efficient Transaction Management: Accounting software enables businesses to efficiently manage their financial transactions, including creating and tracking invoices, recording receipts, and monitoring expenses. This streamlines the bookkeeping process, saving time and effort.

- Accurate Reporting: By automating various accounting tasks, software ensures accurate financial reporting. Tradesmen can generate detailed reports on sales, expenses, profits, and other financial data, providing crucial insights for decision-making.

- Centralized Data: Accounting software stores all financial information in one place, making it easily accessible and eliminating the need for physical records. This reduces the risk of data loss or misplacement and allows for efficient data management.

- Tax Compliance: Many accounting software solutions integrate tax calculation functionalities, simplifying the process of preparing and filing tax returns. Businesses can ensure compliance with tax regulations and avoid penalties or audits.

- Cloud-Based Accessibility: Cloud-based accounting software allows tradesmen to access their financial data from anywhere, using any device with an internet connection. This flexibility enables remote work and collaboration with accountants or team members.

While accounting software offers numerous advantages, it is essential to consider the potential drawbacks as well:

- Cost: Depending on the features and functionalities, accounting software can be expensive, especially for small businesses with limited budgets.

- Learning Curve: Implementing accounting software requires some learning and adaptation to the new system. It may take time for businesses to fully understand and utilize all the software's features.

- Data Security: Storing financial data online raises concerns about data security. Tradesmen must choose reputable and secure accounting software providers and implement appropriate security measures to protect sensitive information.

- Dependency on Technology: Reliance on accounting software means businesses are dependent on technology. Any technical issues or software malfunctions can disrupt financial operations and require immediate troubleshooting.

- Limited Customization: While accounting software offers predefined features, it may not fully cater to the specific needs of every business. Customization options are often limited, and businesses may need to adapt their processes to fit the software's functionalities.

In conclusion, accounting software provides valuable tools for small businesses and tradesmen to manage their finances efficiently. However, considering the potential drawbacks is crucial in determining the suitability of accounting software for each business's needs.

Advantages of automation and time savings

Automation and time savings are key benefits for tradesmen when using accounting software. By automating tasks such as receipt and invoice management, financial bookkeeping, and expense tracking, businesses can save valuable time that can be better spent on core operations.

With accounting software, tradesmen can easily generate invoices and manage transactions with just a few clicks. This eliminates the need for manual data entry and reduces the chances of human error. The software can also automatically categorize expenses, making it easier to track and manage financial records.

Additionally, accounting software streamlines the tax preparation process. With built-in tax features, tradesmen can easily calculate and file their taxes, ensuring compliance with tax regulations. This not only saves time but also helps to prevent costly mistakes that can lead to penalties and fines.

Moreover, cloud-based accounting software allows tradesmen to access their financial data from anywhere, at any time. This flexibility enables users to stay on top of their business finances, regardless of their location. It also simplifies collaboration with accountants or other team members, as information can be easily shared and updated in real-time.

Another time-saving feature of accounting software is automated reporting. Tradesmen can generate financial reports with just a few clicks, saving hours of manual data compilation. This allows for better visibility into the financial health of the business, helping tradesmen make informed decisions and plan for the future.

In conclusion, accounting software offers numerous advantages for tradesmen, ranging from time savings to improved financial management. By leveraging automation and cloud technology, small businesses can streamline their accounting processes, reduce manual errors, and ultimately focus more on growing their business.

Challenges and potential limitations

Tradesmen face unique challenges when it comes to managing their business finances. One of the main challenges is keeping track of expenses. With various costs associated with their trade, such as materials, equipment, and labor, it can be difficult to accurately record and categorize these expenses.

Another challenge is ensuring compliance with tax regulations. Tradesmen are responsible for knowing and accurately reporting their income and expenses for tax purposes. This can be complex, especially for small businesses, as they may have multiple income streams and deductions to consider.

Managing sales and invoices can also be a challenge for tradesmen. They need to stay on top of their outstanding invoices and ensure that they are promptly paid. Additionally, they need to keep a record of all sales transactions for financial reporting purposes.

Payroll management is another potential limitation for tradesmen. If they have employees, they need to handle payroll taxes and deductions accurately and in a timely manner. This can be a time-consuming task, especially for businesses that do not have dedicated payroll departments.

Receipts and record-keeping are crucial for tradesmen. They need to keep track of all their financial transactions, including purchases, sales, and expenses. This requires proper bookkeeping and organization to ensure that all necessary documentation is maintained.

While accounting software can help tradesmen overcome these challenges and limitations, it is important to choose the right software that meets their specific needs. The software should be able to handle the unique requirements of tradesmen, such as tracking expenses by project or client and generating detailed financial reports for tax purposes.

Tips for Choosing the Right Accounting Software

When it comes to selecting the best accounting software for your business, there are several important factors to consider. By choosing the right software, you can streamline your bookkeeping, automate tax calculations, and efficiently manage your expenses.

1. Determine your specific business needs: Before you start looking for accounting software, assess your business requirements. Consider the size of your business, the volume of transactions, and the complexity of your reporting needs. This will help you narrow down the options and focus on software that is tailored to your needs.

2. Look for cloud-based solutions: Cloud-based accounting software offers several advantages. It allows you to access your data from anywhere, collaborate with your team, and automatically back up your information. Additionally, cloud-based software often offers automatic updates and is more secure than traditional software.

3. Consider the features: Make a list of the features you require in an accounting software. This could include features such as invoicing, expense management, payroll, sales tracking, and tax calculation. Assess the software's ability to handle these tasks efficiently and accurately.

4. Check for integration capabilities: If you are already using other software systems for your business, such as CRM or project management tools, ensure that the accounting software you choose can integrate with them. This will help streamline your processes and eliminate the need for manual data entry.

5. Read user reviews and seek recommendations: Before making a final decision, read reviews from other businesses in your industry. Look for feedback on the software's ease of use, customer support, and overall performance. Additionally, reach out to fellow tradesmen or industry associations for recommendations.

6. Consider scalability: As your business grows, your accounting needs may change. Therefore, choose software that can handle your current requirements and has the flexibility to accommodate future growth. This will save you from the hassle of switching to a new software system in the future.

Taking the time to choose the right accounting software is crucial for the success of your business. Consider your specific needs and requirements, and carefully evaluate the features and capabilities of different software options. With the right software in place, you can effectively manage your finances, stay on top of your taxes, and make informed decisions for your business.

Assessing your business needs and goals

When it comes to managing a small tradesman business, keeping track of your financials is crucial for success. An accounting software specifically designed for tradesmen can provide the necessary tools to streamline your business processes and stay on top of your finances.

One key feature to consider in an accounting software is cloud-based functionality. With cloud-based software, you can access your financial data from anywhere, at any time, using any device with an internet connection. This allows you to easily manage your business on the go and reduce the need for physical documentation.

Another important aspect of accounting software for tradesmen is reporting capabilities. Look for software that offers customizable reporting options, so you can easily generate reports on sales, expenses, taxes, and more. These reports can provide valuable insights into the financial health of your business and help you make informed decisions.

Efficient bookkeeping is also essential for tradesmen businesses. Look for software that enables you to easily track your transactions, manage receipts and invoices, and reconcile bank statements. This can save you time and effort in organizing your financial records and ensure accurate bookkeeping.

In addition to core accounting features, some software also offer payroll management functionality. This can help you streamline your payroll processes, calculate and manage employee wages, and ensure compliance with tax regulations.

In conclusion, when assessing your business needs and goals, consider the specific accounting requirements of tradesmen businesses. Look for software that offers strong financial management features, cloud-based accessibility, robust reporting capabilities, efficient bookkeeping tools, and payroll management functionality. Taking these factors into account can help you find the perfect accounting software for your tradesmen business.

Reading customer reviews and testimonials

When it comes to finding the best accounting software for tradesmen, reading customer reviews and testimonials can provide valuable insight. By hearing from other small businesses and tradesmen who have used the software, you can gain a better understanding of its features and benefits.

Customer reviews can give you an idea of how easy the software is to use and whether it effectively manages expenses, receipts, and invoices. Testimonials can also shed light on how well the software handles financial reporting and tax management, which are crucial for businesses in the tradesmen industry.

Reading customer feedback can help you gauge whether the software meets your specific needs as a tradesman. For example, you might be looking for accounting software that is cloud-based, allowing you to access your financial information from anywhere. Customer reviews can indicate whether the software offers this feature and how well it performs.

Additionally, customer reviews can provide insight into the software's customer support and training options. As a tradesman, you may not have extensive accounting or bookkeeping knowledge, so it's important to choose software that offers adequate support and resources. By reading reviews, you can determine whether the software provides the necessary assistance for payroll management and tax filing.

Overall, reading customer reviews and testimonials can help you make an informed decision when choosing accounting software for your tradesmen business. By considering the experiences and opinions of other small businesses in the industry, you can find the perfect solution to effectively manage your finances and taxes.

Requesting demos or free trials

When looking for the best accounting software for tradesmen, it is essential to explore different options before making a decision. One way to do this is by requesting demos or free trials from various software providers. This allows businesses to get a hands-on experience with the software and evaluate its features and functionalities.

During the demo or free trial, tradesmen can test how easy it is to record receipts, manage bookkeeping, create and send invoices, and generate financial reports. They can also see if the software offers payroll functionality to handle employee salaries and taxes.

Cloud-based accounting software often provides the option to import and categorize transactions automatically, saving time and reducing errors. By trying out the software, tradesmen can determine if it meets their specific accounting needs and integrates with other business tools they use.

Furthermore, requesting demos or free trials allows tradesmen to assess the user interface and ease of navigation. This is crucial since small business owners need an intuitive and user-friendly platform that does not require extensive training.

A demo or free trial also provides an opportunity to evaluate the level of customer support provided by the software provider. This is important as tradesmen may need assistance with troubleshooting issues or getting answers to questions.

By taking advantage of demos or free trials, tradesmen can compare different accounting software options and make an informed decision based on their specific needs and preferences. This ensures that the chosen software offers the necessary features and functions to handle the finances effectively, track expenses, calculate taxes, manage sales, and keep accurate financial records.

Implementation and Setup of Accounting Software

Implementing and setting up accounting software is a crucial step for small businesses and tradesmen to streamline their financial management. With the right accounting software, businesses can automate many aspects of their financial tasks, including transactions, payroll, invoices, and sales.

One of the key advantages of using accounting software is the ability to accurately track and manage business expenses. This includes keeping track of receipts, categorizing expenses, and generating detailed reports for tax purposes. The software can also help businesses automate the process of preparing and filing taxes, saving both time and money.

When implementing accounting software, it is important to choose a solution that is compatible with the specific needs of tradesmen and small businesses. Many accounting software solutions offer cloud-based options, which allow for remote access and real-time updates. This can be especially beneficial for tradesmen who often work on-the-go and need access to their financial information from anywhere.

To ensure a smooth implementation and setup process, it is recommended to consult with an accounting professional or software specialist. They can provide guidance on choosing the right software, customizing settings, and integrating the software with other business management tools.

Overall, implementing and setting up accounting software is essential for tradesmen and small businesses to effectively manage their finances. The right software can simplify bookkeeping, automate processes, and provide accurate reporting to support informed financial decision-making. With proper implementation and setup, accounting software can become an invaluable tool for financial management and business success.

Installation and initial configuration

Installing accounting software for your tradesmen business is an essential step towards efficient tax and accounting management. Before you start the installation process, it is recommended to assess your business needs and choose a software that caters specifically to small businesses in the tradesmen industry.

Once you have selected the right software, you can proceed with the installation process. Most accounting software can be easily installed on your computer or accessed via the cloud. Cloud-based software offers the advantage of accessing your financial data from anywhere, at any time.

After installation, you will need to configure the software according to your business requirements. This includes setting up your chart of accounts, payroll details, and tax rates. It is important to enter accurate information to ensure accurate reporting and bookkeeping.

Furthermore, you will need to customize your software to match your business branding. This includes adding your logo and contact information to invoices, receipts, and other financial documents. Personalizing your software adds a professional touch to your business management.

Once the initial configuration is complete, you can start managing your financial transactions, such as sales and expenses, effectively. The software allows you to generate invoices, track receipts, and monitor cash flow, making it easier to manage finances and stay on top of your business's financial health.

In conclusion, choosing the right accounting software and completing the installation and initial configuration are crucial steps for tradesmen businesses. With the right software in place, you can streamline your financial management, improve reporting accuracy, and focus on growing your business.

Importing existing data

When searching for the best accounting software for tradesmen, one important feature to consider is the ability to import existing data. Whether you are a small business owner, a tradesman, or a freelancer, chances are you already have some financial and accounting data that you want to transfer into the new software.

With the right accounting software, you can easily import data such as sales invoices, receipts, and expenses. This can save you a significant amount of time and effort compared to manually entering all the information. Additionally, importing existing data ensures accuracy and consistency in your financial records.

Most accounting software for tradesmen offers the option to import data from various sources, including spreadsheets or other accounting software. Some software also allows you to import data directly from your bank accounts or credit card statements, making it even easier to keep track of your financial transactions.

Importing existing data is particularly helpful when it comes to tax management. By importing your financial data into the accounting software, you can generate accurate tax reports and easily file your taxes. This can save you from the hassle of manual reporting and ensure that you are compliant with tax regulations.

In addition to taxes, importing existing data allows you to have a comprehensive view of your business's financial health. You can analyze your sales, expenses, and payroll data to gain insights into your business's performance. This information can help you make informed decisions and plan for the future.

Furthermore, importing existing data into accounting software that offers cloud-based storage allows you to access your financial information from anywhere at any time. This can be particularly beneficial for tradesmen who are constantly on the go and need access to their financial records on the job site.

Training staff on software usage

Implementing new accounting software can be a challenge for small businesses, especially when it comes to training staff on its usage. However, with the right approach, training can be efficient and effective.

Start by explaining the benefits of using the software, such as automating tasks like recording receipts, tracking transactions, and managing taxes. Emphasize how the software can streamline the accounting and financial reporting processes, making it easier for the business to stay organized.

Provide hands-on training sessions where staff can practice using the software. This can include step-by-step demonstrations, interactive exercises, and real-life examples relevant to the business. Encourage staff to ask questions and provide support throughout the training process.

Additionally, consider creating user manuals or instructional videos that staff can refer to when they need a refresher or encounter specific challenges. These resources should cover topics like entering expenses, recording sales, and managing payroll. Make the resources easily accessible, either in print or via the cloud, so that staff can access them whenever needed.

Lastly, establish a feedback loop to gather staff input on the software's usability and identify any areas that may need improvement. Encourage staff to share their experiences and suggestions for enhancing the software's user-friendly features and addressing any pain points they may encounter.

Best Practices for Using Accounting Software

When it comes to managing the financial aspects of your small trade business, having reliable accounting software is essential. Here are some best practices to follow when using accounting software:

- Choose a cloud-based software: Opt for a cloud-based accounting software as it allows you to access your financial data from anywhere and at any time. This is especially beneficial for tradesmen who are constantly on the go.

- Accurate bookkeeping: Ensure you keep your books up to date by recording all transactions, expenses, sales, receipts, and invoices in a timely manner. Regularly reconcile your accounts to identify any discrepancies.

- Automate processes: Take advantage of the automation features in your accounting software to streamline your financial management. Automate tasks such as payroll processing, invoice generation, and financial reporting.

- Track expenses: Maintain a detailed record of all your business expenses. Categorize them properly to make tax time easier and more efficient. This will also help you track your spending and identify areas where costs can be optimized.

- Generate accurate reports: Leverage the reporting capabilities of your accounting software to gain insights into the financial health of your business. Regularly review financial reports such as profit and loss statements, balance sheets, and cash flow statements to make informed decisions.

- Stay compliant with tax regulations: Utilize your accounting software to stay updated with tax regulations and requirements. Ensure that your software accurately calculates and tracks sales tax, VAT, and other taxes applicable to your business.

- Keep data secure: Protect your financial data by implementing strong security measures. Use secure passwords, enable two-factor authentication, and regularly backup your data to prevent loss or unauthorized access.

By following these best practices, you can effectively use accounting software to streamline your financial management and ensure the success of your trade business.

Regularly reconcile and review financial statements

In order to maintain accurate financial records and ensure that all taxes and expenses are accounted for, it is important for small businesses and tradesmen to regularly reconcile and review their financial statements. This process involves comparing the transactions and balances recorded in the business's accounting software with the supporting documentation, such as receipts and invoices. By doing so, tradesmen can identify any discrepancies or errors and take the necessary steps to correct them.

Regularly reconciling and reviewing financial statements also allows businesses to track their expenses and identify areas where they can cut costs or improve efficiency. This can be especially valuable for tradesmen, who often have to manage numerous expenses related to equipment, materials, and payroll. By closely monitoring their financial statements, tradesmen can ensure that they are making the most of their resources and maximizing their profits.

Another benefit of regularly reconciling and reviewing financial statements is that it helps tradesmen stay compliant with tax regulations. By accurately recording and reporting their income and expenses, tradesmen can minimize their tax liability and avoid any penalties or audits. Additionally, having up-to-date financial statements makes it easier for tradesmen to prepare for tax season and provide the necessary documentation to their accountant or tax software.

Overall, regular reconciliation and review of financial statements is an essential part of effective bookkeeping and financial management for tradesmen. By staying organized and keeping track of their transactions and balances, tradesmen can make informed decisions about their business, manage their cash flow effectively, and ensure compliance with tax regulations.

Back up data and maintain data security

In today's digital age, data is a valuable asset for businesses of all sizes. For tradesmen, it is essential to have a robust system in place to back up and secure their financial data. Using accounting software specifically designed for tradesmen can help ensure that your data is protected and accessible at all times.

One of the key features of accounting software is the ability to back up your data automatically. This means that all your financial information, including transaction history, invoices, receipts, and expenses, is regularly saved and stored in a secure location. In case of any system failures or data loss, you can easily restore your data and continue with your business operations without any disruption.

Data security is another critical aspect of accounting software for tradesmen. With the increase in cyber threats and data breaches, it is crucial to protect your business's sensitive information, such as payroll details, tax records, and financial statements. Most accounting software offers robust security measures, including encryption, firewalls, and multi-factor authentication, to ensure that your data is safe from unauthorized access.

Additionally, accounting software can help you meet your tax obligations by generating accurate and detailed reports. You can easily track sales, expenses, and other financial transactions, making it easier to prepare and file your taxes. Some software even offers integration with tax preparation services, further streamlining the tax filing process for tradesmen.

In summary, using accounting software tailored for tradesmen can help you back up your data automatically and maintain data security. It not only protects your valuable financial information but also streamlines your bookkeeping and reporting processes. Consider investing in accounting software to ensure the smooth and efficient management of your small business.

Stay updated with software updates and new features

As a small business owner or a tradesman, it is essential to stay updated with the latest software updates and new features in accounting software. These updates often include improvements in payroll management, financial reporting, tax calculations, and other important features that can greatly benefit your business.

One of the key advantages of using cloud-based accounting software for tradesmen is that updates are typically automatic and seamless. This means that you don't have to worry about manually installing updates or missing out on new features. The software provider takes care of all the technical aspects, allowing you to focus on your core business activities.

The updates and new features in accounting software can have a significant impact on your business processes. For example, new features may enhance your ability to manage receipts and expenses more efficiently, simplifying the bookkeeping process. Additionally, software updates often include improvements in tax calculations and reporting, ensuring that your taxes are accurate and compliant.

By staying updated with software updates and new features, you can take advantage of the latest tools and functionalities that can streamline your accounting processes. For example, some software may offer advanced invoice management features, allowing you to easily create and send professional invoices to your customers. Others may provide improved sales reporting capabilities, enabling you to track your sales and analyze your business performance more effectively.

In conclusion, staying updated with software updates and new features is crucial for tradesmen and small businesses. By regularly checking for updates and exploring new features, you can maximize the benefits of your accounting software and ensure that your business operates efficiently and effectively.

Additional Resources and Support for Tradesmen

Managing the financial aspects of a trade business can be overwhelming, especially when it comes to keeping track of invoices, receipts, and expenses. Fortunately, there are a variety of resources and support available to help tradesmen streamline their accounting processes and ensure accurate financial management.

Accounting software is a valuable tool for tradesmen. It allows businesses to easily create and send invoices, track sales and expenses, and manage payroll. With cloud-based accounting software, tradesmen can access their financial data from anywhere, making it easier to stay organized and up-to-date with their bookkeeping.

In addition to accounting software, tradesmen can benefit from online resources and guides that provide guidance on tax compliance and reporting. These resources can help tradesmen understand their tax obligations and ensure they are accurately reporting their income and expenses.

Tradesmen can also tap into the support of professional accountants who specialize in working with small businesses. These experts can provide guidance on managing finances, tax planning, and ensuring compliance with accounting standards. Outsourcing accounting tasks to a professional allows tradesmen to focus on their core business activities while ensuring their financials are in order.

Furthermore, tradesmen can take advantage of workshops and seminars that offer training on financial management and accounting best practices. These events provide an opportunity to learn from industry experts and gain valuable insights into optimizing financial processes and maximizing profitability.

In conclusion, there are various resources and support options available for tradesmen to enhance their financial management. From accounting software and online resources to professional services and educational events, tradesmen can find the assistance they need to stay on top of their finances, comply with tax regulations, and achieve long-term success.

Online tutorials and user guides

When it comes to tax and bookkeeping for tradesmen, it's important to stay organized and keep track of your finances. Online tutorials and user guides can be a valuable resource in helping you navigate through the complexities of managing your financial records.

With the help of online tutorials, you can learn how to properly handle receipts, record expenses, and generate accurate financial reports. These tutorials provide step-by-step instructions on how to set up your accounting system, manage transactions, and reconcile your accounts.

User guides, on the other hand, offer detailed information on various aspects of accounting for tradesmen. From understanding tax regulations and deductions to handling sales and payroll, these guides provide comprehensive knowledge on how to effectively manage your small business finances.

Cloud accounting software often comes with its own online tutorials and user guides, making it easy for tradesmen to learn how to use the platform. These resources provide in-depth information on how to create and send professional invoices, track expenses, and generate real-time financial reports.

In addition to tutorials and user guides, some accounting software platforms also offer interactive features such as FAQ sections, forums, and online communities where tradesmen can ask questions and get answers from experts in the field. This can be especially helpful for businesses that are new to cloud accounting and need guidance on specific issues.

Whether you're just starting out or looking to streamline your accounting processes, online tutorials and user guides are an invaluable tool for tradesmen to effectively manage their finances and ensure compliance with tax regulations.

Accounting software forums and communities

When it comes to managing taxes, software forums and communities can be a valuable resource for small businesses and tradesmen. These online platforms provide a space for discussions and knowledge-sharing on topics such as payroll, business expenses, financial reporting, and bookkeeping.

Joining a community of like-minded professionals can help tradesmen stay up-to-date with the latest trends and best practices in accounting software. Members can share their experiences and recommendations for the best accounting software suited for their specific needs, whether it's cloud-based solutions or software tailored for tradesmen.

Accounting software forums and communities provide a platform for tradesmen to ask questions and get answers from experts and fellow business owners. They can seek advice on tax management, financial reporting, receipts and invoices, or any other accounting-related queries. Members can also exchange tips and tricks for efficiently managing their transactions and business expenses.

These forums can also be a great place to find resources and tools to streamline accounting processes. Members can discover new tools for tax filing, expense tracking, and payroll management that can help them save time and improve their overall financial management.

In addition to knowledge-sharing and support, accounting software forums and communities often host events, webinars, and training sessions to further enhance the accounting skills of tradesmen and small businesses. Members can participate in workshops and gain insights on various accounting topics, enabling them to make informed financial decisions for their businesses.

In conclusion, accounting software forums and communities offer a wealth of information and support for tradesmen and small businesses. By actively participating in these platforms, professionals can stay informed, learn from others, and gain valuable insights into the best accounting practices for their businesses.

Professional accounting services for tradesmen

When it comes to running a successful business in the trades industry, keeping track of sales, bookkeeping, and managing financial transactions is crucial. That's where professional accounting services for tradesmen come in. These services provide specialized support to businesses in the trades industry, ensuring that their finances are in order and their accounting processes are efficient.

One of the key aspects of accounting services for tradesmen is the management of invoices, receipts, and expenses. These services help tradesmen keep track of their income and expenses, ensuring that all financial transactions are accurately recorded and organized. This not only helps tradesmen stay on top of their finances but also makes it easier for them to prepare for tax season.

Cloud-based accounting software is often used by accounting services for tradesmen. This allows tradesmen to access their financial data from anywhere, at any time. The software provides tools for creating and sending invoices, tracking expenses, and generating financial reports. It also simplifies payroll management, making it easier for tradesmen to handle employee wages and ensure compliance with tax regulations.

Small business owners in the trades industry can benefit greatly from professional accounting services. These services provide them with the expertise and resources they need to effectively manage their finances, minimize tax liabilities, and ensure the overall financial health of their businesses. By outsourcing their accounting needs, tradesmen can focus on their core business activities and leave the financial management to the professionals.

In conclusion, professional accounting services for tradesmen offer a wide range of benefits for businesses in the trades industry. From efficient bookkeeping to tax management and payroll services, these services help tradesmen save time and money, while ensuring accuracy and compliance with financial regulations. By utilizing cloud-based accounting software and working with experienced professionals, tradesmen can streamline their financial processes and focus on growing their businesses.