Lawyers, as trusted professionals, have the responsibility to manage and protect client funds with a high degree of accuracy and compliance. Trust accounting is a critical aspect of a law firm's financial management, ensuring that client funds are appropriately handled and transactions are recorded accurately.

With the increasing complexity of legal and financial regulations, it is crucial for lawyers to have reliable trust accounting software that can automate and streamline the process of managing client funds. Such software provides tools and features for audit, compliance, and bookkeeping, helping lawyers maintain accurate and transparent financial records.

Trust accounting software for lawyers enables comprehensive management of client funds, including tracking payments, generating reports, and reconciling transactions. It ensures that lawyers can easily manage trust accounts and maintain a clear audit trail of all financial activities related to client funds.

By choosing the best trust accounting software, lawyers can have peace of mind knowing that their trust accounting processes are accurate, efficient, and compliant with the legal and financial requirements. With reliable software, lawyers can focus on providing excellent legal services to their clients, while the software takes care of the financial management aspect of their practice.

Choose the Best Trust Accounting Software for Lawyers: Reliable Solutions

Trust accounting is a crucial aspect of bookkeeping for lawyers, as they handle client funds and must ensure compliance with legal and financial regulations. To effectively manage trust accounts, lawyers need reliable trust accounting software that provides secure and efficient solutions.

Trust accounting software for lawyers should offer features that enable easy management of client funds, including tracking and recording all financial transactions. This includes the ability to process payments, maintain accurate records, and generate reports for audit and legal purposes.

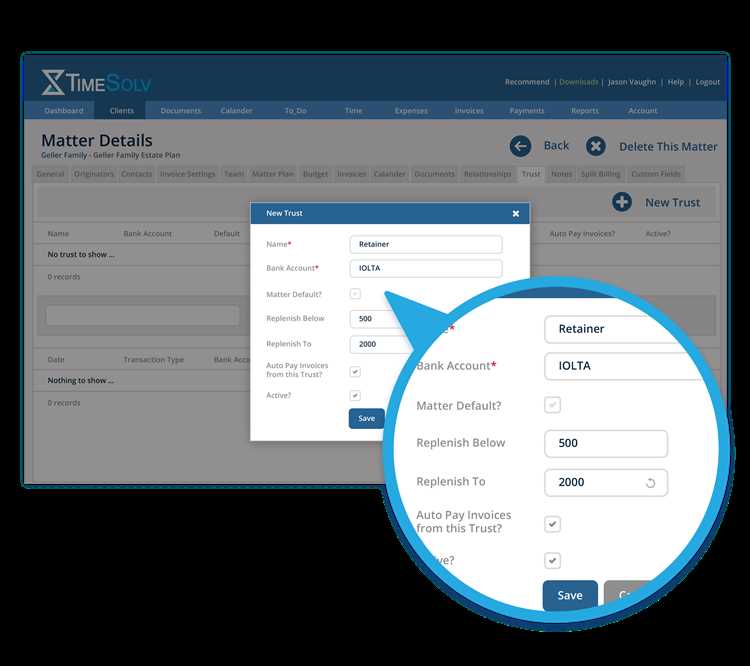

One important aspect of trust accounting software is the ability to handle multiple trust accounts for different clients and matters. Lawyers often need to manage funds for various clients simultaneously and need software that simplifies this process. The software should allow for easy segregation and management of funds, ensuring that each client's funds are properly accounted for.

Security is also a paramount concern when it comes to trust accounting software for lawyers. The software should have robust security measures in place to protect sensitive client information and financial data. This includes encryption of data, user access controls, and regular backups to prevent loss of records.

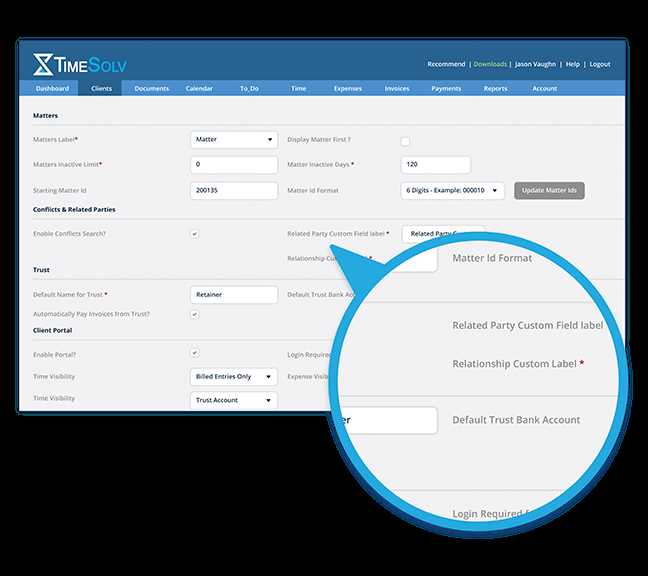

In addition to basic accounting functions, trust accounting software for lawyers should include features that specifically cater to the unique needs of law firms. This could include integration with case management systems, time-tracking tools, and document management systems to provide a comprehensive solution for legal professionals.

Overall, choosing the best trust accounting software for lawyers requires careful consideration of factors such as compliance, security, efficiency, and integration. By selecting a reliable and feature-rich software solution, lawyers can effectively manage their trust accounts and maintain the financial integrity of their law firms.

Understanding the Importance of Trust Accounting Software

Trust accounting software is an essential tool for lawyers and law firms to effectively manage and track their clients' trust accounts. With the complexity of bookkeeping and financial transactions involved in trust management, having reliable software in place is crucial.

One of the primary purposes of trust accounting software is to ensure the proper handling of client funds. Trust accounts are established to hold client money separate from the law firm's own operating accounts. This separation is essential to maintain the trust and confidence of clients, as well as comply with legal and ethical obligations.

Trust accounting software provides a secure and transparent platform for managing trust funds. It allows lawyers and their clients to easily track and monitor all financial transactions, such as deposits, withdrawals, and transfers. With this software, records of each transaction can be organized and easily accessible for future reference or auditing purposes.

In addition to maintaining accurate records, trust accounting software also helps lawyers ensure compliance with legal and regulatory requirements. It can automate the calculation and distribution of the appropriate taxes on behalf of the client. This helps avoid costly errors or penalties in tax reporting and payments.

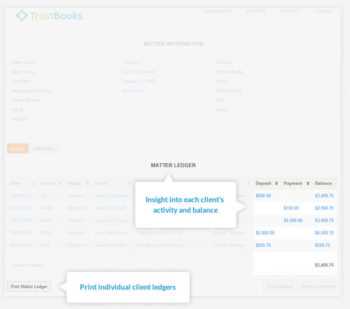

Furthermore, trust accounting software assists in managing the financial health of the law firm itself. By providing real-time insights into the client trust accounts, it enables lawyers to make informed decisions regarding their business operations and financial planning. This software can also generate reports that assist with regular financial audits and reviews.

In summary, trust accounting software plays a critical role in the efficient and secure management of client funds for lawyers and law firms. Its features and capabilities aid in maintaining accurate records, ensuring compliance with legal and ethical obligations, and providing financial transparency to clients. By investing in reliable software, lawyers can streamline their trust accounting processes and focus on delivering quality legal services to their clients.

Why Trust Accounting Software is Essential for Lawyers

Lawyers handle client funds and are required to keep accurate trust accounting records. Trust accounting software is essential for lawyers because it provides the necessary tools for trust fund management and ensures compliance with legal and financial regulations.

Trust accounting software streamlines the process of tracking client funds and managing trust accounts. It allows lawyers to record trust transactions, such as incoming and outgoing payments, and maintain an audit trail of all financial activities. This ensures that every transaction is accurately recorded and can be easily reviewed.

The software also helps with compliance by automatically calculating trust account balances, ensuring that trustees are not overdrawing from client funds, and flagging any irregularities or suspicious activities. This helps lawyers comply with trust accounting rules and provides a higher level of security for clients' funds.

Additionally, trust accounting software simplifies the bookkeeping process by automatically generating trust account statements and reports that can be easily shared with clients and financial institutions. This saves lawyers valuable time and ensures accurate reporting for tax purposes.

In conclusion, trust accounting software is essential for lawyers as it provides efficient trust fund management, helps with legal and financial compliance, and simplifies the record-keeping process. By using such software, law firms can effectively manage client funds, maintain accurate accounting records, and ensure the security of their trust accounts.

Benefits of Using Trust Accounting Software

Trust accounting software offers numerous benefits for lawyers and law firms handling client funds.

One of the main advantages is the ability to accurately track client transactions and maintain detailed records. Trust accounting software provides a streamlined solution for recording and categorizing incoming and outgoing payments, ensuring that all financial activity is properly accounted for.

Furthermore, trust accounting software simplifies the bookkeeping process by automating many tasks that were previously done manually. This not only saves time and reduces the risk of human error, but it also ensures that all transactions are properly reconciled and can be easily audited.

Trust accounting software also helps lawyers and law firms maintain compliance with legal and regulatory requirements. The software typically includes built-in safeguards and controls to prevent unauthorized access to client funds and ensure that all financial activity is transparent and in accordance with applicable laws and regulations.

Additionally, using trust accounting software can provide added security for client funds. The software employs encryption and other security measures to protect sensitive financial information, reducing the risk of fraud or unauthorized access.

Another key benefit is the ease of generating reports for tax purposes. Trust accounting software can automatically generate detailed reports that lawyers and trustees can use for tax filing purposes, ensuring accuracy and compliance with tax laws.

Overall, trust accounting software greatly simplifies the management and tracking of client funds for lawyers and law firms. It helps streamline the accounting process, ensures compliance with legal and regulatory requirements, and provides added security for client funds. By utilizing trust accounting software, lawyers and law firms can efficiently and effectively manage their financial responsibilities while focusing on providing quality legal services to their clients.

Factors to Consider When Choosing Trust Accounting Software

When it comes to choosing trust accounting software for your law firm, there are several important factors to consider. By carefully evaluating your needs and the features offered by different software options, you can ensure that you select the best solution for efficient trust management and compliance with legal requirements.

1. Security: Trust accounting software must have robust security measures in place to protect sensitive financial and client data. Look for software that offers encryption, user access controls, and regular system updates to safeguard against unauthorized access and data breaches.

2. Compliance: Trust accounting software should be designed to meet the specific compliance regulations for managing client funds and financial transactions. Look for software that is regularly updated to reflect changes in trust accounting laws and is able to generate accurate, detailed reports for audits and tax purposes.

3. Ease of Use: Choose software that is intuitive and user-friendly, allowing lawyers and their staff to easily navigate and perform tasks such as recording trust payments, reconciling accounts, and generating financial reports. This will help reduce the time and effort required for accounting and bookkeeping tasks.

4. Integration: Consider whether the trust accounting software integrates with other systems your law firm uses, such as case management software or payment processing systems. Seamless integration can streamline workflows and improve efficiency by eliminating the need for manual data entry or duplicate record-keeping.

5. Support: Look for software providers that offer responsive customer support to address any issues or questions that may arise during the implementation and use of the software. Timely assistance can ensure smooth operation and minimize disruptions to your trust management processes.

6. Cost: Finally, consider the cost of the software and whether it aligns with your budget and expected return on investment. Compare pricing plans and evaluate the value provided by each software option, taking into account factors such as the number of users, storage capacity, and additional features.

By considering these factors, you can choose trust accounting software that meets the specific needs of your law firm, ensuring efficient management of client funds, compliance with legal requirements, and accurate financial reporting.

Compliance with Legal Accounting Requirements

When it comes to managing client funds, trustees, lawyers, and law firms need to ensure compliance with legal accounting requirements. This involves keeping accurate and detailed records of financial transactions and payments, which can be a complex task without the right tools.

Using reliable trust accounting software is essential for lawyers and law firms to meet their compliance obligations. This software helps automate bookkeeping processes and ensures the proper management of client funds. By utilizing this software, lawyers can easily track and record all financial transactions, including trust deposits, withdrawals, and transfers.

In addition to recording transactions, trust accounting software also helps with compliance by providing financial reports that can be used for audits and tax purposes. With this software, lawyers and law firms can generate statements and reports that outline the financial activity of their trust accounts, making it easier to meet legal requirements and obligations.

One of the key aspects of compliance with legal accounting requirements is the security of client funds. Trust accounting software provides robust security features that help protect client funds from unauthorized access or misuse. These features include encryption, password protection, and user permissions, ensuring that only authorized individuals can access and manage the funds.

Overall, using trust accounting software is crucial for lawyers and law firms to ensure compliance with legal accounting requirements. This software streamlines the management of client funds, facilitates accurate record-keeping, and provides the necessary financial reports for audits and tax purposes. By investing in reliable trust accounting software, lawyers can confidently meet their compliance obligations and focus on providing quality legal services to their clients.

Integration with Existing Legal Practice Management Systems

Integration with existing legal practice management systems is an essential feature to consider when choosing trust accounting software for lawyers. Legal practice management systems are designed to streamline and automate various tasks within a law firm, such as client management, document management, and billing. By integrating trust accounting software with these systems, lawyers can have a centralized platform to manage all their legal and financial operations.

With integration, lawyers can easily access client records, financial transactions, and trust accounting details without the need to switch between multiple software applications. This not only saves time but also improves efficiency and accuracy in managing client funds. Additionally, integration allows for seamless transfer of information between the legal practice management software and trust accounting software, ensuring that relevant data is up-to-date and accurate.

Another advantage of integration is that it enables lawyers to maintain compliance with legal and financial regulations. The trust accounting software can automatically generate reports and audit trails, providing a comprehensive overview of financial transactions and ensuring transparency in the handling of client funds. With proper integration, lawyers can also easily reconcile and track payments, ensuring that all financial obligations, such as taxes and trustee fees, are met.

Furthermore, integration with legal practice management systems enhances the overall bookkeeping process for a law firm. Lawyers can track and manage client funds more efficiently, ensuring that all financial transactions are accurately recorded and categorized. This streamlines the accounting process and reduces the risk of errors or misplacements of funds.

In conclusion, integration with existing legal practice management systems is a crucial feature when selecting trust accounting software for lawyers. It improves efficiency, accuracy, compliance, and overall financial management within a law firm, allowing lawyers to focus on providing excellent legal services to their clients while effectively managing their trust accounts.

Security and Data Protection Features

The security and data protection features of trust accounting software are of utmost importance for law firms handling client funds. Trust accounting software provides robust security measures to protect sensitive financial information and ensure compliance with legal and industry standards.

One of the key security features of trust accounting software is encryption. All client and financial data is encrypted to prevent unauthorized access and protect it from potential security breaches. This ensures that sensitive information such as client names, addresses, and payment details are securely stored and transferred.

In addition to encryption, trust accounting software also offers access controls. This allows law firms to restrict access to client records and financial data, ensuring that only authorized personnel can view or modify the information. Access controls help prevent unauthorized changes to financial records and enhance the overall security of the trust accounting system.

Trust accounting software also includes audit trail functionality, which enables law firms to track all financial transactions and actions within the software. This feature provides a complete record of all activities related to the management of client funds, allowing for easy monitoring and identification of any discrepancies or potential issues.

The software also assists law firms in maintaining compliance with legal and regulatory requirements. Trust accounting software is designed to handle complex financial calculations and automate tasks such as tax calculations, bookkeeping, and reporting. This ensures that the law firm remains compliant with tax regulations and industry standards, reducing the risk of errors and penalties.

Overall, trust accounting software offers robust security and data protection features that are essential for law firms handling client funds. By implementing secure encryption, access controls, audit trails, and compliance features, law firms can safeguard sensitive financial information and ensure the integrity of their trust accounting system.

Top Trust Accounting Software Solutions for Lawyers

Legal professionals and law firms rely heavily on accurate and efficient financial management, especially when it comes to handling client funds. Trust accounting software is a crucial tool for lawyers, providing them with the necessary tools to manage their clients' funds, maintain compliance with legal and tax regulations, and ensure the security of financial transactions.

Trust accounting software offers robust features for bookkeeping, including tracking client payments and transactions, managing client records, and generating financial reports. With the right software, lawyers can easily track the flow of funds and maintain accurate records, reducing the risk of errors and inconsistencies.

One of the key advantages of trust accounting software is its ability to ensure compliance with legal and tax regulations. With built-in features and automated processes, lawyers can easily stay on top of their financial responsibilities, such as reconciling trust accounts, managing retainer funds, and generating necessary reports for audits or tax filing.

Security is another crucial aspect of trust accounting software. These solutions offer robust encryption and data protection measures, ensuring the confidentiality and integrity of client information. With secure login credentials and access controls, lawyers can trust that their client's financial information is safe and protected.

When choosing trust accounting software, it is important to consider the specific needs of your law firm. Look for a system that offers comprehensive features for trust management, such as tracking funds, generating reports, and managing trustee responsibilities. Additionally, consider scalability and ease of use to ensure a smooth transition and efficient workflow for your legal practice.

Overall, trust accounting software is an essential tool for lawyers and law firms, providing them with the means to manage client funds accurately, maintain compliance, and ensure the security of financial transactions.

Software 1: Features, Pros, and Cons

The first software option for trust accounting management is designed specifically for lawyers and law firms. It offers a wide range of features to streamline trust accounting processes and ensure compliance with legal regulations.

Key features of this software include:

- Client Management: The software allows lawyers to easily manage client information, including contact details and case-related data.

- Audit Trail: It provides a comprehensive audit trail that tracks all transactions and changes made to client funds, ensuring transparency and accountability.

- Payment Processing: Lawyers can easily record and process client payments, whether it's for legal fees or disbursements.

- Bank Account Reconciliation: The software enables automatic reconciliation of trust account records with bank statements, saving time and reducing errors.

- Compliance: It helps lawyers stay compliant with trust accounting rules and regulations, minimizing the risk of penalties or legal issues.

- Financial Reporting: The software generates comprehensive financial reports, including balance sheets, income statements, and trust ledger reports, to aid in bookkeeping and decision-making.

Some pros of using this software include:

- Efficiency: The software automates many trust accounting processes, saving lawyers time and effort.

- Accuracy: With built-in checks and balances, the software reduces the risk of errors in financial records.

- Trust Compliance: It ensures compliance with trust accounting regulations, giving lawyers peace of mind.

- Security: The software provides robust security measures to protect sensitive client data and financial information.

However, there are also a few cons to consider:

- Cost: Depending on the software provider, the cost of this software may be a significant investment for smaller law firms.

- Learning Curve: It may take some time for lawyers and their staff to fully learn and adapt to the software's features and interface.

- Customizability: The software may have limitations in terms of customization options, which may not align with specific law firm needs.

In conclusion, Software 1 offers a comprehensive set of features to streamline trust accounting processes for lawyers and law firms. While it offers many benefits, it's important to consider the potential costs and learning curve associated with implementing the software.

Software 2: Features, Pros, and Cons

Legal Trust Accounting Software 2 is a comprehensive solution designed specifically for lawyers and law firms to efficiently manage their trust accounting needs. With its advanced features and user-friendly interface, this software is a valuable tool for legal professionals.

One of the key features of this software is its robust bookkeeping capabilities. It allows lawyers to track all trust transactions, including client payments, disbursements, and transfers, ensuring accurate accounting and streamlined financial management.

When it comes to trust accounting, accuracy and compliance are paramount. This software offers essential accounting functionalities that ensure the proper handling of client funds. Lawyers can easily generate comprehensive reports for auditing and tax purposes, maintaining complete and transparent records.

This software also prioritizes security, with built-in safeguards to protect sensitive client information. It employs encryption and access controls to prevent unauthorized access, safeguarding both the law firm's and clients' data. This level of security is crucial for maintaining confidentiality and complying with legal and ethical obligations.

In addition to its accounting features, this software simplifies trust fund management. Lawyers can easily track and manage multiple client funds and swiftly handle payments and transfers. This streamlines processes and reduces the risk of errors or discrepancies.

However, like any software, Legal Trust Accounting Software 2 has its pros and cons. On the positive side, it offers comprehensive features that cater specifically to the needs of legal professionals. Its user-friendly interface and intuitive navigation make it easy to use and understand.

On the flip side, some users may find the software to be expensive, especially for smaller law firms or solo practitioners. Additionally, while it offers various features, some users may feel that certain functionalities could be more customizable or tailored to their specific requirements.

In conclusion, Legal Trust Accounting Software 2 is a powerful tool for lawyers and law firms. Its advanced features, strong security measures, and comprehensive accounting capabilities make it a reliable solution for effectively managing trust accounting and financial management tasks.

Software 3: Features, Pros, and Cons

Software 3 is a comprehensive trust accounting solution designed specifically for lawyers and law firms. It offers a wide range of features to help manage client funds and ensure compliance with legal and financial regulations.

Key features of Software 3:

- Payment processing: The software allows for quick and secure payments, making it easy to receive and disburse client funds.

- Bookkeeping: It provides robust bookkeeping capabilities, allowing users to track and manage financial transactions, reconcile accounts, and generate financial reports.

- Security: Software 3 prioritizes data security, employing encryption and secure servers to protect sensitive client information.

- Record keeping: The software enables efficient tracking and maintenance of client trust accounts, ensuring accurate and up-to-date records of all financial transactions.

- Audit and compliance: It offers tools for internal and external audits, helping lawyers and law firms maintain compliance with trust accounting regulations and guidelines.

- Tax management: Software 3 streamlines tax reporting by generating accurate and comprehensive financial statements that assist in preparing tax returns.

Pros of Software 3:

- User-friendly interface: The software is easy to navigate and use, with intuitive features and a simple, clean layout.

- Efficient trust management: It provides tools for efficiently managing client trust accounts, including reconciliations and fund transfers.

- Comprehensive reporting: Software 3 generates a variety of detailed reports, making it easy to analyze and track trust account activity.

- Customization options: Users can customize the software to fit their specific needs and preferences, allowing for a personalized experience.

Cons of Software 3:

- Cost: This software can be relatively expensive, especially for small law firms with limited budgets.

- Learning curve: While the interface is user-friendly, there may still be a learning curve for users who are not familiar with trust accounting software.

- Training and support: Some users have reported difficulties in accessing timely and efficient customer support, which can be a drawback for those who require assistance.

In summary, Software 3 offers a comprehensive solution for trust accounting and management for lawyers and law firms. While it has several notable features and benefits, it's important to consider factors such as cost and customer support before making a decision.

How to Choose the Right Trust Accounting Software for Your Law Firm

Choosing the right trust accounting software is crucial for any law firm that deals with client funds. Trust accounting involves the management of client funds held in trust by a trustee, typically a lawyer. It is essential for legal professionals to have robust financial record-keeping and management systems in place to ensure compliance, accuracy, and security.

When selecting trust accounting software, it is essential to consider the specific needs of your law firm. Look for software that provides comprehensive trust accounting capabilities, such as trust fund management, client payment processing, and trust account reconciliation. Ensure the software complies with all legal and regulatory requirements, including tax and audit guidelines.

One of the crucial aspects to consider when choosing trust accounting software is security. Clients entrust their funds to your law firm, and it is your responsibility to safeguard their assets. Look for software that offers advanced security features, such as encryption, user access controls, and a secure payment processing system.

The software should also provide robust reporting capabilities to help you track and monitor client fund transactions. This is especially important when it comes to managing trust accounting, as you need to have accurate and up-to-date records for each client. Look for software that can generate detailed reports on clients' trust account balances, payments made, and funds received.

Additionally, the software should be user-friendly and easy to navigate. Lawyers and their staff should be able to enter and access client data quickly and efficiently. Look for software with an intuitive user interface and customizable features that can adapt to your law firm's unique needs. Good customer support and training resources are also essential to help you get the most out of the software.

Lastly, consider the cost of the software. While it is important to invest in reliable trust accounting software, you should also consider your budget. Look for software providers that offer flexible pricing options, such as monthly subscriptions or tiered pricing plans. Consider the value the software brings to your law firm in terms of time saved, increased efficiency, and improved compliance.

In summary, choosing the right trust accounting software for your law firm is a critical decision. Consider the specific trust accounting needs of your firm, including compliance, security, reporting, and usability. Look for software that meets these requirements and fits within your budget. By selecting the right software, you can ensure accurate and efficient trust accounting, protecting both your law firm and your clients.

Assessing Your Law Firm's Needs and Budget

When choosing the best trust accounting software for your law firm, it is important to assess your firm's needs and budget. As lawyers, managing client funds is a critical aspect of our financial responsibilities. Trust accounting software can help automate the process and ensure compliance with legal and ethical obligations.

First, consider the size and complexity of your law firm. Are you a small firm with a handful of clients, or a large firm with multiple practice areas and numerous client transactions? Understanding the scope of your firm's trust accounting requirements will help you choose the right software.

Next, evaluate your budget. Trust accounting software comes in a range of prices, so it is essential to determine how much you are willing to invest in a reliable solution. Keep in mind that investing in quality software can save you time, reduce errors, and streamline the management of client funds.

Consider the specific features and functionalities that are important to your law firm. Do you need advanced reporting capabilities, tax management tools, or secure payment processing? Think about the specific tasks and processes that the software needs to handle, such as bookkeeping, record-keeping, and audit trails.

Finally, prioritize security. As a trustee of client funds, it is crucial to choose software that offers robust security measures to protect sensitive financial information. Look for features such as data encryption, access controls, and regular software updates to ensure the highest level of security for your law firm and your clients.

Requesting Demos and Trials

When choosing a trust accounting software for your law firm, it is important to request demos and trials from the potential providers. Taking the software for a test drive allows you to evaluate its features, functionality, and ease of use. It also gives you a chance to assess the security measures in place to protect your firm's financial data and the client funds you manage.

During the demo or trial period, you should pay attention to how the software handles various accounting tasks specific to law firms, such as trust accounting, managing client funds, and generating reports for audits and taxes. Look for features that automate bookkeeping processes, track transactions, and provide real-time visibility into your firm's financial health.

As a trustee or lawyer, you need a software solution that can accurately manage trust accounts and ensure compliance with legal and ethical standards. Requesting demos and trials allows you to assess how the software handles trust accounting, including tracking funds from multiple clients, managing payments, and generating detailed transaction records.

Make sure the software provides a user-friendly interface and customizable reporting options to fit your law firm's specific needs. Look for features that allow you to easily search and retrieve client information, track expenses, and generate reports for internal and external use. Additionally, consider whether the software integrates with other legal management tools you may be using.

Requesting demos and trials from different software providers gives you the opportunity to compare their offerings and make an informed decision. It allows you to evaluate which software best suits your law firm's trust accounting and financial management requirements. By taking the time to test and evaluate the software, you can ensure that your firm's financial processes are streamlined, efficient, and compliant with legal and ethical standards.

Consulting with Fellow Lawyers and Industry Experts

When it comes to selecting the best trust accounting software for your law firm, consulting with fellow lawyers and industry experts can provide valuable insights and recommendations. These professionals have firsthand experience with different software solutions and can offer their expertise and opinions on security, trust management, and compliance.

Discussing with fellow lawyers allows you to gain insights into their experiences with different software platforms. They can provide valuable feedback on the ease of use, security features, and accuracy of the software in managing client funds, payments, and transactions. Fellow lawyers can also provide insights on the software's ability to generate accurate financial records for audits and ensure compliance with legal and tax regulations.

Consulting industry experts who specialize in legal accounting can provide a broader perspective on the available software options. These experts have in-depth knowledge of the legal industry and understand the unique requirements and challenges that law firms face when it comes to trust accounting and bookkeeping. They can recommend software solutions that are specifically designed to meet the needs of lawyers and trustees, with features such as automated calculations for interest on client funds and trust accounting rules.

By consulting with fellow lawyers and industry experts, you can gather valuable information about the various trust accounting software options available in the market. This will help you make an informed decision, selecting a software solution that meets your firm's specific needs and ensures accurate and compliant management of client funds.

Implementation and Training Considerations

When implementing trust accounting software for lawyers, there are several important considerations to keep in mind. Firstly, it is crucial to ensure that the software is capable of handling trust payments, as this is a fundamental aspect of trust accounting. The software should have features that allow for tracking and recording all trust transactions, ensuring compliance with legal requirements.

Additionally, the software should have robust auditing capabilities to enable thorough review and examination of trust accounting records. This is essential for maintaining the integrity and security of client funds. Trust accounting software should also have strong encryption and security measures in place to protect sensitive financial information from unauthorized access.

Another factor to consider is tax compliance. The software should be able to generate accurate tax reports and provide the necessary tools for efficient tax preparation. This will help law firms and trustees stay organized and avoid potential issues with tax authorities.

Training is an important aspect of implementing trust accounting software. It is crucial that all relevant staff members are properly trained on how to use the software and understand its functionalities. This may involve providing hands-on training sessions or utilizing online resources, such as video tutorials or user manuals provided by the software provider.

In conclusion, when implementing trust accounting software for lawyers, it is important to consider aspects such as software capabilities for managing trust payments, compliance with legal requirements, auditing features, security measures, tax compliance, and training for staff members. By carefully considering these factors, law firms can ensure that they choose the best software solution to effectively manage their clients' trust funds and maintain strong financial management.

Steps to Implement Trust Accounting Software

Implementing trust accounting software is an essential step for any law firm. It helps in maintaining accurate records of all transactions related to client funds, ensuring compliance with legal and tax regulations.

Here are the steps to successfully implement trust accounting software:

- Identify your requirements: First, determine the specific needs of your law firm in terms of trust accounting and management. Consider factors such as the volume of transactions, client base, and the level of financial security required.

- Research available options: Explore different trust accounting software solutions on the market. Look for features that meet the unique needs of your law firm, such as automated bookkeeping, real-time reporting, and integration with other legal software.

- Choose a reliable software: Select a trustworthy and reputable trust accounting software provider. Consider factors such as the software's track record, customer reviews, and the level of customer support provided.

- Implement the software: Once you have chosen a software solution, work with the provider to implement it into your law firm's existing financial management system. Ensure that all necessary data is transferred and that the software is properly configured.

- Train your staff: Provide comprehensive training to your lawyers, accountants, and administrative staff on how to use the trust accounting software effectively. This will ensure that everyone in your firm is knowledgeable about the software and can use it to its full potential.

- Maintain compliance: Regularly monitor and review your trust accounting processes to ensure compliance with legal and regulatory requirements. Conduct internal audits to verify the accuracy of the software's calculations and the security of your client funds.

- Review and improve: Continuously assess the performance of your trust accounting software and identify areas for improvement. Stay updated with the latest advancements in trust accounting software to ensure that your law firm is using the most reliable and efficient solution.

By following these steps, your law firm can successfully implement trust accounting software to streamline your financial management processes, enhance compliance, and improve the overall efficiency of your firm.

Training Your Team to Use the Software Effectively

Proper training is essential for effectively using trust accounting software in your law firm. As a lawyer, it is important to ensure compliance with financial regulations when handling client funds. Therefore, training your team on how to use the software is crucial in maintaining accurate and secure records.

During the training sessions, focus on explaining the features and functionalities of the trust accounting software. This includes how to record transactions, track payments, and generate reports for audits and tax purposes. Emphasize the importance of maintaining proper documentation and how the software can help streamline financial management processes.

Encourage your team to familiarize themselves with the different security measures provided by the software. This can include setting up user permissions, enabling two-factor authentication, and regular password updates. Training should also cover the process of reconciling trust balances to ensure accuracy in client funds management.

Utilize practical examples and scenarios to illustrate how the software can be used in real-world legal situations. This will help your team understand the relevance and importance of trust accounting in their daily tasks. Furthermore, provide ongoing support and encourage questions to address any uncertainties that may arise during the training process.

Consider creating a training manual or guide that summarizes the key aspects of using the trust accounting software. This can serve as a reference for your team and assist them in navigating the software confidently. Finally, reinforce the idea that accurate and compliant trust accounting is essential for maintaining the reputation and integrity of the law firm.

Best Practices for Using Trust Accounting Software

1. Understand the Legal and Financial Requirements: As lawyers and law firms handle various transactions involving client funds, it is crucial to have a solid understanding of the legal and financial requirements related to trust accounting. This includes compliance with trust accounting rules and regulations, proper handling of client funds, and accurate record-keeping.

2. Choose Reliable and Secure Trust Accounting Software: Selecting a trustworthy trust accounting software is essential for effective management of client funds. Look for software that offers robust security features to protect sensitive financial information, including data encryption, user access controls, and regular data backups.

3. Regularly Reconcile Trust Accounts: It is vital to reconcile trust accounts on a regular basis to ensure accuracy and detect any discrepancies. Reconciliation involves comparing the account balances recorded in the trust accounting software with the actual bank statements and identifying and resolving any discrepancies.

4. Keep Detailed Records: Maintaining detailed and organized records of all trust transactions is crucial for transparency and accountability. The software should provide a centralized platform to record and track all trust-related activities, including deposits, withdrawals, payments, and transfers.

5. Separate Trust Funds from Firm's Operating Funds: To prevent commingling of funds, it is essential to keep trust funds separate from the law firm's operating funds. The trust accounting software should allow for easy separation and tracking of client funds to ensure proper handling and compliance with the legal requirements.

6. Generate Accurate Reports: Trust accounting software should have robust reporting capabilities to generate accurate and comprehensive reports. These reports can include trust fund balances, transaction histories, income and expense summaries, and tax-related information, facilitating compliance and decision-making.

7. Regularly Review and Audit Trust Accounts: It is crucial to conduct regular reviews and audits of trust accounts to detect any irregularities or errors. This can be done internally or by external auditors to ensure compliance with regulations and maintain the integrity of the trust accounting system.

8. Stay Updated with Legal and Tax Regulations: Laws and tax regulations related to trust accounting may undergo changes, so it is crucial to stay informed and updated. The trust accounting software should offer features and updates that align with the latest legal and tax requirements, ensuring compliance and minimizing risks.

9. Provide Training and Support: When implementing trust accounting software, providing comprehensive training and ongoing support to lawyers and staff is essential. This will ensure that all users understand the software's functionality, can use it effectively, and adhere to best practices for trust accounting management.

10. Regularly Backup Data: As trust accounting software contains crucial financial and client information, regular backups are necessary to prevent data loss. The software should offer automatic backup features or provide guidance on manual data backups to ensure the security and availability of the records.

Regularly Reconciling Trust Accounts

Regularly reconciling trust accounts is a crucial aspect of accounting for law firms. Trust accounts are used to hold client funds, and accurate and up-to-date records must be maintained to ensure compliance with audit and legal requirements.

Proper trust accounting involves diligently recording all financial transactions related to client funds. This includes deposits, withdrawals, and any interest accrued. Reconciliation ensures that the recorded transactions match the actual transactions, providing an accurate representation of the client's trust account balance.

By regularly reconciling trust accounts, lawyers can identify any discrepancies or errors in the accounting records. This helps to prevent any financial mismanagement or potential fraud. Reconciliation also provides a clear audit trail, which is essential for regulatory compliance and maintaining the trust and confidence of clients.

Using reliable trust accounting software can greatly streamline the reconciliation process. Trust accounting software automates many aspects of bookkeeping, reducing human error and providing enhanced security for sensitive financial information. It can generate detailed reports and statements, making it easier for lawyers to review and analyze their trust account activities.

In addition to ensuring accurate records and regulatory compliance, trust account reconciliation also helps law firms manage their finances more effectively. By regularly reconciling trust accounts, lawyers can identify any outstanding checks or unclaimed funds, allowing them to promptly return these to the clients. This improves client satisfaction and strengthens the lawyer-client relationship.

Maintaining Proper Documentation and Audit Trails

Proper documentation and audit trails are essential for a law firm to ensure accurate record-keeping and compliance with tax and accounting regulations. Trust accounting software can play a critical role in maintaining these records and tracking the financial transactions related to client funds.

Lawyers have a fiduciary duty to their clients and managing client trust funds requires meticulous bookkeeping. With the help of trust accounting software, law firms can easily document and track all incoming and outgoing payments, ensuring that client funds are properly managed and accounted for.

The software provides a secure and centralized platform to record all financial transactions, allowing lawyers to easily generate detailed reports and access a comprehensive audit trail if required. This level of transparency and documentation is crucial for maintaining compliance and providing an accurate picture of the flow of funds.

With trust accounting software, lawyers can accurately track the movement and use of client funds, including deposits, withdrawals, and transfers. The software can also generate reports on the status of client accounts, ensuring that lawyers have an up-to-date understanding of their clients' financial position.

In addition to accurate record-keeping, trust accounting software also offers enhanced security features to protect sensitive client information. The software can restrict access to authorized individuals and implement encryption protocols to safeguard data from unauthorized access.

Maintaining proper documentation and audit trails is not only a legal requirement but also crucial for building trust with clients. By using reliable trust accounting software, law firms can ensure compliance, accuracy, and security while managing client funds and meeting their legal obligations.

Staying Up-to-Date with Legal Accounting Regulations

For any law firm, staying up-to-date with legal accounting regulations is crucial to maintain accurate and compliant financial records. Failure to comply with these regulations can result in penalties, loss of client funds, and even legal consequences.

Legal accounting involves tracking and managing client funds, maintaining proper bookkeeping records, and ensuring financial transactions are accurately recorded. Adhering to these regulations is essential to maintain the trust of clients and ensure transparency in financial operations.

One of the key aspects of legal accounting is the requirement to conduct regular audits. Audits help verify the accuracy and integrity of financial records and ensure that all transactions are accounted for. It is important for lawyers to have a reliable trust accounting software that enables them to generate detailed reports and streamline the audit process.

Security is another critical aspect of legal accounting. Handling client funds and sensitive financial information requires robust security measures to protect against data breaches and unauthorized access. Trust accounting software should have strong encryption protocols, multi-factor authentication, and regular data backups to maintain the integrity and confidentiality of financial records.

In addition to accurate record-keeping and security measures, legal accounting also involves managing tax obligations. Lawyers are responsible for keeping track of tax payments, deductions, and compliance with tax regulations. Trust accounting software that integrates tax management features can help simplify this process and minimize the risk of errors.

By utilizing reliable trust accounting software, lawyers can ensure compliance with legal accounting regulations while also streamlining their financial operations. This allows them to focus on providing quality legal services to their clients while maintaining the trust and confidence of their clients and regulatory bodies.