Wave Accounting is a powerful tool that provides small businesses with a comprehensive solution for managing their finances. One key aspect of this software is its ability to handle sales tax. Sales tax is a crucial component of any business, and having a system in place to accurately calculate and manage it is essential for both legal compliance and financial transparency.

With Wave Accounting, you can easily track your inventory, generate invoices, and manage your expenses. This not only gives you a clear picture of your financials, but also helps you make more accurate forecasts and improve your cash flow. The software also allows you to easily track and categorize your receipts, making it easier to stay on top of your expenses and ensure accurate tax calculations.

Wave Accounting makes sales tax calculation and management a breeze. With its user-friendly interface, you can easily set up sales tax rates specific to your location and automatically apply them to your invoices. This ensures that your customers are charged the correct amount of sales tax and helps you stay compliant with tax laws. You can also generate detailed reports that provide a clear breakdown of your sales tax liabilities, making it easier to file your tax returns.

In addition to sales tax management, Wave Accounting also offers features for payroll, budgeting, and other aspects of financial management. This comprehensive suite of tools allows small business owners to efficiently manage their finances and focus on what matters most – growing their business. With Wave Accounting, you can have peace of mind knowing that your accounting and bookkeeping needs are taken care of, leaving you with more time and energy to devote to other important tasks.

In conclusion, Wave Accounting is a reliable and user-friendly software that provides small businesses with a complete solution for sales tax calculation and management, as well as other aspects of financial management. Its inventory tracking, transparency, forecasting, and cash flow features give businesses the tools they need to stay on top of their finances and make informed decisions. Whether you are a small business owner or an accountant, Wave Accounting can greatly simplify your financial management and reporting processes.

What is Wave Accounting Sales Tax?

Wave Accounting Sales Tax is a feature offered by the Wave accounting software that helps businesses manage their financials, expenses, budgeting, bookkeeping, and taxes. It provides a transparent and efficient solution for sales tax calculation and management.

With Wave Accounting Sales Tax, businesses can easily generate invoices, track receipts, manage inventory, and perform valuation analysis. It also provides reports and financial analysis tools to help businesses understand their cash flow and make informed decisions.

The sales tax calculation feature in Wave Accounting automatically applies the appropriate tax rate based on the customer's location, ensuring accuracy and compliance. Businesses can also customize tax rates and apply different tax rules for specific products or services.

Wave Accounting Sales Tax integrates with the payroll module, allowing businesses to calculate and manage taxes related to employee wages. It helps simplify the tax filing process and ensures businesses stay compliant with tax regulations.

By leveraging Wave Accounting Sales Tax, businesses can streamline their tax management process, save time and effort, and focus on growing their business. The software provides a user-friendly interface and intuitive features that make managing sales tax easy and hassle-free.

Definition and purpose

The term "sales tax" refers to a type of tax that is imposed on the sale of goods and services. It is collected by businesses on behalf of the government and is typically calculated as a percentage of the selling price. The purpose of sales tax is to generate revenue for the government to fund various public services and projects.

Wave Accounting, a popular accounting software, provides comprehensive tools for managing sales tax. It allows businesses to track and calculate sales tax on invoices, receipts, and expenses. This feature helps businesses stay compliant with tax regulations and ensures accurate reporting.

The budgeting feature in Wave Accounting allows businesses to set and manage sales tax amounts within their overall financials. This helps in forecasting and analysis of future cash flows and expenses. By accurately calculating sales tax, businesses can better plan their finances and make informed decisions.

Wave Accounting's sales tax management feature also provides detailed reports and analytics. This includes sales tax reports, tax liability reports, and tax expense breakdowns. These reports help businesses gain insights into their tax obligations and identify areas for improvement.

With Wave Accounting, businesses can automate the calculation of sales tax on invoices and receipts. This saves time and reduces the risk of errors in manual calculations. The software also integrates with payroll and inventory management systems, ensuring accurate tax calculations across all aspects of the business.

Transparency in sales tax calculation and management is crucial for businesses. Wave Accounting provides a clear and auditable trail of all sales tax transactions, making it easier for businesses to meet compliance requirements and simplify their bookkeeping processes.

In conclusion, Wave Accounting's sales tax feature is an essential tool for businesses to streamline their accounting processes, improve financial management and ensure compliance with tax regulations. It helps businesses accurately calculate and track sales tax, generate reports, and make informed decisions based on their financials.

How does it work?

Wave Accounting's sales tax feature allows you to easily calculate and manage sales tax for your business. With this feature, you can track sales, receipts, expenses, financials, and more, all in one place.

When you create an invoice or receipt in Wave Accounting, you can specify the sales tax rate applicable to the transaction. The software will automatically calculate the amount of sales tax based on the subtotal. This saves you time and ensures accurate calculations.

In addition to calculating sales tax, Wave Accounting also helps with inventory management. You can keep track of your stock levels and use the software to analyze sales patterns, manage reordering, and make informed decisions about your inventory.

Another important aspect of Wave Accounting's sales tax feature is its integration with payroll. You can set up your employees' tax deductions and ensure that the correct amount of sales tax is withheld from their wages. This helps you stay compliant with tax laws and makes payroll management more efficient.

Wave Accounting also provides various reporting and analysis tools to help you keep track of your sales tax obligations. You can generate reports that show your sales tax liability, track tax payments, and perform in-depth analysis of your financials. This helps with tax planning, budgeting, forecasting, and overall financial management of your business.

In summary, Wave Accounting's sales tax feature simplifies the process of calculating, managing, and reporting sales tax for your business. The software integrates seamlessly with other financial and tax-related aspects of your business, offering a comprehensive solution for bookkeeping and accounting tasks.

Benefits of Wave Accounting Sales Tax

Transparency: Wave Accounting Sales Tax provides a high level of transparency when it comes to calculating and managing sales tax. With clear and detailed reports, businesses can easily track their tax obligations and ensure compliance with tax laws.

Accurate Calculation: Wave Accounting Sales Tax automates the calculation of sales tax, reducing the risk of errors and ensuring accurate tax calculations every time. This helps businesses avoid penalties and audits, while also simplifying the overall tax filing process.

Cash Flow Forecasting: By accurately calculating and tracking sales tax in real-time, Wave Accounting Sales Tax allows businesses to better forecast their cash flow. This means businesses can plan their expenses and budgeting more effectively, ensuring they have enough funds to cover their tax obligations.

Efficient Management: Wave Accounting Sales Tax streamlines the management of sales tax by automating the entire process. From generating invoices and receipts to tracking inventory and valuing the business, businesses can easily manage all aspects of their sales tax obligations in one place.

Comprehensive Reports: Wave Accounting Sales Tax generates comprehensive reports that provide businesses with detailed insights into their tax obligations and financials. These reports help with tax analysis, payroll management, and overall financial planning.

Simplified Bookkeeping: Wave Accounting Sales Tax integrates seamlessly with Wave’s bookkeeping software, allowing businesses to track their sales tax alongside other expenses and transactions. This simplifies record-keeping and eliminates the need for manual data entry.

Increased Efficiency: Wave Accounting Sales Tax automates many time-consuming tasks, such as tax calculations and form-filling. This saves businesses valuable time and allows them to focus on other crucial aspects of their operations.

Improved Accuracy: With automated calculations and integration with other financial software, Wave Accounting Sales Tax helps businesses maintain accurate and up-to-date sales tax records. This reduces the risk of errors and ensures businesses are always in compliance with tax laws.

Cost Savings: Wave Accounting Sales Tax is an affordable solution that eliminates the need for expensive tax professionals or additional software. This helps businesses save money while still maintaining accurate and efficient sales tax management.

In conclusion, Wave Accounting Sales Tax offers numerous benefits for businesses, including transparency, accurate calculation, cash flow forecasting, efficient management, comprehensive reports, simplified bookkeeping, increased efficiency, improved accuracy, and cost savings. By leveraging the features of Wave Accounting Sales Tax, businesses can streamline their sales tax process and ensure compliance, ultimately improving their overall financial management.

Time-saving

Wave Accounting is a powerful accounting software that offers a range of time-saving features for small businesses. With Wave, you can easily manage your budgeting, sales, inventory, cash flow, receipts, forecasting, and expense tracking in one place. This saves you from the hassle of manually entering data and allows you to focus on growing your business.

One of the key time-saving features of Wave is its efficient management of invoices and payments. You can easily create professional invoices with just a few clicks, send them to your customers, and track payment status. Wave also provides automatic calculation of sales tax, ensuring accurate and seamless tax compliance.

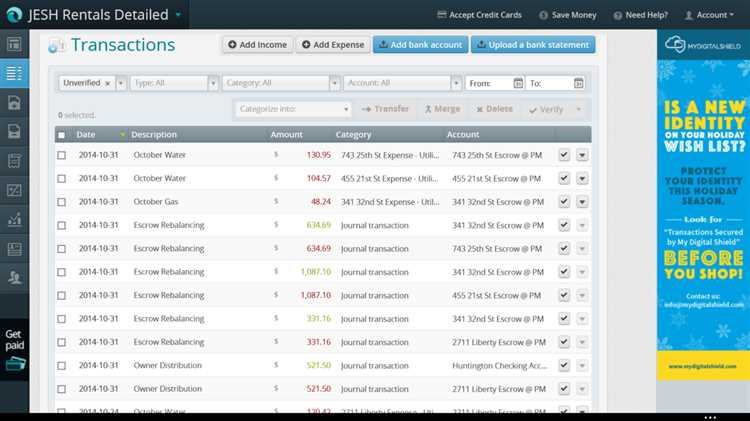

Another time-saving aspect of Wave Accounting is its streamlined bookkeeping and financial reporting capabilities. With Wave, you can automatically import bank transactions, categorize expenses, and generate detailed financial reports. This eliminates the need for manual data entry and provides you with a clear overview of your business's financial health.

Wave also offers time-saving payroll features, allowing you to easily manage employee wages, deductions, and tax payments. With Wave's payroll module, you can automate the payroll process and ensure accurate and compliant calculations.

In addition to its time-saving features, Wave Accounting also provides transparency and analysis of your business's financials. You can easily track and analyze sales trends, expenses, and profitability, enabling you to make informed decisions and plan for the future. Wave's intuitive interface and user-friendly design make it easy for business owners to access and understand their financial data.

Overall, Wave Accounting offers a comprehensive solution for small businesses, saving you time and simplifying your financial management tasks. Whether it's tracking sales, managing invoices, calculating taxes, or analyzing expenses, Wave streamlines and automates these processes, allowing you to focus on what you do best – running your business.

Automated calculations

Wave Accounting's Sales Tax feature allows for automated calculations, taking the hassle out of managing tax expenses. Taxes can be automatically calculated based on the specified rates and applied to invoices, ensuring accurate and consistent tax calculations.

With automated calculations, businesses can save time and reduce the risk of errors. Instead of manually calculating taxes for each invoice or transaction, Wave Accounting does it automatically, allowing businesses to focus on other important tasks.

By automating tax calculations, Wave Accounting ensures compliance with tax laws and regulations. The system is designed to handle various tax rates and exemptions, keeping businesses up to date with the ever-changing tax landscape.

Additionally, Wave Accounting's automated calculations extend beyond sales tax. The platform also offers automated calculations for payroll, expenses, and financials. This comprehensive approach streamlines the entire bookkeeping process, providing businesses with accurate and real-time insights into their financial health.

The automated calculations also enable businesses to generate detailed reports, such as cash flow statements, inventory valuation reports, and budgeting analysis. These reports provide businesses with a clear picture of their financial position and help them make informed decisions.

Moreover, Wave Accounting's automated calculations promote transparency and accountability. Businesses can easily track and manage their invoices, receipts, and expenses, ensuring that everything is accounted for and organized. This helps in maintaining a clear audit trail and facilitates efficient and accurate tax filing.

In conclusion, Wave Accounting's Sales Tax feature offers automated calculations for taxes and various other financial aspects. By automating tax calculations and providing comprehensive bookkeeping solutions, Wave Accounting simplifies the financial management process, saving businesses time and effort.

Integration with other accounting tools

Wave Accounting offers seamless integration with a variety of accounting tools, allowing businesses to streamline their financial management processes. This integration enables easy transfer and syncing of data between Wave Accounting and other accounting software, providing a cohesive and comprehensive solution for businesses of all sizes.

With integration capabilities, businesses can import and export data between Wave Accounting and valuation tools, forecasting software, and other accounting platforms. This enables businesses to track and analyze sales data, monitor cash flow, and make informed financial decisions. The integration also simplifies bookkeeping processes, allowing for efficient invoice creation and management.

Furthermore, integrating Wave Accounting with other accounting tools enhances transparency and accuracy in financial reporting. By seamlessly syncing data, businesses can ensure that their financial records are up-to-date and accurate, reducing the risk of errors and improving tax calculation and reporting processes.

The integration also extends to receipt management, making it easy to track and categorize expenses. Businesses can import receipts from various sources, including email, mobile devices, or scanned copies, and categorize them accordingly. This simplifies expense tracking and facilitates budgeting and analysis, helping businesses stay on top of their financials.

In addition to expense tracking, Wave Accounting's integration capabilities include payroll management. By integrating with payroll software, businesses can effortlessly calculate and manage employee wages, taxes, and benefits. This streamlines the payroll process and ensures compliance with tax regulations, saving businesses time and effort.

Integration with other accounting tools also extends to inventory management. By syncing data between Wave Accounting and inventory systems, businesses can accurately track and manage their stock levels, ensuring efficient supply chain management. This integration enables businesses to make data-driven decisions regarding purchasing, sales, and inventory control.

Lastly, Wave Accounting's integration capabilities include generating comprehensive reports. By integrating with reporting tools, businesses can easily generate financial reports, including balance sheets, income statements, and cash flow statements. These reports provide valuable insights into the financial health of the business, enabling informed decision-making and strategic planning.

In conclusion, Wave Accounting's integration with other accounting tools offers a multitude of benefits for businesses. From seamless data transfer to enhanced financial reporting and analysis, this integration simplifies various financial management processes, improving efficiency and accuracy. By integrating with valuation, forecasting, sales, payroll, and inventory tools, businesses can streamline their accounting and financial operations, ultimately leading to improved financial performance.

Accurate tax reporting

When it comes to tax reporting, accuracy is key. Wave Accounting provides a comprehensive set of tools and features to ensure that your tax reporting is done correctly and efficiently.

One of the key features of Wave Accounting is its integrated payroll system. This allows you to easily track and manage payroll expenses, ensuring that all necessary tax deductions are accounted for and accurately reported.

In addition to payroll, Wave Accounting provides robust accounting and tax management tools. You can easily track your expenses, manage receipts, and generate detailed reports that provide a clear picture of your financials. This makes it easier to calculate and report your taxes accurately.

With Wave Accounting, you can also easily generate sales invoices and track your inventory. This enables you to accurately report your sales and calculate any applicable sales tax. Furthermore, the inventory tracking feature helps ensure that your valuation calculations are accurate, which is important for tax reporting.

Wave Accounting also offers powerful budgeting and forecasting tools. These tools allow you to create budgets and forecast your cash flow, helping you plan for any tax payments that may be due.

Overall, Wave Accounting provides a comprehensive suite of features that make tax reporting accurate and efficient. From payroll and accounting to sales and inventory management, Wave Accounting has everything you need to ensure that your tax reporting is done correctly and with confidence.

Ensuring compliance

When it comes to sales tax, ensuring compliance is crucial for every business. With Wave Accounting, you can easily track and manage all your tax-related activities. From recording sales to calculating and remitting sales tax, Wave Accounting provides you with the necessary tools to stay on top of your tax obligations.

One of the key features of Wave Accounting is its ability to integrate sales tax calculation into your invoicing process. This ensures that the correct amount of tax is added to each invoice, eliminating any manual errors and saving you valuable time. With accurate and automated tax calculations, you can confidently provide your customers with accurate pricing information.

In addition to sales tax calculation, Wave Accounting also allows you to generate detailed tax reports. These reports provide a comprehensive overview of your tax liabilities, making it easy to review your tax information and ensure that you are meeting all regulatory requirements. With Wave Accounting's reporting capabilities, you can quickly and easily generate the necessary documentation for filing your tax returns.

Furthermore, Wave Accounting provides you with the tools to manage your cash flow and budgeting effectively. You can track your expenses, manage receipts, and generate invoices with ease. This helps you stay organized and ensures that you have a clear view of your financials at all times. By having a complete and accurate picture of your income and expenses, you can make informed decisions about your business and plan for the future.

Overall, Wave Accounting offers a comprehensive solution for managing your sales tax obligations. With its powerful features and intuitive interface, you can streamline your tax processes, improve your financial management, and ensure compliance with ease. Whether you are a small business owner or a seasoned entrepreneur, Wave Accounting is a valuable tool for simplifying your bookkeeping and tax-related tasks.

Minimizing errors

Analysis: Conducting a thorough analysis of your financial records is crucial in minimizing errors. Regularly reviewing your bookkeeping and analyzing reports can help identify any discrepancies or inaccuracies that need to be addressed.

Receipts: Keeping track of receipts is essential for minimizing errors. Properly recording and organizing receipts can ensure that all expenses and income are accurately accounted for.

Valuation: Accurately valuing your assets and liabilities is important in minimizing errors. Properly valuing your inventory, equipment, and other assets can ensure that your financial statements reflect the true value of your business.

Budgeting: Creating a budget and sticking to it can help minimize errors. Having a clear understanding of your expected expenses and revenue can reduce the risk of overspending or underestimating your income.

Management: Effective management practices can help minimize errors in your financial records. Implementing strong internal controls, regularly reviewing financial statements, and ensuring proper segregation of duties can all contribute to accurate and reliable financial reporting.

Cash flow: Monitoring and managing your cash flow is essential in minimizing errors. Accurate cash flow forecasting can help identify potential shortfalls or surpluses and allow for proactive management of your financials.

Sales: Carefully tracking your sales transactions is crucial in minimizing errors. Properly recording and invoicing sales can ensure that all revenue is accurately reported and sales tax is appropriately applied.

Inventory: Managing your inventory effectively can minimize errors in your financial records. Regularly conducting physical counts, reconciling variances, and accurately valuing your inventory can help avoid discrepancies in your financial statements.

Tax: Understanding and properly applying tax laws can help minimize errors. Staying up to date with changes in tax regulations and working with a knowledgeable tax professional can ensure that your business remains compliant and minimizes the risk of errors.

Transparency: Maintaining transparency in your financial reporting can help minimize errors. Clearly documenting and explaining your financial transactions and ensuring accurate disclosure of information can promote accuracy and reduce the risk of errors.

Expenses: Tracking and categorizing your expenses correctly is vital in minimizing errors. Accurately recording and classifying expenses can ensure that your financial statements reflect the true costs of running your business.

Payroll: Properly managing payroll is crucial in minimizing errors. Accurately calculating and recording employee wages, benefits, and withholdings can help avoid discrepancies and ensure compliance with tax and employment laws.

Wave Accounting: Utilizing a reliable accounting software like Wave can help minimize errors. Wave provides features such as automated transaction import, real-time reporting, and integrated invoicing and payroll that can streamline your financial management processes and reduce the risk of errors.

How to Set Up Wave Accounting Sales Tax

Accounting: Wave Accounting is a powerful tool for financial management, including sales tax. To set up sales tax in Wave Accounting, follow these steps:

- Management: Go to the Settings tab and click on Taxes.

- Expenses: Choose the country and region where your business operates, as tax rates vary across jurisdictions.

- Payroll: Select your tax settings, including whether you want Wave to automatically calculate sales tax for you.

- Wave: Set up your tax rates. You can enter multiple rates if necessary, depending on the location and type of sales.

- Budgeting: Add a sales tax accounting category to your chart of accounts to track sales tax separately from other income and expenses.

- Calculation: Apply the appropriate tax rate to each sale by enabling automatic tax calculation in your invoices or receipts.

- Transparency: Ensure transparency in your sales tax reporting by providing detailed breakdowns of tax amounts on your invoices and receipts.

- Forecasting: Use Wave's sales tax reports to forecast future tax obligations based on past sales and tax rates.

- Sales: Track your sales tax liability and payments accurately by reconciling your sales tax account regularly in Wave.

- Cash flow: Monitor your cash flow by including sales tax in your revenue projections and budgeting for upcoming tax payments.

- Analysis: Analyze the impact of sales tax on your business by reviewing sales tax reports and comparing them with your other financials.

- Reports: Generate sales tax reports in Wave to keep a record of your tax obligations and provide necessary documentation for audits.

- Bookkeeping: Keep your sales tax records organized and up-to-date by regularly entering sales data and tax payments in Wave Accounting.

- Financials: Include your sales tax liability and payments in your financial statements for a complete picture of your business's financial health.

- Valuation: Accurately value your business by accounting for sales tax liabilities and payments when determining your company's worth.

By following these steps, you can effectively set up and manage your sales tax in Wave Accounting, ensuring compliance with tax regulations and accurate financial reporting.

Create tax profiles

In Wave Accounting, you have the option to create tax profiles for different types of taxes. This feature allows you to set up and manage your tax settings for various jurisdictions and tax rates. By creating tax profiles, you can accurately track and calculate the taxes owed on your sales and purchases.

With tax profiles, you can easily generate detailed tax reports and receipts, which provide a comprehensive overview of your tax obligations. These reports can be used for financial analysis, cash flow management, and budgeting purposes. Additionally, tax profiles enable you to effectively monitor and track your tax expenses, ensuring that they are accurately recorded in your bookkeeping records.

Creating tax profiles in Wave Accounting also allows for seamless integration with other features such as payroll, inventory management, and invoice generation. This integration ensures that accurate tax calculations are applied to your sales and expenses, enabling you to have a clear understanding of your tax liabilities and financials.

Furthermore, tax profiles enable you to forecast and plan for future tax obligations. By assigning the appropriate tax rates to your products or services, you can accurately calculate the taxes that will be owed on future sales. This information is invaluable for budgeting and financial forecasting purposes, as it allows you to plan for and allocate resources accordingly.

In summary, creating tax profiles in Wave Accounting is an essential step in ensuring accurate tax calculation, reporting, and management. By utilizing this feature, you can effectively track your tax liabilities, generate comprehensive tax reports, and plan for future tax obligations. With the integration of tax profiles into other features of Wave Accounting, you can streamline your tax processes and have a clear view of your financials.

Setting tax rates

Setting tax rates is an important task for any business as it directly affects the cash flow and financials of the company. Wave Accounting offers a user-friendly platform that allows you to easily set tax rates for your products or services. By accurately setting tax rates, you can ensure that your revenue, expenses, and payroll are correctly accounted for.

When setting tax rates, it is crucial to consider factors such as inventory, expenses, and valuation. By understanding how taxes are applied to your business operations, you can make informed decisions that will impact your budgeting and financial management. Wave Accounting provides the tools necessary to streamline the tax rate calculation process, giving you the transparency needed to stay on top of your financials.

Wave Accounting also offers features such as the ability to generate tax reports and invoices with ease. These reports and invoices provide valuable insights and analysis, allowing you to track your sales and forecast your tax obligations. By having access to comprehensive tax data, you can effectively plan and manage your business’s finances.

In conclusion, setting tax rates is a key aspect of financial management and bookkeeping. Wave Accounting simplifies this process, providing you with the necessary tools and features to accurately calculate and manage your tax obligations. With its user-friendly interface and transparent reporting capabilities, Wave Accounting ensures that your business remains compliant and financially efficient.

Assigning tax profiles

Assigning tax profiles in Wave accounting is an essential step to ensure accurate calculation and reporting of sales tax. The tax profiles allow businesses to define the appropriate tax rates and rules based on their location and business operations.

By assigning tax profiles, businesses can easily calculate and track sales tax on their invoices, receipts, and other financial transactions. This helps maintain accurate records and ensures compliance with tax regulations.

Wave accounting provides a user-friendly interface to assign tax profiles to different items, services, and expenses. This makes it easy to categorize and track tax liabilities associated with specific products or services.

Assigning tax profiles also helps in cash flow management and budgeting. With accurate tax calculations and reporting, businesses can plan their expenses and budget more effectively.

Additionally, tax profiles assist in financial analysis and valuation. By tracking tax liabilities and expenses, businesses can assess their profitability and make informed decisions about their future growth and investment strategies.

Furthermore, assigning tax profiles facilitates tax reporting and filing. Wave accounting generates comprehensive tax reports that summarize the sales tax collected and paid over a specific period. These reports simplify the tax preparation process and ensure businesses meet their tax obligations.

In conclusion, assigning tax profiles in Wave accounting plays a crucial role in accurate tax calculation, financial management, and compliance. With the ability to assign tax profiles, businesses can ensure their financials, tax calculations, and reporting are in order.

Configure billing and invoicing

Configuring billing and invoicing in Wave Accounting is essential for maintaining transparency and efficient financial management. With Wave Accounting, you can easily set up your billing and invoicing preferences to streamline your sales tax calculation, receipt, and expense tracking processes.

Through the billing and invoicing configuration options, you can integrate your sales tax rates and rules, ensuring accurate calculations and adherence to tax compliance regulations. This enables you to generate invoices with the correct sales tax amounts, improving the accuracy of your financials.

Furthermore, configuring billing and invoicing in Wave Accounting allows you to track inventory, forecast future sales, and manage your payroll, all within one comprehensive platform. You can easily generate detailed reports that provide insights into your business's cash flow, budgeting, and financial performance.

With Wave Accounting, you have the flexibility to customize and personalize your invoices to reflect your branding and professionalism. The platform also supports multiple currencies, making it ideal for businesses operating in international markets.

In summary, configuring billing and invoicing in Wave Accounting provides you with the necessary tools for efficient sales tax calculation, reliable financial reporting, and comprehensive management of your business's financials. Take advantage of Wave Accounting's features to simplify your bookkeeping and valuation processes, allowing you to focus on growing your business.

Enabling tax calculations

Wave Accounting provides a comprehensive solution for enabling tax calculations in your financials. With its powerful features for forecasting and analysis, Wave allows you to accurately calculate taxes on your sales and expenses, ensuring compliance with tax regulations.

The tax calculation functionality in Wave Accounting helps you maintain accurate and up-to-date financials, as it automatically calculates taxes based on your sales receipts and invoices. This ensures that you have a clear understanding of your tax liabilities and can make informed decisions about your budgeting and cash flow management.

With Wave, you can easily configure tax rates for different regions and apply them to your sales transactions. The system also allows you to track and manage tax exemptions and refunds, providing flexibility and transparency in your tax reporting.

In addition to real-time tax calculation, Wave offers a robust set of reports and analytics that give you valuable insights into your tax position. These reports enable you to evaluate the impact of taxes on your business's financial performance and make informed decisions for future growth and investment.

Wave Accounting's tax calculation capabilities integrate seamlessly with its other features, such as bookkeeping, payroll, and expense management. This ensures that your tax calculations are synchronized with your overall financial operations, providing a comprehensive and accurate picture of your business's financial health.

Whether you are a small business owner or a financial professional, Wave Accounting's tax calculation functionality can greatly simplify the process of managing your taxes. Its user-friendly interface, robust features, and accurate calculations make it a valuable tool for any business looking to streamline its accounting processes and ensure compliance with tax regulations.

Displaying taxes on invoices

When creating an invoice in Wave Accounting, it is important to accurately display taxes to ensure proper budgeting and accounting. Wave Accounting allows for seamless integration with your sales tax system, making it easy to calculate and display taxes on your invoices.

By accurately displaying taxes on your invoices, you can ensure that your sales tax calculations are correct. This is essential for proper financials and reporting, as well as for forecasting and budgeting purposes. It allows you to have a clear understanding of your tax liabilities and helps you avoid any potential issues with tax authorities.

Wave Accounting provides a user-friendly interface that makes it easy to enter and calculate taxes. The system automatically calculates the tax amount based on the tax rate and applies it to the invoice. This ensures accuracy and transparency in your bookkeeping and financials.

Additionally, when taxes are displayed on invoices, it provides a clear and organized breakdown of expenses for both you and your clients. This helps with cash flow management and provides a detailed record of your transactions. It also ensures that your clients have a clear understanding of the tax obligations associated with their purchase.

Overall, displaying taxes on invoices in Wave Accounting is crucial for accurate financial analysis and proper tax calculation. It helps streamline your payroll and inventory processes, as well as provides a comprehensive view of your sales and expenses. With Wave Accounting's advanced features, you can easily generate detailed reports and perform in-depth analysis of your tax-related data.

Managing Wave Accounting Sales Tax

Valuation and bookkeeping are key aspects of managing sales tax in Wave Accounting. By accurately tracking inventory and financials, businesses can ensure they are charging the correct amount of tax on each transaction. Wave Accounting provides tools for efficient invoice management, making it easy to add and calculate tax amounts.

Analysis and reports are essential for understanding sales tax liabilities. With Wave Accounting, businesses can generate detailed reports that show the amount of tax collected and owed for a specific period. This data can be used for forecasting and budgeting purposes, helping businesses plan for future tax obligations and expenses.

Receipts and other documentation play a crucial role in sales tax calculation and transparency. With Wave Accounting, businesses can easily upload and store receipts, ensuring that all relevant information is readily available for tax purposes. This helps maintain accurate records and provides transparency in case of any audits or inquiries.

Payroll and employee management are also important considerations when it comes to sales tax. Businesses need to ensure that payroll taxes are properly calculated and withheld from employee wages. With Wave Accounting, businesses can seamlessly integrate payroll services, making it easier to manage both sales and employee taxes in one place.

Overall, Wave Accounting offers comprehensive solutions for managing sales tax. From accurate calculation and invoicing to detailed reporting and budgeting, businesses can streamline their sales tax processes and ensure compliance with tax regulations. By leveraging the features and tools provided by Wave, businesses can efficiently manage and stay on top of their sales tax responsibilities.

Tracking tax liabilities

Tracking tax liabilities is an essential part of managing your financials and ensuring compliance with tax regulations. Wave Accounting provides a comprehensive system for tracking and managing your tax liabilities, giving you the tools you need to stay on top of your taxes.

With Wave Accounting, you can easily create invoices that include the appropriate tax calculation based on the tax rates for your business. This ensures that all your transactions are accurately recorded, helping you keep track of your tax liabilities.

Wave Accounting also provides powerful forecasting and analysis tools that allow you to project your tax liabilities based on your sales and expenses. This helps you plan for the future and ensure that you have enough cash flow to cover your tax obligations.

In addition to tracking your tax liabilities, Wave Accounting also helps you manage other aspects of your finances, such as inventory, cash flow, and valuation. This comprehensive approach allows you to have a complete picture of your financial situation and make informed decisions regarding your tax liabilities.

Wave Accounting provides transparent and accurate tax calculations, ensuring that you meet all your tax obligations. The platform also offers robust bookkeeping and budgeting features that enable you to keep track of your expenses and income related to taxes.

With Wave Accounting, you can generate detailed reports on your tax liabilities and other financial aspects of your business. These reports provide valuable insights into your tax obligations, allowing you to effectively manage your tax liabilities and make strategic decisions for your business.

Tracking tax liabilities with Wave Accounting is a streamlined process that simplifies your tax management. You can easily track your tax liabilities, manage your receipts and expenses, and even integrate with payroll services to ensure accurate tax calculations.

Monitoring tax owed

When it comes to monitoring tax owed, Wave Accounting provides a comprehensive analysis of your financials. With its easy-to-use features, you can track sales, payroll, expenses, and inventory, ensuring that you have a clear understanding of your tax obligations.

By keeping accurate and up-to-date records of your business transactions, Wave Accounting helps you stay on top of your tax liabilities. Its efficient bookkeeping and accounting tools allow for easy generation of tax reports, providing you with the necessary information to make informed decisions about your tax payments.

One of the key advantages of using Wave Accounting is its transparency in tracking your cash flow. Through detailed reports and forecasts, you can gain insights into your business's financial health and make proactive decisions regarding your tax planning. This transparency enables you to effectively budget for tax payments and avoid any surprise tax bills.

Additionally, Wave Accounting simplifies the process of invoicing and recording receipts, ensuring that all relevant financial information is accurately documented. This feature is particularly beneficial when it comes to managing tax audits, as you can easily provide the necessary documentation to support your tax filings.

Wave Accounting also provides valuation and management of your inventory, ensuring that you have an accurate understanding of your business's assets and liabilities. This information is crucial when it comes to calculating your tax obligations, as it allows you to accurately report your inventory value and any associated tax liabilities.

Keeping track of tax payments

Managing tax payments is an essential part of any business's financial management. With Wave Accounting Sales Tax, you can effectively track and record your tax payments to ensure compliance and proper financial reporting.

Wave Accounting Sales Tax provides a comprehensive set of tools to streamline the tax payment process. You can easily set up and manage multiple tax rates and rules, ensuring accurate calculation and reporting of taxes.

With Wave Accounting Sales Tax, you can generate detailed reports that provide insights into your tax liabilities. These reports help you analyze your tax payments, identify areas of improvement, and make informed decisions about budgeting and cash flow management.

The inventory valuation feature in Wave Accounting Sales Tax allows you to track the value of your inventory and calculate the tax payable on your sales. This ensures that you accurately account for taxes in your financials and have a clear understanding of your tax liabilities.

Wave Accounting Sales Tax also provides a seamless integration with other Wave features, such as payroll and expenses. This integration allows for efficient tax calculation and reporting, ensuring that your tax payments are accurately included in your financial statements.

By keeping track of your tax payments with Wave Accounting Sales Tax, you can achieve transparency and accuracy in your financial reporting. This not only helps in fulfilling your tax obligations but also facilitates better financial analysis and forecasting for your business.

Generating tax reports

When it comes to taxation, accurate valuation and reporting of sales tax is crucial for businesses. Wave Accounting provides a comprehensive tool for generating tax reports, ensuring that all sales transactions are properly recorded and reported.

The calculation of sales tax involves multiple factors, including inventory, bookkeeping, receipts, and financials. Wave Accounting simplifies the process by automatically tracking sales and expenses, keeping records organized for easy tax reporting.

With Wave Accounting's tax management system, businesses can easily generate detailed tax reports that provide transparency and analysis of their financials. These reports can be used for budgeting and cash flow management, making it easier to plan for future expenses and growth.

In addition, Wave Accounting offers features such as invoice and payroll management, further streamlining the tax reporting process. This ensures that businesses have a complete and accurate picture of their sales tax liability.

By utilizing Wave Accounting's tax reporting capabilities, businesses can save time and effort in tax compliance, while also ensuring accuracy and minimizing the risk of errors. With its user-friendly interface and robust features, Wave Accounting is a valuable tool for businesses of all sizes.

Sales tax summary

The sales tax summary is an important aspect of Wave Accounting, providing businesses with valuable insights into their budgeting, financials, and bookkeeping. By accurately calculating and recording sales tax expenses, businesses can effectively manage their cash flow and ensure compliance with tax regulations.

With Wave Accounting, businesses can easily generate reports and analysis on sales tax, providing transparency and visibility into their tax management. This allows businesses to make informed decisions regarding their expenses, inventory, and valuation.

Wave Accounting also simplifies the process of recording sales tax by automatically tracking and categorizing receipts and sales. This eliminates the need for manual calculation and ensures accuracy in tax calculations.

By providing a comprehensive invoice and accounting platform, Wave Accounting streamlines the sales tax calculation process. Businesses can easily input sales data and generate accurate tax calculations, saving time and effort.

In addition, Wave Accounting offers forecasting features, allowing businesses to predict future sales tax expenses and plan accordingly. This helps businesses to effectively manage their expenses and budget for tax obligations.

In summary, Wave Accounting provides businesses with the necessary tools and features to effectively manage and calculate sales tax. With its user-friendly interface and comprehensive reporting capabilities, businesses can ensure compliance with tax regulations and optimize their financial operations.

Tax liability details

When it comes to tax liability, Wave Accounting provides a comprehensive set of features to help you manage and understand your tax obligations. From forecasting to bookkeeping, analysis to calculation, Wave has you covered.

With Wave's tax management tools, you can easily track and report on the sales tax you collect, ensuring compliance and transparency. The platform automatically calculates the tax liability for each transaction, making it easier for you to manage your cash flow and accounting processes.

Wave's integrated payroll and invoicing features also help streamline your tax liability details. The system automatically applies the appropriate tax rates and deductions, ensuring accurate calculations and reducing errors. Additionally, Wave's budgeting and reporting tools provide valuable insights into your tax-related financials, helping you make informed business decisions.

In addition to tax liability, Wave Accounting also offers support for other tax-related tasks, such as managing receipts and inventory valuation. The platform allows you to easily organize and categorize your receipts, making it simpler to track and report on your expenses. With Wave's inventory management features, you can also stay on top of your tax obligations related to inventory valuation and reporting.

Overall, Wave Accounting provides a comprehensive suite of tools for managing and understanding your tax liability details. From forecasting and bookkeeping to analysis and calculation, Wave is designed to simplify tax management and help you stay compliant. With its user-friendly interface and intuitive features, Wave is an ideal solution for businesses of all sizes looking to streamline their tax-related processes.