If you are looking for efficient solutions to manage your financial data and streamline your accounting processes, integrating cloud-based accounting software with Salesforce is the way to go. With the power of automation and integration, you can easily track invoices, manage expenses, generate reports, handle payroll, and stay on top of your taxes all from one central hub.

One of the key advantages of using accounting software with Salesforce is the ability to automate billing processes. It allows you to create and send invoices, track payments, and even set up recurring billing for your clients or customers. This not only saves time but also ensures accuracy in your financial transactions.

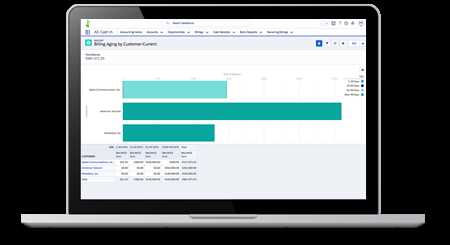

In addition to billing and invoicing, accounting software for Salesforce also provides advanced financial analytics and reporting capabilities. You can generate real-time reports on sales, revenue, expenses, and other key financial metrics, allowing you to make informed business decisions.

Furthermore, integrating accounting software with Salesforce enables seamless inventory management. You can track your products or services, monitor stock levels, and even set up automated reordering to ensure you never run out of inventory.

Top Accounting Software for Salesforce Find the Best Solution for Your Business

When it comes to managing the financial aspects of your business, having the right accounting software can make a world of difference. With the right system in place, you can automate processes such as billing, expenses tracking, and inventory management, allowing you to focus on other important aspects of your business.

Salesforce, a leading customer relationship management platform, offers a wide range of accounting software options that integrate seamlessly with their system. These software solutions can help you streamline your accounting processes and provide you with real-time financial reports and analytics.

One key feature to look for in accounting software for Salesforce is payroll integration. This allows you to easily manage employee salaries, benefits, and taxes, ensuring accurate and timely payments. Additionally, integration with Salesforce's cloud-based system means that all your financial data is stored securely and accessible from anywhere.

Another important aspect to consider is the ability to generate professional and customizable invoices. The software should allow you to create and send invoices directly from the system, as well as track payments and overdue invoices. This will help you stay on top of your accounts receivable and ensure timely revenue collection.

Furthermore, accounting software for Salesforce should also provide robust inventory management features. This includes tracking product quantities, managing stock levels, and generating reports on inventory value and turnover. Having accurate and up-to-date inventory information is crucial to maintaining smooth operations and avoiding stockouts or overstocking.

In conclusion, choosing the right accounting software for Salesforce is essential for the financial health of your business. Look for systems that offer automated billing, expenses tracking, payroll integration, inventory management, and customizable reports. With the right software in place, you can streamline your financial processes and make informed business decisions based on real-time data.

The Importance of Accounting Software for Salesforce

Accounting software solutions are essential for the efficient management of financial processes in any business, and when integrated with Salesforce, they provide even greater benefits. With accounting software for Salesforce, businesses can streamline their financial operations, automate payroll and invoices, and generate accurate financial reports.

One of the key advantages of accounting software for Salesforce is the ability to track financial data in real-time. This allows businesses to have up-to-date information on their revenue, expenses, and cash flow, enabling them to make informed decisions about their financial future.

The automated features of accounting software for Salesforce also greatly simplify tax calculations and reporting. These solutions can automatically calculate taxes based on the business's location and help generate accurate tax reports, saving time and reducing the risk of errors.

Integration between accounting software and Salesforce also enables seamless data exchange between the two systems. This means that sales and customer information from Salesforce can be automatically transferred to the accounting software, ensuring accurate billing and accounting information.

Furthermore, accounting software for Salesforce often comes with cloud capabilities, allowing businesses to access their financial data from anywhere and at any time. This flexibility is especially useful for businesses with multiple branches or remote teams, as it allows them to easily manage their accounting processes from a centralized location.

In addition to these features, accounting software for Salesforce also offers advanced analytics capabilities. Businesses can use these analytics tools to gain valuable insights into their financial performance, identify trends, and make data-driven decisions to optimize their operations.

Overall, the use of accounting software for Salesforce can greatly enhance a business's financial management capabilities, improve efficiency, and enable accurate and reliable tracking of financial transactions, payroll, inventory, and billing. By integrating these systems, businesses can streamline their operations, reduce manual tasks, and gain better control over their financial processes.

Streamlining Financial Processes

When it comes to managing the financial aspects of your business, leveraging the power of Salesforce can greatly simplify and streamline your processes. Salesforce offers a wide range of financial solutions, including accounting, billing, payroll, taxes, and more. These automated software solutions can help you efficiently handle your finances and ensure accuracy in your financial operations.

With Salesforce financial software, you can easily track and manage expenses, generate reports, and integrate with other essential systems like inventory tracking and invoice generation. This integration allows for seamless flow of information and eliminates the need for manual data entry, saving time and reducing errors.

Additionally, Salesforce financial solutions provide powerful analytics and reporting capabilities, allowing you to gain valuable insights into your business performance. You can generate detailed financial reports, analyze trends, and make data-driven decisions to drive your business forward.

One of the key advantages of Salesforce financial software is its cloud-based nature, enabling you to access your financial data securely from anywhere, at any time. This flexibility is particularly beneficial for businesses with multiple locations or remote teams.

In conclusion, Salesforce offers comprehensive financial software solutions that can streamline your financial processes and significantly improve efficiency. From accounting and payroll to taxes and expenses, these automated systems provide a centralized platform for managing your financial operations and ensuring accuracy and compliance. With powerful analytics and seamless integration, Salesforce financial software empowers businesses to make informed decisions and drive growth.

Automating Data Entry and Syncing

In today's fast-paced business environment, automated software solutions have become essential for financial management and integration. One area where automation can significantly improve efficiency is data entry and syncing. By automating these processes, businesses can save time, reduce errors, and improve overall productivity.

Automated accounting software can streamline the syncing of financial data between different systems, such as Salesforce and other expense management systems. This integration allows for seamless transfer of information, ensuring that all transactions, expenses, invoices, and taxes are accurately recorded and tracked.

With automated software, businesses can generate real-time reports and analytics, providing valuable insights into their financial performance. This data can help inform decision-making processes, identify trends, and optimize resource allocation.

Moreover, automation can simplify the billing and invoicing processes by automatically generating and sending invoices to customers. This not only ensures accuracy but also enhances customer satisfaction by providing prompt and efficient service.

Additionally, automation can extend to payroll management, making it easier for businesses to calculate and process employee salaries. By linking payroll systems with accounting software, businesses can automate the calculation of taxes, deductions, and wages. This integration eliminates the need for manual data entry and reduces the risk of errors.

In conclusion, automating data entry and syncing is crucial for businesses seeking to optimize their accounting processes. By investing in cloud-based accounting software that seamlessly integrates with Salesforce and other systems, businesses can improve efficiency, accuracy, and decision-making while reducing the manual workload and potential for errors.

Generating Real-Time Reports and Analytics

Accounting software for Salesforce offers powerful tools for tracking and generating real-time reports and analytics. By integrating with Salesforce's CRM systems, these software solutions provide a comprehensive view of your business's financial data, including sales, expenses, and inventory.

With automated processes for payroll, billing, and taxes, this software streamlines your financial operations and ensures accuracy and compliance. You can easily generate invoices and track expenses, making it easier than ever to keep your financial records up to date.

By leveraging the power of the cloud, accounting software for Salesforce allows you to access your data from anywhere, at any time. This not only enhances collaboration and visibility across your organization but also enables you to make informed decisions based on real-time information.

The reporting and analytics capabilities of these software solutions are robust, offering customizable dashboards and visualizations that allow you to gain insights into your business's financial performance. You can track key metrics, analyze trends, and identify areas for improvement.

Whether you're a small business or a large enterprise, accounting software for Salesforce provides the tools you need to manage your finances efficiently. With its automated features and comprehensive reporting, you can free up valuable time and resources, focusing on growing your business and making strategic financial decisions.

Improving Accuracy and Efficiency

Managing expenses, taxes, and invoices can be a complex and time-consuming task for businesses. With the advancement of cloud technology and accounting software, companies now have access to efficient solutions that can streamline their accounting processes.

By integrating accounting software with Salesforce, businesses can improve accuracy and efficiency in their financial management. The software automates tasks such as expense tracking, payroll management, and inventory tracking. This automation reduces the chances of human error and ensures that financial data is accurately recorded.

Furthermore, accounting software provides real-time analytics and reporting, allowing businesses to make informed decisions based on accurate data. With these insights, companies can better manage their finances and plan for future growth.

Cloud-based accounting software offers the added advantage of remote access, allowing businesses to access their financial data anytime, anywhere. This flexibility is especially beneficial for salesforce teams who are constantly on the move. It enables them to quickly generate invoices, track expenses, and manage billing without being tied to a specific location.

Overall, integrating accounting software with Salesforce provides businesses with a powerful tool to improve accuracy and efficiency in their financial management. By automating tasks, providing real-time analytics, and offering remote access, these software solutions help businesses streamline their accounting processes, reduce errors, and make informed financial decisions.

Minimizing Manual Errors

One of the biggest challenges in accounting is the potential for human error. Manual data entry and calculations can lead to mistakes that can have significant repercussions for a business. However, with the right systems in place, these errors can be minimized.

Accounting software integrated with Salesforce can help automate many processes, reducing the need for manual data entry. By automatically capturing and syncing data from various sources, such as sales, expenses, and inventory tracking, the software ensures that the financial records are accurate and up-to-date.

Furthermore, the software can provide real-time analytics and reports that allow for a comprehensive view of the company's financials. This not only helps in decision-making but also provides a valuable tool for tax management. With accurate and detailed reports, businesses can easily track their tax obligations and ensure compliance.

Additionally, the integration of payroll software with Salesforce accounting solutions enables automated payroll processing. This eliminates the need for manual calculations and reduces the risk of errors in employee compensation. Payroll software can also generate electronic pay stubs and handle tax withholdings, further streamlining the process.

Another area prone to manual errors is billing and invoicing. With Salesforce accounting software, businesses can automate billing processes and generate professional invoices. This reduces the chances of mistakes in calculation, ensures timely and accurate billing, and improves cash flow management.

Overall, using accounting software integrated with Salesforce can greatly minimize manual errors. By automating various financial processes, businesses can improve accuracy, save time, and focus on more strategic aspects of their operations.

Increasing Productivity through Workflow Automation

In today's fast-paced business environment, it is essential to find ways to increase productivity and efficiency. One way to achieve this is through workflow automation. By automating various tasks and processes, businesses can streamline their operations and free up valuable time and resources that can be directed towards more value-added activities.

Accounting software plays a crucial role in automating workflows. With the right software in place, businesses can automate payroll management, billing and invoicing, expense tracking, and financial reporting. This eliminates the need for manual data entry and reduces the chances of errors and inconsistencies.

Cloud-based accounting software solutions offer even more benefits. They provide real-time access to financial data, allowing businesses to make informed decisions. Additionally, cloud-based systems offer seamless integration with other software platforms, such as Salesforce, providing a holistic view of the business and enabling efficient collaboration across departments.

Workflow automation in accounting software also extends to inventory management. Businesses can automate the tracking and management of inventory, ensuring optimal stock levels and reducing the risk of stockouts or overstocks. This improves customer satisfaction and enables businesses to make data-driven decisions related to purchasing and production.

Automation also plays a crucial role in tax compliance. With automated tax systems, businesses can ensure accurate and timely filing of taxes, reducing the risk of penalties or audits. The software can automatically calculate taxes based on predefined rules and generate reports for easy submission.

In conclusion, by implementing automated workflow solutions in accounting software, businesses can significantly increase productivity and efficiency. From payroll management to financial reporting, automation streamlines processes, eliminates manual errors, and provides real-time insights. Furthermore, integration with other software platforms like Salesforce enables businesses to have a comprehensive view of their operations and collaborate effectively across departments. Embracing automation is crucial for businesses looking to stay competitive and achieve sustainable growth.

Enhancing Collaboration and Communication

Effective collaboration and communication are critical for the success of any business, especially when it comes to accounting and financial management. With the integration of top accounting software for Salesforce, businesses can streamline their processes and enhance collaboration between teams.

By combining accounting and Salesforce systems, businesses can automate financial processes such as report generation, payroll management, and tax tracking. These automated systems ensure accuracy and efficiency, eliminating the need for manual data entry and reducing the risk of errors.

Additionally, the integration of accounting software with Salesforce enables real-time collaboration and communication between different departments and teams. Sales teams can easily access and update financial information, allowing them to make informed decisions and provide accurate quotes to customers.

The software also provides advanced analytics and reporting capabilities, allowing businesses to gain insights into their financial performance. Interactive dashboards and customizable reports provide a comprehensive view of revenue, expenses, and inventory, helping businesses make data-driven decisions.

Moreover, accounting software for Salesforce enables seamless billing and invoice management. Businesses can generate and send professional-looking invoices to clients directly from Salesforce, improving the billing process and reducing delays in payment.

Overall, the integration of accounting software with Salesforce enhances collaboration and communication within a business. It streamlines financial processes, provides real-time access to data, and enables teams to work together more efficiently and effectively.

Facilitating Cross-Department Collaboration

In today's business landscape, collaboration across different departments is crucial for the success of any organization. When it comes to accounting processes, having a system in place that facilitates seamless collaboration between departments is essential. Salesforce offers top accounting software solutions that can help businesses track their finances and streamline cross-department collaboration.

By integrating accounting software with Salesforce, various departments such as sales, finance, and inventory management can easily access and share financial data. This integration eliminates the need for manual data entry and reduces the chances of errors. Departments can work together in real-time, ensuring that the latest financial information is available to all teams.

The software allows for automated tracking of invoices, payroll, taxes, and expenses, providing a streamlined and efficient way of managing financial processes. With cloud-based accounting software systems, all pertinent data can be accessed from anywhere, at any time, ensuring that collaboration is not hindered by physical location or time constraints.

Additionally, the integration of accounting software with Salesforce enables advanced analytics and reporting capabilities. By generating reports and analytics, businesses can gain valuable insights into their financial performance and make informed decisions. These insights can be shared across departments, allowing for better cross-department collaboration.

Overall, the use of accounting software integrated with Salesforce offers automated and efficient solutions for financial management. Through seamless cross-department collaboration and access to real-time data, businesses can improve their accounting processes and make more informed financial decisions.

Enabling Seamless Communication with Clients

When it comes to managing accounting tasks for your business, having efficient and effective communication with your clients is crucial. With the right software solutions and integration with Salesforce, you can ensure seamless communication throughout the entire process.

By utilizing accounting software that is specifically designed for Salesforce, you can easily track and manage payroll, taxes, inventory, and expenses. This integration allows for real-time updates and automated reports, giving you and your clients immediate access to important financial information.

With automated billing and invoicing systems in place, you can streamline the entire billing process, ensuring accurate and timely invoices for your clients. This not only helps improve payment cycles but also builds trust and transparency between you and your clients.

Additionally, the integration of accounting software and Salesforce provides powerful analytics and reporting capabilities. You can generate comprehensive financial reports, track sales and expenses, and gain valuable insights into your business's financial health. These insights can then be shared with your clients, enabling informed decision-making and strategic planning.

Effective communication with clients is essential for any business, and by utilizing accounting solutions that seamlessly integrate with Salesforce, you can ensure a streamlined and efficient process. From payroll and taxes to inventory management and financial reporting, the right software can help you provide exceptional service to your clients and foster strong relationships built on trust and transparency.

Top Accounting Software Solutions for Salesforce

When it comes to managing your business's finances, having top accounting software solutions that seamlessly integrate with Salesforce can greatly improve your efficiency and accuracy. Whether you need to track expenses, create invoices, or manage your accounting inventory, there are a variety of software systems available to meet your needs.

One of the key benefits of using accounting software solutions for Salesforce is the ability to automate your financial processes, saving you time and reducing the risk of errors. With integrated tracking and analytics, you can easily monitor your expenses and generate detailed reports to gain valuable insights into your business's financial health.

Many top accounting software solutions for Salesforce also offer payroll management features, allowing you to easily track and process employee salaries and tax information. With cloud-based software, you can access your financial data from anywhere, giving you greater flexibility and convenience.

In addition to streamlining your accounting processes, these software solutions also provide billing and invoicing features, making it easy for you to create and send professional-looking invoices to your clients. With automated reminders and payment processing integration, you can also ensure that you get paid on time.

When choosing the best accounting software solution for your business, it's important to consider your specific needs and budget. Look for a software that offers comprehensive financial management features, reliable integration with Salesforce, and a user-friendly interface. With the right solution in place, you can effectively manage your business's finances, ensure compliance with tax regulations, and make better-informed decisions for your company's growth.

Solution A

The Solution A is a comprehensive accounting software that is designed to integrate seamlessly with Salesforce, the leading CRM platform. It offers a range of features including invoices and billing, payroll management, expense tracking, and automated inventory management.

With Solution A, businesses can automate their financial processes and gain real-time visibility into their financial data. The software allows for easy integration with other cloud-based systems, making it a flexible and scalable solution for businesses of all sizes.

One of the key features of Solution A is its robust tax management capabilities. It automatically calculates and tracks taxes, ensuring compliance with local tax regulations. The software also provides detailed analytics and reports, allowing businesses to make informed financial decisions.

By using Solution A, businesses can streamline their accounting processes, improve accuracy, and save time and resources. With its comprehensive set of features, this software is an ideal solution for businesses looking to enhance their accounting and financial management.

- Features of Solution A:

- Invoices and billing

- Payroll management

- Expense tracking

- Automated inventory management

- Tax management

- Integration with Salesforce and other cloud-based systems

- Analytics and reports

Solution B

Solution B is a comprehensive accounting software for Salesforce that offers automated billing and accounting integration. It provides seamless integration with Salesforce's CRM platform, allowing businesses to streamline their financial processes and improve efficiency.

With Solution B, businesses can easily generate and manage invoices, track expenses, and gain better control over their financial management. The software offers robust features for inventory management, allowing businesses to track their products and stock levels accurately.

One of the key advantages of Solution B is its cloud-based nature, which allows businesses to access their financial data from anywhere with an internet connection. This makes it easier for teams to collaborate and share information, improving overall productivity.

The software also provides in-depth analytics and reporting capabilities, allowing businesses to gain valuable insights into their financial performance. Users can generate detailed reports on sales, expenses, and taxes, making it easier to make informed decisions and plan for the future.

In addition, Solution B offers integrated payroll functionality, making it easy for businesses to manage employee salaries and benefits. The software automatically calculates taxes and deductions, ensuring compliance with regulations and reducing the risk of errors.

Overall, Solution B is a powerful accounting software solution for businesses using Salesforce. Its automated features, integration capabilities, and financial management tools make it an ideal choice for businesses looking to streamline their accounting processes and improve overall efficiency.

Solution C

Solution C is a comprehensive accounting software that offers a range of features for businesses looking to streamline their financial management processes. With Solution C, businesses can effectively track their inventory, automate payroll, and manage billing systems.

One of the key advantages of Solution C is its automated expense tracking capabilities. This feature allows businesses to easily monitor and categorize their expenses, ensuring accurate expense reporting and easy tax preparation.

In addition, Solution C provides efficient invoice management, enabling businesses to create and send invoices to their clients with ease. With integrated financial reporting and analytics, businesses can generate comprehensive reports that provide valuable insights into their financial performance.

One of the key highlights of Solution C is its seamless integration with Salesforce, a popular customer relationship management platform. This integration allows for easy data sharing between the two systems, ensuring that businesses have real-time access to accurate financial information.

Another key advantage of Solution C is its cloud-based architecture, which allows businesses to access their accounting data from anywhere and at any time. This enables businesses to efficiently manage their financial operations, even if they have multiple locations or remote team members.

Overall, Solution C offers businesses a robust and reliable accounting software solution with features that support inventory tracking, payroll automation, billing management, and financial reporting. Its integration with Salesforce and cloud-based architecture make it a flexible and scalable choice for businesses of all sizes.

Solution D

Solution D is a comprehensive accounting software solution specifically designed for Salesforce users. With its seamless integration with the Salesforce platform, Solution D provides users with a powerful and efficient system for managing their financial operations.

One of the key features of Solution D is its robust reporting capabilities. Users can generate detailed reports on their sales, expenses, and taxes, allowing for better tracking and analysis of financial data. Whether it's analyzing sales trends or calculating tax liabilities, Solution D provides the necessary tools for informed decision-making.

Another area where Solution D excels is inventory management. With its advanced inventory tracking features, users can easily keep track of their products, maintain accurate stock levels, and streamline their order management process. This ensures that businesses have the right products available at the right time, leading to improved customer satisfaction and increased sales.

Additionally, Solution D offers a range of features for efficient billing and invoicing. Users can create professional-looking invoices, automate billing processes, and even set up recurring payments. This helps businesses streamline their accounts receivable process and ensure that payments are received in a timely manner.

Furthermore, Solution D includes robust payroll management functionality. Users can easily calculate and track employee salaries, manage tax withholdings, and generate accurate pay slips. This not only saves time and reduces manual errors, but also ensures compliance with payroll regulations.

With Solution D's cloud-based architecture, users can access their financial data from anywhere, at any time. This not only provides flexibility and convenience, but also ensures data security and backup. Additionally, Solution D offers advanced analytics capabilities, allowing users to gain valuable insights into their financial performance and make data-driven decisions.

In conclusion, Solution D is a powerful accounting software solution for Salesforce users. With its comprehensive suite of features for financial management, inventory tracking, billing, payroll, and analytics, Solution D helps businesses streamline their operations, improve efficiency, and make informed decisions.

Solution E

Solution E is a comprehensive financial management software for Salesforce that offers a wide range of features to help businesses with their accounting needs.

With Solution E, businesses can easily create and manage invoices, track expenses, and calculate taxes all in one unified platform. The software enables automated integration with Salesforce, ensuring that financial data is seamlessly shared between the accounting and sales departments.

One of the key benefits of Solution E is its robust reporting and analytics capabilities. The software provides detailed reports on financial performance, allowing businesses to gain insights and make data-driven decisions.

Additionally, Solution E offers cloud-based systems, enabling users to access their financial data from anywhere at any time. This flexibility makes it easier for businesses to manage their accounting processes and collaborate with team members remotely.

Another notable feature of Solution E is its inventory tracking and billing functionalities. Businesses can easily keep track of their inventory, automate billing processes, and streamline their order management.

Overall, Solution E is a powerful accounting software solution that offers a comprehensive set of tools to manage financial processes within the Salesforce ecosystem. Whether it's invoicing, tax calculations, expense tracking, or inventory management, Solution E provides businesses with the necessary tools to streamline their accounting operations and drive growth.

Factors to Consider When Choosing Accounting Software for Salesforce

When selecting accounting software for Salesforce, there are several important factors to consider. Integration with Salesforce is crucial, as it allows for seamless data transfer between the two systems and ensures accurate billing and sales tracking. Look for solutions that offer reliable integration capabilities and provide real-time updates for both accounting and sales teams.

Another factor to consider is the software's reporting and analytics features. An accounting solution that can generate comprehensive reports and provide valuable insights into financial data is essential for making informed business decisions. Look for software that offers customizable reports and analytics tools to suit your specific needs.

The software's ability to handle inventory and taxes is another important consideration. Ensure that the accounting solution can accurately track inventory levels and calculate taxes, saving your business time and effort. Additionally, look for software that can generate invoices and handle payroll and expenses, as these features can streamline your financial processes and improve efficiency.

Cloud-based accounting software is also worth considering, as it offers the flexibility to access your financial data from anywhere, at any time. This allows for remote collaboration and ensures that your accounting system is always up to date. Furthermore, automated features, such as automated data entry and bank reconciliation, can save time and reduce the risk of errors.

Ultimately, the choice of accounting software for Salesforce will depend on your business's specific needs and requirements. Consider factors such as integration capabilities, reporting and analytics features, inventory and tax handling, cloud accessibility, and automation options when evaluating different solutions. By carefully considering these factors, you can find the best accounting software to complement your Salesforce system and drive your business's financial success.

Integration with Salesforce CRM

The top accounting software solutions offer seamless integration with Salesforce CRM, allowing businesses to streamline their financial processes and track expenses more efficiently. With this integration, businesses can connect their accounting systems with Salesforce's customer relationship management platform to access real-time financial data and automate various tasks.

By integrating accounting software with Salesforce CRM, businesses can easily manage their accounting, payroll, inventory, and billing processes all in one place. They can create and track invoices, manage financial transactions, and generate reports for better analytics and insights. This integration eliminates the need for manual data entry and ensures accurate and up-to-date financial information.

Moreover, integration with Salesforce CRM enables businesses to automate tax calculations and compliance. The software can automatically calculate taxes based on rules and rates, reducing the risk of errors and ensuring accurate tax filings. This integration also provides a centralized platform for tracking financial data, making it easier to monitor cash flow, expenses, and profitability.

Cloud-based accounting software solutions that integrate with Salesforce CRM offer additional benefits. Businesses can access their financial data and software from anywhere, at any time, using any device with an internet connection. This flexibility allows for better collaboration and decision-making, as teams can easily share and access financial information from different locations.

In conclusion, integration with Salesforce CRM provides businesses with a comprehensive and automated solution for their accounting and financial management needs. With seamless integration, companies can improve efficiency, accuracy, and transparency in their financial processes, leading to better decision-making and business growth.

Scalability and Customizability

When it comes to accounting software for Salesforce, scalability and customizability are key factors to consider. As your business grows, you need a system that can handle increasing volumes of data and transactions. The right accounting software should be able to accommodate your expanding business operations without any limitations or performance issues.

Furthermore, customizability is crucial as it allows you to tailor the accounting software to meet your specific business needs. You should be able to customize various features and workflows, such as billing, analytics, taxes, and invoices, to align with your unique business processes and requirements.

An accounting software that seamlessly integrates with Salesforce is ideal, as it allows for efficient data synchronization and eliminates the need for manual data entry. This integration ensures that your financial information remains accurate and up-to-date across both systems.

Automated financial management processes are another important aspect of scalability. An accounting software should offer automation for tasks such as expense tracking, payroll management, and inventory management. This automation not only saves time but also reduces the risk of human error, ensuring the accuracy and reliability of your financial data.

Lastly, the ability to generate comprehensive reports is vital for monitoring the financial health of your business. The accounting software should provide robust reporting capabilities that allow you to analyze key financial metrics and make informed decisions. Having access to real-time financial reports empowers you to identify trends, assess performance, and plan for future growth.

Reporting and Analytics Capabilities

When it comes to managing your financial data, it is crucial to have robust reporting and analytics capabilities in your accounting software. With the integration of Salesforce and top accounting software solutions, you can streamline your reporting processes and gain valuable insights into your business.

One of the key benefits of using accounting software is the ability to generate detailed financial reports. These reports provide you with a clear overview of your revenues, expenses, and overall financial health. You can easily track invoices and payments, allowing you to stay on top of your cash flow and ensure timely payments from customers.

Automated solutions offer advanced reporting features, such as customizable dashboards and visual analytics. These features enable you to easily monitor key financial metrics and identify trends or patterns in your data. By having access to real-time financial insights, you can make informed decisions and optimize your business operations.

Accounting software also integrates with other systems, which can enhance your reporting and analytics capabilities. For example, you can integrate your accounting software with your inventory management system to track inventory levels and costs. This enables you to generate comprehensive reports on inventory turnover, pricing, and profitability.

In addition to financial reporting, accounting software can also help you with tax compliance and payroll management. With built-in tax and payroll features, you can automate tax calculations, generate tax forms, and ensure accurate payroll processing. This eliminates the need for manual calculations and reduces the risk of errors in your tax filings and employee payments.

Furthermore, cloud-based accounting software provides seamless access to your financial data from anywhere, at any time. This is especially beneficial for businesses with multiple locations or remote teams. Cloud-based solutions offer real-time syncing of data, allowing you to access the latest financial reports and make informed decisions even when you are on the go.

User-Friendly Interface

The top accounting software for Salesforce offers a user-friendly interface that makes financial management easy and efficient. With intuitive navigation and clear icons, users can easily access the various features and functionalities of the software.

These systems provide customizable dashboards and reports, allowing users to track and analyze their accounting data in real-time. The user-friendly interface also enables seamless integration with other Salesforce applications, such as sales and customer relationship management, providing a holistic view of the business.

Users can automate tasks such as expense tracking, invoicing, and billing, reducing manual errors and saving time. The software also handles complex financial processes, such as tax calculations and payroll management, ensuring compliance with regulations.

Additionally, the user-friendly interface allows for easy inventory management, enabling businesses to track their products and streamline their supply chain. This feature is especially beneficial for businesses with multiple locations or e-commerce platforms.

The software's user-friendly interface also facilitates collaboration among team members. Users can assign tasks, share documents, and communicate within the system, improving efficiency and productivity within the accounting department.

With advanced analytics and reporting capabilities, the software provides valuable insights into the company's financial performance. Users can generate financial statements, analyze trends, and make informed business decisions based on the data.

In conclusion, the top accounting software for Salesforce offers a user-friendly interface that simplifies financial management, automates tasks, and provides comprehensive insights. This powerful tool streamlines the accounting process, improves efficiency, and helps businesses make informed financial decisions.

Cost-Effectiveness and ROI

When it comes to managing the financial aspects of your business, cost-effectiveness and ROI are crucial considerations. With the right accounting software for Salesforce, you can achieve both. By automating manual tasks and streamlining processes, you can save time and reduce human error, leading to cost savings and increased productivity.

One of the key benefits of using accounting software for Salesforce is that it allows you to effectively manage your inventory. With real-time tracking and reporting features, you can easily keep track of your stock levels, reducing the risk of overstocking or running out of crucial items. This can help you optimize your inventory management and avoid unnecessary costs.

Cloud-based accounting solutions offer significant cost advantages compared to traditional on-premises software. With no hardware or maintenance costs, you can save money while still enjoying the benefits of a robust accounting system. The automated billing and invoicing features also help to streamline your financial processes, reducing the need for manual input and improving accuracy.

The integration capabilities of accounting software for Salesforce allow for seamless connectivity with other business systems, such as payroll and tax management. This integration eliminates the need for manual data entry and ensures that information is consistently and accurately shared across departments. This not only saves time but also reduces the risk of errors and discrepancies.

In addition to cost savings, accounting software for Salesforce also provides valuable financial insights through detailed reports and analytics. These reports can help you make informed business decisions by providing visibility into your financial performance, cash flow, and profitability. With the ability to easily generate customized reports, you can track key metrics and identify areas for improvement.

Overall, implementing accounting software for Salesforce can have a significant impact on your business's cost-effectiveness and ROI. With automated processes, efficient inventory management, integrated systems, and valuable financial insights, you can streamline your operations, reduce costs, and maximize profitability.