When running a cleaning services business, it is crucial to have a clear understanding of the chart of accounts. This financial tool helps in organizing and categorizing various types of transactions, including income, expenses, assets, and liabilities, for accurate bookkeeping and financial analysis.

The chart of accounts provides a systematic way to track and record the flow of money in the business. It consists of different accounts, each representing a specific financial element, such as revenue, expenses, assets, and liabilities. By maintaining a well-organized chart of accounts, cleaning service businesses can easily monitor their financial health and make informed decisions about the direction of their organization.

Income accounts in the chart of accounts for cleaning services capture the revenue generated from various sources, such as one-time cleanings, recurring services, or special projects. These accounts help track the money coming into the business and provide insights into the profitability of different services offered.

On the other side of the spectrum are expense accounts, which record the costs incurred in operating the cleaning business. Expenses, such as purchasing cleaning supplies, paying employees, or renting equipment, are tracked under specific expense accounts. This allows business owners to identify areas of high expenditure and optimize their operations to reduce costs.

Assets and liabilities accounts in the chart of accounts establish the balance and financial position of the cleaning services business. Assets include items like cleaning equipment, vehicles, or cash on hand, while liabilities represent any debts or payments owed by the business. These accounts provide a snapshot of the organization's financial standing and aid in making informed decisions regarding investments or loan repayments.

In conclusion, investing time and effort into understanding and maintaining a comprehensive chart of accounts is crucial for any cleaning services business. It ensures accurate and organized financial records, facilitates effective bookkeeping and financial analysis, and helps in making informed decisions to drive the success and growth of the organization.

Importance of the Chart of Accounts

The chart of accounts is a crucial component of financial management for cleaning services. It serves as a tool for organizing and categorizing financial transactions, giving businesses a clear picture of their income, expenses, and overall financial performance.

One of the main benefits of a well-designed chart of accounts is that it allows cleaning service providers to accurately track their profit and loss. By categorizing income and expenses into specific accounts, businesses can easily identify areas of the organization that are generating revenue and those that are incurring expenses.

The chart of accounts also plays a vital role in bookkeeping and financial reporting. By organizing transactions into different accounts, cleaning services can prepare accurate financial statements, such as balance sheets and income statements. These statements provide a comprehensive overview of the business's financial health, enabling sound decision-making and planning for the future.

In addition, the chart of accounts helps in managing invoices and payments. By assigning each invoice to the appropriate account, cleaning services can easily track outstanding payments and monitor their cash flow. This level of organization ensures that all revenue is accounted for and that all expenses are properly recorded.

Furthermore, the chart of accounts helps cleaning services stay compliant with tax obligations and other legal requirements. By properly categorizing transactions, businesses can easily identify their tax liabilities and ensure accurate reporting to tax authorities. This level of transparency and compliance reduces the risk of penalties or audits and demonstrates the business's commitment to financial responsibility.

In conclusion, the chart of accounts is an indispensable tool for cleaning services. It provides a structured way to organize and track financial transactions, enabling businesses to assess their profitability, manage invoices and payments, and stay compliant with legal and tax requirements. By maintaining an accurate and well-designed chart of accounts, cleaning services can effectively monitor their financial performance and make informed decisions for the future success of their business.

Overview of Cleaning Services Industry

The cleaning services industry is a highly profitable and competitive sector that provides a range of services to both residential and commercial clients. This industry plays a vital role in maintaining cleanliness and hygiene in various settings, including homes, offices, hospitals, and schools.

To effectively manage their financial operations and ensure a profitable business, cleaning service organizations need to maintain accurate accounts and track their income and expenses. This is where the chart of accounts comes into play.

The chart of accounts is a financial tool that helps businesses organize and categorize their financial transactions. It consists of various accounts that categorize revenue, expenses, assets, and liabilities. These accounts enable cleaning service businesses to track their income and expenses, calculate profit and loss, and maintain a balanced financial statement.

Common accounts used in the cleaning services industry include revenue accounts, such as income from cleaning services and sales of cleaning products. Expenses accounts may include costs related to cleaning supplies, equipment maintenance, employee salaries, and utilities. Assets accounts may include vehicles, cleaning equipment, and buildings, while liabilities accounts may include loans and outstanding payments.

In addition to managing finances, cleaning service businesses also need to handle their bookkeeping and invoicing processes. This involves creating and maintaining invoices for clients, tracking payments, and ensuring accurate record-keeping. A well-maintained ledger assists in keeping track of financial transactions, which is crucial for the financial health and success of the organization.

In conclusion, the cleaning services industry requires efficient financial management to ensure profitability and sustainability. By utilizing a comprehensive chart of accounts, businesses can effectively track their income and expenses, manage their assets and liabilities, and maintain accurate financial records, ultimately leading to a successful and thriving cleaning service business.

Market Size and Growth

The market for cleaning services has been steadily growing over the years, driven by an increasing demand for professional cleaning solutions. According to industry reports, the global cleaning services market is expected to reach a revenue of $74.3 billion by 2022. This growth can be attributed to a variety of factors, including the rising awareness of hygiene and cleanliness in both residential and commercial settings.

Companies operating in the cleaning services industry primarily generate their revenue through the provision of cleaning services to individuals, businesses, and organizations. This revenue is recorded in the company's financial books, such as the ledger, where all transactions related to cleaning services, payments, and expenses are documented.

In terms of financial management, cleaning service companies need to carefully track their assets, liabilities, income, and expenses to ensure profitability. They need to monitor their accounts receivable and payable, as well as keep a record of all financial transactions such as invoices and payments. This is crucial for effective bookkeeping and maintaining financial stability.

The market size for cleaning services is also influenced by the overall growth of the economy. As businesses and organizations expand, there is a greater need for professional cleaning services to maintain a clean and sanitary environment. This has led to an increase in demand for cleaning services and has created opportunities for new businesses to enter the market.

Additionally, the ongoing COVID-19 pandemic has further highlighted the importance of cleaning and disinfection, resulting in an even greater demand for cleaning services. As businesses and individuals prioritize hygiene and cleanliness, cleaning service providers are experiencing a surge in demand and are expected to grow in the coming years.

In conclusion, the market for cleaning services is growing steadily, driven by factors such as increased awareness of hygiene, economic growth, and the impact of the COVID-19 pandemic. As the demand for professional cleaning services continues to rise, cleaning companies need to effectively manage their financial accounts and ensure they provide high-quality services to stay competitive in the market.

What is a Chart of Accounts?

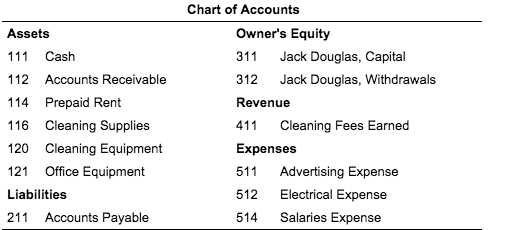

A Chart of Accounts is a crucial element in the financial organization of a cleaning services business. It is a categorized list of all the financial accounts, such as income, expenses, assets, liabilities, and equity, used to record and track the financial transactions of the organization. Each account in the Chart of Accounts is assigned a unique number and description, allowing for easy identification and classification of financial activities.

The Chart of Accounts is like a financial ledger for a cleaning services business. It serves as a roadmap for recording and reporting financial information, ensuring accurate and organized bookkeeping. With a well-structured Chart of Accounts, cleaning services businesses can effectively monitor their financial performance, analyze profit and loss, and make informed decisions about the allocation of resources.

A comprehensive Chart of Accounts for a cleaning services business typically includes accounts for revenue and income, such as service fees and contract payments, as well as accounts for expenses like cleaning supplies, equipment maintenance, and employee wages. It also includes accounts for assets, such as vehicles and equipment, and liabilities such as loans or outstanding payments. The Chart of Accounts provides a holistic view of the financial health of the organization and helps track the balance between income and expenses.

By maintaining a detailed Chart of Accounts, cleaning services businesses can easily generate financial reports and statements, monitor cash flow, and track their financial goals. It streamlines the financial management process and ensures that all financial transactions are properly recorded and categorized. It is essential for accurate record-keeping, financial analysis, and compliance with accounting regulations.

Definition and Purpose

The chart of accounts is a financial tool used in bookkeeping to categorize and organize a company's financial transactions. It provides a systematic way to record and track various income, expenses, assets, and liabilities of a business.

The primary purpose of a chart of accounts is to create a standardized structure for recording financial data. It helps in maintaining accurate and consistent records, making it easier to analyze and understand the financial health of a business.

A chart of accounts typically consists of a list of numbered accounts that represent different categories of financial transactions. These accounts can include revenue accounts, expense accounts, asset accounts, liability accounts, and equity accounts.

One of the key benefits of using a chart of accounts is its ability to provide a clear and organized view of a company's finances. It allows for easy tracking of income and expenses, making it simpler to generate financial statements and reports.

Additionally, a chart of accounts helps in preparing tax returns, tracking payments and invoices, and calculating profit or loss. It also aids in budgeting and forecasting, as it provides a solid foundation for analyzing the financial performance of a business.

Structure of the Chart of Accounts

The chart of accounts is a vital component of a cleaning services organization's financial bookkeeping system. It provides a structured framework for categorizing and recording all financial transactions related to the business. By maintaining a well-organized chart of accounts, an organization can effectively track its revenue, income, expenses, assets, liabilities, and profit or loss.

In the chart of accounts, accounts are grouped into different categories based on their nature and purpose. These categories typically include assets, liabilities, equity, revenue, and expenses. Each category is assigned a specific range of account numbers for easy identification and reference.

Assets encompass all the resources owned by the cleaning services business, including cash, equipment, vehicles, and property. These accounts are essential for tracking the organization's financial strength and the value of its tangible resources.

Liabilities represent the cleaning services organization's financial obligations, such as loans, outstanding invoices, and payments due to suppliers or contractors. Properly managing liabilities is crucial for maintaining a healthy financial position and ensuring timely payments.

Equity accounts reflect the cleaning services organization's net worth, which is the residual interest in the business's assets after deducting liabilities. This category includes accounts such as owner's equity or retained earnings.

Revenue accounts capture all the income generated by the cleaning services business, including fees charged for cleaning services, sales of cleaning products, or any other sources of revenue. Tracking revenue is essential to monitor the organization's income and measure its financial performance.

Expenses accounts record all the costs incurred by the cleaning services organization in operating the business. This can include wages and salaries, rent, utilities, cleaning supplies, and any other expenses necessary for running the business. Monitoring and controlling expenses are crucial for managing profitability and ensuring efficient operations.

By having a well-structured chart of accounts, a cleaning services organization can easily record and track its financial transactions. This not only ensures accurate and efficient bookkeeping but also provides the necessary information for making informed decisions about the business's financial health and future growth. Additionally, it allows the organization to prepare financial statements, such as balance sheets and income statements, which provide a snapshot of the business's financial position and performance.

Account Categories

The chart of accounts is an essential tool for any business, including cleaning services, as it helps in organizing the financial information in a systematic manner. An effective chart of accounts categorizes the different types of financial transactions and provides a clear picture of a company's financial health.

One of the key aspects of a chart of accounts is the account categories. These categories group similar types of accounts together, making it easier to track and analyze financial information. Some common account categories for cleaning services include revenue, expenses, assets, liabilities, and equity.

Revenue: This category includes all income generated from providing cleaning services. It typically includes invoices and payments received from clients for services rendered. Revenue accounts are crucial for understanding the financial performance of the business and determining its profitability.

Expenses: Cleaning services incur various expenses to operate, such as salaries, cleaning supplies, equipment maintenance, and advertising. Expenses accounts help in tracking and controlling these costs and determining the overall profitability of the business.

Assets: Assets are the resources owned by the cleaning business, such as cash, vehicles, cleaning equipment, and accounts receivable. Tracking assets is important for managing cash flow, making informed decisions, and evaluating the overall value of the business.

Liabilities: Liabilities represent the financial obligations of the business, such as loans, outstanding payments to suppliers or employees, and taxes. Tracking liabilities is crucial for maintaining financial stability and ensuring that the business meets its financial obligations.

Equity: Equity represents the owner's investment in the business and reflects the residual value after deducting liabilities from assets. It provides an indication of the owner's stake in the business and can be used to assess the ownership's financial health.

By organizing the various accounts into these categories, companies in the cleaning services industry can effectively manage their finances, make informed business decisions, and maintain accurate bookkeeping records. A well-structured chart of accounts helps in providing clarity and transparency, ensuring the financial success of the organization.

Account Numbering System

In the world of financial bookkeeping, organizing and categorizing accounts is essential for any business, including cleaning services. One of the key aspects of this organization is the account numbering system. This system helps in identifying and tracking different types of accounts, including income, expenses, assets, liabilities, and more.

A well-designed account numbering system provides a structured and logical framework for recording and managing financial transactions. Each account is assigned a unique number, making it easier to locate and analyze specific accounts when needed. This system also helps in maintaining a balance in the chart of accounts and provides a clear view of the financial health of the organization.

The account numbering system generally follows a hierarchical structure, with each level representing a different category or type of account. For example, the first digit might represent the account type, such as income or expenses, while the remaining digits indicate specific subcategories within that type.

Using a consistent account numbering system enables effective tracking of payments, invoices, and other financial transactions. It helps in identifying the source of income and tracking expenses associated with specific services or operations. This information can be valuable for budgeting, forecasting, and financial analysis.

Additionally, a well-organized account numbering system enables businesses to monitor their profitability and identify areas of potential loss. By categorizing revenue and expenses accurately, it becomes easier to calculate the profit margin and determine the overall financial performance of the cleaning services business.

Benefits of Using a Chart of Accounts

A chart of accounts is an essential tool for any organization, including cleaning services, as it provides a structured and organized system for recording financial information. Here are some key benefits of using a chart of accounts:

- Clarity and organization: A chart of accounts helps to categorize and classify various income, expenses, assets, liabilities, and other financial elements of a cleaning business. This categorization ensures that all financial transactions are recorded in a clear and organized manner, making it easier for bookkeeping and financial reporting tasks.

- Accurate financial reporting: By using a chart of accounts, cleaning services can generate accurate and detailed financial reports. This allows business owners and managers to analyze the revenue, expenses, and overall financial performance of the company. The chart of accounts provides a structured framework for recording and tracking financial data, ensuring the accuracy of the reports generated.

- Income and expense tracking: A chart of accounts helps in tracking the income and expenses specific to a cleaning business. It allows businesses to monitor their revenue streams, such as income from regular cleaning services, one-time deep cleaning projects, or specialized services like carpet cleaning or window washing. It also helps in tracking various expenses, including labor costs, cleaning supplies, equipment maintenance, and other overhead costs.

- Budgeting and planning: The chart of accounts provides a foundation for budgeting and planning in a cleaning business. By categorizing and tracking various expenses, business owners can calculate their costs, forecast future expenses, and develop an effective budget. This enables better financial planning and ensures that the business operates within its means.

- Compliance and tax preparation: A well-maintained chart of accounts facilitates compliance with tax regulations and simplifies tax preparation. The organized financial records allow for easy identification of deductible expenses, ensuring that the business takes advantage of all tax benefits. It also makes it easier to provide accurate financial information to tax authorities when required.

- Analysis of profitability and losses: The chart of accounts helps in analyzing the profitability and losses of a cleaning business by providing a clear view of the revenue generated and the expenses incurred. This enables business owners to identify areas of improvement, make informed decisions, and take corrective actions to increase profitability and minimize losses.

In conclusion, using a chart of accounts is crucial for cleaning services as it provides numerous benefits, including clarity, accurate financial reporting, income and expense tracking, budgeting and planning, compliance with tax regulations, and analysis of profitability and losses. Implementing a chart of accounts can greatly enhance the financial management and overall success of a cleaning business.

Streamlined Financial Reporting

Streamlined financial reporting is essential for cleaning services businesses to effectively manage their finances and make informed decisions. By maintaining a well-organized chart of accounts, owners and managers can easily track their company's financial health and performance.

The chart of accounts serves as a comprehensive list of all the financial accounts used in a business. It categorizes income, expenses, assets, liabilities, and equity, providing a clear picture of the company's financial position. This allows cleaning services businesses to quickly identify trends, analyze revenue and profit patterns, and make informed decisions based on real-time financial information.

A streamlined financial reporting system also facilitates efficient bookkeeping and accurate financial record-keeping. By categorizing transactions into specific accounts, such as revenue from services, expenses for supplies and equipment, and payments received from clients, cleaning services businesses can easily generate financial statements and reports. This helps them understand their income, expenses, and overall profitability.

Moreover, a well-maintained chart of accounts enables cleaning services companies to track outstanding invoices, manage cash flow, and monitor expenses. By having a clear overview of accounts receivable and payable, business owners can ensure timely payments and avoid financial losses. This helps maintain a positive cash flow and overall financial stability.

Overall, a streamlined financial reporting system is crucial for cleaning services businesses to effectively manage their finances, make informed decisions, and ensure financial success. By utilizing a well-organized chart of accounts and leveraging financial information, owners and managers can effectively track revenue, manage expenses, monitor cash flow, and maintain a profitable and thriving cleaning services business.

Accurate Tracking of Expenses

Accurate tracking of expenses is crucial for any cleaning organization to maintain a healthy financial balance and accurately determine the profitability of its services. By utilizing a well-organized chart of accounts, a cleaning business can effectively track its revenue and expenses, ensuring that all financial transactions are properly recorded and categorized.

By setting up specific ledger accounts for different types of expenses, such as cleaning supplies, equipment maintenance, employee wages, and advertising costs, a cleaning business can easily track its expenditures and identify areas where expenses may be too high or out of balance with the revenue generated. This detailed tracking allows for better financial decision-making and the ability to make proactive adjustments to enhance profitability.

Accurate tracking of expenses also enables a cleaning organization to accurately calculate its profit or loss over a specific period. By comparing the total revenue generated with the total expenses incurred, a business can determine its net profit or loss. This information is critical for assessing the financial health of the organization and making informed decisions for future growth and success.

Additionally, accurate expense tracking aids in managing cash flow and ensuring that payments to vendors and suppliers are made on time. By monitoring expenses closely, a cleaning business can avoid late payment penalties and maintain good relationships with its suppliers, ensuring the availability of necessary cleaning supplies and equipment.

In conclusion, accurate tracking of expenses is essential for the financial stability and success of a cleaning business. By utilizing a comprehensive chart of accounts and maintaining accurate bookkeeping practices, a cleaning organization can effectively manage its financial obligations, make informed business decisions, and achieve long-term profitability.

Efficient Tax Preparation

Efficient tax preparation is essential for cleaning services businesses to ensure compliance with tax laws and maximize tax savings. The chart of accounts plays a critical role in this process by categorizing financial transactions into different accounts, making it easier to prepare accurate tax returns.

One key aspect of tax preparation is keeping track of payments received for cleaning services. This is recorded in the revenue account, which represents the income generated by the business. By maintaining a detailed ledger of all payments and invoices issued, the organization can accurately report its income and ensure that no revenue is left unaccounted for.

Additionally, the chart of accounts includes specific accounts for various expenses incurred by the cleaning services business. This includes accounts for labor costs, supplies, and overhead expenses. By classifying these expenses correctly, the organization can deduct eligible expenses and reduce its taxable income, ultimately lowering its tax liability.

Furthermore, the chart of accounts also helps to track the business's assets and liabilities. Assets represent the resources owned by the business, such as cleaning equipment and vehicles, while liabilities include any debts or obligations. By accurately tracking assets and liabilities, the organization can determine its net worth and calculate its tax liability more efficiently.

Efficient tax preparation also involves analyzing the business's profit and loss statement. This statement summarizes the organization's revenues and expenses over a specific period, allowing the business owner to assess profitability and make informed financial decisions. By regularly reviewing the profit and loss statement, the business can identify areas for improvement and optimize its tax strategy.

In summary, efficient tax preparation for cleaning services businesses relies on a well-organized chart of accounts. By accurately categorizing transactions and maintaining detailed records, the organization can maximize tax savings, accurately report income, deduct eligible expenses, and assess profitability. This not only helps the business comply with tax laws but also allows it to make informed financial decisions for long-term success.

Designing a Chart of Accounts for Cleaning Services

When it comes to running a cleaning services business, having a well-designed chart of accounts is essential for maintaining a clear financial balance. The chart of accounts serves as a ledger for organizing and categorizing the financial transactions of your business, including income, expenses, assets, liabilities, revenue, and profit.

The chart of accounts for a cleaning services organization should be designed in a way that reflects the specific financial needs and requirements of the business. It should include accounts that allow for easy tracking of income sources, such as revenue from cleaning services rendered, as well as accounts for recording expenses, such as payments for cleaning supplies and equipment.

One important aspect of designing a chart of accounts for a cleaning services business is to ensure that it accurately reflects the specific services and activities of the organization. This can include creating accounts for specialized cleaning services, such as carpet cleaning, window cleaning, or deep cleaning, which may have different revenue and expense patterns compared to general cleaning services.

In addition to income and expense accounts, a chart of accounts for a cleaning services business should also include accounts for tracking assets and liabilities. This can include accounts for recording the value of cleaning equipment and vehicles, as well as accounts for tracking any debts or loans taken on by the business.

In conclusion, designing a chart of accounts for a cleaning services business is an important step in maintaining financial organization and ensuring accurate tracking of income, expenses, assets, and liabilities. By carefully categorizing financial transactions, the chart of accounts provides a clear picture of the financial health of the business and allows for effective analysis of profit and loss.

Tailoring Accounts to your Business

When it comes to managing the finances of your cleaning services business, having a well-structured chart of accounts is crucial. It allows for accurate bookkeeping, efficient financial organization, and easy tracking of expenses and revenue.

To tailor your chart of accounts to your specific business needs, you should consider the different types of services you offer and the expenses associated with them. For example, if you offer residential and commercial cleaning services, you may want to create separate accounts for each to track revenue and expenses separately.

Another important aspect to consider is the different types of payments you receive from customers. You can create separate accounts for cash payments, check payments, and online payments. This allows you to easily track the different sources of income and determine which payment methods are most popular among your customers.

In addition to revenue and expenses, you should also account for assets and liabilities in your chart of accounts. This includes any equipment or vehicles you own for your cleaning business, as well as any loans or debts you have. By tracking these accounts, you can get a clear picture of your overall financial health.

Furthermore, organizing your chart of accounts in a logical and systematic way can make it easier to generate financial reports, such as income statements and balance sheets. You can use sub-accounts under each main account to further categorize your expenses and revenues, such as creating sub-accounts for supplies, payroll, and advertising.

Overall, tailoring your chart of accounts to your specific cleaning services business allows for more accurate financial tracking and reporting. By considering the various aspects of your business, such as types of services, payments, assets, and liabilities, you can create a comprehensive chart of accounts that suits your unique needs.

Common Accounts for Cleaning Services

As a cleaning services organization, it is important to keep track of your financial transactions and maintain a well-structured chart of accounts. This will help you to effectively manage your business, track revenue and expenses, and ensure that your financial records are accurate.

Revenue Accounts: These accounts track the income generated from your cleaning services. Examples of revenue accounts for cleaning services include "Commercial Cleaning Revenue" and "Residential Cleaning Revenue." These accounts are used to record the revenue earned from different types of cleaning services provided by your organization.

Expense Accounts: Expense accounts are used to record all the costs incurred in running your cleaning services business. Examples of expense accounts include "Cleaning Supplies Expense," "Employee Wages Expense," and "Insurance Expense." These accounts help you track and manage your expenses so that you can evaluate your business performance and make informed financial decisions.

Asset Accounts: Asset accounts represent the resources owned by your cleaning services business. Examples of asset accounts include "Cash," "Accounts Receivable," and "Cleaning Equipment." These accounts track the value of your assets and help you maintain a healthy balance sheet.

Liability Accounts: Liability accounts represent the debts and obligations of your cleaning services organization. Examples of liability accounts include "Accounts Payable" and "Accrued Salaries." These accounts track the amounts owed by your business and provide a clear picture of your financial obligations.

Payments and Invoices: In addition to the chart of accounts, it is important to keep a ledger of payments and invoices. This will help you track and reconcile the payments received from clients, as well as the invoices issued for your cleaning services. A well-maintained ledger ensures that your financial records are accurate and up-to-date.

In conclusion, a comprehensive chart of accounts is essential for a cleaning services business to effectively manage its financial transactions. By properly categorizing revenue, expenses, assets, and liabilities, you can analyze your profit and loss, maintain a balanced financial position, and ensure accurate bookkeeping for your organization.

Revenue Accounts

In the context of chart of accounts for cleaning services, revenue accounts are crucial for tracking the payments received by the business. Revenue accounts represent the income generated by the organization from providing cleaning services to clients. These accounts are considered assets and contribute to the overall financial health of the business.

Revenue accounts are essential components of the organization's ledger and bookkeeping system. They help in monitoring the inflow of money from clients and ensure that all invoices are accurately recorded. By tracking revenue accounts, the business can evaluate its income and determine the profitability of its cleaning services.

Cleaning service providers typically have multiple revenue accounts to categorize different sources of income. For example, a revenue account may be dedicated to regular cleaning services, while another may track income from specialized services like carpet cleaning or window cleaning. By splitting revenue accounts, it becomes easier for the organization to analyze the performance of specific services and make informed business decisions.

Tracking revenue accounts also enables the business to calculate its expenses and determine the profit or loss incurred. By comparing revenue with expenses, the organization can assess its financial performance and target areas for improvement. Revenue accounts play a vital role in providing a comprehensive understanding of the financial health of a cleaning services business.

Overall, revenue accounts are integral to the chart of accounts for cleaning services. They help in organizing and tracking the income generated by the business, providing a clear picture of its financial standing. By properly managing revenue accounts, cleaning service providers can optimize their operations and ensure long-term success.

Expense Accounts

In any organization, it is important to maintain a clear and organized bookkeeping system for all financial transactions. For cleaning services, this involves keeping track of various expense accounts to accurately record the cost of providing services. These accounts are an essential part of the organization's financial ledger and help to determine the net income or loss of the business.

Expense accounts are used to track all the payments made for the cleaning services provided. They include accounts such as cleaning supplies, equipment maintenance, employee wages, and utility bills. By categorizing expenses in this way, organizations can easily understand and analyze their financial position.

Expense accounts play a vital role in maintaining the balance of the chart of accounts. They help organizations keep track of their invoices and payments, and ensure that all expenses are properly recorded. This allows the organization to accurately calculate their revenue and determine the profitability of their cleaning services.

Tracking expense accounts also helps organizations manage and control their expenses. By keeping a record of all the expenses incurred, organizations can identify areas where they may be overspending or where cost-saving measures can be implemented. This information can be used to make informed decisions about the allocation of resources and optimize the financial performance of the business.

In summary, expense accounts are an essential component of the financial management of cleaning service organizations. By accurately recording and categorizing expenses, organizations can gain a clear understanding of their income, expenses, and overall financial health. This information can then be used to make data-driven decisions and ensure the long-term success of the business.

Implementing and Maintaining the Chart of Accounts

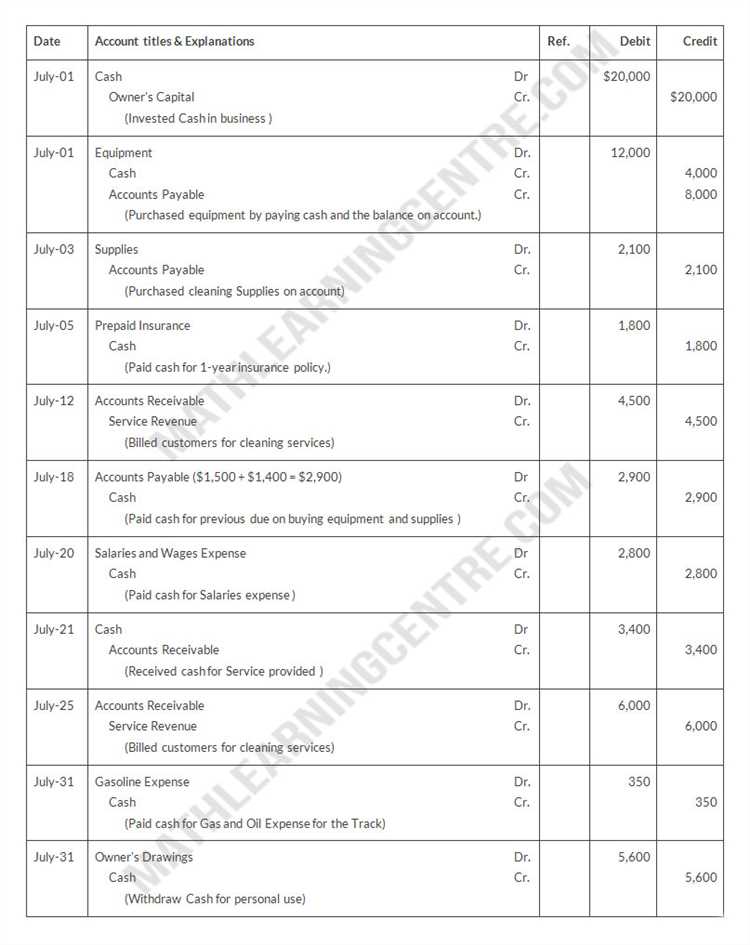

Implementing and maintaining a well-organized chart of accounts is essential for the smooth financial operations of any cleaning services business. The chart of accounts acts as a ledger, categorizing and recording all financial transactions for the organization. It provides a clear and systematic representation of the company's financial health.

The first step in implementing the chart of accounts is to establish various categories for different types of financial activities. This can include accounts for cleaning services revenue, expenses, assets, liabilities, and equity. Each category should have its own set of sub-accounts that provide more detailed information.

Once the chart of accounts has been established, it is important to regularly review and update it to ensure accuracy and relevance. This can be done by adding or removing accounts as the business evolves and new financial activities occur.

One crucial aspect of maintaining the chart of accounts is to ensure that all transactions are recorded accurately. This includes creating and tracking invoices for cleaning services rendered, as well as recording all payments received. By doing so, the business can accurately track its income and expenses, allowing for better decision-making and analysis of profit and loss.

In addition to tracking income and expenses, the chart of accounts also helps in tracking the financial performance of the cleaning services business. With accurate and up-to-date records, it is possible to generate financial reports that provide key insights into the organization's profitability and liquidity. These reports can help in identifying areas of improvement and in making informed financial decisions.

Overall, implementing and maintaining a well-structured chart of accounts is crucial for the financial success of any cleaning services business. It allows for better bookkeeping and financial management, ensuring that the organization can accurately track its revenue, expenses, assets, and liabilities. By regularly reviewing and updating the chart of accounts, the business can stay organized and make more informed financial decisions.

Setting up the Chart of Accounts

When starting a cleaning services business, it is crucial to set up a comprehensive chart of accounts to effectively manage the financial aspects of the organization. The chart of accounts is a system that categorizes all the financial transactions of the business, including revenue, expenses, assets, liabilities, and more.

One of the main purposes of setting up a chart of accounts is to track the financial performance of the cleaning services business. By organizing the different accounts, such as income and expenses, the organization can easily calculate its profit or loss. This information is vital for making informed decisions and evaluating the success of the business.

Furthermore, having a well-structured chart of accounts helps maintain a balance between the income and expenses. It allows the organization to keep track of its cash flow, which is essential for maintaining financial stability. By regularly reviewing the accounts, the business can identify any discrepancies or areas where adjustments need to be made to ensure the smooth operation of the organization.

The chart of accounts for a cleaning services business may include various categories, such as cleaning supplies, wages, advertising expenses, equipment, and utility bills. Each of these categories will have sub-accounts, allowing for more detailed tracking of financial transactions. For example, under the category of cleaning supplies, there might be separate accounts for different types of cleaning products.

In addition to creating the accounts, it is important to establish a system for recording and organizing financial data. Many organizations use a ledger or accounting software to keep track of payments, invoices, and other financial transactions. Regularly updating the chart of accounts with accurate information is crucial for effective bookkeeping and financial management.

Overall, setting up a chart of accounts is a critical step in managing the financial aspects of a cleaning services business. By properly categorizing income, expenses, assets, and liabilities, the organization can ensure accurate reporting, monitor its financial performance, and maintain the financial health of the business.

Managing Changes and Updates

Managing changes and updates to the chart of accounts is a crucial aspect of financial organization for cleaning services. The chart of accounts serves as a comprehensive ledger for tracking the financial activities of the organization, including its assets, liabilities, income, and expenses. As the organization grows and evolves, it is important to regularly review and update the chart of accounts to ensure that it accurately reflects the financial status of the cleaning services business.

When managing changes and updates to the chart of accounts, it is important to consider the specific needs and requirements of the cleaning services industry. This may include adding new categories for services provided, such as carpet cleaning or window washing, and adjusting income and expense categories to accurately reflect revenue and costs associated with these services. By regularly reviewing and updating the chart of accounts, the organization can ensure that its financial records are accurate and up to date.

One important aspect of managing changes and updates to the chart of accounts is ensuring that all financial transactions are properly recorded. This includes accurately recording income from invoices and payments received for cleaning services, as well as tracking expenses associated with the business, such as cleaning supplies and equipment. By properly recording these transactions, the organization can maintain an accurate balance sheet and income statement, which are essential for evaluating the financial health of the business.

In addition to managing changes and updates to the chart of accounts, it is also important to regularly review and analyze the financial records to identify areas of improvement or potential issues. This may include identifying trends in revenue and expenses, evaluating the profitability of different cleaning services, and identifying any areas of concern, such as consistently high expenses or a significant loss of profit. By regularly analyzing the financial records, the organization can make informed decisions regarding its operations and financial strategies.

Overall, managing changes and updates to the chart of accounts is an important aspect of bookkeeping for cleaning services. By regularly reviewing and updating the chart of accounts, accurately recording financial transactions, and analyzing the financial records, the organization can ensure that it has a clear and accurate picture of its financial health. This can help inform decision-making, improve financial management, and ultimately contribute to the success and profitability of the cleaning services business.

Adding or Removing Accounts

When it comes to managing the financial aspects of your cleaning business, keeping an accurate and organized chart of accounts is crucial. This allows you to track your business expenses, assets, and liabilities, as well as monitor your revenue and income.

Periodically, you may find the need to add or remove accounts from your chart of accounts. This could be due to changes in your business operations, the introduction of new services, or the discontinuation of certain expenses. Whatever the reason, it is important to approach this task thoughtfully and strategically.

To begin, carefully assess your current chart of accounts and identify any accounts that need to be added or removed. It is helpful to review your bookkeeping records, invoices, and payment history to ensure you capture all relevant accounts. This will help maintain an accurate financial balance and ensure nothing is overlooked.

Once you have identified the accounts that need to be added or removed, update your chart of accounts accordingly. It is essential to maintain consistency and organization throughout this process. Add the new accounts in a logical and systematic manner, categorizing them appropriately based on their purpose and nature.

Similarly, when removing accounts, be cognizant of the potential impact on your financial statements. Make sure to transfer any remaining balance or activity from the account being removed to an appropriate account. This will ensure your financial statements accurately reflect the financial position and performance of your cleaning business.

In addition to updating your chart of accounts, it is advisable to communicate these changes to your bookkeeper or accounting team. This will help them stay informed and properly handle future financial transactions. It also allows for alignment between your bookkeeping system and the overall financial objectives of the organization.

By carefully managing your chart of accounts and making necessary additions or removals, you can maintain a clear and accurate financial picture of your cleaning business. This empowers you to make informed decisions, track your profitability, manage your expenses effectively, and ensure the long-term financial success of your organization.

Using the Chart of Accounts for Financial Analysis

When it comes to analyzing the financial performance of a cleaning services business, the chart of accounts plays a crucial role. This bookkeeping tool helps to categorize and organize various financial transactions, allowing for a comprehensive understanding of the company's financial health.

One key aspect of financial analysis is examining revenue and expenses. By using the chart of accounts, the organization can track and monitor different sources of income, such as payments from clients for cleaning services provided. This allows for a clear overview of the cleaning business's cash flow and revenue streams.

The chart of accounts also helps identify and track expenses incurred by the cleaning services business. This can include costs for supplies, equipment, and wages, among others. By analyzing these expenses, the organization can identify areas of inefficiency, potential cost savings, or opportunities for growth.

Furthermore, the chart of accounts provides insight into the profitability of the cleaning services business. By comparing revenue and expenses, the organization can determine the net profit or loss for a given period. This information is crucial for assessing the company's financial performance and making informed decisions for future growth and development.

Additionally, the chart of accounts enables the tracking of assets and liabilities. Assets, such as cleaning equipment or vehicles, can be recorded and monitored to assess their value and depreciation over time. Liabilities, such as outstanding invoices or loans, can also be tracked to ensure proper financial management and planning.

In conclusion, the chart of accounts is a valuable tool for financial analysis in the cleaning services business. It helps track revenue, expenses, profit, balance, assets, and liabilities, providing a comprehensive overview of the organization's financial performance. By using this bookkeeping tool effectively, cleaning services businesses can make informed decisions and optimize their financial operations.

Analyzing Revenue and Profitability

To effectively assess the financial health of a cleaning services business, it is crucial to analyze its revenue and profitability. Revenue, or the income generated from providing cleaning services, is a key indicator of the organization's financial performance. By examining the revenue figures over a specific period, such as a month or a year, business owners can gain insights into the growth and stability of their cleaning services.

Profitability, on the other hand, refers to the amount of profit that the business generates after deducting all expenses and costs from the total revenue. This metric provides a clear picture of the financial success of the cleaning services business. A positive profit signals that the business is generating more income than it is spending, while a negative profit indicates a loss.

Analyzing revenue and profitability involves reviewing various financial documents such as income statements, invoices, and balance sheets. Income statements showcase the revenue earned and expenses incurred during a specific period, allowing business owners to identify any trends or patterns. Invoices and payments received can also provide insight into the cash flow and collection process of the cleaning services business.

In addition to analyzing the revenue and expenses, it is essential to examine the assets and liabilities of the business. Assets, such as cleaning equipment and supplies, contribute to the overall value of the business and can impact its profitability. Liabilities, such as loans or outstanding payments, can affect the company's financial stability and should be carefully monitored.

By maintaining a detailed ledger and regularly updating the bookkeeping records, business owners can effectively track the revenue, expenses, and overall financial performance of their cleaning services company. This information can help them make informed decisions, identify areas for improvement, and ensure the long-term success of their business.

Evaluating Expense Categories

When evaluating the expense categories of your cleaning services business, it is important to have a clear understanding of the various financial aspects. This includes your assets, liabilities, income, and expenses. By properly categorizing and tracking these expenses, you can gain valuable insights into the financial health of your organization and make informed business decisions.

One important expense category is payments to suppliers and vendors. This includes any invoices or bills you receive for cleaning supplies, equipment, or other materials needed to provide your services. Keeping track of these expenses can help you identify any cost-saving opportunities or negotiate better deals with your suppliers.

Another key expense category to evaluate is labor costs. As a cleaning services business, your employees or contractors play a crucial role in delivering high-quality services to your clients. Tracking expenses related to salaries, wages, and benefits can help you assess the profitability of each job and make necessary adjustments to optimize your revenue and expenses.

Additionally, it is essential to evaluate expenses related to marketing and advertising. Building a strong brand and attracting new clients is vital for the growth and success of your cleaning services business. By tracking expenses associated with marketing campaigns, online advertising, or promotional materials, you can assess the effectiveness of your marketing efforts and make informed decisions about where to allocate your financial resources.

Other expense categories to consider include utilities (such as electricity, water, and internet), rent or mortgage payments for your office or storage space, insurance premiums, vehicle expenses, and any professional or legal fees. By organizing and tracking these expenses in your chart of accounts and general ledger, you can have a comprehensive overview of your financial situation, identify areas of profit and loss, and ensure accurate and efficient bookkeeping processes for your cleaning services business.

Labor and Payroll Expenses

When it comes to running a cleaning services business, labor and payroll expenses are a crucial aspect of bookkeeping. These expenses involve the payments made to employees for their hours worked and services provided. Properly tracking and recording these expenses is essential for maintaining an accurate financial record of the organization's operations.

The labor and payroll expenses can be categorized under various accounts in the chart of accounts. Some common accounts related to labor and payroll expenses include wages and salaries, payroll taxes, employee benefits, and contractor payments. Each of these accounts represents different types of expenses incurred by the business.

In the ledger, labor and payroll expenses are recorded as liabilities since the organization is responsible for paying its employees and fulfilling its payroll obligations. These expenses need to be regularly reconciled with bank statements, invoices, and other financial documents to ensure that the ledger balance is accurate.

Monitoring labor and payroll expenses is crucial for determining the profitability of the cleaning services business. By analyzing these expenses in relation to the income generated from the services provided, the organization can assess its financial health. If the expenses exceed the income, it may indicate a potential loss or need for adjustments in business operations.

Properly managing labor and payroll expenses also helps in ensuring compliance with legal and regulatory requirements. Businesses are required to adhere to labor laws, tax withholding and reporting obligations, and provide employee benefits as per their employment agreements. Failing to accurately track and report these expenses can result in financial penalties and legal issues.

Overall, labor and payroll expenses play a significant role in the financial management of a cleaning services business. By accurately maintaining and monitoring these expenses, the organization can make informed decisions, maintain financial stability, and ensure the smooth operation of its business activities.

Supplies and Equipment Costs

Supplies and equipment costs are an essential part of running a successful cleaning business. These costs include expenses related to purchasing cleaning supplies such as chemicals, cleaning tools, and equipment. It is important for cleaning service organizations to accurately track these expenses in order to effectively manage their financial resources and maintain profitability.

Tracking supplies and equipment costs is crucial for several reasons. First, it helps businesses understand their expenses and ensure that they are allocating their financial resources wisely. This knowledge allows them to make informed decisions about purchasing supplies and equipment, ensuring that they are getting the best value for their money.

Additionally, tracking supplies and equipment costs allows cleaning services to accurately determine their income and calculate their revenue. By associating these costs with specific services or clients, businesses can better understand which aspects of their operations are generating the most revenue and identify areas where they may need to make adjustments.

Bookkeeping for supplies and equipment costs involves maintaining an accurate and organized chart of accounts. This chart includes specific categories for tracking various types of expenses related to supplies and equipment. These categories may include cleaning supplies, cleaning tools, equipment maintenance, and equipment depreciation.

Tracking supplies and equipment costs also involves creating and managing invoices for clients. Invoices should clearly state the costs associated with the supplies and equipment used for each service provided. Regularly reviewing and reconciling these invoices can help businesses identify any discrepancies or errors, ensuring that they are accurately tracking their expenses and preventing financial loss.

Overall, effectively tracking supplies and equipment costs is essential for the financial health and success of a cleaning service business. By maintaining an organized chart of accounts, accurately tracking expenses, and regularly reviewing invoices, businesses can ensure that they are maximizing their revenue, minimizing expenses, and maintaining a balanced financial ledger.