Are you tired of dealing with cash payments and manual invoices? It's time to embrace the future of business transactions with the best online payment collection app. This transactional platform is designed to simplify your financial processes and help you save both time and effort.

With this app, you can create digital wallets for your customers, making it easier for them to pay you. No more waiting for checks to arrive in the mail or dealing with the hassle of physical money. Your customers can simply log in to their e-wallets and make a payment with just a few clicks.

Security is a top priority in today's digital age, and this app understands that. It utilizes advanced encryption technology to ensure that every transaction is secure and protected. You can rest easy knowing that your customers' sensitive financial information is safe.

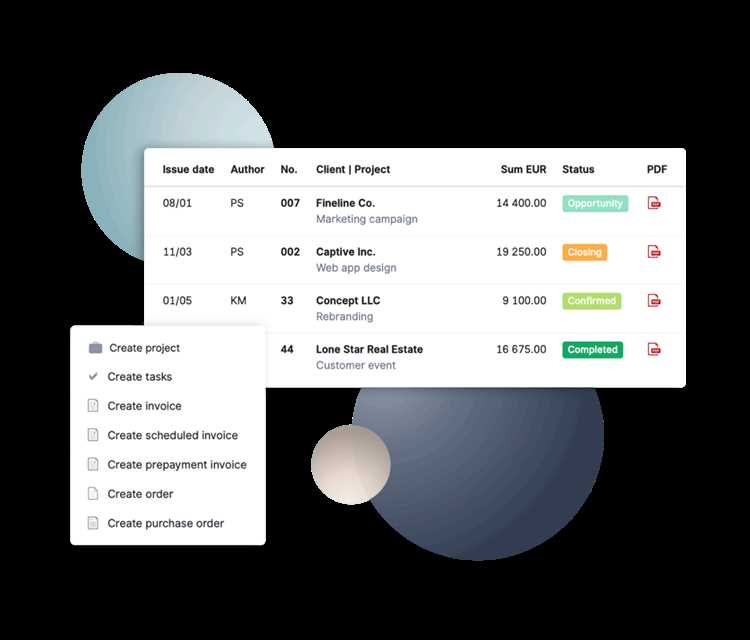

Not only does this app make it easier for your customers to pay, but it also simplifies the process for you. Generating invoices and keeping track of payments is a breeze with its user-friendly interface. You can monitor all of your transactions in one place and easily reconcile your financial records.

Say goodbye to the headaches of traditional payment methods and say hello to a more efficient and streamlined way of doing business. Try out the best app for payment collection today and transform the way you handle financial transactions.

What is a Payment Collection App?

A payment collection app is a digital platform that allows individuals and businesses to collect and manage financial transactions online. It serves as an e-wallet or virtual wallet where individuals and businesses can securely receive payments made through various methods, such as credit or debit cards, bank transfers, or mobile payments.

Through a payment collection app, users can create and send invoices to customers or clients, enabling them to easily pay for products or services. These apps typically provide a user-friendly interface with features like payment reminders, automatic payout, and detailed transaction history.

The main purpose of a payment collection app is to streamline the payment process, making it convenient and efficient for both the payer and the payee. By utilizing such an app, businesses can offer their customers a seamless checkout experience, while individuals can easily and securely send money to friends or family.

One of the key advantages of using a payment collection app is the ability to accept digital payments. This means that users can avoid the hassle of handling physical cash or cheques, and instead, receive payments directly into their digital wallet.

Overall, a payment collection app provides a secure and convenient way to manage financial transactions, making it an essential tool for businesses and individuals alike in today's digital era.

Definition and Features

A digital wallet is a mobile application that allows users to securely store and manage their financial information, such as credit and debit card details, for convenient transactions. With a digital wallet, users can make payments, store loyalty cards, receive and send money, and access transactional history, all from their mobile devices.

One of the key features of a digital wallet app is its ability to streamline the payment process. Users can easily select a payment method, such as a credit card or an e-wallet, and initiate a secure transaction with just a few taps. The app securely stores the user's payment information, eliminating the need to enter these details for each purchase, speeding up the checkout process.

Another important feature of a digital wallet app is its invoicing capabilities. Users can easily create and send invoices to their clients, making it convenient to collect payments for products or services. The app provides various customizable templates, allowing users to include important details such as due dates and payment methods.

In addition to payment and invoicing functionalities, a digital wallet app also offers advanced financial management features. Users can track their expenses, set budget limits, and receive notifications when approaching these limits. The app can also provide insights on spending patterns, helping users make informed financial decisions.

A secure and reliable payment collection platform ensures that all transactions made through the digital wallet app are protected. It employs encrypted technology to safeguard sensitive financial information, preventing unauthorized access or fraud. In case of any issues or disputes, the app provides customer support to resolve them, ensuring a smooth payment experience.

Overall, a digital wallet app is an essential tool for businesses and individuals looking to streamline their payment collection process. By offering features such as secure transactions, easy invoicing, and advanced financial management, it enables users to efficiently manage their finances and collect payments in a convenient and secure manner.

Importance of Streamlining Business Transactions

The financial success of any business heavily relies on its ability to efficiently manage and streamline its transactions. In today's mobile-driven world, businesses need to adopt streamlined payment collection processes that are quick, secure, and convenient for both the business and its customers.

A streamlined payment collection platform or app provides businesses with the flexibility to accept various modes of payment, including online payments, credit or debit cards, e-wallets, and mobile wallet apps. This allows businesses to cater to the preferences of their customers, making it easier for them to pay for goods or services.

By streamlining business transactions, businesses can reduce the time and effort required to complete payments. Traditional methods of payment collection, such as cash or check, are time-consuming and often involve manual processing and record-keeping. With a streamlined payment collection app, businesses can automate payment processes, generate digital invoices, and ensure timely collection and reconciliation of payments.

Efficient transactional processes not only enhance the overall customer experience but also improve cash flow management for businesses. With streamlined payment collection, businesses can easily track and monitor their incoming payments, view payment histories, and generate financial reports. This enables them to have a clear picture of their financial health and make informed decisions.

Furthermore, a streamlined payment collection app enhances the security of transactions. It encrypts sensitive customer data, ensures compliance with data protection regulations, and reduces the risks associated with handling cash. Customers also benefit from secure payment options that protect their personal and financial information.

In conclusion, streamlining business transactions through a mobile payment collection app plays a crucial role in the success and growth of any business. It improves efficiency, customer experience, financial management, and security. By adopting a streamlined payment collection platform, businesses can stay ahead in the digital era and cater to the diverse payment preferences of their customers.

Benefits of Using a Payment Collection App

1. Streamlined Transactions: A payment collection app provides a seamless and efficient way to handle financial transactions. It eliminates the need for manual processing and paperwork, allowing businesses to save time and increase productivity.

2. Credit and Debit Card Acceptance: Many payment collection apps support credit and debit card payments, making it convenient for customers to pay using their preferred method. This expands the customer base and helps businesses increase sales.

3. Online and Mobile Platforms: Payment collection apps are usually available on both online and mobile platforms, making it convenient for businesses to accept payments regardless of the device used by their customers. This ensures a smooth checkout experience and boosts customer satisfaction.

4. Secure Digital Wallets: Payment collection apps often offer secure digital wallet options, allowing customers to store their payment information securely. This eliminates the need to enter payment details for each transaction, making the payment process quicker and more convenient.

5. Efficient Payouts: Payment collection apps enable businesses to receive payments quickly and efficiently. They offer streamlined payout processes, ensuring that businesses can access their funds in a timely manner.

6. Transactional History: Payment collection apps typically provide businesses with a transactional history, allowing them to track and monitor their financial activities easily. This helps in financial planning and decision-making.

7. Improved Accountability: By using a payment collection app, businesses can maintain a clear record of all transactions. This improves accountability and makes it easier to resolve any disputes or discrepancies that may arise.

- 8. Versatility: Payment collection apps can be used across various industries and sectors. They can be customized to meet specific business needs, making them a versatile solution for payment collection.

- 9. Efficiency: With a payment collection app, businesses can streamline their payment processes, reducing the time and effort required for manual handling. This improves overall efficiency and allows businesses to focus on other important aspects of their operations.

Efficiency and Time-Saving

When it comes to handling money, efficiency and time-saving are crucial factors for any business. With the increasing reliance on digital transactions, having a secure and streamlined checkout process is essential. An e-wallet app can provide a seamless payment experience for both customers and merchants.

By using a debit or credit card linked to an e-wallet, users can easily make payments without the hassle of carrying cash or entering their card details for every transaction. This not only saves time but also reduces the risk of fraud as sensitive financial information is securely stored within the app.

In addition, an e-wallet app can simplify the process of creating and sending invoices. With just a few taps on a mobile device, merchants can generate professional-looking invoices and send them to customers instantly. This eliminates the need for manual paperwork and speeds up the payment collection process.

Furthermore, with a reliable payment collection platform, businesses can automate payout processes, reducing the need for manual intervention. This ensures that funds are transferred to the intended recipient in a timely manner, improving cash flow and overall financial management.

Overall, embracing a digital payment collection app can significantly enhance the efficiency and time-saving aspects of a business. The ability to quickly and securely process transactions, create invoices, and automate payouts can streamline operations and improve the overall financial health of a company.

Automated Payment Processing

Automated payment processing is a financial solution that allows businesses to streamline their online transactions and collect money more efficiently. With automated payment processing, businesses can generate and send invoices to customers, set up recurring payments, and process credit and debit card transactions effortlessly.

One of the key benefits of automated payment processing is the ability to automate the entire payment collection process. This eliminates the need for businesses to manually process payments, reducing the risk of errors and saving valuable time. Businesses can set up automatic payouts to vendors and suppliers, ensuring timely payments and maintaining good relationships.

Another advantage of automated payment processing is the improved security it provides. Payment information is encrypted and stored securely, protecting sensitive financial data from theft and fraud. Customers can confidently make payments through a secure checkout process, knowing that their information is safe.

Automated payment processing also offers convenience for both businesses and customers. Businesses can accept payments through various channels, including mobile apps and online platforms, allowing customers to pay using their preferred methods. Customers can store their payment information in a secure digital wallet, making future transactions quick and easy.

Overall, automated payment processing is a valuable tool for businesses looking to streamline their payment collection process. By leveraging a secure and efficient platform or app, businesses can improve their cash flow, reduce administrative tasks, and provide a seamless payment experience for their customers.

Invoicing and Billing Made Easy

Streamlining your financial transactions has never been easier with our secure and user-friendly invoicing and billing app. Whether you need to send an invoice to clients or collect payments from customers, our platform provides you with all the tools you need to simplify and automate the entire process.

Our digital invoicing system allows you to create and customize professional invoices with ease. You can add your company logo, contact information, and itemized services or products, making it easy for your clients to understand and pay. With just a few clicks, you can generate and send invoices directly to your clients' email addresses, eliminating the need for manual paperwork and postage.

Once the invoice is sent, our app allows your customers to make payments online through various channels. They can choose to pay via credit or debit card, mobile wallet, or even through their online banking platform. Our secure payment gateway ensures that all transactions are encrypted and protected, giving both you and your customers peace of mind.

Managing your financial transactions becomes effortless with our app's intuitive dashboard. You can track and monitor payment statuses, view transaction history, and generate reports for your records. Additionally, our app provides a comprehensive wallet feature, allowing you to store, manage, and transfer funds from one account to another seamlessly.

Forget about the hassle of manual invoicing and billing. With our app, you can automate the entire process, saving you time, effort, and money. Whether you run a small business or a large corporation, our invoicing and billing app is the perfect solution to streamline your payment collection process and boost your financial efficiency.

Increased Revenue Generation

With the growing popularity of mobile payments and the rise of e-commerce, businesses are constantly looking for ways to increase their revenue generation. One effective way to achieve this is by utilizing a reliable and secure payment collection app. By implementing a mobile payment platform for your business, you can streamline the payment process and make it easier for your customers to pay.

An online payment collection app allows your customers to make payments using their preferred payment method, whether it be credit cards, debit cards, or digital wallets. This not only increases convenience for your customers but also enhances their overall shopping experience.

Furthermore, a payment collection app provides a seamless and secure payment process, protecting both your business and your customers from any potential fraud or unauthorized transactions. By offering a safe and reliable platform for online transactions, you build trust with your customers, leading to repeat business and increased revenue.

Additionally, a payment collection app can also help streamline your financial processes by automating recurring payments and providing detailed transactional data. This allows you to easily track and manage your payment collection, simplifying your overall financial management.

By implementing a reliable and secure payment collection app, you can optimize your business processes and increase revenue generation. Providing various payment options, ensuring secure transactions, and simplifying financial management are essential steps in growing your business in the digital age.

Accept Multiple Payment Methods

When it comes to running a transactional business, offering multiple payment methods is essential. A successful financial app or online payment platform should allow users to accept various payment options to cater to different customer preferences.

An app or platform that accepts multiple payment methods provides flexibility for customers to pay invoices or make purchases in their preferred way. This includes accepting online payments, digital wallets, mobile money, credit cards, debit cards, and more.

By offering a range of payment options, businesses can increase their reach and attract a wider audience. Customers appreciate the convenience of being able to pay using their preferred method, leading to higher conversion rates and customer satisfaction.

Moreover, accepting multiple payment methods helps businesses streamline their payment collection process. With an integrated platform, businesses can easily track and manage transactions from various sources, simplifying the financial management of the business.

Finally, security is paramount when it comes to payment collection. A platform that allows for multiple payment methods should prioritize the security of transactions to protect sensitive customer data. By choosing a secure payment collection platform, businesses can instill trust in their customers, ensuring that their money is safe and secure during the transaction.

Simplify Subscription Management

Managing subscriptions can be a complex and time-consuming task for businesses. However, with the right payment collection app, you can simplify the process and streamline your subscription management.

One key feature of a good payment collection app is the ability to link multiple payment methods, such as credit cards, debit cards, and digital wallets. This allows your customers to choose their preferred method of payment, making it more convenient for them to subscribe and pay for your services.

Additionally, an online payment collection app should provide an easy-to-use invoice and checkout system. This enables you to send digital invoices to your customers and allows them to make quick and secure payments with just a few clicks. The app should also have a mobile-friendly platform, allowing customers to manage their subscriptions and make payments on the go.

A secure and transactional payment collection app is crucial for businesses. It should offer advanced security features, such as encrypted data transmission and secure storage of customer payment information. This ensures that your customers' financial details are protected and reduces the risk of fraudulent activities.

Another important feature to consider when choosing a payment collection app is its ability to automate subscription payments and payout processes. This saves you time and effort by automatically collecting payments from your customers and depositing them into your account. The app should also provide detailed reporting and analytics to help you track your revenue and manage your finances effectively.

In conclusion, simplifying subscription management is essential for businesses, and the right payment collection app can make a significant difference. By choosing an app that offers multiple payment methods, an easy-to-use invoice and checkout system, mobile compatibility, advanced security features, and automated payment processes, you can streamline your subscription management and provide a seamless experience for your customers.

Improved Customer Experience

With the best app for payment collection, customers can enjoy an improved checkout process. Instead of fumbling for cash or swiping their credit cards, they can simply use their e-wallet to pay for their purchases. This online and digital payment method is not only convenient, but also secure, ensuring that customers' financial information is protected.

Furthermore, with the best app for payment collection, customers can easily view and manage their invoices and payment history. They can track their transactions, monitor their spending, and even set up automatic payments for recurring bills. This mobile platform simplifies the collection process and provides customers with a seamless experience.

In addition, the best app for payment collection offers various options for customers to receive their payouts. Whether they prefer to use their debit card, credit card, or e-wallet, this app provides a flexible and convenient way for customers to access their money. With just a few taps on their mobile devices, customers can securely transfer funds from their digital wallet to their bank account.

Overall, the best app for payment collection enhances the customer experience by offering a quick, secure, and efficient way to pay for goods and services. It eliminates the need for physical cash and simplifies the checkout process. With this app, customers can enjoy the convenience of making payments online or on the go, while also having complete control over their financial transactions.

Convenient and Seamless Payment Process

With the rise of e-commerce and digital transactions, having a convenient and seamless payment process is crucial for any business. An e-wallet is a popular and efficient tool that streamlines the transactional collection process. It allows users to store their financial information securely in a digital platform, making it easier to make payments and receive payouts.

Using an e-wallet app, customers can link their credit or debit cards to their wallet and make online payments with just a few clicks. There is no need to manually enter payment information or go through a lengthy checkout process. This saves time and creates a smoother payment experience for both the business owner and the customer.

Another advantage of using an e-wallet is the ability to generate and send invoices directly from the app. This eliminates the need for paper invoices and allows for quick and secure payment collection. Business owners can easily create and customize invoices, add payment details, and send them to their clients from their mobile device.

Security is a top concern when it comes to online transactions, and e-wallets provide a secure way to handle money. The wallet app implements robust security measures to protect the user's financial information, such as encryption and multi-factor authentication. This gives both the business owner and the customer peace of mind when making and receiving payments.

In conclusion, having a convenient and seamless payment process is essential for any business. An e-wallet app offers a secure and efficient way to handle transactions, collect payments, and manage invoices. With its user-friendly interface and advanced security features, it is an excellent choice for businesses looking to streamline their payment collection process.

Enhanced Security and Data Protection

When it comes to financial transactions, security and data protection are of utmost importance. With the best app for payment collection, you can ensure enhanced security features that protect sensitive information.

One of the key security features is the encryption of credit and debit card details. This ensures that any payment information entered through the app is encrypted during the transactional process, making it more secure and safeguarding it from unauthorized access.

Additionally, the app provides secure checkout options by utilizing trusted and verified payment gateways. This ensures that all online transactions are conducted in a safe and secure manner, preventing any data breaches or fraudulent activities.

The app also offers advanced authentication methods such as two-factor authentication, which adds an extra layer of security by requiring an additional verification step to access the platform or complete a payment transaction. This helps to prevent unauthorized access to the user's e-wallet or digital payment account.

Furthermore, the app implements stringent data protection measures, complying with industry standards and regulations. This includes regularly monitoring and updating security protocols to protect against potential vulnerabilities and staying up-to-date with the latest security practices.

In conclusion, with the best app for payment collection, you can have peace of mind knowing that your financial transactions are conducted securely and your sensitive data is protected. The app's enhanced security features, encryption methods, secure checkout options, and advanced authentication methods all contribute to providing a safe and secure platform for payment collection and online transactions.

Top Features to Look for in a Payment Collection App

When choosing a payment collection app, it is important to consider a range of features that can streamline your business transactions and make the payment process more convenient for both you and your customers. Here are some top features to look for:

- Debit and credit card support: Look for an app that supports both debit and credit card payments, as this will allow you to cater to a wider range of customers and maximize your earning potential.

- Online and mobile payment options: Ensure that the app provides the ability to accept online and mobile payments, as these are increasingly popular methods of payment in today's digital age.

- Secure transactions: Security is crucial when it comes to handling financial transactions. Look for an app that offers secure encryption and fraud protection to safeguard your customers' payment information.

- Invoice generation: A good payment collection app should provide the capability to generate professional-looking invoices, allowing you to easily keep track of your transactions and improve your organization.

- Integrations with other platforms: Consider whether the app can integrate with other platforms that you use for your business, such as accounting software or e-commerce platforms. This can save you time and effort by automatically syncing data between systems.

- Payout options: Check if the app offers multiple payout options, such as direct bank transfers or e-wallet transfers. This can give you more flexibility in how you receive your funds.

- Transaction history: Look for an app that provides a detailed transaction history, allowing you to easily track and analyze your payment activity. This can help you gain insights into your business and make informed decisions.

- Checkout customization: Consider whether the app allows you to customize the checkout experience, such as adding your company logo or branding. This can help enhance your brand image and create a more professional look and feel.

By considering these top features when choosing a payment collection app, you can ensure that you find a platform that meets your business needs and provides a seamless payment experience for both you and your customers.

Intuitive User Interface

The best app for payment collection should have an intuitive user interface that is easy to navigate and understand. A well-designed app will have a user-friendly layout and simple navigation menus, making it effortless for users to access the app's features.

With an intuitive app interface, users can quickly create or manage their online wallets for secure payments and collections. The app should allow users to link their debit or credit cards to their e-wallet for seamless transactions.

Furthermore, an intuitive user interface should offer a streamlined checkout process for users to complete their payments efficiently. This includes displaying a clear breakdown of the payment amount, providing various payment options, and allowing users to review and confirm their transactions before finalizing payment.

In addition to payment collection, the app should also have a built-in feature for initiating payouts. With a few taps on their mobile devices, users should be able to request and process payments to relevant parties, making it convenient for businesses to distribute funds or manage financial transactions.

The app's user interface should also include a dashboard or summary page where users can easily view their transaction history, check their available balance, and access detailed financial reports or invoices. This allows users to have better visibility and control over their digital payment collections and transactions.

In summary, an intuitive user interface is crucial for a payment collection app as it ensures ease of use, clear navigation, seamless transactions, and transparent financial management. By providing a user-friendly platform, businesses can optimize their payment collection processes and enhance customer satisfaction.

Simplified Setup and Navigation

When it comes to managing your e-wallet and making payments, you want a seamless experience that is quick and hassle-free. With the best payment collection app, you can enjoy simplified setup and navigation, allowing you to start using the app within minutes.

Setting up the app is a breeze. All you need to do is download it onto your mobile device and create an account. Once you've registered, you can link your bank account or debit/credit card for seamless money transfers and payments.

The app's user-friendly interface makes it easy to navigate through various features and options. Whether you want to send or request money, pay bills, or collect payments for your business transactions, you can do it all with just a few taps on your screen.

Streamlined navigation ensures that you can find what you need quickly and efficiently. The app provides clear and intuitive options, making it easy for both individuals and businesses to use. Whether you're sending an invoice, checking out at an online store, or making a transactional payment, the app guides you through the process step-by-step.

Additionally, the app offers high-level security to protect your financial information. Your transactions, personal details, and payment history are stored securely within the app. You can also set up additional security features such as biometric authentication or PIN verification to ensure that only authorized individuals can access your e-wallet and make payments.

With simplified setup and navigation, you can confidently manage your finances and carry out transactions with ease. Say goodbye to the complexities of traditional payment methods and embrace the convenience of a digital payment collection platform.

Customizable Branding and Design

When it comes to choosing the best app for payment collection, customizable branding and design options are essential. With the right app, you can easily customize the checkout experience to match your brand's aesthetic, ensuring a seamless and cohesive user experience.

By incorporating your company logo, color scheme, and other branding elements, you can create a professional and consistent look throughout the payment process. This not only enhances your brand's image but also instills trust in your customers, assuring them that they are making secure transactions on a reliable platform.

Moreover, the ability to customize your invoices and receipts allows you to include relevant details such as order summaries, customer information, and transactional notes. This ensures that your customers have all the necessary information at their fingertips and can easily keep track of their online payments.

Additionally, a mobile app with customizable branding and design options is crucial for businesses that often handle transactions on the go. Whether you're attending trade shows, meeting clients, or delivering goods, having a personalized app enables you to collect payments efficiently and professionally.

A well-designed app with customizable branding not only elevates your business's image but also enhances the overall payment experience for your customers. By utilizing the right app, you can create a seamless and aesthetically pleasing checkout process, making it convenient and enjoyable for customers to pay with their preferred digital payment methods, including credit cards, e-wallets, debit cards, and more.

Flexible Payment Options

When it comes to managing payments, having flexible options is crucial for any business. With a reliable payment collection app, you can provide your customers with various ways to pay, ensuring convenience and satisfaction.

One of the key benefits of a flexible payment platform is the ability to accept different types of transactions. Whether your customers prefer to pay with credit or debit cards, e-wallets, or even through mobile payment apps, having a platform that supports multiple payment methods is essential.

Digital invoices and online checkout processes are also vital components of a flexible payment collection solution. By allowing your customers to easily access invoices and make payments through a secure online portal, you can streamline the payment process and eliminate unnecessary manual tasks.

Furthermore, a flexible payment app should offer a seamless integration with your existing financial systems. This means that all payment information should be automatically synced with your accounting software or CRM, reducing the chances of errors and providing real-time financial updates.

Whether you are collecting payments for products, services, or subscriptions, having a flexible payment app is crucial. Not only does it enable you to offer multiple payment options to your customers, but it also helps you improve your overall transactional efficiency and collect money in a timely manner.

Support for Credit Cards, Debit Cards, and Digital Wallets

When it comes to digital and mobile payment collection, having support for different payment methods is crucial. A payment collection app should provide seamless integration with various payment options to cater to the diverse needs of businesses and customers. This includes credit cards, debit cards, and digital wallets.

By offering support for credit cards, businesses can allow their customers to make convenient and secure payments online. Credit cards provide a flexible way for customers to pay for goods or services, and they are widely accepted worldwide. With the help of a payment collection app, businesses can ensure a smooth checkout experience for their customers by accepting credit card payments.

Debit cards are another essential payment method that should be supported by a payment collection app. Many customers prefer paying with debit cards as it allows them to use their own money for transactions rather than relying on credit. By accepting debit card payments, businesses can cater to the needs of customers who want to manage their finances more prudently.

Furthermore, with digital wallets gaining popularity, a payment collection app should also provide support for these convenient payment methods. Digital wallets such as Apple Pay, Google Pay, and PayPal offer users a secure and easy way to pay for goods and services using their smartphones or other devices. By integrating with digital wallets, businesses can offer their customers a seamless and secure payment experience.

In conclusion, a payment collection app should support credit cards, debit cards, and digital wallets to cater to the diverse needs of businesses and customers. By providing multiple payment options, businesses can streamline their transactions and offer a convenient and secure way for customers to pay.

Integration with Payment Gateways

When it comes to online transactions, having a secure and seamless payment process is crucial for any business. Integration with payment gateways allows businesses to offer a variety of payment options and streamline the checkout process for their customers.

By integrating with payment gateways, businesses can accept various payment methods, including credit cards, debit cards, and digital wallets. This ensures that customers can pay using their preferred method, increasing convenience and reducing barriers to purchase.

Furthermore, integration with payment gateways ensures that transactions are processed securely. Payment gateways provide robust encryption and fraud prevention measures to protect both businesses and their customers from unauthorized access and financial loss.

With the rise of mobile and digital payments, having an integrated payment gateway is more important than ever. A mobile-friendly payment gateway allows businesses to accept payments on the go, whether it's through a mobile app or a responsive website. This flexibility enables businesses to reach customers wherever they are and capture sales opportunities in real-time.

In addition to accepting payments, integration with payment gateways also enables businesses to manage their financial operations efficiently. Businesses can automate invoice generation and payment tracking, reducing the need for manual paperwork and streamlining the entire transactional process.

Overall, integration with payment gateways is an essential feature for any payment collection app. It provides businesses with a secure, convenient, and seamless platform to collect and manage money, helping them optimize their financial operations and provide a superior customer experience.

Comprehensive Reporting and Analytics

When it comes to managing your financial transactions, having access to comprehensive reporting and analytics is crucial. With the right payment collection app, you can gain insight into your transactions and make informed decisions to streamline your business operations.

The app's reporting capabilities provide you with detailed information about each transaction, such as the payment method used (credit card, debit card, e-wallet), the date and time of the transaction, and the amount paid. You can easily generate reports that can be exported or shared with your team for further analysis.

Analytics tools offered by the app allow you to track trends and patterns in your payment collection process. By analyzing the data, you can identify areas for improvement, such as optimizing checkout processes or introducing new payment methods to meet customer preferences.

Moreover, the app's reporting and analytics features enable you to monitor the performance of your invoices and payouts. You can track the status of each invoice, whether it has been paid or is pending, and identify any discrepancies or delays in your payouts. This level of transparency helps you stay on top of your finances and ensures a smooth payment collection process.

With secure access to your financial data on a mobile platform, you can conveniently monitor your payment collection activities anytime, anywhere. The app's user-friendly interface and intuitive navigation make it easy for you to navigate through the reporting and analytics features, empowering you to make data-driven decisions to grow your business.

Track Sales and Payment Trends

With the help of a secure and online financial app for transactional money collection, businesses can easily track their sales and payment trends. This digital payment solution provides a convenient and efficient way to collect payments, ensuring a smooth checkout experience for customers and faster payout for businesses.

The app's e-wallet platform allows businesses to securely receive payments from customers using various payment methods, such as debit and credit cards, as well as digital wallets. This flexibility ensures that businesses can cater to a wide range of customers and their preferred payment options.

By using the app's invoice feature, businesses can easily create and send professional-looking invoices to their customers. The app's tracking capabilities allow businesses to keep tabs on outstanding invoices and monitor payment trends over time. This helps businesses identify any patterns or issues regarding late or missed payments and take proactive steps to address them.

One of the key benefits of using this app for payment collection is its ability to provide businesses with valuable insights into their sales and payment trends. The app generates detailed reports and analytics, allowing businesses to track their revenue, payment methods, and customer behavior. This information can be used to make informed business decisions and optimize sales strategies.

In conclusion, using a secure and online financial app for payment collection offers businesses a digital and efficient solution for tracking sales and payment trends. With features such as e-wallet integration, invoice management, and detailed analytics, businesses can streamline their payment processes and gain valuable insights into their financial performance.

Generate Financial Reports

Managing your financial transactions is essential for any business. With the right payment collection app, you can easily generate detailed financial reports to keep track of your payments, invoices, and transactions.

Whether you are using a mobile app or an online platform, generating financial reports allows you to have a clear overview of your business's financial health. These reports provide you with valuable insights into your payment history, allowing you to identify trends, monitor outstanding invoices, and analyze your cash flow.

A secure payment collection app with robust reporting capabilities enables you to view transactional data such as the amount of money collected, payout details, and payment methods used, including credit and debit cards, e-wallets, and online wallets.

Financial reports also help you reconcile your income and expenses, providing a comprehensive view of your business's financial performance. By categorizing payments and invoices, you can easily track revenue streams and analyze different aspects of your business.

By utilizing a digital payment collection app's reporting features, you can gain valuable insights for making informed business decisions. You can identify your top-performing products or services, track customer behavior, and measure the effectiveness of different marketing strategies. These insights can help you optimize your business operations, increase revenue, and improve customer satisfaction.