As tax season approaches, many individuals find themselves scrambling to gather the necessary documentation to claim deductions and expenses. One of the most commonly overlooked deductions is mileage, but with the Mileage IQ app, keeping track of your business mileage has never been easier.

Whether you're self-employed or work for a company that requires you to track your mileage for reimbursement, the Mileage IQ app is a must-have. This app simplifies the process of logging your mileage and ensures that you remain compliant with IRS regulations.

With the Mileage IQ app, you can say goodbye to the days of manually recording your mileage in a logbook. This app automatically tracks your mileage by using GPS technology, making it incredibly accurate and convenient. You no longer have to worry about forgetting to log your miles or spending hours calculating your deductions.

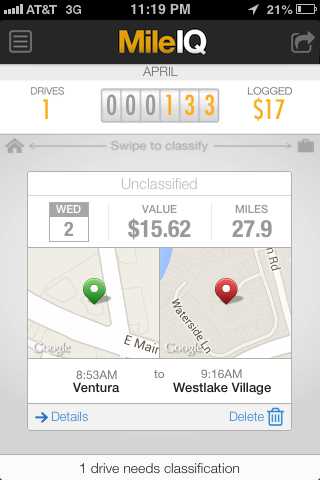

In addition to automatically tracking your mileage, the Mileage IQ app offers a range of features that make it stand out from other mileage tracking apps. It allows you to categorize your trips as business, personal, or medical, and even provides a map of your route for each trip. This level of detail is invaluable when it comes to providing proof to the IRS or your employer.

Overall, the Mileage IQ app is a game-changer when it comes to tracking your mileage and maximizing your deductions. Its user-friendly interface, accurate tracking, and IRS compliance make it a must-have for anyone who needs to track their mileage for tax purposes or reimbursement. Don't let tax season stress you out - let the Mileage IQ app handle the tracking and ensure you get every deduction you're entitled to.

About Mileage IQ App

The Mileage IQ app is a powerful tool designed to help individuals conveniently and accurately track their expenses and mileage for business purposes. With this app, users can easily record their travel expenses and log their mileage in a digital logbook.

One of the main advantages of using the Mileage IQ app is its automatic tracking feature. The app uses advanced technology to automatically detect and record mileage, eliminating the need for manual input. This ensures that all mileage is accurately captured and logged, saving users time and effort.

In addition to its convenience, the Mileage IQ app is also IRS compliant, making it an ideal choice for individuals who need to track their mileage for tax purposes. The app generates detailed mileage reports that can be easily used for tax deductions and mileage reimbursement. This can be especially helpful during tax season, as it simplifies the process of calculating mileage deductions.

Business owners and self-employed individuals can benefit greatly from using the Mileage IQ app. By accurately tracking their mileage, they can ensure that they are claiming all eligible deductions and maximizing their tax savings. The app also provides them with a clear and organized record of their business mileage, which can be useful for monitoring expenses and managing their finances.

Overall, the Mileage IQ app is a reliable and efficient tool for mileage tracking. Its automatic tracking feature, IRS compliance, and user-friendly interface make it a top choice for anyone needing to track their mileage for business or tax purposes. Whether it's for personal record-keeping or for claiming deductions, the Mileage IQ app simplifies the process and provides users with accurate and detailed mileage logs.

Why Should You Track Your Mileage?

Tracking your mileage is important for several reasons.

First and foremost, accurate mileage tracking is essential for claiming mileage reimbursement. Whether you are self-employed or work for a company that reimburses business expenses, keeping a record of your mileage is crucial for getting the money you deserve. By using a mileage tracking app like Mileage IQ, you can easily and automatically track your mileage, saving you time and effort.

Moreover, tracking your mileage can help you stay IRS compliant. The IRS requires that you have a detailed mileage logbook if you want to deduct business mileage expenses on your tax return. By using an app like Mileage IQ, you can ensure that your mileage log is accurate and meets the IRS guidelines, avoiding any potential issues during tax season.

Not only does tracking your mileage help with taxes and expenses, but it also provides you with valuable insights into your business. By regularly reviewing your mileage log, you can analyze your travel patterns, identify any unnecessary trips, and make more informed decisions about your business.

Overall, a mileage tracker app like Mileage IQ is a valuable tool for any business owner or employee who regularly drives for work. It simplifies the process of tracking your mileage, ensures IRS compliance, and provides valuable insights for improving your business. So, start using Mileage IQ today and experience the benefits of easy mileage tracking.

Key Features

The Mileage IQ app offers several key features that make it a must-have for anyone who regularly drives for business or needs to keep track of their mileage for tax purposes.

1. Automatic mileage tracking: The app uses auto-detection technology to automatically track your mileage every time you drive, saving you time and effort.

2. IRS compliant mileage log: With the Mileage IQ app, you can easily create and maintain an IRS compliant digital mileage logbook, ensuring that you have all the necessary documentation to support your mileage deductions.

3. Accurate mileage tracker: The app uses advanced GPS technology to accurately track the miles you drive for business, eliminating the need for manual calculations and reducing the risk of errors.

4. Mileage reimbursement: The Mileage IQ app allows you to easily calculate your mileage reimbursement for business trips, ensuring that you receive the full amount of money you are entitled to.

5. Easy review and categorization: The app provides a simple and intuitive interface for reviewing and categorizing your mileage, making it easy to keep track of your business and personal trips.

6. Seamless integration: The app integrates with popular accounting and tax software, allowing you to easily export your mileage data and use it for tax preparation.

7. Convenient tax season support: During tax season, the Mileage IQ app provides you with easy access to all your mileage records and deductions, saving you time and stress.

With its comprehensive set of features and user-friendly interface, the Mileage IQ app is the perfect tool for anyone who needs to track their mileage for business or tax purposes.

Automatic Mileage Tracking

One of the standout features of the Mileage IQ app is its automatic mileage tracking. This feature allows users to effortlessly and accurately track their mileage for various purposes such as mileage reimbursement, tax deductions, or simply keeping track of expenses for personal or business use.

The app is IRS compliant, which means that it meets the requirements set by the Internal Revenue Service for mileage tracking. This is crucial for individuals and businesses who want to ensure that their mileage records are accepted by the IRS during tax season.

With the Mileage IQ app, users no longer have to rely on manual methods such as pen and paper or spreadsheets to keep track of their mileage. The app automatically logs and categorizes mileage based on GPS location, saving users time and effort.

Users can easily review and edit their mileage logbook within the app, ensuring that all necessary details are recorded accurately. The app also allows users to classify mileage as business or personal, making it easier to determine relevant deductions for tax purposes.

By automatically tracking mileage, users can have a complete and up-to-date record of their mileage, making it easier to calculate deductions and claim reimbursement. This not only saves time but also helps to maximize tax savings and ensure compliance with IRS regulations.

GPS Tracking and Trip Classification

The Mileage IQ app offers accurate GPS tracking and trip classification to help you track your mileage with ease. With its advanced GPS technology, the app automatically tracks your trips and accurately records the distance traveled for each trip.

By using the Mileage IQ app as your mileage tracker, you can be confident that your mileage log is IRS compliant. The app is designed to meet the requirements of the IRS for accurate and detailed mileage tracking, ensuring that you have the necessary documentation for tax season.

The app not only tracks your mileage automatically, but it also classifies your trips based on their purpose. Whether you're driving for business or personal reasons, the app will categorize each trip accordingly, making it easy for you to differentiate between business and non-business trips.

This trip classification feature is especially useful for individuals who need to separate their business mileage for tax purposes. By having a clear distinction between business and personal trips, you can easily calculate your mileage deductions and expenses for your business.

In addition to helping with taxes, the Mileage IQ app also simplifies mileage reimbursement processes. If you're eligible for mileage reimbursement from your employer, the app can provide you with a detailed mileage logbook that includes all the necessary information for submitting your mileage claims.

Overall, the Mileage IQ app's GPS tracking and trip classification features make it a valuable tool for anyone who needs to track and document their mileage for tax purposes or mileage reimbursement. With its accurate tracking and IRS compliance, the app streamlines the process of managing your business expenses and maximizing your deductions.

Expense Tracking and Reporting

Keeping track of expenses is a crucial aspect of managing your finances, especially for auto owners who can claim tax deductions for business mileage. With a reliable mileage app like Mileage IQ, you can easily track your mileage, ensuring accurate mileage reimbursement and deductions when tax season comes.

Mileage IQ is an IRS compliant mileage tracker that allows you to automatically log your business mileage. This eliminates the need for manual recording in a mileage logbook, saving you time and ensuring accuracy.

The app's mileage tracking feature ensures that every mile driven for business purposes is recorded, so you can claim the maximum deductions allowed by the IRS. This is particularly important for individuals who frequently travel for work or have a job that requires extensive driving.

One of the key benefits of using Mileage IQ is its ability to generate detailed reports. These reports can be easily exported and shared, making it convenient for submitting expenses to employers or filing taxes. The app provides a breakdown of your mileage by date, destination, and purpose, making it easy to track and categorize your expenses.

By using Mileage IQ, you can stay organized and be confident that your expense tracking is in compliance with IRS regulations. The app provides an intuitive and user-friendly interface, making it simple to input and review your mileage data. With accurate mileage tracking and reporting, you can ensure that you never miss out on potential deductions or face audits from the IRS.

In conclusion, Mileage IQ is a reliable and efficient tool for tracking and reporting your expenses. Whether you need to claim mileage reimbursement or deductions on your taxes, this mileage app provides the necessary features to keep your finances in order. Take control of your business mileage tracking and start using Mileage IQ today.

User Experience

The Mileage IQ App provides an exceptional user experience for individuals and businesses looking to track their mileage and expenses. With its user-friendly interface and intuitive design, this app makes it easy for anyone to keep track of their auto mileage for tax purposes.

One of the standout features of the Mileage IQ App is its automatic tracking capabilities. Users no longer need to manually log their mileage or keep track of paper receipts. The app uses advanced technology to automatically track and record mileage, ensuring accuracy and saving time.

For individuals who need to comply with IRS regulations, the Mileage IQ App is an ideal choice. It meets all IRS requirements for a mileage logbook and is fully IRS compliant. This is crucial during tax season when individuals need to accurately report their mileage expenses for potential deductions or mileage reimbursement.

The Mileage IQ App also offers a seamless integration with business expenses. Users can easily track and categorize their mileage within the app, making it effortless to separate personal and business mileage for tax purposes. This eliminates the need for tedious manual calculations and ensures accurate reporting.

With the Mileage IQ App, keeping track of mileage has never been easier. Users can access their mileage log on any device, including smartphones, tablets, and computers. This allows for flexibility and convenience, making it easier than ever to stay organized and up-to-date with mileage tracking.

In conclusion, the Mileage IQ App offers a streamlined and efficient user experience for tracking mileage and expenses. Its automatic tracking capabilities, IRS compliance, and seamless integration with business expenses make it a top choice for individuals and businesses looking to simplify their mileage tracking process and maximize potential tax deductions.

Intuitive Interface

The Mileage IQ app offers an intuitive interface that makes it easy to track your mileage for tax season. With taxes and deductions being a complex aspect of managing your finances, having a reliable mileage log is crucial. The Mileage IQ app provides a simple and user-friendly interface that allows you to easily enter and track your mileage.

By using the app's mileage logbook feature, you can keep a detailed record of your business mileage, ensuring that you are accurately tracking your expenses. This is especially important for those who rely on mileage reimbursement for their business expenses. With the Mileage IQ app, you can be confident that your records are accurate and IRS compliant.

The app automatically tracks your mileage, making it effortless to keep a reliable record. Whether you are traveling for business or personal purposes, the Mileage IQ app will accurately track your mileage and expenses. This eliminates the need for manual tracking and reduces the risk of human error.

With the Mileage IQ app, you can easily review and categorize your mileage log, making it simple to keep track of your business expenses. The app provides a comprehensive review of your mileage tracker, allowing you to see all of your trips in one place. This makes it easy to identify any discrepancies and ensure that your records are complete.

In conclusion, the Mileage IQ app's intuitive interface makes it a valuable tool for tracking your mileage. With its accurate and IRS compliant tracking system, the app simplifies the process of managing your business expenses. Whether you are self-employed or work for a company, the Mileage IQ app is a must-have for anyone looking to streamline their mileage tracking process.

Seamless Integration with Other Apps

The Mileage IQ app offers seamless integration with other popular productivity apps, making it incredibly easy to track your mileage and expenses for business purposes. Whether you're a freelancer, small business owner, or simply looking to make tax season less daunting, this mileage tracker is a valuable tool.

With the Mileage IQ app, you can review and manage your mileage data with ease. The app provides a comprehensive overview of your miles driven, allowing you to categorize them and calculate potential deductions for taxes. Its user-friendly interface makes it simple to navigate and understand your mileage logbook.

One of the key benefits of using the Mileage IQ app is that it is IRS compliant. This means that all your mileage trackings are in accordance with IRS regulations, making it easier for you to claim mileage reimbursement and deductions when filing your taxes. The app generates accurate and detailed reports that can be easily exported and shared with your accountant or tax preparer.

In addition to its compatibility with other apps, the Mileage IQ app also offers automated mileage tracking. By using the app's auto-tracking feature, your mileage is recorded automatically whenever you take a business-related trip. This saves you time and ensures that you never miss recording any business-related miles.

The Mileage IQ app is a valuable asset for any business or individual looking to track and manage their mileage expenses. Its seamless integration with other productivity apps, accurate tracking capabilities, and IRS compliance make it an essential tool for anyone needing to stay on top of their mileage and maximize tax deductions.

Customization Options

The Mileage IQ app offers a wide range of customization options to fit your specific needs when it comes to tracking your mileage and expenses. Whether you're a small business owner looking to optimize your deductions and mileage reimbursement, or an individual trying to accurately track your mileage for tax season, this app has you covered.

One of the key features of the app is its ability to automatically track your mileage. With the app running in the background, it can detect when you're driving and start tracking your mileage without any manual input required. This feature saves you time and ensures that your mileage log is accurate and up-to-date without any effort on your part.

Another customization option the app offers is the ability to categorize your trips. This allows you to easily distinguish between business and personal trips, making it simple to calculate your deductible mileage for tax purposes. By organizing your trips in this way, you can ensure that your mileage logbook is organized and ready to use when it's time to file your taxes.

The app also allows you to customize the style and format of your mileage logs. You can choose from various templates and layouts to suit your preferences, making it easy to view and analyze your mileage and expenses. Whether you prefer a simple list or a detailed table, the app has options that make it easy to track and manage your mileage efficiently.

Overall, the Mileage IQ app provides a high level of customization to meet your specific mileage tracking needs. From automatically tracking your mileage to categorizing your trips and customizing your mileage logs, this app is designed to make tracking your business mileage and expenses as easy and efficient as possible.

Benefits

Tracking your mileage is an essential task for businesses, especially during tax season. With the Mileage IQ app, you can easily track your mileage on the go, ensuring that you have an accurate record to support your deductions and mileage reimbursement requests.

The app is IRS compliant, so you can trust that your mileage logbook will meet the necessary requirements for tax purposes. The IRS recognizes the importance of accurate mileage tracking and having a reliable app like Mileage IQ can save you time and hassle during tax season.

One of the key benefits of using the Mileage IQ app is that it automatically tracks your mileage. You don't have to manually enter each trip or remember to start and stop tracking. The app uses advanced technology to detect when you're in a moving vehicle and starts recording your mileage automatically.

With the app, you can easily classify your trips as business or personal. This classification is crucial for accurately tracking your business-related mileage and distinguishing it from personal use. This feature ensures that you can easily calculate your deductible auto expenses and maximize your tax deductions.

The Mileage IQ app provides detailed reports that you can easily export and use for tax purposes. You can generate reports for specific time periods, categorize trips, and view your mileage data in a clear and organized manner. This level of organization and documentation is invaluable when it comes to filing your taxes.

In summary, the Mileage IQ app offers numerous benefits for businesses and individuals who need to track their mileage. With its IRS compliance, automatic tracking, accurate mileage log, and detailed reports, the app simplifies the process of tracking your mileage and helps you maximize your tax deductions and reimbursements.

Time and Effort Saving

Tracking mileage for business purposes can be time-consuming and tedious. However, with the Mileage IQ app, you can save time and effort by automating the process. This app allows you to track your mileage accurately and effortlessly, eliminating the need for manual calculations and record-keeping.

By using this mileage app, you can easily keep track of all your business-related trips and generate a mileage logbook. This logbook will be automatically filled with all the necessary details, such as the date, time, starting point, destination, and mileage. This not only saves you time but also ensures that your mileage log is accurate and up-to-date.

Aside from saving time, the Mileage IQ app also helps you save money. By accurately tracking your mileage, you can easily claim deductions and receive proper reimbursement for your business-related travel expenses. This can be particularly beneficial during tax season, as the app provides you with an IRS-compliant mileage log that can be used to maximize your deductions.

Not only does the Mileage IQ app save you time and money, but it also provides peace of mind. With its automatic tracking feature, you don't have to worry about forgetting to log your mileage or keeping track of your trips manually. The app does all the work for you, ensuring that your mileage tracking is thorough and reliable.

In conclusion, the Mileage IQ app offers a convenient and efficient solution for mileage tracking. It saves you time and effort by automatically tracking your mileage, generating an accurate mileage log, and helping you maximize your deductions. Whether you're a business owner, freelancer, or self-employed individual, this app is a valuable tool for managing your mileage and expenses.

Accurate Mileage Records for Tax Purposes

Keeping accurate mileage records is crucial for individuals and businesses alike, especially when it comes to taxes. The Mileage IQ app offers a convenient and efficient way to track your auto mileage for tax purposes. Whether you're running a business or simply wanting to claim deductions on your personal taxes, this app ensures you have the necessary documentation to support your expenses.

One of the key advantages of using Mileage IQ is that it is IRS compliant. The app will automatically track and log your mileage, saving you time and effort. This means no more manual tracking or worrying about lost mileage logbooks. The app accurately records your mileage using GPS technology, ensuring that you have reliable documentation for tax season.

During tax season, accurate mileage records are essential for proving your business expenses or claiming deductions for your personal vehicle use. With the Mileage IQ app, you can access your mileage data at any time and easily generate reports for your tax filings. This streamlines the process and ensures that you have all the necessary information to maximize your deductions and minimize your tax liability.

The Mileage IQ app also offers features for mileage reimbursement if you use your vehicle for work purposes. The app allows you to categorize your trips, automatically classifying them as business or personal. This way, you can easily submit your mileage logs to your employer or clients, saving you from having to manually calculate and record your expenses.

In conclusion, the Mileage IQ app provides an accurate and efficient way to track your mileage for tax purposes. The app's automatic tracking and IRS compliance make it a valuable tool during tax season. Whether you need to claim deductions or seek reimbursement for your mileage, this app ensures that you can do so with ease and confidence. Say goodbye to manual record-keeping and hello to simplified mileage tracking with the Mileage IQ app.

Increased Cost Deductions

During tax season, it is crucial to have an accurate mileage logbook in order to maximize your mileage deductions. The Mileage IQ App provides a convenient way to track your mileage for business purposes, ensuring that you are able to claim the proper deductions on your taxes.

With the Mileage IQ App, you can easily keep track of your mileage by using the mileage log feature. This allows you to input the details of each trip, such as the starting and ending odometer readings, the purpose of the trip, and any notes or comments. By keeping a detailed mileage log, you can ensure that you have all the necessary information to claim your mileage deductions accurately.

One of the key benefits of using the Mileage IQ App is that it automatically calculates your mileage reimbursement based on the mileage rates set by the IRS. This ensures that you are reimbursed for your business mileage at the appropriate rate, saving you time and effort in calculating these expenses manually.

In addition to accurately tracking your mileage for tax purposes, the Mileage IQ App also provides other features that can help you save money on your taxes. For example, the app can track other business expenses related to your vehicle, such as gas, maintenance, and repairs. By keeping a record of these expenses, you can easily claim them as deductions on your taxes.

The Mileage IQ App is IRS-compliant, which means that it meets all the requirements set by the IRS for mileage tracking. This gives you peace of mind knowing that your mileage log is accurate and in compliance with IRS regulations. With an accurate mileage log, you can confidently claim your business mileage deductions without the fear of being audited.

In conclusion, using the Mileage IQ App can greatly increase your cost deductions during tax season. The app provides a convenient and accurate way to track your business mileage, as well as other vehicle-related expenses. By utilizing the app's features and ensuring that your mileage log is IRS compliant, you can confidently claim your deductions and save money on your taxes.

Pricing and Availability

Mileage IQ is an essential mileage app for any professional or business owner looking to keep track of their mileage reimbursement. This mileage tracker is available for download on both iOS and Android devices, making it convenient and easily accessible.

The pricing for Mileage IQ depends on the type of subscription you choose. They offer both a free version and a premium version for enhanced features and benefits. The premium version is available for a monthly fee, which can be a great investment during tax season when you need to accurately track your expenses for deductions.

With Mileage IQ, you'll never have to worry about maintaining a physical mileage logbook again. The app automatically tracks your mileage as you drive, ensuring that all your trips are accounted for. Plus, it is IRS compliant, so you can trust that your mileage reports will meet the necessary requirements for tax purposes.

Having an accurate and detailed mileage log is crucial for maximizing your deductions and saving money on taxes. Mileage IQ takes the guesswork out of tracking your business mileage, allowing you to focus on the more important aspects of your business.

In conclusion, Mileage IQ is a reliable and user-friendly app that simplifies the process of tracking your mileage for tax purposes. It is available for download on both iOS and Android devices, offering convenience and accessibility. Whether you're a business owner or a professional looking to maximize your deductions, Mileage IQ is a valuable tool to have during tax season and throughout the year.

Subscription Plans

If you're a business owner or self-employed, keeping track of your mileage is essential for accurate expense deductions and taxes. With the Mileage IQ app, you can ensure that your mileage is automatically recorded and organized, making it easier to claim your mileage reimbursement and deductions when tax season arrives.

The app offers various subscription plans to cater to different user needs. The basic free plan allows you to track up to 40 trips per month, providing a great starting point for those who have minimal mileage needs. However, if your business requires more extensive mileage tracking, the premium subscription plans offer unlimited trip tracking.

One of the standout features of the premium subscription plans is their IRS compliance. The Mileage IQ app is IRS compliant, meaning that it meets the requirements and standards set by the Internal Revenue Service. This ensures that your mileage logbook is accurate and can be confidently used for tax purposes.

The premium subscription plans also offer additional benefits, such as the ability to categorize trips by purpose or client, create detailed mileage reports, and access advanced analytics. These features can help you gain insights into your business expenses and make better-informed decisions.

In addition to the premium subscription plans, Mileage IQ also offers a business plan specifically designed for teams. This plan allows multiple users to access and track mileage under one account, streamlining the process and ensuring consistency across the team.

With its range of subscription plans, the Mileage IQ app provides flexibility for individuals and businesses. Whether you're a freelancer looking to maximize your deductions or a small business owner managing a team, the app offers a convenient and accurate solution for tracking your mileage and simplifying your tax season.

Operating Systems and Devices

The Mileage IQ app is compatible with various operating systems and devices, making it accessible to a wide range of users. Whether you have an Android or iOS device, you can easily download and install the app to start tracking your mileage.

With the Mileage IQ app, you can track your mileage on the go using your smartphone or tablet. The app provides a user-friendly interface that allows you to log your mileage quickly and accurately. You can also categorize your trips as personal or business expenses, making it easier to track and separate your mileage for tax purposes.

One of the key features of the Mileage IQ app is its automatic mileage tracking. The app uses GPS technology to detect when you're driving and automatically records your mileage. This eliminates the need for manual logbooks or remembering to start and stop tracking your mileage.

The Mileage IQ app is IRS-compliant and can generate detailed mileage reports that are accepted by the IRS. This is essential during tax season when you need to provide accurate mileage records for business expenses and mileage reimbursement.

Whether you're a self-employed professional or a business owner, the Mileage IQ app can help you stay organized and save time when it comes to tracking your mileage. By accurately recording your mileage, you can ensure that you claim the appropriate deductions and avoid any potential issues with the IRS.

Free Trial and Money-Back Guarantee

If you're an auto owner or a business owner who relies on mileage reimbursement, you know how important it is to keep track of your mileage for tax purposes. With Mileage IQ, you can automatically track your mileage and maintain an accurate mileage logbook.

During tax season, tracking your mileage is crucial for claiming expenses and deductions. Mileage IQ app is IRS compliant, making it easy for you to meet the requirements set by the IRS. You can be confident that your mileage log is accurate and reliable.

But what if you're not sure if Mileage IQ is the right app for you? Don't worry. You can take advantage of their free trial to see how the app works and if it fits your needs. This way, you can experience firsthand the convenience and efficiency of using a mileage app.

Additionally, Mileage IQ offers a money-back guarantee. If you're not satisfied with the app within a certain period of time, you can request a refund. This guarantee shows that Mileage IQ values customer satisfaction and believes in the quality of their product.

With the free trial and money-back guarantee, there's no risk in trying out Mileage IQ. Start tracking your mileage today and simplify your tax season preparations with this reliable and user-friendly mileage tracker app.

Summary

Tracking your business expenses and mileage is a crucial task, especially during tax season. A reliable mileage app like Mileage IQ can help you automate this process, saving you time and ensuring accurate deductions.

Mileage IQ is an IRS-compliant app that offers a convenient way to keep track of your mileage. Using advanced technology, it automatically records your mileage every time you drive, eliminating the need for manual input. This allows you to focus on your business while the app takes care of the tracking.

With Mileage IQ, you can easily generate a mileage logbook that meets IRS standards. This logbook can be invaluable when it comes to filing your taxes and claiming deductions. The app provides you with detailed reports that include the date, distance, and purpose of each trip, ensuring that you have all the necessary information at your fingertips.

One of the key benefits of using Mileage IQ is its accuracy. The app uses GPS technology to accurately track your mileage, ensuring that you never miss out on valuable deductions. It also allows you to classify each trip as personal or business, making it easy to separate your mileage for tax purposes.

Overall, Mileage IQ is a must-have app for anyone who relies on their car for business purposes. It streamlines the tracking process and provides you with an accurate and detailed mileage log, saving you time and money during tax season. With its user-friendly interface and advanced features, Mileage IQ is the ultimate mileage tracker for any business owner or professional.

Efficient Mileage Tracking Made Easy

Tracking mileage has never been easier with the Mileage IQ app. This convenient app allows you to accurately track your mileage with its reliable mileage tracker feature. Whether you're a freelancer, business owner, or just someone looking to maximize their deductions for tax purposes, this app is a must-have.

One of the standout features of Mileage IQ is its ability to automatically log your mileage. Gone are the days of manually recording every trip in a mileage logbook. With this app, all you have to do is let it run in the background, and it will do all the hard work for you.

Accurate mileage tracking is particularly essential if you're seeking mileage reimbursement or looking to claim mileage deductions on your taxes. The Mileage IQ app ensures that all your mileage records are IRS-compliant, making tax season a breeze. Say goodbye to the stress of calculating your mileage expenses manually.

Using Mileage IQ is not only efficient but also beneficial for your business. By accurately tracking your mileage, you can easily calculate your business expenses and deductions. This allows you to have a clear and organized view of your financials.

With the Mileage IQ app, you can also optimize your mileage routes, allowing you to save time and money. The app suggests the most efficient routes based on real-time traffic data, helping you navigate through congested areas and avoid unnecessary detours.

In conclusion, the Mileage IQ app is a game-changer when it comes to mileage tracking. Its accurate and automatic tracking feature, along with its ability to optimize routes, makes it an indispensable tool for any individual or business looking to streamline their mileage tracking process. Say goodbye to the hassle of manual mileage logs and embrace the convenience of the Mileage IQ app.