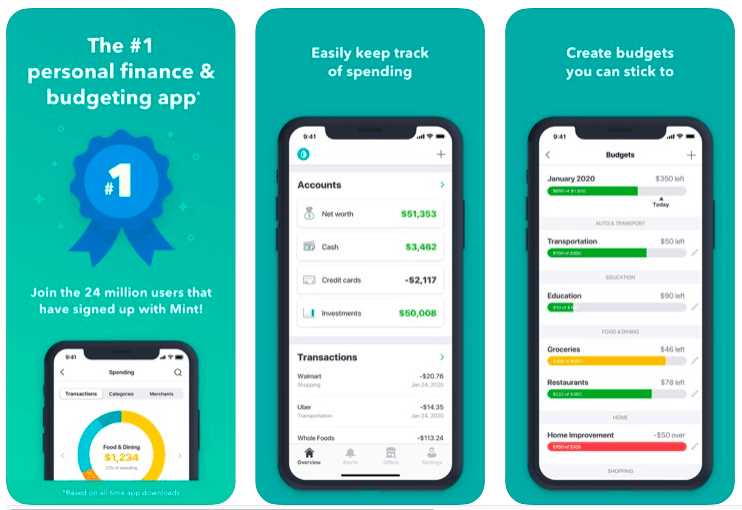

Finance management is an essential aspect of anyone's life, and having a reliable app for planning and budgeting can make all the difference. With the right personal accounting app, you can easily track your expenses, manage your debt, and stay on top of your transactions. Whether you want to keep a close eye on your balance, track your cash flow, or simply ensure your financial well-being, a top-notch app can help you achieve your goals.

One of the key features of a great personal accounting app is its ability to provide comprehensive expense and income tracking. By categorizing your spending and savings, you can evaluate your financial habits and make informed decisions. Additionally, these apps often come with features like bill reminders and goal-setting tools, which can assist you in managing your finances effectively.

The best personal accounting apps also offer advanced features such as automatic syncing with your bank accounts and credit cards, ensuring that your financial data is always up to date. This not only saves you time but also eliminates the risk of manual errors. Furthermore, these apps often provide detailed reports and visualizations, allowing you to have a clear overview of your financial status.

When it comes to personal accounting, having the right app can make a tremendous difference in your financial journey. From expense tracking to budgeting, from debt management to goal setting, a reliable app can be a powerful tool in helping you achieve your financial goals and build a secure future. With so many options available in the market, it's essential to choose an app that suits your needs and offers the features necessary for efficient money management.

Understanding the Importance of Personal Accounting

Personal accounting is a crucial aspect of managing one's finances effectively. It involves the systematic tracking and analysis of one's savings, cash flow, expenses, and income. By maintaining a comprehensive record of all financial transactions, individuals can gain insight into their spending habits and make informed decisions regarding budgeting and financial planning.

Effective personal accounting allows individuals to gain a clear understanding of their overall financial situation. By categorizing and recording each expense and income source, it becomes easier to track where money is being spent and how much is being saved. This awareness can help individuals make necessary adjustments to their spending habits and identify areas where they can save more money.

Furthermore, personal accounting enables individuals to make informed decisions about investments and debt management. By accurately tracking expenses and income, individuals can assess their financial stability and determine whether they can afford to take on additional debt or invest in opportunities for growth. With a clear understanding of their financial situation, individuals can make prudent decisions to maintain a healthy balance between income and debt.

A personal accounting app can greatly simplify the process of managing finances. These apps provide convenient tools for expense tracking, budgeting, and goal setting. They can also generate reports and charts to visualize financial data, making it easier to identify areas of improvement or potential issues with cash flow. By utilizing a personal accounting app, individuals can streamline their financial management processes and make informed decisions based on accurate, up-to-date information.

In conclusion, personal accounting plays a vital role in effective money management. It allows individuals to gain a clear understanding of their financial situation, track expenses and income, plan for the future, and make informed decisions about investments and debt management. By utilizing personal accounting apps, individuals can simplify the process and gain more control over their finances.

Why you should track your finances

A personal accounting app is a powerful tool for efficiently managing your money and achieving your financial goals. Tracking your finances allows you to have a clear understanding of your income, expenses, and savings. It provides you with insights into your financial habits and enables you to make informed decisions about how to allocate your funds.

By keeping track of your transactions, you can easily identify patterns and trends in your spending. This helps you identify areas where you may be overspending and allows you to adjust your budget accordingly. It also allows you to monitor your savings and ensure that you are putting enough money aside for future expenses or emergencies.

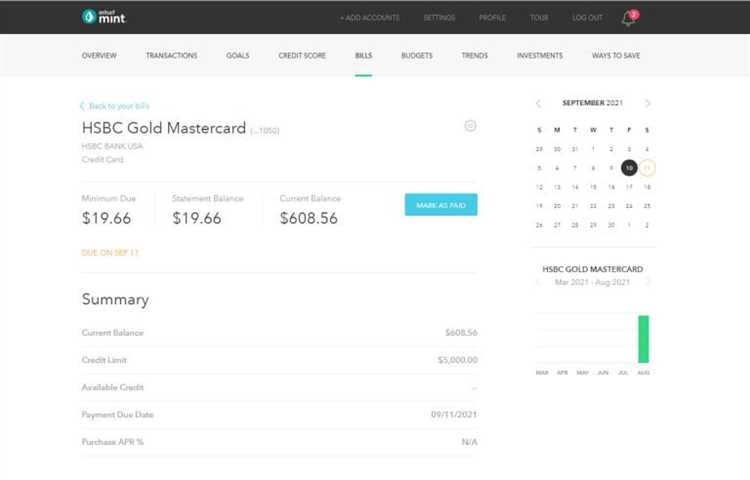

Financial tracking is essential for effective debt management. With an accounting app, you can keep a close eye on your debts and easily track your progress in paying them off. This can be especially helpful if you have multiple debts, as it allows you to prioritize your payments and develop a plan for becoming debt-free.

Effective financial management involves careful planning and budgeting. By tracking your income and expenses, you can create a realistic budget that aligns with your financial goals. An accounting app can automate this process, making it easy to categorize and track your expenses, ensuring that you stay within your budget and make informed decisions about your spending.

Tracking your finances through a personal accounting app empowers you to take control of your financial future. It provides you with a clear snapshot of your financial health and helps you identify areas for improvement. With its powerful tools and features, an accounting app is a valuable asset for anyone looking to achieve financial stability and success.

Benefits of Using a Personal Accounting App

Managing your personal finance and keeping track of your expenses and income is essential for maintaining a healthy financial life. Using a personal accounting app can provide several benefits in this area.

- Debt Management: A personal accounting app allows you to efficiently manage your debts by providing a clear overview of what you owe and when it is due. This can help you avoid late payment fees and make informed decisions about prioritizing your debt repayments.

- Expense Tracking: With a personal accounting app, you can easily track your daily expenses. This helps you gain insights into your spending habits and identify areas where you can cut back to save money.

- Financial Planning: By analyzing your income and expenses, a personal accounting app can help you create a budget and set financial goals. It can also provide recommendations on how to achieve these goals, such as saving a certain percentage of your income each month.

- Transaction Management: An accounting app allows you to categorize and organize your transactions, making it easier to review and reconcile them. This saves you time and effort when it comes to tracking your financial activities.

- Balance and Savings Monitoring: Keeping an eye on your account balances and savings is important for maintaining financial stability. A personal accounting app can provide real-time updates on your balances, allowing you to make informed decisions about your finances.

- Efficient Money Management: Overall, using a personal accounting app enables you to efficiently manage your money and take control of your financial life. It provides a centralized platform for all your financial information and empowers you to make smart financial decisions.

Convenient and Easy-to-Use

Managing your personal finances has never been easier with the help of a convenient and easy-to-use accounting app. This app allows you to stay on top of your financial management by keeping track of your spending, income, and expenses all in one place.

With this app, you can easily create a budget and track your expenses to ensure that you are staying within your financial goals. You can also set up alerts to notify you when you are approaching your budget limits, helping you to avoid overspending and save money.

The app provides a clear and user-friendly interface that allows you to easily input all your financial transactions, including income, expenses, and savings. You can categorize your transactions and add notes to make it easy to track and analyze your financial activities.

One of the key features of the app is its ability to provide a real-time balance of your cash, savings, and debt. This allows you to have a clear picture of your financial health at any given moment and helps you make informed decisions about your spending and saving habits.

In addition to tracking your income and expenses, the app also offers tools and resources to help you plan for your financial future. You can set financial goals and track your progress, create savings plans, and even get personalized advice on how to achieve your financial goals.

In conclusion, the convenient and easy-to-use personal accounting app provides a comprehensive and efficient way to manage your money. With its powerful features and user-friendly interface, you can easily track your income, expenses, and savings, create budgets, and plan for your financial future.

Saving time and effort

Managing personal finances can be a time-consuming task, but with the right app, it can become an effortless process. A top personal accounting app offers efficient ways to save time by automating various tasks.

One of the key features is the ability to track and categorize expenses automatically. Instead of manually entering each transaction, the app can link to your bank accounts and credit cards, pulling in all the necessary information. This eliminates the need to manually input every expense, saving you valuable time.

Another time-saving feature is the ability to set up recurring payments and reminders. Whether it's for monthly bills or debt repayment, the app can automate these processes, allowing you to focus on other important financial tasks.

Budgeting and planning are also made easier with a good personal accounting app. It allows you to set financial goals, create budgets, and track your progress effortlessly. With a few clicks, you can see where your money is going and make adjustments to your spending habits.

The app can also help you save time by providing comprehensive financial reports. Instead of manually compiling income and expense data, the app can generate reports that give you a clear picture of your financial situation. This saves you the hassle of manually crunching numbers and allows you to make informed decisions about your personal finances.

In conclusion, a top personal accounting app can save you time and effort by automating tasks such as expense tracking, budgeting, and financial reporting. It simplifies the process of managing your money, allowing you to focus on more important things in your life.

Accessible anytime, anywhere

When it comes to personal finance management, accessibility is key. With the top personal accounting app, you can easily access your financial data and tools anytime, anywhere. Whether you're at home, in the office, or on the go, you can stay connected to your financial information.

With this app, you can have convenient access to your spending and income data, helping you make more informed financial decisions. Whether you're planning a big purchase or paying off debt, you can keep track of your financial goals and progress.

By providing real-time updates, this app enables you to manage your money effectively. You can easily monitor your cash flow, track expenses, and make necessary adjustments to your budgeting. This ensures that you always have an accurate and up-to-date view of your financial situation, even when you're away from your computer.

No matter where you are, you can view your savings balance and make smart financial choices. With a user-friendly interface, you can easily navigate through different financial categories and view detailed reports, allowing you to analyze your spending patterns and identify areas for improvement.

The top personal accounting app ensures that you have a seamless and convenient way to manage your finances, providing you with peace of mind and empowering you to achieve your financial goals at any time, from anywhere.

Key Features to Look for in a Personal Accounting App

When searching for a personal accounting app, there are several key features to consider that can help you effectively manage your finances. These features include:

- Expense Tracking: A good app should allow you to easily track and categorize your expenses, helping you understand where your money is going.

- Budgeting Tools: Look for an app that offers budgeting tools, such as the ability to set spending limits and track your progress towards your financial goals.

- Savings Planning: A personal accounting app should help you plan and track your savings goals, whether it's for a vacation, a down payment on a house, or an emergency fund.

- Debt Management: Consider an app that offers features to help you manage your debt, such as tracking your loans and credit card balances, and providing strategies for paying off debt.

- Income Management: Look for an app that allows you to track and categorize your income, making it easier to understand how much money you're bringing in and where it's coming from.

- Transaction Management: An app that allows you to easily import and categorize your financial transactions can save you time and help you stay organized.

- Balance Monitoring: Look for an app that provides real-time updates on your account balances, so you can always see how much money you have available.

- Financial Reports: Consider an app that offers customizable financial reports, allowing you to analyze your spending habits and make informed financial decisions.

By finding a personal accounting app with these key features, you can take control of your finances and make more informed decisions with your money.

Expense Tracking

Expense tracking is an essential part of personal finance management. By keeping track of your expenses, you can gain valuable insights into your spending habits and make informed decisions about your savings and budgeting.

A good expense tracking app can help you efficiently manage your cash flow by recording all your transactions, including income and expenses. This way, you can easily calculate your balance and analyze where your money is coming from and where it is going.

With expense tracking, you can set budgets for different categories and track your expenses against them. This allows you to plan your spending and ensure that you stay within your limits. By knowing exactly where your money is going, you can prioritize your financial goals and allocate funds towards savings or debt repayment.

An expense tracking app provides the convenience of managing your expenses on the go. You can access your financial information anytime and anywhere, making it easy to stay organized and in control of your money. With features like automatic categorization and receipt scanning, you can save time and effort in managing your expenses.

Effective expense tracking is a crucial aspect of personal finance management. By using a reliable app, you can gain a clear understanding of your financial situation, make informed decisions, and take control of your spending and saving habits. Whether you are planning for a big purchase, saving for the future, or working towards financial independence, expense tracking is a valuable tool in managing your personal finances.

Categorizing expenses

One of the key features of a top personal accounting app is the ability to categorize expenses. By categorizing your expenses, you can easily track and manage your spending, which is crucial for effective money management.

With the help of an app, you can easily categorize your expenses into different categories such as food, transportation, entertainment, and more. This allows you to have a clear overview of where your money is going and identify areas where you can save.

By categorizing your expenses, you can also identify any unnecessary spending and make informed decisions about where to cut back. For example, if you notice that you are spending a significant amount of money on dining out, you can make a conscious effort to reduce these expenses and allocate more towards your savings or debt repayment.

Categorizing your expenses also helps with financial planning and budgeting. By analyzing your spending patterns, you can develop a realistic budget and set goals for saving and debt reduction.

Additionally, categorizing your expenses can help you track your income and monitor your cash flow. By organizing your income and expenses into categories, you can easily see how much money you have coming in and how much is going out. This provides you with a comprehensive view of your financial situation, enabling you to make informed decisions about your personal finance.

Generating reports

One of the key features of a good personal accounting app is the ability to generate detailed reports. These reports provide a comprehensive overview of your financial situation, allowing you to analyze your expenses, debts, and income.

With a reliable accounting app, you can easily track and analyze your personal finances. The app will automatically categorize your expenses and income, providing you with a clear overview of where your money is going. This can be especially helpful when it comes to budgeting and planning for the future.

The reports generated by the app will show you a breakdown of your expenses and income, allowing you to easily identify any areas where you may be overspending. You can also see your financial balance and track your progress towards your savings goals.

Additionally, a good personal accounting app will provide you with insights into your spending habits. It can show you your average monthly expenses, help you identify trends, and even provide recommendations for how to better manage your money.

Overall, generating reports with a personal accounting app is a powerful tool for financial management. It allows you to take control of your finances and make informed decisions about your money. By tracking and analyzing your expenses, debts, and income, you can gain a deeper understanding of your financial situation and work towards achieving your financial goals.

Budgeting Tools

When it comes to efficient money management, budgeting is essential. Budgeting tools can help individuals and families plan their finances, track their spending, and stay on top of their financial goals.

One popular budgeting tool is an expense tracking app. This app allows users to input their daily expenses and categorize them, giving them a clear picture of where their money is going. By reviewing their expenses, users can identify areas where they may be overspending and make adjustments to their budget accordingly.

Another helpful budgeting tool is a cash flow planner. This tool helps individuals manage their income and expenses by providing a visual representation of their cash flow. Users can input their income and expenses, and the planner will calculate their cash balance over time. This can help individuals budget for their financial goals and ensure they have enough money for necessary expenses.

Savings goal trackers are also popular budgeting tools. These tools allow users to set savings goals and track their progress towards those goals. Users can input an amount they want to save and the timeframe they want to save it in, and the tracker will calculate how much they need to save each month to reach their goal. This can help individuals stay motivated and focused on their savings objectives.

Ultimately, budgeting tools are essential for financial management. They help individuals and families keep track of their income, expenses, and savings, enabling them to make informed decisions about their finances and stay on top of their financial goals. Whether it's tracking daily transactions, managing debt, or planning for the future, budgeting tools provide the necessary tools for effective personal accounting and finance.

Setting financial goals

Setting financial goals is an important part of effective money management. By setting clear and achievable goals, you can take control of your finances and work towards a more secure financial future.

When setting financial goals, it is essential to start by evaluating your current financial situation. Take a close look at your income, expenses, and debt. This will help you understand where your money is going and identify areas where you can cut back and save.

Next, you can begin planning your goals. Determine what you want to achieve with your finances, whether it's paying off debt, saving for a specific purchase or milestone, or simply improving your overall financial well-being. It's important to set realistic and specific goals that you can work towards.

Tracking your expenses is a crucial step in setting financial goals. Use a personal accounting app or a budgeting tool to monitor your income, expenses, and savings. This will allow you to see where your money is going and make informed decisions about your spending habits.

One important aspect of setting financial goals is prioritizing your expenses. Create a budget to allocate your income towards different categories such as housing, transportation, food, and entertainment. This will help you prioritize your spending and ensure that your money is being used efficiently.

Another important consideration is saving money. Setting a goal to save a certain percentage of your income each month can help you build an emergency fund, save for retirement, or achieve other financial objectives. By regularly saving a portion of your income, you are developing healthy financial habits and working towards your long-term financial goals.

Finally, review your progress regularly and make adjustments as needed. Revisit your goals and adjust them accordingly based on changes in your income, expenses, or financial priorities. Setting financial goals is an ongoing process, and it's important to stay flexible and adapt to any changes that may occur.

In conclusion, setting financial goals is an essential part of efficient money management. By evaluating your current financial situation, planning your goals, tracking expenses, prioritizing spending, saving money, and regularly reviewing your progress, you can take control of your financial future and work towards a more stable and secure financial life.

Creating detailed budgets

Managing your finances effectively requires careful planning and budgeting. One of the key features of a top personal accounting app is the ability to create detailed budgets. With this feature, you can track your income, savings, and expenses, allowing you to better manage your financial situation.

Budgeting for your income: The app allows you to set a budget for your income, helping you allocate your earnings towards various financial goals, such as saving for a vacation or paying off debt. By creating a budget for your income, you can ensure that you are maximizing your earnings and making the most of your financial resources.

Tracking your expenses: With the app's budgeting feature, you can easily track your expenses and categorize them accordingly. This allows you to see where your money is going and identify areas where you can cut back or make adjustments. By tracking your expenses, you can gain a better understanding of your spending habits and make more informed financial decisions.

Planning for the future: Budgeting with the app also enables you to plan for the future. By including expenses such as saving for retirement or buying a house, you can create a comprehensive budget that takes into account both your immediate and long-term financial goals. This allows you to stay on track and make progress towards your objectives.

Managing your debt: The app's budgeting feature can also help you manage your debt. By including your debt payments in your budget, you can see how much you need to allocate towards paying off your loans each month. This helps you stay on top of your debt and work towards becoming debt-free.

Overall, creating detailed budgets with a top personal accounting app is essential for efficient money management. It allows you to have a clear overview of your income, savings, expenses, and debt, helping you make informed financial decisions. By tracking your spending and planning for the future, you can achieve greater financial stability and reach your financial goals faster.

Syncing with Bank Accounts

One of the key features of the top personal accounting apps is the ability to sync with your bank accounts. This allows for seamless tracking and management of your finances in one place.

By syncing your bank accounts with the app, you can easily view and track your income and expenses, categorizing them for better financial planning. This helps you keep a close eye on your spending habits and identify areas where you can save money.

The syncing feature also ensures that your account information is always up to date. You can easily view your current account balance, including your savings and any outstanding debts. This helps you stay on top of your financial situation and make informed decisions about your money.

The app provides a comprehensive overview of your financial health, displaying your income and expense trends over time. With this information, you can set realistic budgets and financial goals to help you achieve better money management.

In addition to tracking your personal bank accounts, some apps also allow you to sync with your cash and credit card accounts. This provides a complete picture of your financial transactions, allowing you to see how your spending habits affect your overall monetary well-being.

Overall, syncing your bank accounts with a personal accounting app is a powerful tool for efficient money management. It enables you to have a clear understanding of your financial situation, make informed decisions, and work towards achieving your financial goals.

Automatically importing transactions

One of the most convenient features of a personal accounting app is its ability to automatically import transactions from various financial accounts. This feature saves a lot of time and effort, as users no longer have to manually enter each transaction into the app. Instead, the app automatically retrieves transaction data from linked bank accounts, credit cards, and other financial institutions.

This automation ensures that users have an up-to-date and accurate view of their finances. They can easily keep track of their income, expenses, and savings without the need to manually reconcile their transactions. This is especially useful for budgeting and financial planning, as users can quickly see where their money is going and make adjustments as needed.

In addition to automatically importing transaction data, the app also categorizes and organizes expenses. This allows users to easily see how much they are spending in different categories such as groceries, dining out, transportation, and entertainment. Having this information readily available is valuable for managing expenses and identifying areas where users can cut back and save money.

Another benefit of automatically importing transactions is that it helps users stay on top of their debt payments. By monitoring their credit card transactions and loan payments, users can see how much they owe, track their progress in paying off their balances, and avoid late fees or penalties. This feature is particularly helpful for those trying to reduce their debt and improve their overall financial health.

With the ability to automatically import and track transactions, a personal accounting app provides users with a comprehensive view of their finances. It simplifies money management, enhances financial planning, and ensures accurate accounting. Whether it's for personal or business use, having a reliable app to handle transaction tracking and financial management is essential for achieving financial goals and maintaining a healthy financial lifestyle.

Reconciling bank statements

When it comes to personal accounting, reconciling bank statements is an essential step in effective money management. This process involves comparing the transactions recorded in your personal accounting app with the transactions shown on your bank statement. By doing this, you can ensure that all of your income and expenses are accurately tracked and accounted for.

Reconciling bank statements is particularly important for budgeting and financial planning. It allows you to see how much money you have available to spend or save, and helps you make informed decisions about your financial goals. By regularly reconciling your bank statements, you can identify any discrepancies or errors in your financial transactions, such as missing or duplicate entries, which can help you avoid potential costly mistakes.

Furthermore, reconciling bank statements can help you stay on top of your savings and debt management. By reviewing your expenses and income, you can identify areas where you might be overspending or where you could potentially cut back. This can be especially helpful if you are trying to pay off debt or save for a specific financial goal. Reconciling bank statements also gives you a clear picture of your cash flow, helping you manage your finances more effectively.

In summary, reconciling bank statements is an important part of personal accounting and financial management. By comparing your personal accounting app with your bank statement, you can ensure that your income and expenses are accurate and accounted for. This process is crucial for budgeting, saving, and keeping track of your financial transactions. So, make sure to regularly reconcile your bank statements to stay on top of your expenses, debt, and overall financial well-being.

Top Personal Accounting Apps for Efficient Money Management

When it comes to managing your personal finances, it's important to stay on top of your debt, track your expenses, and effectively manage your income. Fortunately, there are several top personal accounting apps available that can help you with money management and ensure you stay on track financially.

One such app is designed specifically for expense tracking and management. It allows you to easily record your cash flow, categorize your expenses and income, and create budgets to help you plan your spending. With this app, you can also set financial goals and track your progress towards achieving them.

Another personal accounting app focuses on debt management. It helps you keep track of your loans, credit card balances, and other debts, allowing you to see your overall debt picture at a glance. This app also provides tools for creating a debt payoff plan and tracking your progress towards becoming debt-free.

For those who want a comprehensive approach to personal finance management, there are apps that offer a wide range of features. These apps allow you to track your income and expenses, plan your budget, manage your investments, and analyze your financial health. They also provide tools for managing your bank accounts and credit cards, and can even help you with tax planning.

Personal accounting apps are a great tool for anyone looking to gain better control over their finances. With these apps, you can easily track your transactions, monitor your account balances, and stay on top of your financial goals. Whether you need help with budgeting, expense tracking, or debt management, there is an app out there that can help you manage your money more efficiently.

App name

App name is a top personal accounting app that provides efficient money management tools for individuals. With this app, users can easily track and manage their income, expenses, and personal transactions.

The app allows users to input their cash flow data and easily keep track of their income and expenses. It provides a clear overview of the user's financial situation, including their current cash balance and any outstanding debt.

App name also offers features for budgeting and financial planning. Users can set goals, plan their expenses, and track their progress towards achieving their financial goals. The app provides insights into spending patterns and suggests ways to save money and reduce debt.

With its user-friendly interface and intuitive design, App name makes it easy for individuals to manage their finances effectively. Users can easily input and categorize their expenses, track their spending habits, and gain a better understanding of where their money is going.

Overall, App name is a powerful tool for personal money management. It helps users stay on top of their finances, make informed financial decisions, and work towards building a secure financial future. Whether you're looking to save money, reduce debt, or simply budget more effectively, App name is the app for you. Start taking control of your finances today with App name.

Overview of features

To effectively manage your finance and keep a track of your cash flow, it is important to have a reliable money management app. XYZ app provides a range of features that enable efficient management of your finances.

- Budgeting: Create and manage budgets to plan your spending and keep your expenses within limits.

- Tracking expenses: Keep track of all your income and expenses in one place, making it easier to monitor your spending habits.

- Transaction management: Record and categorize all your financial transactions, including income, expenses, and savings.

- Debt management: Keep a track of your debts and plan repayment strategies to effectively manage your liabilities.

- Financial goal setting: Set savings goals and track your progress towards achieving them, helping you stay motivated and focused.

- Saving features: Explore various saving options like regular savings plans, investment accounts, and automatic round-up of transactions to build your savings.

- Expense analysis: Analyze your expenses using intuitive charts and graphs to identify areas where you can cut back and save.

- Accounting tools: Benefit from built-in accounting tools such as balance sheets, profit and loss statements, and cash flow summaries for a comprehensive financial overview.

With XYZ app, you can take control of your finances, make informed decisions, and work towards your financial goals with ease and efficiency.

Pricing options

When choosing a personal accounting app for efficient money management, it's important to consider the pricing options available. Different apps offer various budgeting and expense management features, so it's essential to find one that fits your needs and financial goals.

Some apps offer a free version with limited features, allowing you to track your income and expenses, create a budget, and monitor your savings. However, if you need more advanced features such as debt management or personalized financial planning, there may be a subscription or one-time payment required.

Consider what areas of your financial life you want to focus on. If you need help with debt management, look for apps that offer tools to track and pay off debts efficiently. If you want to focus on saving and investing, look for apps that provide features like automatic savings transfers or investment tracking.

Be sure to read the app's pricing and terms carefully. Some apps charge a monthly or annual fee, while others may offer a one-time purchase option. Additionally, some apps offer a free trial period, allowing you to test out the features before committing to a paid plan.

Remember that personal finance is an ongoing process, and choosing the right app for your financial management needs is an important decision. Consider your financial goals, budget, and the features you require when comparing pricing options.

App name

App name is a highly effective finance management app that provides a comprehensive solution for personal accounting. With its user-friendly interface and powerful features, this app helps you maintain a balance between your income and expenses, track your savings, and manage your debt efficiently.

With App name, you can plan your finances effectively by setting up budgets and tracking your expenses. It allows you to categorize your transactions, making it easy to analyze your spending habits and identify areas where you can save more. Additionally, the app provides detailed reports and visualizations to help you understand your financial situation better.

This app offers a range of accounting features that make it convenient for you to manage your personal finances. It allows you to keep track of your income, expenses, and cash flow, ensuring that you have a clear understanding of where your money is going. You can also set financial goals and monitor your progress towards achieving them.

With App name, you can easily manage your debt by keeping track of your loan payments and interest rates. It provides tools to help you prioritize and strategize your debt repayment, empowering you to become debt-free faster. The app also offers features for effective financial planning, enabling you to forecast future income and expenses.

In summary, App name is a powerful personal accounting app that offers efficient money management solutions. It simplifies the task of managing your finances, helping you maintain a healthy financial life. Whether you want to track your expenses, save money, manage your debt, or plan for the future, this app has got you covered.

Overview of features

The top personal accounting app provides a range of features to help with efficient money management. From budgeting to tracking expenses, this app covers all aspects of personal finance.

One of the key features is budgeting, which allows users to set and track their spending limits across various categories. This feature helps users keep their finances in balance and avoid overspending.

The app also offers a cash flow management feature, which provides a comprehensive view of all financial transactions, including income, expenses, and savings. This allows users to have a clear understanding of their financial situation and make informed decisions.

In addition to budgeting and cash flow management, the app also includes an expense tracking feature. This feature allows users to easily record and categorize their expenses, making it easier to identify areas where they can cut back and save money.

Another useful feature is debt management. The app helps users keep track of their debts and provides tools for creating a repayment plan. This feature is particularly beneficial for individuals looking to pay off their debts and improve their financial situation.

Overall, the top personal accounting app provides a comprehensive set of features for efficient money management. Whether it's budgeting, expense tracking, or debt management, this app covers all aspects of personal finance and helps users stay on top of their financial goals.

Pricing options

When choosing a personal accounting app for efficient money management, it is important to consider the pricing options available. Different apps offer various pricing models, so you can find one that suits your needs and budget.

Some apps offer a free version with limited features, which is ideal for those who want to test the app before purchasing a premium version. This free version usually allows you to track a certain number of transactions or expenses, and may not include advanced planning tools or detailed balance and savings tracking.

If you are looking for more comprehensive personal finance management, you can opt for a premium version of the app. These versions usually have a monthly or yearly subscription fee, but provide access to a wide range of features such as budgeting, expense tracking, accounting tools, and robust financial management.

For those who want to get the most out of their personal finance app, there are also options for lifetime access or one-time payment. This allows you to use the app indefinitely without worrying about monthly or yearly fees.

Before making a decision, it is important to consider your financial goals and needs. Think about the features you require, such as cash flow management, debt tracking, income analysis, or expense categorization. Compare the pricing options of different apps and choose the one that best fits your budget and financial management requirements.

App name

With the personal accounting app "App name", managing your money has never been easier. This powerful app is designed to help you keep track of your cash flow, spending, and expenses, giving you a clear picture of your financial health.

Through its intuitive interface, "App name" allows you to easily input and categorize your transactions, ensuring accurate and efficient financial tracking. Whether it's income, expenses, or savings, this app has got you covered.

One of the key features of "App name" is its comprehensive accounting and balance management system. You can track your income and expenses, view your balance in real-time, and even set financial goals for yourself.

Planning and budgeting are made simple with "App name". The app allows you to create customized budgets and monitor your progress, helping you make informed financial decisions and achieve your financial goals.

With "App name", you can also easily generate detailed reports and charts to visualize your financial data, making it easier to understand your spending patterns and identify areas for improvement.

Whether you're a seasoned finance guru or just starting your financial journey, "App name" is the perfect tool for effective money management. It's time to take control of your finances and get on the path to financial success.

Overview of Features

Finance Manager is a powerful personal accounting app that offers a comprehensive set of features for efficient money management. With this app, you can easily track and monitor your expenses, income, and savings in one place.

Expense Tracking: The app allows you to categorize your expenses and track them in real-time. You can set budgets for different categories and receive notifications when you are close to exceeding them.

Financial Planning: Finance Manager provides advanced financial planning tools that help you plan and achieve your financial goals. You can set saving targets and track your progress towards them. The app also provides insights and recommendations to optimize your spending and increase your savings.

Transaction Management: With the app's transaction management feature, you can easily record and categorize your income and expenses. This helps you have a clear view of your cash flow and make informed decisions about your money.

Debt Management: Finance Manager enables you to keep track of your debts and manage them effectively. You can set reminders for loan repayments and monitor your progress in paying off your debts.

Budgeting: The app offers powerful budgeting tools that allow you to create and manage budgets for different time periods. You can set spending limits for various categories and track your actual spending against the budget.

Balance Analysis: Finance Manager provides a detailed analysis of your financial balance. You can visualize your income and expenses through charts and graphs, making it easier to understand your financial situation and make informed decisions.

In conclusion, Finance Manager is a comprehensive personal accounting app that offers a wide range of features for efficient money management. Whether you want to track your expenses, plan your finances, or manage your debt, this app provides all the tools you need to take control of your financial well-being.

Pricing options

When it comes to choosing a personal accounting app for efficient money management, one of the key factors to consider is the pricing options.

Most personal accounting apps offer different pricing tiers or plans to cater to various needs and budgets. These options usually include a free plan, as well as premium plans with additional features and benefits.

The free plan is a great option for individuals who are just getting started with expense tracking and basic financial management. It provides essential features such as transaction tracking, budgeting, and income tracking. However, the free plan may have limitations in terms of the number of transactions or accounts that can be managed.

For those who require more advanced features and functionalities, premium plans are available at a monthly or annual subscription fee. These plans may include additional tools for debt and savings management, advanced budgeting and planning, and personalized financial insights. They also often offer priority customer support and enhanced data security.

It is important to carefully evaluate the pricing options and consider your personal finance goals and requirements. Take into account factors such as the number of accounts you need to manage, the complexity of your financial situation, and the level of customer support you prefer. By choosing the right pricing plan, you can effectively manage your personal finances and make the most of your chosen accounting app.

Choose the Best App to Manage Your Finances

Managing your expenses and keeping track of your transactions is essential for financial stability and planning. With the right personal accounting app, you can easily take control of your money and achieve your financial goals.

One of the key features to look for in a financial management app is budgeting. This allows you to set spending limits for different categories and helps you prioritize your expenses. You can also create a detailed budget plan that includes your income, expenses, and savings goals.

A good app should provide comprehensive income and expense management. This means that you can easily categorize and track your income sources, such as salary, investments, or side hustles. Additionally, you should be able to record your expenses and view detailed reports to understand where your money is going.

Efficient spending tracking is another important feature that an accounting app should offer. It allows you to see a clear overview of your spending habits and identify areas where you can make adjustments. By monitoring your expenses regularly, you can make informed decisions that will contribute to your financial well-being.

Managing your savings and debt is also crucial for your financial stability. Look for an app that enables you to set savings goals and tracks your progress. It should also provide tools to manage and pay off your debts, helping you to stay on top of your financial obligations.

Choosing the best app to manage your finances depends on your personal needs and preferences. Consider features such as ease of use, security measures, and compatibility with your devices. Taking the time to research and compare different apps will ensure that you find the one that fits your financial management requirements.