Bank logs play a crucial role in the functioning of a banking system. They are an integral part of the online banking infrastructure, providing clients with a detailed record of their financial transactions and account activities. These logs contain valuable information such as login credentials, account balances, and transaction history.

Security is of the utmost importance when it comes to bank logs. The system is designed to protect sensitive data and ensure that only authorized individuals have access. Clients are required to provide a username and password to log in to their online banking account, which is then encrypted to prevent unauthorized access.

Bank logs serve as a means for clients to keep track of their financial activities. They allow users to check their account balance, review past transactions, and monitor any suspicious or unauthorized activities. These logs provide a transparent and detailed overview of a client's financial history, helping them make informed decisions about their banking needs.

It is essential for banks to protect their clients' information when it comes to bank logs. Safeguarding these logs helps prevent identity theft and fraudulent activities. Banks employ various security measures, such as encryption and multi-factor authentication, to ensure the confidentiality and integrity of the data stored in these logs.

In conclusion, bank logs are a critical component of the banking system, providing clients with access to their financial information and transaction history. They are designed to protect sensitive data and ensure the security of clients' online banking accounts. Understanding how bank logs work can empower individuals to take control of their finances and make well-informed decisions.

The Basics of Bank Logs

A bank log is a record of all financial transactions and account information that is made available to a client through online banking systems. It provides access to important data such as account balances, transaction history, and check images. These logs are secured and protected by the bank's system to ensure the privacy and security of the client's financial information.

Bank logs play a crucial role in modern banking, allowing clients to conveniently monitor their accounts, transfer funds, and review transaction details. They provide a comprehensive overview of the client's financial activities and help ensure the accuracy and integrity of their financial records.

When a client logs into their online banking account, they are required to provide authentication information such as a username and password. This login process helps protect the client's data and prevents unauthorized access to their account. The bank's system utilizes encryption and other security measures to safeguard sensitive information and detect any potential fraud.

By regularly reviewing their bank logs, clients can stay informed about their financial status and monitor for any unauthorized transactions or suspicious activity. They can easily track their spending, reconcile their records, and detect any discrepancies or errors. If any fraud or unauthorized activity is identified, clients can promptly report it to the bank for investigation and resolution.

Overall, bank logs are a valuable tool in managing one's finances and ensuring the security of their accounts. They provide clients with easy access to important financial information and offer a means to protect their assets. By understanding how bank logs work and actively monitoring their account, clients can maintain financial stability and peace of mind.

Definition and Purpose

In the world of online banking, bank logs play a crucial role in providing clients with access to their financial information. Bank logs are essentially a record or log of the client's transactions and activities within their bank account. They contain important data such as the transaction history, account balance, and client details.

The main purpose of bank logs is to allow clients to keep track of their finances and manage their accounts more effectively. By accessing their bank logs, clients can review past transactions, check their current balance, and monitor any new activity on their account. This provides them with a clear overview of their financial situation and helps them make informed decisions when it comes to their money.

Bank logs also serve a crucial role in the security of online banking. They help protect the client's account from fraud and unauthorized access. Each client has their own username and password to access their bank logs, ensuring that only they can view their financial information. This adds an extra layer of security to the banking system, as unauthorized users would need to know the client's login credentials and pass the security measures to gain access.

Overall, bank logs are an essential component of online banking systems. They provide clients with vital information about their accounts and allow them to effectively manage their finances. By protecting the client's data and ensuring secure access, bank logs play a crucial role in maintaining the trust of clients and the integrity of the banking system.

Types of Bank Logs

The username logs are one of the key components of a bank's system. These logs contain information about each client's access to their online bank account, including details such as the date and time of login, the IP address used, and the type of device used for access. These logs are important for tracking any suspicious activity or fraud attempts.

The system logs in a bank's infrastructure help to monitor and maintain the overall security and operation of the bank's online banking platform. These logs record various events and activities, such as server status, system updates, and error messages. Analyzing these logs can provide insights into system performance and identify potential vulnerabilities.

Fraud logs play a critical role in combating fraudulent activities. Banks maintain a dedicated team to analyze these logs and detect any unusual transactions or patterns that may indicate fraud. Fraud logs contain data about suspicious transactions, including the client's information, transaction details, and any indicators of fraudulent behavior. Timely detection and investigation of these logs help protect clients' financial interests.

Online banking logs are essential for providing clients with an overview of their financial activities. These logs often include information about account balances, transaction history, and other relevant details. Clients can access their online banking logs to check their account balances, review transaction details, and monitor their financial activities from anywhere at any time.

To protect the security of online banking, login logs are recorded to keep track of client access. These logs capture login attempts, including the client's username, IP address, and timestamp. This information helps identify suspicious login attempts and protect against unauthorized access. Banks may also use additional security measures, such as two-factor authentication, to enhance login security.

The Process of Bank Logs

Fraud detection: Bank logs are an essential part of the online banking system to protect against fraud. When a client tries to access their bank account, the system checks their username, password, and other authentication information to ensure the transaction is legitimate.

Access and security: Bank logs keep a record of all login attempts and actions performed by the client. This helps the bank in monitoring and detecting any suspicious activity that could compromise the security of the client's account and personal information.

Transaction history: Bank logs provide a detailed record of all the transactions performed by the client, including deposits, withdrawals, and transfer of funds. This information allows the client to keep track of their account balance and verify the accuracy of their banking activities.

Protection of client data: Bank logs play a crucial role in protecting the confidentiality of client information. They help prevent unauthorized access to sensitive data by keeping a log of all activities performed within the online banking system.

Investigation and resolution: In case of any discrepancies or issues, bank logs serve as crucial evidence for investigation and resolution. They can be used to trace the source of fraudulent transactions, identify potential security breaches, and facilitate the recovery of funds.

Compliance and regulatory requirements: Bank logs are essential for complying with regulatory requirements and ensuring the bank operates in accordance with industry standards. They provide an audit trail, enabling the bank to demonstrate compliance and respond to inquiries from regulatory bodies.

Acquisition of Bank Logs

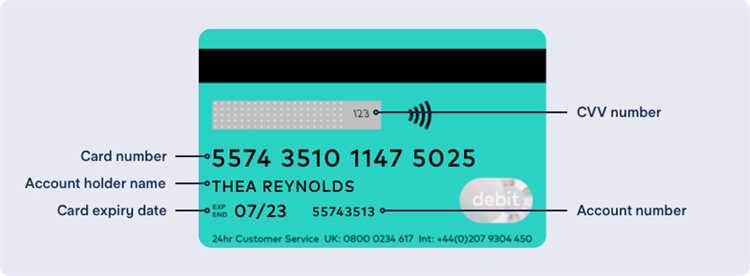

When it comes to understanding bank logs, one important aspect to consider is the acquisition of these logs. Banks use logs to keep track of various transactions and activities that occur within their systems. These logs contain important data such as the client's username, password, transaction details, and balance information.

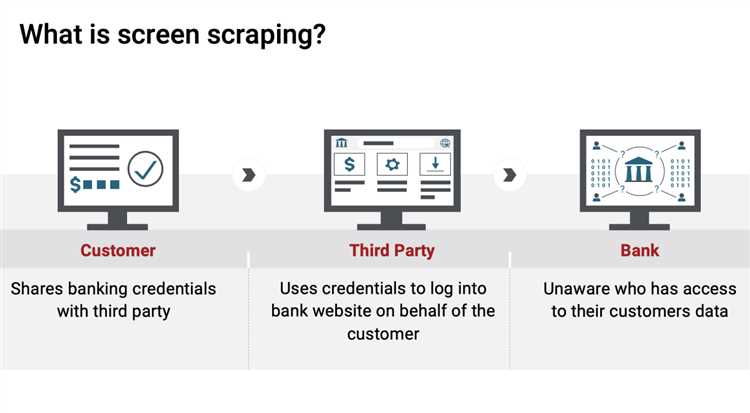

Acquiring bank logs involves gaining unauthorized access to the bank's system and extracting this information. This can be done through various methods, such as phishing attacks or hacking. It is important to note that acquiring bank logs is illegal and considered a form of fraud.

Bank logs are valuable targets for cybercriminals because they provide access to sensitive financial information. With this information, criminals can carry out fraudulent activities, such as identity theft or unauthorized transactions. It is crucial for banks to have robust security measures in place to protect against unauthorized access to their logs.

One way banks protect their log data is by implementing strong login credentials and multi-factor authentication. By requiring clients to provide additional verification, such as a unique code sent to their mobile device, the bank adds an extra layer of security to prevent unauthorized access.

Furthermore, banks invest in advanced security systems to monitor and detect any suspicious activities within their systems. These systems can detect unusual patterns, such as multiple login attempts from different locations or large transactions exceeding a client's usual spending habits. When such activities are detected, the system can flag them for further investigation.

In conclusion, the acquisition of bank logs involves gaining unauthorized access to a bank's system to extract valuable financial information. It is essential for banks to implement robust security measures to protect against unauthorized access and fraudulent activities that could result from the misuse of bank logs.

Usage of Bank Logs

Bank logs, also known as banking records or transaction logs, are an essential component of online banking. They provide a detailed record of all financial activities associated with a client's bank account.

One of the main purposes of bank logs is to keep track of account balances and ensure accuracy in financial transactions. Users can check their balance, review past transactions, and monitor their financial activity through the bank's online system.

Besides providing easy access to financial data, bank logs also play a crucial role in ensuring the security of online banking. Each user is assigned a unique username and password to protect their account's confidentiality. Without the correct login credentials, unauthorized access to bank logs is prevented, reducing the risk of fraud and identity theft.

Banks take various measures to protect their clients' data by employing advanced security systems and encryption protocols. This helps maintain the integrity and confidentiality of bank logs, providing a secure environment for financial transactions.

Bank logs are not only beneficial for clients but also play a crucial role in the overall functioning of the banking system. They enable banks to keep track of transactions, analyze customers' financial behavior, and identify any suspicious activities that may indicate fraud or money laundering.

In conclusion, bank logs are an integral part of the online banking experience, providing users with easy access to their financial data while maintaining the security and integrity of their accounts. Through bank logs, customers can stay updated on their balances, review transactions, and ensure the safety of their financial information.

Security Measures

To protect the banking system and ensure the safety of clients' financial information, banks have implemented various security measures. One of the most important measures is the requirement of a username and password to access online banking. This login credential is unique to each client and serves as a first line of defense against unauthorized access.

In addition to secure login credentials, banks also employ encryption technology to protect the transmission of sensitive information during online transactions. This ensures that any data exchanged between the client's computer and the bank's server is securely encrypted and cannot be intercepted by hackers.

Banks also use security logs to monitor and track any suspicious activity. These logs record information about each transaction, including the date, time, and summary of the transaction. By regularly checking these logs, banks can quickly identify and investigate any fraudulent or unauthorized activity.

To further protect clients' accounts, banks may also implement two-factor authentication. This involves adding an extra layer of security by requiring clients to provide a second form of identification, such as a fingerprint or a one-time password sent to their mobile device, in addition to their username and password.

Another security measure employed by banks is the use of firewalls and intrusion detection systems. Firewalls act as a barrier between the bank's internal network and the external internet, preventing unauthorized access to sensitive data. Intrusion detection systems monitor network traffic and can alert bank security teams of any potential threats or breaches.

Overall, these security measures help protect clients' accounts and prevent fraud in the banking system. By combining secure login credentials, encryption technology, security logs, two-factor authentication, firewalls, and intrusion detection systems, banks can create a robust and secure banking environment for their clients.

Common Uses of Bank Logs

The main use of bank logs is to provide account holders with access to their financial information. With a bank log, a client can log in to their account online using their username and password. This allows them to view their transaction history, check their account balance, and perform various banking activities.

Bank logs also play a crucial role in ensuring the security of online banking systems. By keeping a record of login activities, banks can detect and prevent fraudulent access to client accounts. If there is any suspicious activity or login attempt, the bank can take immediate action to protect the client's information and prevent any unauthorized transactions.

In addition, bank logs are useful for monitoring and analyzing financial data. By logging every transaction and activity, banks can generate reports and insights about their clients' spending habits and financial behaviors. This information can be used to provide personalized financial advice, identify potential risks, and improve the overall banking experience for clients.

Moreover, bank logs are essential for resolving any discrepancies or issues that may arise with client accounts. If a client notices an incorrect balance or a missing transaction, they can refer to their bank logs to provide evidence and seek assistance from the bank's customer service. By having access to detailed logs, banks can investigate the issue and resolve it efficiently.

In summary, bank logs are a fundamental component of online banking systems. They allow account holders to access their financial information, provide security against fraud, enable data analysis, and assist in resolving account-related issues. Their accurate and reliable recording of banking activities ensures the smooth and secure functioning of the banking system for both clients and institutions alike.

Identity Theft

Identity theft is a serious concern in today's digital age. It refers to the unauthorized access to someone's personal data, such as their name, address, social security number, and financial information, with the intention of committing fraud or other criminal activities.

One way to protect yourself from identity theft is by regularly monitoring your bank account and transaction logs. By keeping a close eye on your balance and any suspicious activity, you can quickly detect any unauthorized transactions and report them to your bank. Additionally, it is important to safeguard your login credentials, such as your username and password, and avoid sharing them with anyone.

It is crucial to choose strong and unique passwords for your online banking accounts. A strong password consists of a combination of letters, numbers, and special characters. Avoid using easily guessable passwords or using the same password for multiple accounts, as this increases the risk of your information being compromised.

Banks also play a significant role in protecting their clients from identity theft. They employ advanced security measures, such as encryption and firewalls, to ensure the confidentiality and integrity of their clients' data. Banks often use two-factor authentication systems to provide an extra layer of security, requiring clients to provide additional information or a verification code to access their accounts.

If you suspect that you have become a victim of identity theft, it is important to act quickly. Contact your bank immediately and inform them of the fraudulent activity. They will guide you through the necessary steps to secure your account, such as freezing it, changing your login information, and monitoring your transactions for any further signs of fraud. It is also advisable to report the incident to the appropriate authorities, such as the police or the Federal Trade Commission, to help prevent further unauthorized access to your personal information.

In conclusion, understanding identity theft and implementing security measures can help protect your financial and personal information. By actively monitoring your bank logs, choosing strong passwords, and being vigilant for signs of fraud, you can reduce the risk of becoming a victim of identity theft.

Financial Fraud

Financial fraud is a serious concern in the banking system, as it poses a threat to the security of customers' accounts and their financial information.

To protect clients from fraud, banks have implemented various security measures. These include login credentials, such as username and password, which are required to access online banking.

Banks regularly check for any suspicious activity in customer accounts by analyzing their transaction logs. If any unauthorized transactions or irregularities are detected, the bank can quickly take action to protect the client and their funds.

In addition to monitoring transactions, banks also employ encryption and other security protocols to protect sensitive information. This ensures that customer data, such as account balances and personal details, remain secure and inaccessible to unauthorized individuals.

It is important for customers to be vigilant and proactive in protecting themselves from financial fraud. This includes regularly checking their account statements, monitoring their balance, and reporting any suspicious activity to the bank immediately.

By remaining informed about the latest scams and fraud techniques, customers can better protect themselves and their financial assets. Banks also play a crucial role in educating their clients about the potential risks and providing them with tools and resources to enhance their online security.

Money Laundering

Money laundering is a criminal activity that involves disguising the origins of illegally obtained funds. It is a way for individuals or organizations to make their ill-gotten gains appear legal by hiding the true source of the money.

In the context of banking, money laundering typically involves using fraudulent techniques to gain access to someone's account. This can include methods such as obtaining login credentials, passwords, or other sensitive information to perform unauthorized transactions.

One common technique used in money laundering is to create fake transactions within a banking system to make it appear as though the funds are coming from legitimate sources. This can involve manipulating data to change the balance of an account or creating fictitious transactions to move money between accounts.

Financial institutions have implemented various measures to protect against money laundering, such as strict identity verification processes and monitoring of suspicious transactions. Additionally, online banking systems often require two-factor authentication, where users must go through an additional security check to access their accounts.

The fraud and security risks associated with money laundering emphasize the importance of maintaining the confidentiality of personal banking information. It is crucial for clients to check their account activity regularly and report any suspicious transactions to their bank immediately.

By implementing robust security measures and providing ongoing education to clients, banks can play a vital role in preventing money laundering and protecting the financial system from illicit activities.

Protecting Yourself from Bank Log Misuse

Security of your bank logs: The security of your bank logs is essential to protect your financial information. Keep your bank logs safe and ensure that only authorized individuals have access to them. Treat your bank logs as confidential and avoid sharing them with others.

Monitoring your account: Regularly check your bank logs and transaction history to identify any suspicious activities. If you notice any unauthorized transactions or changes in your account balance, immediately contact your bank and report the fraud.

Securing your login credentials: Create strong and unique usernames and passwords for your online banking account. Avoid using easily guessable information such as your name, date of birth, or phone number. Change your passwords regularly and never share them with anyone.

Protecting your personal information: Be cautious while sharing your personal information online, especially on social media platforms. Avoid posting sensitive details such as your account number or debit/credit card information. Beware of phishing attempts where fraudsters try to obtain your personal information through deceptive emails or websites.

Using secure devices and networks: When accessing your online banking account, ensure that you are using a secure device and a private network. Avoid accessing your account from public computers or unsecured Wi-Fi networks, as they may expose your sensitive data to potential threats.

Being aware of common scams: Stay informed about the latest banking scams and fraud techniques. Be cautious of unsolicited phone calls, emails, or text messages that claim to be from your bank or other financial institutions. Verify the authenticity of such communications before providing any sensitive information.

Enabling two-factor authentication: Enable two-factor authentication whenever possible to add an extra layer of security to your online banking. This authentication method requires both your password and a unique verification code, usually sent to your registered mobile number, to access your account.

Regularly updating your banking app: Keep your banking app up to date to benefit from the latest security features and patches. Developers frequently release updates to fix vulnerabilities and enhance the security of their applications, so make sure you install these updates as soon as they become available.

Keeping track of your financial statements: Review your bank statements regularly and match them with your transaction history. This will help you identify any discrepancies or fraudulent activities. If you find any discrepancies, report them to your bank immediately.

Contacting your bank: If you suspect any misuse of your bank logs or encounter any suspicious activities, contact your bank immediately. They can guide you on how to protect your account and prevent any further unauthorized access or fraudulent transactions.

Secure Online Banking Practices

In order to protect your financial data and prevent fraud, it is important to follow secure online banking practices. Here are some tips to ensure the safety of your account and personal information.

1. Choose a strong password: When creating a password for your online banking account, avoid using easily guessable information such as your name or birthdate. Instead, opt for a combination of letters, numbers, and symbols to make it more secure.

2. Enable two-factor authentication: Many online banking systems offer the option to enable two-factor authentication. This adds an extra layer of security by requiring you to enter a unique code sent to your mobile device when logging in.

3. Regularly check your account: Periodically review your bank account statements and transaction logs to identify any unauthorized activity. If you notice any suspicious transactions, report them to your bank immediately.

4. Keep your login credentials confidential: Avoid sharing your username and password with anyone, including family members or friends. Keep this information private to prevent unauthorized access to your account.

5. Update your banking apps and software: Make sure to regularly update your online banking apps and software to ensure you have the latest security patches and protections against potential vulnerabilities.

6. Be cautious of phishing attempts: Be wary of emails or messages that appear to be from your bank asking for your login credentials or personal information. Legitimate banks will never ask for this information via email or text.

7. Use a secure internet connection: Avoid accessing your online banking account using public Wi-Fi networks. Instead, use a secure and private internet connection to reduce the risk of unauthorized access to your data.

8. Protect your computer or device: Install reputable antivirus software on your computer or mobile device to detect and prevent malware that could compromise your online banking security.

9. Be cautious of third-party apps: Avoid downloading or granting permissions to third-party apps that claim to offer online banking services. Stick to using the official banking app or website provided by your bank.

10. Regularly monitor your account balance: Keep an eye on your account balance to quickly identify any suspicious or unauthorized transactions. Reporting these incidents promptly can help mitigate potential financial losses.

By following these secure online banking practices, you can help protect your financial information and prevent fraudulent activities. Remember to stay vigilant and report any suspicious activity to your bank immediately.

Monitoring Your Bank Statements

Monitoring your bank statements is an essential part of managing your finances and ensuring the security of your accounts. With the increasing popularity of online banking, it has become easier than ever to access your bank statements and keep track of your financial transactions.

One of the main reasons why monitoring your bank statements is important is to detect any fraudulent transactions. By regularly reviewing your statements, you can quickly identify any unauthorized activity and report it to your bank. This helps protect your funds and prevent potential financial loss.

When monitoring your bank statements, it is crucial to pay attention to your account balance and transactions. Make sure that the reported balance matches your own records, and carefully review each transaction to ensure its accuracy. If you notice any discrepancies or unauthorized transactions, contact your bank immediately.

Accessing your bank statements online provides convenience and real-time access to your financial information. However, it is essential to protect your online banking credentials, such as your username and password. Use strong and unique passwords, and avoid using easily guessable information. Regularly update your passwords and avoid sharing them with anyone.

Another important aspect of monitoring your bank statements is to keep track of your personal data. Ensure that your bank has up-to-date contact information, such as your phone number and email address, to receive important notifications and alerts about your account. Additionally, be cautious when sharing your personal information online and only provide it on secure websites.

Overall, monitoring your bank statements is a proactive step towards ensuring the security of your financial information and protecting your funds. Regularly checking your statements helps detect fraudulent activity, verify your account balance, and maintain the accuracy of your transactions. By staying vigilant and taking necessary precautions, you can keep your financial information safe and effectively manage your banking experience.

Reporting Suspicious Activity

When using the online banking system, it is important for clients to stay vigilant and report any potentially fraudulent activity. If you notice any suspicious transactions on your bank account, it is crucial to take immediate action to protect your finances and personal information.

One of the first steps to take when reporting suspicious activity is to contact your bank directly. This can typically be done by calling the customer service hotline or visiting a nearby branch. Provide them with your username, account number, and any relevant information about the fraudulent transaction.

In addition to contacting your bank, it is also advisable to change your password as soon as possible. This will help to secure your account and prevent unauthorized access. Remember to choose a strong and unique password that cannot be easily guessed or hacked.

Banks have sophisticated security measures in place to protect their clients' data and prevent fraud. By reporting suspicious activity, you are not only helping to protect yourself, but also contributing to the overall security of the banking system. Banks can use the information provided to investigate the matter further and take appropriate actions to mitigate any risks.

It is important to keep a close eye on your account balance and transaction logs. Regularly checking your bank statements can help you detect any unauthorized transactions and report them promptly. If you notice any discrepancies or unfamiliar entries, it is crucial to report them to your bank immediately.

Remember that online banking provides convenience and accessibility, but it also introduces certain risks. Protecting yourself and your finances requires constant vigilance. By staying aware of potential fraud and promptly reporting any suspicious activity, you can help maintain the security of your online banking experience.