In the world of finance, the concept of cost plays a crucial role in understanding the financial health of individuals, businesses, and organizations. Cost can be defined as the expenditure or payment required to acquire or produce goods and services. It encompasses various elements such as debt, budget, capital, profit, liabilities, income, and more.

Debt is a common term in finance, referring to the amount of money borrowed from a lender, typically in the form of a loan. It is classified as a liability and has a direct impact on an individual's or entity's financial standing. Budget, on the other hand, refers to the allocation of funds for different expenses, including both costs and revenues.

Capital is an essential component in finance, representing the financial resources and assets owned by an individual or organization. It can be used for various purposes, such as starting a business, making investments, or funding operations. Profit, in financial terms, is the difference between revenues and expenses, indicating the financial gain or loss generated by an entity.

When it comes to understanding finance costs, it is crucial to differentiate between expenses and liabilities. Expenses are the costs incurred in the process of generating revenue, such as salaries, rent, utilities, and advertising. Liabilities, on the other hand, are the financial obligations of an individual or entity, including loans, mortgages, and other debts.

One of the most significant aspects of finance costs is interest. Interest refers to the additional amount of money charged by a lender for the borrowed funds. It is a critical factor that affects the overall cost of a loan or credit. Proper accounting and management of finance costs are essential for individuals and organizations to ensure financial stability and success.

Understanding Finance Cost

Finance cost refers to the expenditure associated with obtaining funds for a business or individual. It includes various components such as interest payments, fees, and charges. Understanding finance cost is crucial for effective financial management and decision-making.

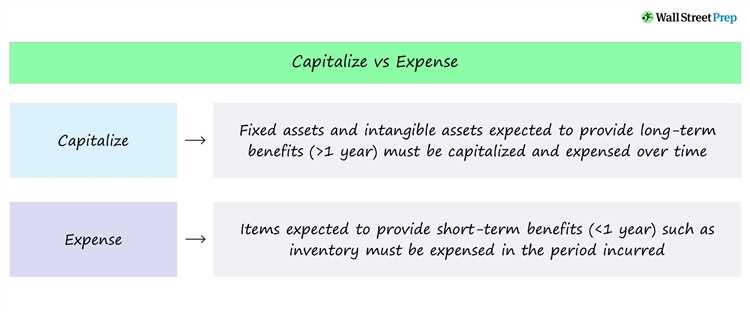

In the world of finance, cost can be classified into two broad categories: financial cost and accounting cost. Financial cost pertains to the actual expenses incurred in borrowing money or acquiring financial resources. This includes interest payments on loans, dividends on equity, and other charges related to financing activities.

On the other hand, accounting cost refers to the way these financial expenses are recorded and reported in the financial statements. It takes into account factors such as timing, accruals, and the principles of accounting. Accounting cost is used for reporting purposes and helps in assessing the financial health and performance of an organization.

Finance cost has a significant impact on the income statement of an entity. Interest payments and other financial charges are recorded as expenses, reducing the overall profit or increasing the loss. Higher finance cost can also affect the cash flow and liquidity position of a business.

Managing finance costs requires careful planning and budgeting. Businesses need to evaluate the available financing options, compare interest rates, and consider the impact on profitability. The timing of repayments and the length of the loan term are other important factors to be taken into account.

In summary, finance cost plays a crucial role in the financial management of any entity. It encompasses various components such as interest payments, fees, and charges related to obtaining funds. Understanding and effectively managing finance cost is essential for maintaining a healthy financial position, maximizing profits, and making informed investment decisions.

Definition of Finance Cost

Finance cost refers to the expenses incurred by a company or an individual in relation to their financial activities. It encompasses the various costs associated with managing and obtaining financial resources for a business or personal investment.

Finance cost is a liability that arises from the use of borrowed capital to finance a project or operation. It includes interest paid on loans, dividends to shareholders, and other expenses related to the acquisition of capital or assets.

Finance cost plays a significant role in determining the profitability and viability of an investment or business venture. It is an essential component in financial planning, budgeting, and accounting as it affects the overall financial performance and stability of a company.

Finance cost can be categorized into several types, including interest expense on loans, cost of issuing debt or equity instruments, lease payments, and various other fees and charges.

The impact of finance cost on a company's financial statements is significant. It directly affects the company's revenue, earnings, and profitability. Higher finance costs can lower a company's income, reduce its profit margin, and increase its financial leverage.

Managing finance costs involves efficient financial management, strategic investment decisions, and debt management. By minimizing unnecessary expenses and optimizing the capital structure, companies can reduce their finance costs and improve their financial performance.

In summary, finance cost is an expenditure incurred by individuals or businesses to obtain and manage financial resources. It encompasses various expenses related to borrowing, investing, and capital acquisition. Understanding and effectively managing finance costs are crucial for maintaining financial stability and maximizing profitability.

Types of Finance Cost

When it comes to financial costs, there are various types that individuals and businesses need to consider in order to effectively manage their finances. These costs can impact a company's profitability and its ability to meet its financial obligations. Here are some common types of finance costs:

- Interest Expense: This refers to the cost of borrowing money, such as the interest payments on a loan or credit card debt. It represents the expense incurred by the borrower for using the lender's funds.

- Capital Costs: These are the costs associated with acquiring and maintaining assets, such as buildings, equipment, and vehicles. These costs include depreciation, repairs, insurance, and other expenses necessary for keeping the assets in good working condition.

- Operating Expenses: These are the day-to-day expenses incurred by a business to keep it running. This includes rent, utilities, salaries, marketing costs, and other expenses associated with the regular operations of the business.

- Financial Fees: Banks and financial institutions often charge fees for various services, such as account maintenance fees, transaction fees, and overdraft fees. These fees can add up and impact a company's overall financial health.

- Investment Costs: When making investments, there are costs associated with researching, purchasing, and managing those investments. This includes broker fees, financial advisor fees, and any other costs related to the investment process.

- Debt Service Costs: These costs are associated with repaying debt, such as monthly loan payments or interest payments on outstanding debt. Managing debt service costs is crucial for maintaining a healthy financial position.

- Opportunity Costs: Opportunity costs refer to the potential benefits or profit that could have been obtained from an alternative use of resources. This cost represents the value of the next best option that is forgone when a decision is made.

Understanding and managing these different types of finance costs is important for individuals and businesses to effectively budget, allocate resources, and make informed financial decisions.

Interest Expenses

Interest expenses refer to the fees that a borrower pays for the use of borrowed funds. These expenses are a crucial part of the budgeting process as they can significantly impact a company's financial health and profitability.

When a company takes out a loan or incurs any other form of debt, it becomes liable for paying interest on that debt. This interest expense is classified as a financial cost and is recorded as an expenditure in the company's accounting records.

Interest expenses can occur in various financial transactions, such as loans, bonds, or credit lines. The interest rate on these financial instruments represents the cost of borrowing money for the borrower. The higher the interest rate, the greater the expense the borrower will incur.

For businesses, interest expenses can have a significant impact on their financial performance. They directly affect the company's cash flow and can reduce its available income and revenue. High interest expenses can also limit a company's ability to make new investments or expand its operations.

Managing interest expenses is crucial for financial planning. Companies often aim to minimize these expenses by negotiating favorable loan terms, refinancing debt, or utilizing other financial strategies. By reducing interest expenses, businesses can increase their profit margins and allocate more funds to growth and investment opportunities.

In summary, interest expenses are the fees paid by a borrower for using borrowed funds. They are a key consideration in financial planning and can significantly impact a company's budget, liabilities, and ability to generate profit. Effective management of interest expenses is important for maintaining financial health and maximizing growth potential.

Fees and Commissions

In the financial world, fees and commissions are essential components of various transactions and services. They represent charges or payments made to financial institutions or professionals for their services or assistance in managing financial matters. These fees and commissions can apply to a wide range of financial activities, such as investment management, asset acquisition or sale, borrowing or lending of funds, and more.

For example, when an individual applies for a loan, financial institutions often charge an origination fee as compensation for processing the loan application and disbursing the funds. This fee is typically a percentage of the loan amount or a fixed amount. On the other hand, investment advisors or brokers may earn commissions from buying or selling financial assets on behalf of their clients. These commissions can be a percentage of the transaction value or a flat fee.

Furthermore, fees and commissions can impact the overall revenue, income, and expenses of both individuals and businesses. For individuals, these charges represent expenses that reduce their available income or savings. On the other hand, financial institutions and professionals rely on these fees and commissions as a source of revenue and profit. The amounts received from fees and commissions contribute to their financial health and capital. Therefore, it is essential for individuals and businesses to carefully consider these costs when making financial decisions.

From an accounting perspective, fees and commissions are recorded as liabilities for individuals or as income for financial institutions. For individuals, these charges increase their debt or expenditure, while financial institutions record them as earnings. Understanding the impact of fees and commissions is crucial for individuals and businesses to effectively manage their finances and make informed financial decisions.

Transaction Costs

Transaction costs are a vital component of financial transactions, involving the loan, expenditure, and capital invested in an enterprise. These costs impact the profit and financial performance of any business.

When it comes to loans, transaction costs include the interest rates charged by lenders, which are a form of payment for the use of borrowed funds. The interest paid on a loan is considered an expense and affects the budgeting and accounting of the borrower.

Transaction costs also encompass the fees and commissions paid to intermediaries and brokers involved in investment activities. These costs are essential in buying and selling financial assets and are recorded as liabilities or expenses in a company's books.

Moreover, transaction costs affect the revenue and earnings of a business. For example, when a company incurs costs associated with debt or financing, such as interest payments, it directly impacts the company's income and profit margins.

Overall, transaction costs play a significant role in the financial well-being of an organization. It is crucial for businesses to carefully consider these costs when making investment decisions and to effectively manage them to optimize their financial performance.

Financing Charges

Financing charges refer to the costs associated with obtaining funds to finance an investment or project. These charges can include interest payments on loans, fees for issuing bonds, and other expenses related to securing capital. The goal of calculating financing charges is to determine the total cost of obtaining financing and factor it into the budget and financial planning process.

When a company or individual needs additional capital to fund an investment or project, they can seek financing options such as loans or issuing bonds. However, obtaining funds comes with costs, which are referred to as financing charges. These charges vary depending on factors such as the interest rate on the loan or the fees associated with issuing bonds.

Financing charges are an important consideration in financial planning as they can have a significant impact on a company's or individual's budget. For example, if the financing charges are high, it can reduce the profit or income generated from the investment. It is crucial to carefully analyze and forecast the financing charges to ensure that the investment will generate enough revenue to cover the costs and generate a satisfactory return on investment.

Accounting for financing charges involves recording them as liabilities in the financial statements. Loans, bonds, and other forms of financing are considered liabilities because they represent an obligation to make future payments. By recording financing charges as liabilities, it allows for a comprehensive view of a company's or individual's financial position, including both assets and liabilities.

In summary, financing charges are the costs associated with obtaining funding for investments or projects. They can include interest payments on loans, fees for issuing bonds, and other expenses related to securing capital. It is important to factor in these charges when planning and budgeting to ensure that the investment or project will generate enough revenue to cover the costs and be financially sustainable.

Impact of Finance Cost

The impact of finance cost can be significant on various aspects of a business, including revenue, investment, income, expenditure, liabilities, and debt. Finance cost refers to the expenses incurred by a company in obtaining and managing its financial resources, such as loans and debts.

One of the key impacts of finance cost is on the company's profitability and overall financial performance. High finance costs can eat into the company's profit margins, reducing the amount of income generated from its operations. This can restrict the company's ability to invest in growth opportunities and expand its operations.

Additionally, the interest payments on loans and debts can be a significant expense for a company, affecting its cash flow and liquidity. High finance costs can strain a company's budget, making it difficult to meet other financial obligations and cover necessary expenses. This can lead to financial instability and potential default on payments.

Furthermore, the presence of high finance costs may discourage potential investors and lenders from providing capital to the company. This can limit the company's access to funding and hinder its ability to pursue new projects or seize business opportunities. It can also have a negative impact on the company's creditworthiness and borrowing capacity.

From an accounting perspective, finance costs are considered as an expense and are deducted from the company's earnings. This can reduce the company's net income and subsequently its taxable income. Managing finance costs effectively is therefore crucial for minimizing the impact on a company's financial performance and maximizing its profitability.

In conclusion, finance costs have a significant impact on various aspects of a business, ranging from profit and investment opportunities to cash flow and borrowing capacity. It is essential for companies to carefully analyze and manage their finance costs to ensure financial stability and optimize their overall performance.

Profitability

Profitability is a key measure of financial performance that indicates the ability of a business to generate profit. It is calculated by subtracting expenses from revenue. Profit is the surplus gain achieved when the income or revenue of a business exceeds its expenses or expenditure. It is a yardstick that reflects the financial success and sustainability of a company.

Accounting plays a crucial role in measuring profitability by providing accurate financial information on the income and expenses of a business. It helps in determining the profit margin, return on investment, and other profitability ratios that assess the efficiency and effectiveness of a company's operations and financial management.

Profitability is closely linked to various aspects of finance. It encompasses the return on investment and the return on capital employed, indicating the efficiency of resources utilization and the financial viability of an enterprise. Additionally, profitability also influences investment decision-making and attractiveness to lenders, as higher profitability increases the likelihood of earnings and cash flows.

Profitability is influenced by various factors, including interest rates, market conditions, competition, and cost structure. Effective cost management and budgeting are essential for improving profitability. Minimizing costs and maximizing revenue can enhance profitability. It is crucial to identify and control costs, optimize the allocation of resources, and manage financial risks to maintain and improve profitability.

Overall, profitability is a pivotal aspect of financial management that reflects the success, efficiency, and sustainability of a business. It is a critical indicator for investors, lenders, and stakeholders, serving as a measure of financial strength and potential returns on investment. By closely monitoring and managing profitability, businesses can ensure long-term growth and stability in a dynamic financial environment.

Cash Flow

Cash flow is a vital aspect of finance and accounting. It refers to the movement of money in and out of a business or individual's finances. It encompasses the inflows and outflows of cash, including revenue, expenditure, payment, investment, and profit.

Positive cash flow occurs when the incoming cash from sources such as sales, earnings, and investments exceeds the outgoing cash for expenses, costs, and liabilities. Negative cash flow, on the other hand, occurs when the outgoing cash exceeds the incoming cash, resulting in a deficit.

A healthy cash flow is crucial for the financial stability and success of any entity or individual. It enables the timely payment of debts, liabilities, and expenses, including interest and loan payments. It also provides the necessary funds for capital investment and growth opportunities, such as purchasing assets or expanding operations.

Managing cash flow effectively involves creating and implementing a budget that includes accurate revenue and expenditure forecasts. This aids in identifying potential cash shortages or surpluses, allowing for proactive measures to be taken to mitigate risks or allocate funds strategically.

Furthermore, cash flow plays a significant role in evaluating the financial performance of a business or individual. Positive cash flow indicates that the entity is generating sufficient income to cover its expenses and is potentially profitable. In contrast, negative cash flow may signal financial difficulties or the need for adjustments in operations, financing, or cost management.

Investment Decisions

When making investment decisions, it is crucial to consider various financial factors such as liabilities, assets, and profitability. These decisions involve evaluating different opportunities and determining the most lucrative options.

One important consideration is the cost of investment, which includes expenses such as interest payments on loans or the cost of acquiring assets. These costs can have a significant impact on the overall profitability of an investment.

Furthermore, it is essential to analyze the potential returns or earnings that the investment can generate. This includes evaluating the projected revenue and income streams that the investment is expected to generate over its lifetime.

A thorough understanding of financial statements and accounting principles is necessary to assess the financial viability of an investment. This involves analyzing the company's financial statements to evaluate its financial health, liquidity, and ability to generate profit.

Another crucial aspect is the budgeting of investment expenses. It is necessary to plan and allocate funds for various investment costs, such as capital expenditures, operating expenses, and debt payments.

Additionally, assessing the risk associated with the investment is vital. This includes evaluating factors such as market volatility, potential changes in interest rates, and the overall economic environment. Understanding these risks can help in making informed investment decisions.

In conclusion, investment decisions involve considering various financial factors such as liabilities, assets, profit potential, and expenses. It requires a thorough analysis of financial statements, budgeting, and understanding of the risks involved. Making informed investment decisions is crucial for maximizing returns and achieving financial objectives.