When it comes to employment in Florida, it is important for both employers and employees to understand the state's overtime laws. Overtime refers to any work hours that exceed the standard 40 hours per week. According to state law, nonexempt employees must be paid at least one and a half times their regular rate of pay for any overtime hours worked.

In order to determine whether an employee is eligible for overtime pay, several factors must be considered. First and foremost, the employment status of the individual is crucial. Nonexempt employees are entitled to overtime compensation, while exempt employees are not. The distinction between exempt and nonexempt is typically based on the employee's job duties, salary, and the type of work performed.

Florida's overtime laws are in place to ensure fair compensation for employees who exceed the standard 40-hour workweek. In addition to the minimum wage requirements, the state's law provides protection for workers who put in extra time and effort. Overtime pay is a crucial aspect of fair labor practices, as it encourages employers to limit excessive work hours and compensates employees for their additional efforts.

It is important for both employers and employees in Florida to familiarize themselves with the state's overtime laws. Employers must ensure that they comply with the law and properly compensate eligible employees for their overtime hours. Employees, on the other hand, should be aware of their rights and seek the appropriate compensation if they believe they have not been paid appropriately for their overtime work.

Overtime Basics

When it comes to understanding overtime laws in Florida, it's essential to have a solid grasp of the basics. Overtime is a term used to describe the additional compensation that an employee is entitled to receive when they work more than the standard number of hours in a workweek. It is regulated by both federal and state law to ensure fair labor practices and protect the rights of employees.

In Florida, the primary law governing overtime is the Fair Labor Standards Act (FLSA), which is enforced by the Department of Labor. According to the FLSA, nonexempt employees are entitled to receive overtime pay at a rate of one and a half times their regular pay for any hours worked over 40 in a workweek. It's important to note that overtime pay is based on the total hours worked in a workweek, not on a daily basis.

It's important to distinguish between exempt and nonexempt employees when it comes to overtime. Exempt employees are typically salaried and are not entitled to receive overtime pay. They are exempt from the FLSA's minimum wage and overtime provisions. Nonexempt employees, on the other hand, are entitled to receive overtime pay for any hours worked beyond the standard 40 hours in a workweek.

Employers in Florida are required to accurately classify their employees as exempt or nonexempt to ensure compliance with overtime laws. This classification is based on various factors, including job duties, salary level, and salary basis. Employers who misclassify employees can face legal consequences and may be required to pay back wages and penalties.

Overall, understanding the basics of overtime laws in Florida is crucial for both employers and employees. Employers must accurately classify their employees to ensure compliance with the law, while employees should be aware of their rights to fair compensation for overtime work. By following the regulations set forth by the FLSA and the Department of Labor, both employers and employees can foster a fair and equitable work environment.

Definition of Overtime

Overtime refers to the additional compensation that an employee receives for working more than the standard number of hours in a workweek. In the state of Florida, the standard workweek consists of 40 hours. Any hours worked beyond this threshold may be eligible for overtime pay, assuming the employee meets the necessary criteria.

Employees who are eligible for overtime pay are typically classified as nonexempt under the Fair Labor Standards Act (FLSA) and Florida labor laws. Nonexempt employees are entitled to receive overtime pay at a rate of at least 1.5 times their regular hourly wage for every hour worked beyond 40 hours in a workweek.

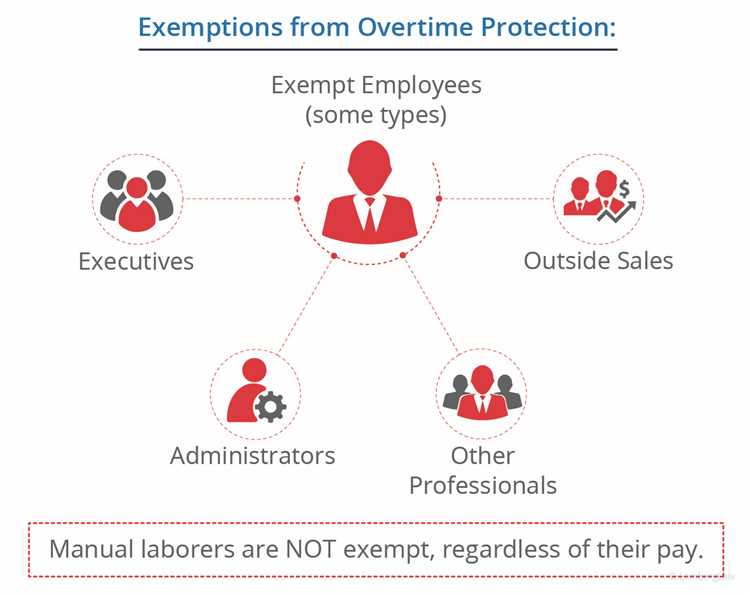

It is important to note that not all employees are eligible for overtime pay. Exempt employees, such as those who are paid on a salary basis and meet certain criteria outlined by the FLSA, may be exempt from overtime pay requirements. These exempt employees are typically classified as executive, administrative, professional, or outside sales employees.

In order to be considered for overtime pay, an employee must meet both the minimum wage and overtime pay requirements set forth by federal and state employment laws. This means that even if an employee is paid above the minimum wage, they may still be entitled to overtime pay if they work more than 40 hours in a workweek.

It is important for both employers and employees to understand the laws and regulations surrounding overtime pay in Florida to ensure fair compensation for work performed beyond the standard 40-hour workweek.

Federal Overtime Laws

Federal labor laws in the United States establish certain regulations for employers and employees regarding overtime pay. Under the Fair Labor Standards Act (FLSA), employees who work more than 40 hours in a workweek are generally entitled to overtime pay, which is set at one and a half times their regular rate of pay.

The Department of Labor (DOL) is responsible for enforcing federal overtime laws and ensuring that employers comply with the regulations. The DOL has specified that employees who are considered nonexempt must receive overtime pay for any hours worked beyond the standard 40-hour workweek.

An employee's classification as exempt or nonexempt is determined by the nature of their job duties, salary basis, and salary level. Exempt employees, such as executives, professionals, and certain administrative employees, are not entitled to overtime pay. Nonexempt employees, on the other hand, are eligible for overtime compensation.

In addition to the federal overtime laws, some states, including Florida, have their own overtime laws that may provide additional protections for employees. In Florida, the minimum wage is set by state law, but the federal overtime laws still apply to eligible employees.

Employers are required to maintain accurate records of the hours worked by their employees in order to determine and calculate overtime pay accurately. Failure to comply with federal overtime laws can result in legal consequences for employers, including fines and compensation owed to employees. It is important for employees to be aware of their rights and for employers to understand and comply with the federal overtime laws to ensure fair employment practices and proper compensation for work performed.

Florida Overtime Laws

Florida has specific laws in place that govern overtime pay for employees. Overtime is defined as any hours worked over 40 in a single work week. Employees who qualify for overtime are entitled to receive additional compensation for those extra hours worked.

Under Florida law, overtime pay is calculated at a rate of 1.5 times the regular rate of pay. This means that if an employee earns $10 per hour, their overtime pay would be $15 per hour. It is important to note that overtime pay is based on the employee's regular rate of pay, which may include salary, wages, commissions, and certain bonuses.

Not all employees are eligible for overtime pay. Certain positions are considered exempt from overtime laws, meaning that they are not entitled to receive additional compensation for working over 40 hours in a week. These exempt positions may include executives, administrative employees, and professionals who meet specific criteria set forth by the Department of Labor.

Nonexempt employees, on the other hand, are entitled to receive overtime pay under Florida law. This includes employees who do not meet the criteria for exempt status and who are not paid a salary of at least $684 per week. Nonexempt employees must be paid overtime for any hours worked over 40 in a week, regardless of their regular rate of pay.

The Fair Labor Standards Act (FLSA) is the federal law governing overtime compensation. While Florida overtime laws may be similar to federal laws, it is important to understand the specific regulations and requirements that apply to employees in the state of Florida. The Department of Labor is responsible for enforcing these laws and ensuring that employees receive fair compensation for their hours of work.

Minimum Wage and Overtime Exemptions

Under the overtime laws in Florida, not all employees are eligible for overtime pay. Some employees are exempt from receiving overtime pay, while others are considered nonexempt. The exempt employees are those who meet certain criteria set by the Department of Labor, which include salary and job duties.

An exempt employee is someone who is not entitled to receive overtime pay because they meet the criteria for exempt status. These employees are usually paid on a salary basis and are not eligible for overtime pay, regardless of the number of hours they work.

On the other hand, nonexempt employees are entitled to receive overtime pay for any hours worked beyond the standard 40 hours per week. They are protected under the Fair Labor Standards Act, which sets the minimum wage and overtime pay standards.

In Florida, the current minimum wage is $8.65 per hour, and nonexempt employees are entitled to receive overtime pay at a rate of one and a half times their regular rate of pay for every hour worked over 40 in a workweek.

It is important for both employers and employees to understand the overtime laws in Florida to ensure fair compensation and compliance with the law. Employers should properly classify their employees as exempt or nonexempt and provide the appropriate overtime pay, while employees should be aware of their rights and entitlements under the law.

- Exempt employees are not eligible for overtime pay.

- Nonexempt employees are entitled to receive overtime pay at a rate of one and a half times their regular rate of pay for every hour worked over 40 in a workweek.

- Minimum wage in Florida is $8.65 per hour.

Calculating Overtime Pay in Florida

Calculating overtime pay in Florida is important for both employers and employees to ensure fair compensation for any hours worked beyond the standard workweek. In order to determine the proper overtime pay, it is essential to understand the employment laws and regulations in Florida.

Under the Fair Labor Standards Act (FLSA), which is enforced by the Department of Labor, certain employees may be exempt from overtime pay. These exempt employees usually fall into categories such as executive, administrative, professional, outside sales, or certain computer-related occupations. Nonexempt employees are entitled to receive overtime pay for any hours worked over 40 in a workweek.

For nonexempt employees in Florida, overtime pay must be calculated at a rate of at least one and a half times their regular hourly wage. This means that if an employee earns a regular hourly wage of $10, their overtime rate would be $15 per hour. It is important to note that some employees may be entitled to a higher overtime rate if they are covered by a collective bargaining agreement or if state laws require a higher rate.

When calculating overtime pay, it is also important to consider what is considered "hours worked" under the law. Hours worked generally include all time an employee is required to be on duty or on the employer's premises, as well as any time the employee is allowed to work. This can include additional time spent on tasks such as training, travel, or preparation for work.

Employers in Florida should also be aware of the state's minimum wage laws. As of January 1, 2021, the minimum wage in Florida is $8.65 per hour. This means that even if an employee's regular hourly wage is below this minimum, their overtime rate must still be calculated at one and a half times their regular hourly wage.

Overall, calculating overtime pay in Florida requires a thorough understanding of the state's employment and labor laws. Employers should ensure they are in compliance with these laws to avoid any potential legal issues, and employees should be aware of their rights to fair compensation for their hours worked.

Who Qualifies for Overtime?

In Florida, overtime pay is regulated by the Fair Labor Standards Act (FLSA), which sets guidelines for employers on how to compensate their employees for working more than the standard 40 hours per week. To be eligible for overtime pay, an employee must meet certain criteria.

Firstly, an employee must be considered nonexempt from overtime. This means that they are not exempt from the FLSA's overtime provisions and are entitled to receive overtime compensation for any hours worked beyond 40 in a week.

Employees who are considered exempt from overtime are typically those who fall under the executive, administrative, professional, or outside sales exemption. These employees are exempt from the FLSA's minimum wage and overtime pay requirements and are paid on a salary basis. However, just because an employee is paid a salary does not automatically make them exempt from overtime.

To be exempt from overtime, an employee must also meet certain job duties criteria. For example, an executive employee must primarily manage the enterprise, direct the work of at least two employees, and have the authority to hire or fire employees, among other requirements. Similarly, administrative employees must primarily perform office or non-manual work directly related to management or business operations.

It's important for employees to understand their rights when it comes to overtime pay. If you believe you have been denied overtime pay, it's recommended to consult with the Department of Labor or seek legal advice to ensure that your employer is following the appropriate labor laws in Florida.

Non-Exempt Employees

Non-exempt employees in Florida are individuals who are not exempt from the overtime provisions of the Fair Labor Standards Act (FLSA). These employees are entitled to certain rights and protections when it comes to their work hours and compensation.

Under Florida law, non-exempt employees must be paid at least the minimum wage for all hours worked. This means that if an employee works more than 40 hours in a week, they are entitled to receive overtime pay at a rate of 1.5 times their regular wage for each additional hour worked.

The Department of Labor sets the federal minimum wage, which currently stands at $7.25 per hour. However, Florida has its own state minimum wage, which is currently set at $8.56 per hour. Non-exempt employees in Florida must be paid at least the higher of the two rates.

In addition to receiving overtime pay, non-exempt employees in Florida are also protected by other provisions of the FLSA. For example, non-exempt employees must be provided with meal and rest breaks during their workday. These breaks are not considered as work time and are therefore unpaid.

It is important for employers to accurately classify their employees as exempt or non-exempt based on the nature of their job duties and salary. Misclassification can result in a violation of labor laws and can lead to legal consequences for the employer. It is advisable for employers to consult with an employment law attorney to ensure compliance with overtime laws in Florida.

Exempt Employees

Exempt employees in Florida are those who are not eligible for overtime pay under the state's labor laws. These employees are typically classified as salaried workers who meet certain criteria set forth by the Fair Labor Standards Act (FLSA).

To be considered exempt, an employee must meet specific requirements related to their pay, job duties, and level of responsibility. Nonexempt employees, on the other hand, are entitled to receive overtime pay for any hours worked beyond the standard 40 hours per week.

Exempt employees are typically paid a fixed salary, regardless of how many hours they work in a given week. Unlike nonexempt employees, they are not legally entitled to overtime compensation.

The U.S. Department of Labor's Wage and Hour Division outlines different categories of exempt employees, including executive, administrative, and professional employees, as well as certain computer professionals and highly compensated employees.

It's important for employers in Florida to properly classify their employees to ensure compliance with overtime laws. If an employee is misclassified as exempt when they should be nonexempt, they may be entitled to unpaid overtime wages and potential penalties under the law.

Common Overtime Violations

Understanding overtime laws is crucial for both employers and employees in Florida. Failure to comply with these laws can result in serious consequences for the employer and potentially unpaid wages for the employee. Here are some common violations that employers should be aware of:

- Misclassifying employees as exempt: It is important to correctly classify employees as either exempt or nonexempt from overtime pay. In Florida, the Fair Labor Standards Act (FLSA) governs overtime laws, and it states that most employees must receive overtime pay for hours worked over 40 in a workweek, unless they are classified as exempt. Misclassifying employees as exempt to avoid paying overtime can lead to legal issues and penalties.

- Failing to include all forms of compensation: Overtime pay is typically calculated based on an employee's regular rate of pay. This includes not only their base salary, but also other forms of compensation, such as bonuses or commissions. Failing to include these additional forms of compensation when calculating overtime pay can result in underpayment.

- Not counting all hours worked: All hours worked by an employee must be counted when determining overtime pay. This includes time spent doing work-related activities outside of regular working hours, such as responding to work-related emails or attending work-related events. Failure to accurately track and compensate for all hours worked can lead to wage and hour violations.

- Not paying overtime for travel time: In some cases, travel time may be considered compensable and should be included when calculating overtime pay. If an employee is required to travel for work outside of their regular working hours, that time may be considered eligible for overtime pay.

- Violating minimum wage requirements: In addition to overtime pay, employers must also ensure that employees are paid at least the minimum wage for all hours worked. Failing to meet minimum wage requirements can result in wage violations and legal consequences.

To avoid these common overtime violations, it is important for employers in Florida to familiarize themselves with the state and federal overtime laws, properly classify employees, accurately calculate overtime pay, and keep thorough records of all hours worked by their employees.

Unpaid Overtime

Under overtime laws in Florida, it is important for employers to understand the concept of unpaid overtime. Overtime refers to any hours worked by an employee that exceed the standard 40 hours per week. While overtime is usually compensated at a higher rate than regular hours, some employers may try to avoid paying their employees the fair compensation they deserve.

When determining whether an employee is eligible for overtime pay, it is important to consider their classification as either exempt or nonexempt. Exempt employees are typically paid a fixed salary and are not entitled to overtime pay, while nonexempt employees are entitled to overtime pay for any additional hours worked beyond the standard 40 hours per week.

In order to be considered exempt, an employee must meet certain criteria set forth by the Department of Labor. These criteria typically involve the employee's salary level, job duties, and job responsibilities. It is important for employers to properly classify their employees to ensure they are receiving the appropriate compensation for their overtime hours.

Failure to pay employees for their overtime hours in accordance with the law can result in significant legal consequences for employers. In Florida, employees have the right to file a complaint with the Department of Labor regarding unpaid overtime. The Department of Labor can then investigate the claim and take appropriate action to ensure the employee receives the proper compensation they are entitled to under Florida labor law.

Overall, it is important for employers in Florida to understand their obligations when it comes to paying employees for their overtime hours. The law is clear that employees must receive fair compensation for their work, including overtime pay. By properly classifying employees and adhering to the minimum wage and overtime laws, employers can avoid legal issues and maintain a fair and compliant workplace.

Misclassification of Employees

In accordance with Florida labor law, it is essential for employers to correctly classify their employees in order to ensure proper wage and hour treatment. Misclassifying employees as exempt from overtime pay when they should be classified as nonexempt can result in serious legal consequences.

Nonexempt employees are entitled to overtime pay for any hours worked beyond the standard 40 hours in a workweek. This overtime pay must be calculated at a rate of one and a half times their regular rate of pay. Failure to provide overtime compensation to nonexempt employees can lead to legal action, including the recovery of unpaid wages, penalties, and attorney fees.

The Department of Labor and the Fair Labor Standards Act provide guidance on employee classification to help employers navigate the complexities of wage and hour laws. To determine if an employee is exempt or nonexempt, various factors such as job duties, salary, and industry-specific regulations must be considered.

Exempt employees are typically salaried individuals who perform executive, administrative, or professional duties and are not entitled to overtime pay. However, meeting the salary threshold alone does not automatically qualify an employee as exempt. The employee must also meet certain criteria regarding job duties and responsibilities.

To avoid misclassification issues, employers should thoroughly review the job duties and responsibilities of their employees to ensure compliance with Florida labor laws. It is also crucial to stay informed about any changes to employment laws and regulations that may impact employee classification and overtime compensation.

Off-the-Clock Work

Off-the-clock work refers to any labor performed by an employee outside of their regular working hours and without receiving proper compensation, such as overtime pay. This could include tasks such as answering work-related emails, attending meetings or training sessions, and performing job-related duties.

According to the Fair Labor Standards Act (FLSA), all nonexempt employees are entitled to minimum wage and overtime pay for any hours worked beyond 40 in a workweek. Florida follows the federal law in this regard, meaning that nonexempt employees in Florida are also covered by the same labor and employment laws.

It is important to note that if an employer requires or allows an employee to work off-the-clock, they are still obligated to pay for that work. Under the FLSA and Florida law, employers must keep accurate records of all hours worked by nonexempt employees, even if the work is performed outside of the regular hours.

Employers who fail to properly compensate employees for off-the-clock work may be in violation of labor laws and may be subject to penalties and legal action. Employees who believe they have not been paid for all hours worked, including off-the-clock work, may file a complaint with the Wage and Hour Division of the Department of Labor.

In summary, off-the-clock work is labor performed outside of regular working hours without proper compensation, such as overtime pay. Nonexempt employees in Florida are entitled to minimum wage and overtime pay under federal and state labor laws. Employers must keep accurate records of all hours worked, including off-the-clock work, and failure to do so may result in legal consequences.

Filing an Overtime Claim in Florida

If you believe that you have not received proper overtime pay for your work in Florida, you have the right to file a claim with the state's Department of Labor. This applies to nonexempt employees who are entitled to overtime compensation under state and federal labor laws.

To file an overtime claim in Florida, you will need to provide detailed information about your employment, including your job title, the number of hours you worked, and the rate of pay you received. It is important to keep records of your work hours and any related documentation, such as timesheets or pay stubs, as evidence of your overtime hours.

Florida follows the Fair Labor Standards Act (FLSA), which sets the minimum wage and overtime standards for most employees. According to the FLSA, nonexempt employees are entitled to receive one and a half times their regular rate of pay for any hours worked over 40 in a workweek.

If your employer has classified you as exempt from overtime and you believe that you should be considered nonexempt, you can still file an overtime claim to challenge the classification. The Department of Labor will review your claim and evaluate whether your job duties and salary meet the criteria for exemption.

It is important to note that there is a statute of limitations for filing an overtime claim in Florida. Generally, you have two years from the date the wages were due to file a claim. However, if your employer willfully violated the law, the statute of limitations may be extended to three years.

If you believe that you are owed overtime pay, it is recommended to consult with an employment law attorney who specializes in wage and hour issues. They can help you navigate the process and ensure that your rights are protected.

Florida Agency Resources

Understanding overtime laws in Florida can often be challenging for both employers and employees. Thankfully, there are a number of agency resources available to provide guidance and clarity on this matter.

The primary agency responsible for enforcing overtime laws in Florida is the Department of Labor's Wage and Hour Division. This division ensures that employees are paid a fair wage for all hours worked and that employers comply with minimum wage and overtime requirements.

The Wage and Hour Division provides valuable resources for both employers and employees, including information on how overtime pay is calculated, what constitutes as work hours, and which employees may be exempt from overtime pay. They also offer guidance on how to file a complaint if an employee believes they have not been properly paid for overtime work.

In addition to the Wage and Hour Division, the Florida Department of Economic Opportunity's Division of Workforce Services also provides resources to assist employers with understanding and complying with overtime laws. This division offers workshops, training materials, and one-on-one assistance to help employers navigate the complexities of overtime laws and ensure they are paying their employees correctly.

Employment attorneys in Florida can also be a valuable resource for both employers and employees seeking guidance on overtime laws. These attorneys specialize in labor and employment law and can provide legal advice and representation in cases related to wage and hour disputes.

Overall, it is important for both employers and employees in Florida to familiarize themselves with the state's overtime laws and access the resources available to ensure compliance. By understanding the laws and seeking guidance when needed, employers can avoid potential legal issues and employees can ensure they are receiving appropriate compensation for their work.

Legal Assistance for Overtime Claims

If you believe that you have not been properly compensated for your overtime work in Florida, it may be wise to seek legal assistance. Overtime pay is a legal entitlement for nonexempt employees who work more than 40 hours in a workweek. The Florida Department of Labor and Employment provides guidelines for employers to follow in determining overtime eligibility.

An employee's eligibility for overtime pay is dependent on various factors, including their salary and job duties. In Florida, the minimum wage is set by the Fair Labor Standards Act and is currently $8.56 per hour. However, being paid the minimum wage does not automatically make an employee eligible for overtime pay.

Under Florida law, certain employees are considered exempt from overtime pay, such as executives, administrative employees, and professionals. However, if an employee does not meet the criteria to be exempt, they should be receiving overtime pay for any hours worked over 40 in a workweek.

Seeking legal assistance for overtime claims can help employees understand their rights and determine if they have a valid claim. A lawyer specializing in employment and labor law can review the specifics of the situation and provide guidance on potential legal options. They can also assist in filing a complaint with the appropriate authorities, such as the Florida Department of Labor and Employment or the federal Department of Labor.

It is important to note that employers are prohibited from retaliating against employees who exercise their rights to pursue overtime pay. If an employer retaliates against an employee for filing a complaint or seeking legal assistance, they may be subject to additional legal consequences.

Overall, understanding overtime laws in Florida and seeking legal assistance when necessary can help employees ensure they are receiving fair compensation for their work. It is important to consult with a legal professional to fully comprehend the complex regulations surrounding overtime pay and protect your rights as an employee.