Comdata is a leading provider of payment and financial solutions for companies and individuals. Through its innovative card system, Comdata offers a range of services that help employers streamline their payment processes and manage expenses more efficiently.

For corporations, the Comdata card offers a convenient and secure way to handle employee payments and reimbursements. With the automated system, employers can easily deposit funds onto the card, allowing employees to access their wages without the need for paper checks or manual transactions. This not only saves time and reduces administrative costs, but also provides employees with instant access to their funds.

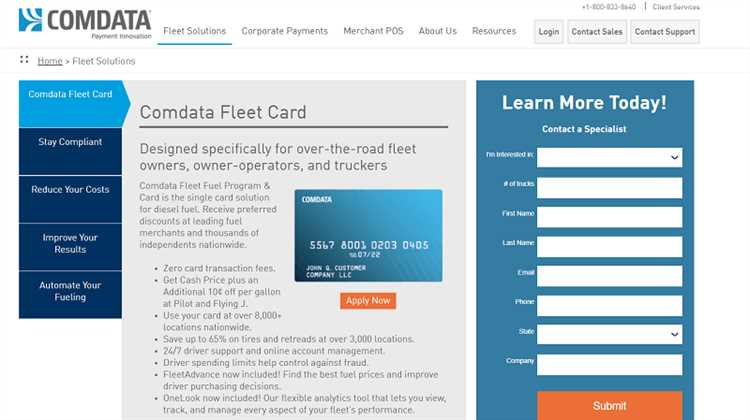

One of the key benefits of the Comdata card is its versatility. It can be used for a variety of purposes, such as truck fueling and maintenance, travel expenses, loyalty programs, and much more. The card functions as a prepaid debit card, which means it can be loaded with a set amount of money in advance, providing individuals with a convenient and secure way to make purchases or access funds.

In addition to its payment functions, the Comdata card also offers a range of financial management tools. Cardholders can easily track their expenses and manage their budgets with the help of the online portal, which provides detailed transaction histories and customizable reporting features. This makes it easier for individuals to keep track of their spending and make informed financial decisions.

Overall, the Comdata card provides numerous benefits for both employers and individuals. By streamlining payment processes, reducing administrative costs, and providing convenient access to funds, the card offers a secure and efficient solution for managing expenses and reimbursements. With its versatile functionality and financial management tools, the Comdata card is a valuable tool for corporations and employees alike.

Understanding the Benefits of a Comdata Card: Everything You Need to Know

A Comdata card is a financial tool that offers a wide range of benefits for both employees and employers. This loyalty card is issued by Comdata Corporation, a leading provider of payment services and financial solutions.

For employees, the Comdata card serves as a convenient payment system for various transactions. It can be used to pay for fuel, truck expenses, and other business-related purchases. With this card, employees can enjoy automated fuel tax reporting and receive reimbursement for their expenses in a timely manner.

One of the major benefits of the Comdata card is its flexibility. Employees can use it at a wide network of merchants, making it a versatile payment tool. Whether it's for fueling up at a gas station or purchasing supplies for the job, the Comdata card can be used for various corporate needs.

Employers also benefit from the Comdata card's features. This card allows for efficient tracking and reporting of employee expenses, simplifying the reimbursement process. It provides employers with greater control over company spending, as they can easily monitor and manage transactions made using the card.

In addition, the Comdata card offers valuable insights through its reporting capabilities. Employers can access detailed transaction data and analyze spending patterns to make more informed financial decisions. This helps in optimizing budget allocation and identifying areas for potential cost savings.

Overall, the Comdata card provides a convenient and secure way to handle corporate expenses. It streamlines the payment process, offers improved financial visibility, and ensures compliance with company policies. With its array of benefits, this loyalty card has become an essential tool for many businesses and their employees.

What is a Comdata Card?

A Comdata card is a corporate prepaid card that offers a variety of benefits and services to both employers and employees. It is issued by Comdata Corporation, a financial services company that specializes in payment solutions for the transportation industry.

The Comdata card can be used for a range of expenses, including fuel, lodging, and other business-related transactions. It provides a convenient and automated way for employers to reimburse their employees for these expenses, eliminating the need for paper checks or manual reimbursement processes.

One of the key benefits of a Comdata card is the ability to manage and control corporate expenses. Employers can set spending limits and restrict the types of purchases that can be made with the card. This helps to ensure that employees are only using the card for approved expenses and prevents unauthorized or frivolous spending.

In addition to its payment and expense management features, the Comdata card also offers loyalty and rewards programs. This allows users to earn points or cash back on their purchases, providing even more value and incentives for both employers and employees.

The Comdata card is a versatile financial tool that provides a secure and convenient way to manage corporate expenses. Whether it is used by a trucking company to manage fuel costs or by a corporation to streamline financial processes, the Comdata card offers a range of benefits and services that make it an attractive option for many businesses.

How does a Comdata Card work?

The Comdata card is a financial tool that provides a range of benefits for both employees and employers. It is primarily used by truck drivers and other employees who need to manage their expenses while on the road. The Comdata card functions like a payment card, similar to a debit card, but with additional features and services provided by the Comdata corporation.

With a Comdata card, employees can easily track and manage their expenses, including fuel purchases, lodging, and other travel-related expenses. The card can be used for both personal and business transactions, and it provides a convenient and automated system for reimbursing employees for their expenses. Additionally, employees can earn loyalty rewards through the Comdata card, which can be redeemed for various services and products.

Employers also benefit from the use of Comdata cards. The cards enable employers to have better control over their employees' expenses and ensure that they are used in compliance with company policies. The cards can be customized to fit the specific needs of the employer, allowing for restrictions on certain types of transactions or spending limits. The Comdata card system also offers various reporting and tracking tools, providing employers with detailed insights into their employees' spending habits.

In addition to its financial management features, the Comdata card also offers convenient services such as fuel card integration. This enables truck drivers to easily pay for fuel at specific fuel stations using their Comdata card, eliminating the need for cash or other payment methods. The Comdata card can also be used for cash advances, allowing employees to access funds when needed.

In summary, the Comdata card is a prepaid debit card that offers a range of financial management and payment services for employees, particularly those in the trucking industry. It provides benefits for both employees and employers, including expense tracking, automated reimbursement, loyalty rewards, and customized controls. The card simplifies and streamlines financial transactions, making it a valuable tool for managing expenses while on the road.

Why is a Comdata Card useful?

The Comdata card is a highly useful financial tool that offers a range of benefits to individuals and corporations alike. As a debit card, the Comdata card allows users to easily manage their finances and make payments for various goods and services.

One of the key benefits of the Comdata card is its loyalty system, which provides users with rewards and incentives for their continued use of the card. This can include discounts on fuel, access to exclusive discounts, and other perks that can help individuals and corporations save money.

In addition to its loyalty system, the Comdata card is also a powerful expense management tool. For truck drivers and employees who need to keep track of their corporate expenses, the Comdata card allows for automated tracking of expenses and provides detailed reports on spending.

For corporations, the Comdata card offers a range of services designed to streamline payment processes and improve financial management. This includes features such as automated invoice processing, real-time transaction monitoring, and centralized reporting, all of which can help employers gain better control over their financial operations.

Furthermore, the Comdata card can be used as a prepaid card, allowing corporations to easily provide funds to employees for various purposes such as travel expenses or supplies. With the ability to restrict spending and set limits on the card, employers can ensure that funds are used appropriately and effectively.

In summary, the Comdata card offers a range of benefits for both individuals and corporations. Its automated financial management system, loyalty program, and prepaid features make it a valuable tool for managing expenses, tracking spending, and improving overall financial management.

Convenient Payment Solution

The Comdata card offers a convenient payment solution for truck drivers and other employees who need to receive and manage corporate reimbursements. This card is a prepaid debit card that is issued by Comdata, a leading financial corporation that specializes in providing payment solutions and services to corporations.

With the Comdata card, employees can easily receive their reimbursements in a convenient and automated manner. The card allows for easy tracking and management of corporate expenses, making it a great tool for both employers and employees.

One of the key benefits of the Comdata card is its flexibility and ease of use. It can be used for various types of expenses, including fuel purchases, making it a versatile payment tool for truck drivers. The card can be used at any location that accepts Mastercard, making it widely accepted and convenient to use.

In addition to its payment capabilities, the Comdata card also offers various other features and benefits. For example, the card can be linked to a loyalty program, allowing employees to earn rewards for their purchases. This can be a great way to incentivize employees and promote loyalty within the organization.

The Comdata card also offers advanced reporting and tracking features, giving employers and employees real-time visibility into their financial transactions. This can help both parties to better manage and control their expenses, leading to better financial management overall.

In conclusion, the Comdata card is a convenient payment solution that offers a range of benefits for both employers and employees. With its automated reimbursement system, flexible usage, and additional features such as loyalty programs and expense tracking, the Comdata card is an excellent tool for managing corporate expenses.

Acceptance at numerous locations

The Comdata card offers wide acceptance at numerous locations, making it a convenient and versatile payment option. Whether you need to fuel up your vehicle, make corporate purchases, or pay for other expenses, the Comdata card allows you to do so effortlessly.

With the Comdata card, you can easily access fuel and maintenance services at various truck stops and fueling locations across the country. This ensures that you can conveniently fill up your truck without worrying about carrying cash or dealing with reimbursement processes.

In addition to fuel, the Comdata card can also be used for a range of corporate expenses. It can be used to make purchases from authorized vendors and suppliers, allowing you to efficiently manage your corporation's financial transactions. This automated payment system saves time and eliminates the hassle of manual expense reimbursement processes.

Moreover, the Comdata card offers benefits beyond just financial transactions. It also provides a platform for employers to reward their employees through a loyalty program. The card can be used to earn and redeem loyalty points on eligible purchases, creating incentives for employees to use the Comdata card for their corporate expenses.

The Comdata card, whether it is a prepaid or a corporate card, offers a secure and convenient payment solution for businesses and individuals. Its wide acceptance, coupled with its automated expense management system, makes it a preferred choice for financial transactions and expense reimbursement processes.

Easy to track expenses

One of the biggest benefits of using a Comdata card is that it makes tracking expenses incredibly easy. With traditional methods, such as paper-based systems, it can be a tedious and time-consuming process to keep track of every single transaction and expense.

However, with the Comdata card, all of your services and transactions are automatically recorded and stored in the system. This means that both the employee and the employer can easily access and review their expenses at any time.

The payment system associated with the Comdata card allows for automated financial transactions, making it even easier to track each payment made. Whether it's for fuel for a truck or other corporate expenses, the card can be used for direct payment, eliminating the need for manual reimbursement processes.

Additionally, the card can be used for both prepaid and loyalty programs. This means that employees can earn points or rewards for their purchases, and employers can track these benefits and incentives.

Overall, the Comdata card provides an efficient and convenient way to track expenses. It simplifies the process for both employees and employers, making it easier to manage finances and ensure that all transactions are accounted for. Whether it's for personal or corporate use, the Comdata card offers a streamlined solution for tracking expenses and managing finances effectively.

Integration with existing systems

The Comdata card offers automated integration with existing systems within a corporation. This integration allows for seamless management of various financial transactions such as employee expenses, fuel payments, and loyalty benefits. By linking the Comdata card to the corporate system, employers can easily track and manage expenses, ensuring accuracy and efficiency.

The Comdata card is a prepaid debit card that can be issued to employees for various corporate services. The card can be loaded with funds for employee reimbursement, eliminating the need for paper checks or cash payments. Integration with the corporate system allows for easy tracking of expenses and simplifies the reimbursement process for both the employer and the employee.

Additionally, the Comdata card can be integrated with the existing fuel management system for truck fleets. This integration allows for direct payment of fuel expenses using the Comdata card, streamlining the process and reducing the administrative burden. The ability to integrate the Comdata card with other financial systems provides a comprehensive solution for managing corporate expenses.

In summary, the integration of the Comdata card with existing systems offers numerous benefits for corporations. It provides automated tracking and management of expenses, simplifies the reimbursement process for employees, and streamlines fuel payments for truck fleets. By utilizing the Comdata card and integrating it with the corporate system, companies can improve financial efficiency and reduce administrative burdens.

Enhanced Security Features

Comdata's corporate prepaid card provides enhanced security features that benefit both employers and employees. This card is designed to securely handle various financial transactions, including expense reimbursements and corporate expenses.

One of the key benefits of using a Comdata card is the automated system that tracks and monitors all transactions made with the card. This helps employers keep better control over their finances and ensures that all expenses are within the authorized limits. The system also provides real-time updates, allowing employers to stay informed about the financial activities of their employees.

The Comdata card offers increased security measures, such as EMV chip technology, which helps prevent fraud and unauthorized use. The chip stores encrypted data that is difficult for criminals to access, making it a more secure option than traditional magnetic stripe cards. Additionally, the Comdata card requires a PIN for certain transactions, adding an extra layer of security.

Another security feature of the Comdata card is its ability to restrict spending to specific categories or merchant types. This allows employers to limit employee spending to only necessary items, such as fuel for company vehicles. By setting these restrictions, employers can prevent unauthorized or excessive spending and ensure that funds are used appropriately.

In addition to its security features, the Comdata card also offers benefits such as loyalty programs and automated reporting. These features help employers save time and streamline their financial processes. The card's reporting capabilities allow employers to easily track and analyze expenses, making it a valuable tool for managing corporate finances effectively.

In conclusion, the Comdata card provides enhanced security features that protect employers and employees from fraud and unauthorized use. Its automated system and security measures ensure that transactions are monitored and controlled, while also providing benefits such as loyalty programs and automated reporting. By opting for a Comdata card, employers can enhance their financial security and improve overall efficiency in managing employee expenses.

Protection against fraud

The Comdata card provides employees with an extra layer of financial protection when it comes to their payment and expense transactions. By utilizing Comdata's secure payment system, employees can benefit from enhanced security measures that help prevent fraudulent activity.

One of the main areas where the Comdata card provides protection against fraud is in fuel expenses. The card can be used at authorized fuel locations, and its automated system helps verify the purchase by matching it with the fuel transaction data. This ensures that unauthorized fuel expenses are detected and prevented.

In addition to fuel expenses, the Comdata card also offers protection against fraud for other types of expenses. The card can be used for a variety of corporate services, such as truck maintenance and repairs. By using the Comdata card for these expenses, employees can rest assured that their payments are securely processed and that they are protected from fraudulent transactions.

Comdata's loyalty program is another way the card provides protection against fraud. The program allows employees to earn rewards or receive prepaid reimbursement for purchases made using the Comdata card. This incentivizes employees to use the card for their transactions, which can help prevent fraud by ensuring that all transactions are properly recorded and monitored.

Overall, the Comdata card offers numerous benefits when it comes to protection against fraud. With its secure payment system, employees can have peace of mind knowing that their financial transactions are being closely monitored and protected. Whether it's for fuel expenses, corporate services, or loyalty program rewards, the Comdata card is a trustworthy payment option that helps safeguard against fraudulent activity.

PIN protection

PIN protection is an important feature of the Comdata card that helps to ensure the security of your expenses and payments. The PIN, or Personal Identification Number, acts as a password that only you know, providing an extra layer of security for your financial transactions.

With PIN protection, only the authorized holder of the card can access and use it, preventing unauthorized individuals from making fraudulent purchases or withdrawals. This is especially important for truck drivers and employees who may be responsible for making purchases on behalf of their employer.

In addition to protecting your card from unauthorized use, PIN protection also helps in cases of lost or stolen cards. Without the PIN, it would be virtually impossible for anyone to use the card for fraudulent purposes. This gives you peace of mind, knowing that even if your card is misplaced, your financial information and funds are still secure.

Comdata offers a range of services that benefit both employers and employees. For employers, the PIN protection system helps to minimize financial loss due to unauthorized transactions. By implementing a secure payment system, employers can have better control over corporate expenses and ensure that funds are used for legitimate business purposes.

For employees, the PIN protection system provides a secure method for receiving payments and reimbursements. Instead of relying on cash or checks, employees can use their Comdata card to receive their funds electronically, which is not only more convenient but also more secure. This eliminates the risk of lost or stolen checks and reduces the need for manual paperwork and processes.

In summary, PIN protection is a crucial feature of the Comdata card that provides enhanced security for both employers and employees. By using a PIN, individuals can ensure that their card is protected from unauthorized use, preventing fraudulent purchases and withdrawals. This not only protects their financial information but also provides peace of mind knowing that their funds are safe and secure.

Lost or stolen card reporting

If you find yourself in the unfortunate situation of losing your Comdata card or if it gets stolen, it is important to take immediate action to protect your finances and prevent any unauthorized transactions from occurring. Comdata provides an automated system for reporting lost or stolen cards, ensuring quick response and minimizing any potential financial loss.

Once you realize that your card is missing, you should immediately contact Comdata's customer service department to report the incident. They will guide you through the process of deactivating your lost or stolen card, ensuring that it can no longer be used for any transactions.

Comdata also offers reimbursement services for any fraudulent charges that may have been made using your lost or stolen card. This provides peace of mind, knowing that you will not be held financially responsible for any unauthorized transactions.

In addition to reporting a lost or stolen card, Comdata offers various other services to assist both employees and employers. For example, their prepaid debit card system allows employers to easily provide payment to their employees, while also offering loyalty and rewards programs.

Comdata is especially known for its truck fleet card services, providing corporate fuel cards that enable businesses to efficiently manage and track their fuel expenses. This helps companies to control costs and maintain accurate records of fuel usage.

Overall, Comdata Corporation offers a range of financial products and services that cater to the needs of businesses and individuals. Their commitment to providing secure and convenient payment solutions, including lost or stolen card reporting, makes them a trusted and reliable partner in the financial industry.

Streamlined Expense Management

Managing payments, reimbursements, and expenses can be a time-consuming task for both employers and employees. However, with the use of a Comdata card, this process can be streamlined and made much more efficient.

The Comdata card provides an automated payment system that allows employers to easily distribute funds to their employees. Instead of issuing traditional checks or manually processing reimbursements, employers can simply load the prepaid Comdata card with the necessary funds. This eliminates the need for paper checks and ensures that employees receive their payments in a timely manner.

One of the main benefits of the Comdata card is its versatility. In addition to being used for employee payments and reimbursements, the card can also be used for other purposes, such as fuel purchases. This is especially useful for trucking companies, as it allows drivers to conveniently pay for fuel expenses using a single card.

The Comdata card also offers a range of loyalty and rewards programs. By using the card for various transactions, employees can earn points or cash back, which can then be redeemed for a variety of benefits. This not only incentivizes employees to use the card for their expenses but also provides additional value to both the employee and the employer.

From a financial perspective, the use of a Comdata card can have significant benefits for corporations. By automating the expense management process, companies can reduce administrative costs and avoid the potential for errors or fraud. The card also provides detailed reporting capabilities, allowing employers to easily track and analyze expenses.

In summary, the Comdata card offers numerous benefits for both employers and employees. With its automated payment system, versatility, and loyalty programs, the card can streamline expense management and provide added value to both parties. Whether it's for employee payments, fuel purchases, or other expenses, the Comdata card is a valuable tool for improving financial management within a corporate setting.

Real-time monitoring

One of the key benefits of using a Comdata card is the ability to have real-time monitoring of corporate expenses. This prepaid card system allows employers to track and monitor employee spending in real-time, giving them greater control over financial transactions.

The Comdata card can be used for various payment services, including automated reimbursement of expenses. With real-time monitoring, employers can easily track employee expenses, ensuring compliance with company policies and reducing the potential for fraudulent activities.

In addition to monitoring corporate expenses, the Comdata card also offers real-time monitoring of fuel transactions for businesses in the trucking industry. This is particularly beneficial for trucking companies, as it allows them to track and manage fuel costs more effectively, optimizing their fuel expenses and improving overall financial efficiency.

With the Comdata card, employers can set spending limits and restrictions, ensuring that employees do not exceed their authorized limits. This helps to prevent overspending and promotes responsible financial habits within the organization.

In conclusion, real-time monitoring is a valuable feature of the Comdata card, providing employers with greater visibility and control over corporate expenses. Whether it is for employee reimbursement or fuel management in the trucking industry, this card offers automated and secure payment services, ultimately saving time and improving financial efficiency.

Customizable spending limits

One of the key benefits of a Comdata card is the ability to set customizable spending limits. This feature allows financial managers in corporations to easily control and monitor the expenditure of their employees. Whether it is a truck driver purchasing fuel or an employee making a payment for corporate expenses, the customizable spending limits ensure that expenditure stays within budget and is in line with company policies.

The Comdata card offers a secured and controlled way to manage expenses by providing a prepaid debit card that can be used for various services. This includes fuel expenses, payment for corporate expenses, or even employee reimbursement. By setting spending limits, employers can prevent unauthorized transactions and ensure that their employees are using the card responsibly.

The customizable spending limits feature also allows employers to allocate different amounts to different categories of expenses. For example, they can set higher spending limits for fuel purchases and lower limits for other expenses. This flexibility helps companies allocate their financial resources efficiently and effectively.

The Comdata card's automated expense management system further enhances the benefits of customizable spending limits. All transactions made using the card are tracked and recorded, providing employers with a detailed view of their company's expenses. This helps in identifying any discrepancies or unauthorized spending.

In addition, the customizable spending limits feature allows for better control over loyalty and rewards programs. Employers can set spending limits to take advantage of loyalty programs offered by fuel stations or other service providers. This not only helps in saving costs but also provides additional benefits to the company and its employees.

In conclusion, the ability to set customizable spending limits on a Comdata card provides financial managers in corporations with greater control and monitoring capabilities. It helps in managing expenses efficiently, preventing unauthorized transactions, and optimizing budget allocation. This feature, along with the other benefits offered by the Comdata card, makes it a valuable tool for corporate expense management.

Automated expense reporting

Comdata offers a comprehensive system for automated expense reporting, providing numerous financial benefits for both the employer and the employees. With the Comdata card, employees can easily track and manage their expenses, eliminating the need for paperwork and manual processes.

One of the key benefits of the automated expense reporting system is its integration with the corporate fuel card. Employees can use their Comdata card for fuel purchases, and the transactions are automatically recorded and categorized. This streamlines the process of tracking fuel expenses and ensures accurate reporting.

In addition to fuel, the Comdata card can also be used for other corporate expenses, such as meals, lodging, and transportation. Each transaction is documented, allowing for quick and efficient expense management. The system also allows employees to attach receipts and provide detailed information about each expense, facilitating the reimbursement process.

For employers, the automated expense reporting system offered by Comdata provides several benefits. The system simplifies the process of expense reimbursement, reducing administrative costs and paperwork. It also provides real-time visibility into employee expenses, allowing for better budgeting and financial planning.

Moreover, the Comdata card can be personalized with various services, such as loyalty programs and corporate discounts. This further enhances the benefits for both the employer and the employee, providing additional cost savings and rewards.

Overall, the automated expense reporting system offered by Comdata simplifies and streamlines the process of managing corporate expenses. It eliminates manual processes, reduces paperwork, and provides real-time visibility into employee spending. With its financial benefits and additional services, the Comdata card is a valuable tool for employers and employees alike.

Opportunities for Savings

Using a Comdata card can provide numerous opportunities for savings, particularly when it comes to fuel expenses. The card allows employees to pay for fuel at approved locations, offering them access to various discounts and benefits. By using the Comdata card, both employers and employees can take advantage of lower fuel prices and reduce their overall expenses.

In addition to fuel savings, the Comdata card offers a range of other benefits that can result in significant cost reductions for businesses. For example, the card can be used for a variety of corporate payments, such as vendor payments and invoice processing. By streamlining these financial services and automating transactions through the Comdata system, companies can save both time and money.

Furthermore, the Comdata card enables employers to monitor and manage employee expenses more effectively. With the ability to set spending limits and restrictions, employers can ensure that employees adhere to company policies and control unnecessary expenditures. This level of control can lead to substantial cost savings and a more efficient financial management system.

Another area where the Comdata card can generate savings is through its loyalty program. The card offers a unique loyalty program that rewards users with points for every eligible purchase made. These points can then be redeemed for various rewards, such as gift cards or travel discounts. By taking advantage of this program, businesses and employees can enjoy additional savings and perks.

Overall, the Comdata card provides numerous opportunities for savings across different aspects of business expenses. From fuel savings to streamlined financial management and loyalty rewards, the card offers a comprehensive solution for reducing costs and optimizing resource allocation. By leveraging the benefits of the Comdata card, businesses can achieve greater financial efficiency and enjoy significant savings in the long run.

Discounted fuel prices

One of the major benefits of a Comdata card is that it offers discounted fuel prices to corporate clients. This is especially advantageous for companies that have a large number of transactions involving fuel expenses, such as trucking companies. By using a Comdata card for payment, these companies can take advantage of the negotiated lower prices on fuel, saving them money on their prepaid fuel expenses.

Comdata partners with various fuel stations and providers to offer these discounted prices to its cardholders. This partnership allows the cardholders to access a network of fuel locations where they can enjoy discounted rates. The Comdata card acts as a payment tool for these transactions, making it easy for both the employer and the employee to keep track of fuel expenses.

In addition, the Comdata card offers a loyalty program for fuel purchases. This means that the more fuel transactions made using the Comdata card, the more the company can benefit from additional discounts or rewards. This feature can significantly reduce fuel expenses for businesses that heavily rely on transportation, such as trucking corporations.

The Comdata system also provides automated financial services, making fuel expense management more streamlined and efficient. Companies can easily track and control fuel purchases, set spending limits, and review fuel consumption patterns. This level of control helps companies manage their expenses effectively and reduce the risk of unauthorized or excessive fuel spending.

Rebates and rewards programs

The Comdata card offers a range of rebates and rewards programs that can benefit both the employer and the employee. Through these automated programs, both parties can enjoy financial benefits and incentives.

One of the key benefits of the Comdata card is the ability to earn rebates on fuel purchases. For employees who frequently use company vehicles or have a job that involves a lot of travel, this can result in significant savings. Additionally, employers can also benefit from the rebates by receiving a percentage of the fuel purchase amounts as reimbursement.

Another benefit of the Comdata card is the loyalty program. This program allows employees to earn points for every transaction made using the card. These points can then be redeemed for various rewards such as gift cards, merchandise, or even cash. By participating in the loyalty program, employees can enjoy additional perks and incentives while also maximizing the benefits of using the Comdata card.

In addition to rebates and rewards, the Comdata card also offers a range of other financial benefits. For employers, the card provides a convenient and secure way to manage corporate expenses. It eliminates the need for employees to submit reimbursement requests and allows for easy tracking and reporting of expenses. The card also offers a simplified payment process, helping to streamline financial operations for the employer.

Overall, the rebates and rewards programs offered by the Comdata card provide tangible benefits to both employers and employees. From fuel rebates to loyalty programs, these features enhance the financial advantages of using the Comdata card for corporate expenses and transactions.

Savings on administrative costs

One of the significant benefits of using a Comdata card is the potential savings on administrative costs. With the Comdata card, companies can streamline their corporate financial management by reducing paperwork and manual processes associated with payment and reimbursement. This helps save time and resources, allowing employees to focus on more critical tasks and initiatives.

The Comdata card offers automated payment services, making it easier for companies to track and manage expenses. By using the card for fuel, truck services, and other transactions, companies can reduce the need for paper receipts and manual data entry. This not only saves time but also reduces the chance of errors and discrepancies.

Additionally, the Comdata card can be used as a prepaid or debit card, which provides additional benefits for corporations and their employees. Companies can load funds onto the card, and employees can use it for authorized expenses, such as fuel and other business-related purchases. This eliminates the need for employees to use their personal funds for corporate expenses and simplifies the reimbursement process.

The card also offers loyalty programs, where companies can earn rewards and discounts on various services and purchases. These programs can help companies save even more on their administrative costs by providing additional incentives for using the Comdata card for various corporate expenses.

In summary, the Comdata card offers a range of benefits for companies looking to save on administrative costs. From automated payment and expense management services to prepaid and debit card capabilities, the Comdata card helps simplify financial processes and reduce paperwork. Additionally, the loyalty programs provide opportunities for further cost savings. Overall, using a Comdata card can help companies optimize their financial operations and focus on their core business activities.