When it comes to startups, one of the key aspects that both employers and employees need to understand is vesting. Vesting is the process by which an employee earns ownership over a certain number of shares or stocks in the company. It is a way for startups to reward their employees for their hard work and also to align their interests with the long-term success of the company.

One of the common forms of equity compensation for employees in startups is the granting of stock options. Stock options give employees the right to purchase a certain number of shares in the company at a specified price, known as the grant price. However, these options do not immediately become available to the employees. Instead, they are subject to a vesting period, which is a predetermined amount of time during which the employee must remain with the company in order to earn the right to exercise their options.

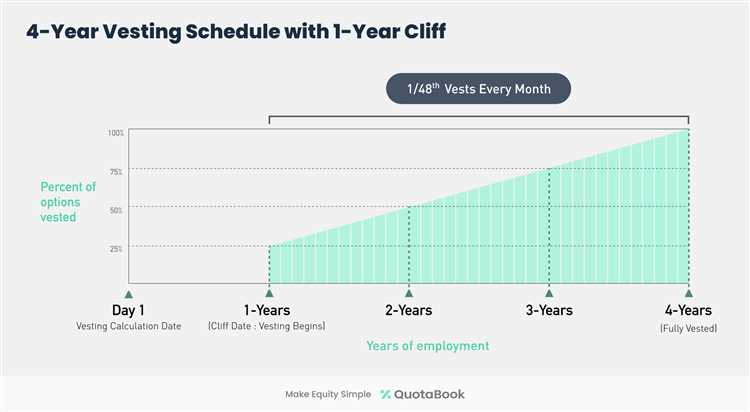

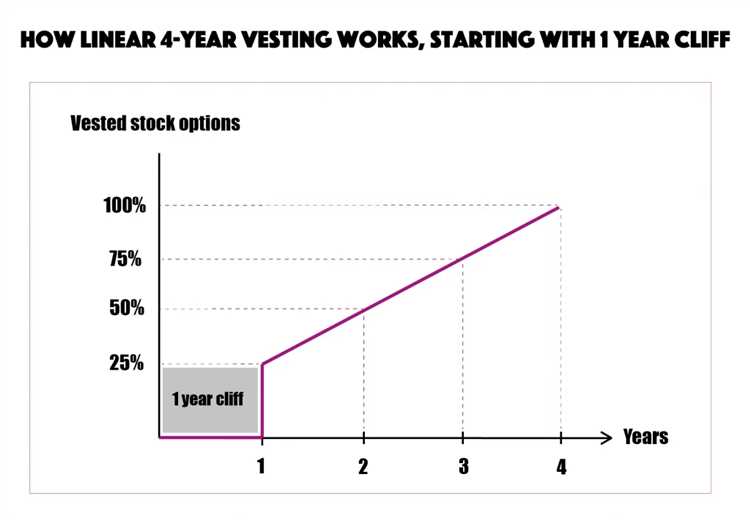

The concept of a 1 year cliff is an important aspect of the vesting process. It refers to the period of time that an employee must remain with the company before any stock or options are vested. During this period, the employee does not have any ownership rights over the stock or options that have been granted to them. It is only after the 1 year cliff has passed that the employee starts earning ownership over their equity.

However, it is important to note that the 1 year cliff is not the only milestone in the vesting process. After the cliff, the employee typically continues to vest their equity on a monthly or quarterly basis until they have earned full ownership. Some startups also have provisions in their equity agreements that can accelerate the vesting schedule in certain situations, such as a change in control or hitting a specific company milestone.

In conclusion, the concept of a 1 year cliff is an important aspect of the vesting process for employees in startups. It represents the initial period of time during which the employee does not have any ownership rights over their granted equity. By understanding this concept, both employers and employees can ensure a fair and transparent process for earning and retaining equity in the company.

Explaining the 1 Year Cliff

The concept of a 1 year cliff is often encountered in the realm of equity ownership and stock options in startups. This period refers to the initial year after an employee receives their stock grant or options. During this time, the employee does not have any ownership rights or the ability to exercise their options.

When an employee joins a startup or a company that offers equity, they are usually subject to a vesting schedule. Vesting is the process of earning ownership rights over a period of time. The 1 year cliff is the first milestone in this schedule, after which the employee begins to gradually earn ownership rights over their granted shares or options.

Why is this 1 year cliff significant? It serves as a protection mechanism for the employer. By implementing a cliff in the vesting schedule, the company ensures that employees who leave within the first year do not receive any ownership benefits. This is important for startups, as it allows them to retain valuable equity and incentivize employees to stay with the company for a longer period of time.

After the 1 year cliff, the vesting schedule typically follows a monthly or quarterly basis, where a certain percentage of the employee's shares or options are vested. This gradual release of ownership rights encourages employees to stay with the company and contribute to its growth and success.

It is worth noting that the 1 year cliff is not the only milestone in a vesting schedule. Depending on the terms of the grant, there may be additional cliffs or milestones throughout the vesting period. These milestones may coincide with the achievement of specific goals or milestones for the company.

In summary, the 1 year cliff is a concept related to equity ownership and vesting in startups. It represents the initial period during which employees do not have ownership rights or the ability to exercise their stock options. This period serves as a protection mechanism for employers and incentivizes employees to stay with the company for a longer period of time.

What is a 1 Year Cliff?

In the context of employee stock options, a 1 year cliff refers to a milestone period that determines when an employee gains ownership of their shares. When an employee is granted stock options by their employer, the concept of vesting comes into play. Vesting is the process by which the employee earns the right to exercise their options and acquire shares in the company.

During the 1 year cliff period, the employee's stock options do not vest, meaning they do not gain ownership of the shares. Instead, the options are "restricted" and the employee must wait until the cliff period is over before they can exercise the options and acquire the shares.

Once the 1 year cliff has passed, the employee's stock options begin to vest. This means that a certain percentage of the options become exercisable and the employee can acquire the corresponding shares. The vesting schedule usually specifies how many shares vest at each milestone, such as quarterly or monthly increments, after the initial cliff period.

The 1 year cliff is a common feature in stock option grants for employees in startups or founding members of a company. It serves as a way to both incentivize employees to stay with the company for a certain period and to protect the company from employees who might leave early and take their stock options with them. If an employee leaves before the cliff period ends, they typically forfeit their unvested options and lose any potential ownership in the company.

How Does the 1 Year Cliff Work?

The concept of a 1 year cliff is commonly used by startups and other companies to incentivize and retain employees. It refers to a period of time, usually one year from the employee's start date, during which their ownership or equity in the company is restricted.

The 1 year cliff acts as a milestone or a vesting period, ensuring that employees have a vested interest in the company's success before they can fully benefit from their ownership or investment. Until the cliff is reached, employees do not have full ownership of the shares, stock, or options that were granted to them.

If an employee leaves the company before the 1 year cliff, they will not be entitled to any ownership or equity in the company. However, once the cliff is reached, their ownership or equity will accelerate, and they will be entitled to the shares, stock, or options that were granted to them according to the vesting schedule.

The 1 year cliff can be particularly important for startups and founding employees. It helps prevent employees from leaving too early after receiving their equity or ownership, ensuring that they are committed to the company for at least a year. This can be essential for a startup's growth and stability in its early stages.

In summary, the 1 year cliff is a period of time during which an employee's ownership or equity in a company is restricted. It acts as a milestone or vesting period, ensuring that employees have a vested interest in the company's success. Once the cliff is reached, their ownership or equity will accelerate and they will be entitled to the shares, stock, or options that were granted to them.

Pros and Cons of the 1 Year Cliff

The 1 Year Cliff is a key concept in equity compensation plans, particularly in startups. It refers to the period of time that must elapse before an employee's ownership of restricted shares granted as part of a vesting schedule starts to vest.

Pros:

- Retention: The 1 Year Cliff helps startups retain key employees by providing an incentive for them to stay with the company for at least a year. This is especially important in the early stages of a startup when employee turnover can be high.

- Alignment: By linking the vesting of restricted shares to a 1 Year Cliff, employees have a stronger alignment with the company's long-term success. They are motivated to contribute to the growth and profitability of the company to maximize their equity value.

- Risk mitigation: The 1 Year Cliff serves as a risk mitigation tool for both the employer and the employee. It allows the employer to assess the employee's performance and fit within the company during the initial period. On the other hand, it gives employees the chance to evaluate the company and its prospects before committing to a long-term equity investment.

Cons:

- Delayed ownership: The 1 Year Cliff means that employees have to wait for at least a year before they start owning any of the granted equity. This delay can be frustrating for employees who may feel a lack of ownership and motivation during this period.

- Loss of value: If an employee leaves the company before the 1 Year Cliff is reached, they forfeit any unvested shares. This can result in a loss of potential value for the employee, especially if the company achieves significant milestones or has a successful exit before the cliff is reached.

- Accelerated vesting: In some cases, a 1 Year Cliff can be disadvantageous for employees if the company achieves significant milestones or experiences rapid growth. In such situations, employees may prefer a shorter cliff or immediate vesting to take advantage of the increased value of their equity.

In conclusion, the 1 Year Cliff has its pros and cons for both employers and employees. It provides a retention tool and aligns employee interests with the company's success, but it also introduces delays in ownership and potential loss of value. Companies should carefully consider their specific circumstances and employee needs when designing their equity compensation plans.

Advantages of the 1 Year Cliff

Vesting options: The 1 year cliff is a common vesting period for stock options in startups. It allows the employer to grant stock options to employees without immediately giving them full ownership of the shares. Instead, the ownership of the shares gradually vests over time, with a cliff period of one year before any shares are vested.

Milestone-based investment: The 1 year cliff is advantageous for startups because it aligns with milestone-based investment. Investors often want to see that a startup has achieved certain milestones before fully committing their funding. By implementing a 1 year cliff, the startup can show investors that the founding team is committed to the long-term success of the company.

Ownership motivation: The 1 year cliff encourages employees to stay with the company for at least one year in order to fully vest their shares. This creates a sense of ownership and motivation among employees, as they are incentivized to contribute to the company's growth and success in order to reap the benefits of their vested shares.

Flexibility in granting stock: The 1 year cliff allows startups to grant stock options to employees without immediately diluting the ownership of existing shareholders. This is especially important in the early stages of a company when resources are limited and preserving equity is crucial for attracting future investors.

Acceleration of vesting: Another advantage of the 1 year cliff is that it allows for the acceleration of vesting in certain circumstances. For example, if the company achieves a significant milestone or if the employee is terminated without cause, the vesting period can be accelerated, ensuring that the employee is not unfairly penalized for circumstances beyond their control.

Disadvantages of the 1 Year Cliff

The 1 Year Cliff is a common concept in equity grants for employees in startups and other companies. It refers to a period of time, typically one year from the date of grant, during which the employee's ownership stake in the company is restricted. During this period, the employee's shares do not vest, meaning they do not have the right to exercise their options or receive any benefits from the equity.

While the 1 Year Cliff can be advantageous for employers, as it incentivizes employees to stay with the company for at least one year, there are also several disadvantages to this concept. One major disadvantage is that it can create a significant hurdle for employees who are looking to accelerate their ownership in the company. If an employee leaves before the 1 Year Cliff period is over, they forfeit all of their equity, regardless of any milestones they may have achieved during their tenure.

Another disadvantage of the 1 Year Cliff is that it can delay the potential financial benefits for employees. In startups, where cash compensation may be limited, equity is often seen as a key part of the overall compensation package. However, if an employee has to wait for a full year before their shares start vesting, it can significantly delay their ability to benefit from their investment in the company.

Furthermore, the 1 Year Cliff can create a sense of uncertainty and instability for employees. While it is understandable that employers want to ensure their employees are committed to the company before granting them equity, requiring a full year of service before any benefits are granted can make employees feel less secure in their role. This can lead to a higher turnover rate and make it more difficult for companies to retain top talent.

In conclusion, while the 1 Year Cliff can be a useful concept for employers looking to protect their investment and incentivize employees to stay with the company, it also has several disadvantages. It can restrict employees' ability to accelerate their ownership and delay their financial benefits. Additionally, it can create uncertainty and instability, potentially leading to higher turnover rates. Companies should carefully consider the impact of the 1 Year Cliff on their employees and overall company culture before implementing this concept.

Factors to Consider

The 1-year cliff is a key concept in equity compensation plans, especially in startups. It refers to a specific period of time, usually set at one year from the date of grant, during which an employee's stock options or other equity awards do not vest. This means that the employee does not gain ownership rights to their shares until the cliff period has passed.

During this cliff period, the employee's shares are considered to be restricted, meaning they cannot be sold, transferred, or otherwise disposed of. This restriction is put in place to incentivize employees to stay with the company for at least one year and to provide time for the startup to achieve certain milestones or demonstrate progress.

Once the 1-year cliff is reached, the vesting of the employee's shares can accelerate. This means that a portion or all of the shares that would have vested over time can be granted immediately. This can be a significant milestone for employees, as it allows them to gain ownership of a larger portion of their equity at once.

The 1-year cliff concept also serves as a protection for employers and investors. It ensures that employees have a vested interest in the long-term success of the company and are not simply looking for a quick return on their investment. It aligns the interests of both parties and helps to create a sense of loyalty and commitment.

In summary, the 1-year cliff is an important aspect of equity compensation plans. It provides a mechanism for startups to incentivize employees to stay with the company and rewards them for their commitment and contribution. It also protects the interests of employers and investors by ensuring that employees are fully invested in the long-term success of the company.

Employee Retention

In order to retain employees, employers often use various methods to incentivize them to stay with the company for a longer period. One common method is the concept of a 1 year cliff. This is a period in which an employer grants stock options or restricted shares to employees, but these options or shares are not immediately granted or fully vested. Instead, the employee must wait for a specified period, usually one year, before they can begin to exercise or receive ownership of the granted options or shares.

This concept of a cliff serves as a milestone or a performance accelerator for employees. It incentivizes them to stay with the company for at least one year, as they want to unlock the potential value of the stock options or restricted shares granted to them. This method is particularly common in startups and companies that rely heavily on stock or equity-based compensation as part of their overall employee compensation package.

By utilizing a 1 year cliff, employers can promote employee retention and loyalty. It provides an additional level of commitment and motivation for employees to contribute to the company's success and remain dedicated to its long-term goals. Employees who are granted stock options or restricted shares at the founding or early-stage of a company may have a greater incentive to stay with the company, as they have a stake in the company's future success and potential financial gain.

In addition to promoting employee retention, the concept of a 1 year cliff can also be beneficial for employers. It helps reduce the risk of significant turnover among employees, as they are more likely to remain with the company for at least one year in order to fully benefit from the granted stock options or restricted shares. This can be especially important for companies that have received significant investment or are in the early stages of growth, as the stability and continuity of the workforce can positively impact the company's overall performance and success.

Company Performance

In the context of startup companies and equity ownership, the concept of a 1 year cliff plays a significant role. When an employer grants equity or stock options to an employee, it is often subject to a vesting period. This means that the employee's ownership of the equity or option shares is restricted until certain milestones or time periods are reached. The 1 year cliff refers to a specific milestone, usually the one-year mark from the date of founding or the date of investment.

During the 1 year cliff period, the employee does not have any ownership rights to the granted equity or options. This serves as a protection for the company, ensuring that employees who leave the company before the cliff period ends do not retain any ownership. At the same time, it motivates employees to stay with the company for at least one year before they can fully benefit from the granted equity or options.

After the 1 year cliff, the vesting schedule often accelerates, meaning that the restrictions on the equity or options are lifted at a faster rate. This allows employees to gradually gain full ownership over their granted shares based on their continued employment. The accelerated vesting schedule can be based on a time-based schedule or performance-based milestones, depending on the company's policies.

In summary, the concept of a 1 year cliff is an important aspect of equity ownership for employees in startups. It ensures that employees have a vested interest in the success of the company and motivates them to stay with the company for at least the first year. As the company performs well and reaches milestones, the vested equity or options can become a valuable asset for the employee, aligning their interests with the success of the company.

Market Conditions

In the volatile market conditions, startups often struggle to attract and retain top talent. One way they incentivize employees is through the granting of equity options. These options give employees the right to purchase a certain number of company shares at a predetermined price, usually referred to as the grant price.

One important concept in the world of equity options is the concept of a 1 year cliff. This refers to a period of time, usually one year from the founding of the company, during which employees do not have any ownership rights to the stock options granted to them. After this cliff period, the options start vesting, meaning they gradually become available for the employee to exercise.

During the cliff period, employees hold restricted stock units (RSUs) or restricted stock grants, which means they cannot sell or transfer their shares until the cliff period is over. This motivates employees to stay with the company until the cliff period has passed, as they would not want to leave without receiving any ownership in the company.

However, it is important to note that some companies have acceleration provisions in place. These provisions allow employees to accelerate the vesting of their stock options if certain milestones are achieved or if there is a change in control of the company. This can provide employees with an additional incentive to stay with the company and work towards its success.

Overall, the concept of a 1 year cliff is a common practice in the startup world. It helps align the interests of employees and employers and encourages employees to stay with the company for the long term. By granting equity options and implementing vesting schedules, startups can attract and retain top talent in the highly competitive market conditions.

Alternative Vesting Schedules

When it comes to equity grants, companies have the flexibility to choose alternative vesting schedules for their employees. These schedules outline the timeline and conditions under which employees can acquire ownership of their granted shares.

One common alternative to the traditional 1 year cliff is the graded vesting schedule. Under this arrangement, a certain percentage of shares are vested over a specified period of time, typically on an annual or quarterly basis. For example, an employee may be granted 1,000 shares with a graded vesting schedule of 25% per year for four years. This means that after one year of service, the employee will have acquired 250 shares, and will continue to vest an additional 250 shares each subsequent year.

Another alternative vesting schedule is the milestone-based vesting schedule. This approach ties the vesting of shares to specific milestones or achievements met by the company or the employee. For instance, an employee may be granted 1,000 shares that vest upon the successful completion of a project or the achievement of a certain revenue target. This schedule incentivizes employees to work towards specific goals and aligns their interests with the company's success.

Companies can also choose to include an acceleration clause in the vesting schedule. This provision allows for the immediate vesting of shares in the event of certain circumstances, such as a merger or acquisition, change of control, or the termination of the employee without cause. Acceleration clauses provide employees with increased flexibility and can help retain talent during times of uncertainty or transition.

Overall, alternative vesting schedules provide companies with the ability to customize their equity grants to fit their specific needs and goals. Whether it's to reward longevity, incentivize performance, or align interests, these schedules play a crucial role in structuring equity compensation plans and fostering a sense of ownership and commitment among employees.

Gradual Vesting

When it comes to equity in startups, gradual vesting is a concept that plays a crucial role. Unlike a 1 year cliff, where the founding team or employee must wait for a specific period before any shares are granted, gradual vesting allows for a more flexible timeline for the ownership of shares.

In a gradual vesting arrangement, the employer grants a certain number of restricted stock or options to the employee, with the ownership gradually transferring over a period of time. This period is typically referred to as the vesting period, and it can range from a few months to several years.

During this vesting period, the employee's ownership of the granted shares gradually increases, usually on a monthly or quarterly basis. This gradual increase ensures that the employee is incentivized to stay with the company and reach certain milestones. It also aligns their interests with those of the company and its long-term goals.

If an employee leaves the company before the end of the vesting period, they may forfeit a portion of their granted shares. This is known as a "cliff", and it acts as a way to protect the employer's investment in the employee. However, some companies may include acceleration provisions, which allow for the vesting to accelerate in certain situations, such as a company acquisition or IPO.

Overall, gradual vesting is a fair and common practice in startups, as it provides a way to reward and incentivize employees while also ensuring their commitment to the company's long-term success. It allows for a more sustainable and balanced approach to equity ownership, benefiting both the employer and the employee.

Milestone Based Vesting

Milestone based vesting is an equity vesting structure commonly used by startups to incentivize and retain employees. It involves granting restricted stock or stock options to employees as part of their compensation package. Instead of having a standard time-based vesting schedule, milestone based vesting is tied to the achievement of specific milestones or goals.

When an employee is granted equity, they are typically subject to a vesting period, which is the amount of time they have to wait before they can exercise or sell their shares. During this period, the employee's rights to the shares are restricted, and they only become fully vested after the vesting period is complete.

In milestone based vesting, the vesting of shares is tied to the achievement of predetermined milestones or goals. These milestones can be related to the company's performance, such as reaching a certain revenue target or completing a specific project. The milestones can also be individual goals set for each employee, such as securing a certain number of new clients or launching a new product.

Once a milestone is achieved, a portion of the employee's shares vest, meaning they are no longer subject to restrictions and the employee becomes the full owner of those shares. This can incentivize employees to work towards the milestones and align their interests with the success of the company.

In some cases, milestone based vesting can also include an acceleration clause, which allows the vesting of shares to accelerate in the event of a change in control of the company, such as a merger or acquisition. This can provide additional incentives for employees to stay with the company during a period of transition or uncertainty.

Milestone based vesting can be a flexible and effective way for startups to reward and retain employees, as it aligns the employees' incentives with the company's goals. By tying equity vesting to the achievement of milestones, employees are motivated to work towards these goals and contribute to the success of the company.

Reverse Vesting

Reverse vesting is a concept related to the ownership of shares in a company, particularly in the context of founding or early-stage startups. It refers to a process where the employer or the company grants ownership of shares to employees, but with certain restrictions and conditions.

Unlike traditional vesting, where employees gradually earn ownership of their shares over a certain period of time, reverse vesting works in the opposite way. It means that employees already have full ownership of their shares when they are granted, but the company has the right to repurchase these shares back if certain conditions are not met.

The purpose of reverse vesting is to align the interests of the employees with the company's long-term goals and provide an incentive for them to stay with the company for a certain period of time. It also protects the company's investment by ensuring that employees who leave early do not retain full ownership of the shares.

In reverse vesting, there are usually milestones or predefined periods of time after which the restrictions on the shares are lifted. For example, the company may specify a 4-year vesting period with a 1-year cliff, meaning that the shares will fully vest after 4 years, but if an employee leaves before 1 year, they will not have any ownership rights to the shares.

Reverse vesting is commonly used in startup companies and is often applied to the shares of founders and key employees who have a significant impact on the company's success. By implementing reverse vesting, startups can ensure that their employees have a long-term commitment to the company and its growth, while also protecting the company's equity and investment.