An outstanding deposit refers to a sum of money that has been credited to a bank account but is not yet available for withdrawal. It is essential for customers to have a clear understanding of this concept to prevent any confusion or unexpected fees.

When a deposit is made, whether it is through an ATM, electronic transfer, or a physical check, the funds are usually credited to the customer's account immediately. However, this does not mean that the deposit is considered outstanding. Banks may place a hold on the funds to ensure that the transaction is legitimate and to provide time for the check or other forms of payment to clear.

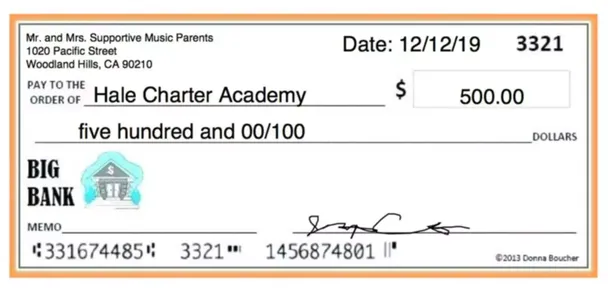

One common example of an outstanding deposit is when a customer deposits a check into their account. Even though the bank may credit the customer's account for the amount of the check, it can take several days for the funds to become available. During this time, the check is being processed, and the bank is verifying the payer's account balance and signature.

It is essential for customers to keep track of their outstanding deposits, as it can affect their account balance and potentially lead to overdraft fees. Banks typically provide statements or notifications to inform customers of their current balance and any outstanding deposits still in the process of being cleared. By regularly reviewing these statements and being aware of the outstanding transactions, customers can avoid any unnecessary fees or issues with their account.

Understanding Outstanding Deposits

An outstanding deposit refers to a payment made by a customer that has not yet been credited to their account. This can happen when the customer deposits a check or cash into their account, but the bank has not yet processed the transaction. Until the deposit is processed and the funds are available, the customer's account balance will not reflect the deposit amount.

When a customer makes a deposit, whether through an ATM or with a teller, the bank will typically issue a receipt as proof of the transaction. However, the deposit may still be considered outstanding until it has been verified and cleared by the bank.

Outstanding deposits can be important for customers to keep track of, especially if they are relying on those funds to cover expenses or avoid overdraft fees. It is important for customers to regularly review their account statements to ensure that all outstanding deposits have been credited to their account.

If a deposit does not appear in a customer's account after a reasonable amount of time, they should contact their bank for clarification. The bank may require additional documentation or provide a timeline for when the deposit will be processed.

In some cases, an outstanding deposit may be canceled or reversed. This can happen if the deposit was made in error, if the check bounces, or if there are insufficient funds in the customer's account to cover the deposit. It is important for customers to be aware of these possibilities and take appropriate action if necessary.

Outstanding deposits can also impact a customer's available credit. For example, if a customer has outstanding deposits that have not yet been credited to their account, their available credit may be lower than expected. This can affect their ability to make purchases or borrow additional funds, such as applying for a loan or credit card.

To avoid any confusion or issues with outstanding deposits, it is crucial for customers to maintain accurate records of their deposits. They should also ensure that they receive regular notifications from their bank regarding any pending deposits or withdrawals.

In conclusion, understanding the concept of outstanding deposits is crucial for customers to manage their finances effectively. By keeping track of their deposits, verifying the status with their bank, and maintaining accurate records, customers can ensure that their account balances reflect the true available funds and avoid any unnecessary fees or complications.

What are Outstanding Deposits?

An outstanding deposit is a transaction that has been made into a bank account but has not yet been credited to the account balance. It can include various types of deposits, such as checks, cash, or funds transferred from another account.

When a customer makes a deposit at an ATM or a bank teller, the funds are typically deposited into the account immediately. However, in some cases, the deposit may be considered outstanding until it has been processed and verified by the bank.

Outstanding deposits can also occur when a customer deposits a check that has not yet cleared. The bank may place a temporary hold on the funds until the check has been processed, which can take a few business days. During this time, the deposit will be considered outstanding.

It is important for customers to keep track of any outstanding deposits to ensure their account balance is accurate. This can be done by reviewing the account statement regularly or through online banking. If a customer notices any discrepancies or missing deposits, they should contact their bank immediately for clarification.

While an outstanding deposit may not be immediately available for withdrawal, it may still accrue interest or be subject to fees. It is essential for customers to familiarize themselves with the terms and conditions of their account to understand how outstanding deposits are handled.

In summary, an outstanding deposit refers to a transaction that has been made into an account but has not yet been credited to the account balance. It can include various types of deposits, such as checks or cash. Customers must monitor their account balance and contact their bank if they notice any issues or discrepancies with outstanding deposits.

Factors Contributing to Outstanding Deposits

When it comes to understanding the concept of an outstanding deposit, there are several factors that contribute to the occurrence of such a situation in a customer's account.

- Delayed statement processing: Sometimes, a customer may deposit funds through an ATM or make a deposit near the end of a billing cycle. If the statement is generated before the deposit is processed, it can lead to an outstanding deposit.

- Bank processing time: Banks may have different processing times for deposits. If a customer makes a deposit close to the end of the business day or on a weekend, it may take longer for the funds to be credited to their account.

- Canceled or returned checks: If a customer deposits a check that is later canceled or returned due to insufficient funds, the deposit becomes outstanding and may result in fees or overdrafts.

- Loan repayments: When a customer makes a loan repayment, the funds are typically deposited into their account. If the repayment is made close to the statement generation date, it can result in an outstanding deposit.

- Delayed notifications: In some cases, the bank may not immediately notify the customer of a deposit that has been made, causing the deposit to remain outstanding until the customer becomes aware of it.

It is important for customers to keep track of their deposits and review their account statements regularly to ensure that outstanding deposits are accounted for and do not lead to discrepancies in their balance. Additionally, customers should be aware of any fees or interest charges that may be associated with outstanding deposits or overdrafts to maintain the security of their accounts.

Avoiding Overdrafts

Overdrafts can be a major financial burden for individuals and can lead to a significant amount of fees and penalties. To avoid overdrafts, it is important to maintain a positive balance in your bank account by keeping track of your transactions and expenses.

One way to avoid overdrafts is by ensuring that you have enough funds in your account to cover any upcoming withdrawals or transactions. This can be done by regularly monitoring your bank statements and keeping track of your spending habits. If you notice any outstanding checks or pending transactions, make sure to account for them in your balance.

Another effective way to avoid overdrafts is by setting up automatic notifications from your bank. This can help keep you informed about any upcoming payments or withdrawals that may put your account at risk of becoming overdrawn. By receiving timely notifications, you can take the necessary steps to ensure that your account remains in good standing.

It is also important to be aware of your bank's policies regarding overdrafts. Some banks offer overdraft protection, which allows you to link your checking account to a savings account or a line of credit. In the event that you do not have enough funds to cover a transaction, the bank will automatically transfer money from your linked account to cover the amount, saving you from incurring overdraft fees.

Lastly, it is important to avoid using credit as a security net for overdrafts. While it may be tempting to rely on credit cards or loans to cover any gaps in funds, this can lead to high interest rates and additional debt. Instead, focus on building an emergency savings account that can serve as a financial cushion in case of unexpected expenses or overdrafts.

Budgeting and Cash Flow Management

Managing your budget and cash flow is crucial in maintaining financial security and stability. By understanding and monitoring your income and expenses, you can effectively plan and allocate your funds.

Creating a budget starts with analyzing your income statement to identify the sources and amount of money coming in. This includes salaries, investments, and any outstanding deposits. By tracking these funds, you can ensure that you have enough money to cover your expenses.

On the other hand, managing cash flow involves keeping track of your expenses and ensuring that you don't overspend. It's important to stay aware of any outstanding overdraft fees, ATM fees, or credit card fees that can eat into your funds.

To maintain a healthy cash flow, it's crucial to monitor your account balance regularly. This will help you avoid overdrawing on your account and incurring additional fees. By setting up alerts and notifications from your bank, you can stay informed about any changes in your account balance and avoid surprises.

Another aspect of cash flow management is optimizing your savings and managing your investments. By keeping a portion of your funds in a high-interest deposit account, you can earn passive income through interest. Additionally, it's important to regularly review and check your statements and transactions to ensure there are no unauthorized or fraudulent activities.

In summary, budgeting and cash flow management are vital for maintaining financial stability and security. By effectively tracking your income, expenses, and outstanding deposits, you can ensure that you are using your funds wisely and avoid any unnecessary fees or unexpected financial challenges.

How Outstanding Deposits Affect Your Finances

Understanding the concept of an outstanding deposit is crucial for managing your finances effectively. An outstanding deposit refers to a check or a bank transfer that has been made to your account but has not been credited yet. This means that the funds are not immediately available for use.

When you make an outstanding deposit, it is important to keep track of it and ensure it is properly recorded in your bank statement. Failing to do so can lead to overdraft fees and other charges if you mistakenly think you have more money in your account than you actually do. It is advisable to regularly check your bank statement to reconcile any outstanding deposits and ensure the accuracy of your account balance.

Outstanding deposits can also affect your loan repayments. If you have an outstanding deposit and your loan payment is due, the bank may consider the deposit as part of your available funds and deduct it from the loan amount. This can result in a lower loan payment or even eliminate the need for a payment altogether, depending on the amount of the outstanding deposit.

Additionally, outstanding deposits can impact the interest you earn on your account. Banks calculate interest based on your average daily balance, which includes any outstanding deposits. So if you have a significant outstanding deposit, your average daily balance will be higher, and you may earn more interest on your funds.

As a customer, it is essential to understand the importance of accurately recording your outstanding deposits and keeping track of them. This not only helps you maintain a clear picture of your account balance, but also ensures that you are maximizing the use of your funds and avoiding unnecessary fees. By staying on top of your outstanding deposits, you can effectively manage your finances and make informed decisions regarding your financial security.

Delayed Availability of Funds

When a customer makes a deposit at a bank, the funds are not always immediately available for withdrawal or other transactions. This delay is due to the bank's policy of ensuring the security and validity of the deposit.

Typically, funds from a check deposit may be subject to a hold period, during which the bank reviews the check and verifies the availability of funds in the account from which the check was drawn. The hold period can vary depending on the bank's policies, the amount of the deposit, and the customer's account history. During this hold period, the balance in the customer's account may not accurately reflect the deposit amount.

Customers should be aware that this delay in availability can have an impact on their account balance and transactions. For example, if a customer makes a withdrawal or writes a check against an outstanding deposit, they may incur overdraft fees if the funds are not yet available. It is important for customers to carefully monitor their account balances and consider the availability of funds before making any transactions.

To help customers stay informed, banks often provide notification statements that detail the status of deposits and withdrawals. These statements may indicate when a deposit is pending and when the funds are expected to become available. It is advisable for customers to regularly review these statements to ensure they have an accurate understanding of their account balance.

In some cases, the availability of funds can be expedited. For example, some banks offer instant availability of funds for certain types of deposits, such as electronic transfers. Additionally, customers with a good credit history or an established relationship with the bank may have shorter hold periods or faster access to funds.

In summary, the delayed availability of funds is a common banking practice aimed at ensuring the security and validity of deposits. However, customers should be aware of the potential impact on their account balance and transactions. By monitoring their account balances, reviewing notification statements, and understanding the bank's policies, customers can navigate this process effectively and avoid any unnecessary fees or complications.

Potential Impact on Financial Goals

An outstanding deposit can have a significant impact on your financial goals by providing you with additional funds to meet your objectives. When a deposit is made into your account, it increases your available balance and provides you with more money to work with. This can help you to pay off debts, save for the future, or invest in opportunities that align with your financial goals.

One potential impact of an outstanding deposit is that it can help you avoid overdraft fees. If you have a low balance in your account and are at risk of overdrawing, a deposit can bring your account back to a positive balance and prevent overdraft fees from being charged. This can save you money and keep your financial goals on track.

In addition, an outstanding deposit can provide you with a sense of security and financial stability. Having a positive balance in your account can give you peace of mind and the confidence to pursue your financial goals. It can also provide you with a safety net in case of unexpected expenses or emergencies.

Furthermore, an outstanding deposit can have an impact on your credit. If you have outstanding payments or loans, making a deposit towards these obligations can help improve your credit score and demonstrate responsible financial behavior. This can have long-term benefits when it comes to obtaining future loans or credit.

Lastly, an outstanding deposit can open up new opportunities for you to earn interest or invest. By having a larger balance in your account, you may qualify for higher interest rates or investment options that can help you grow your funds and achieve your financial goals faster.

Managing Outstanding Deposits

When it comes to managing outstanding deposits, it is essential for a customer to stay vigilant and keep track of their transactions. Banks often charge fees for checks that are deposited and then canceled, so it is important to be aware of any canceled checks and notify the bank accordingly.

One way to manage outstanding deposits is to regularly check your account statement. This will allow you to see if any deposits are still pending or have not been credited to your account. If you notice any discrepancies, it is crucial to contact the bank immediately to resolve the issue.

Another key aspect in managing outstanding deposits is to be cautious when using ATMs. While ATMs offer convenience, there is a risk of your deposit not being properly credited. To minimize this risk, always ensure that you receive a receipt for your deposit. This will serve as a proof of the transaction.

Furthermore, it is important to keep track of any outstanding withdrawals or loans against your account. These can affect the available balance for the outstanding deposit. By monitoring your withdrawals, loans, and outstanding deposits, you can avoid any overdraft fees or account balance discrepancies.

Additionally, it is advisable to regularly review your account for any interest earned on your outstanding deposit. This will enable you to take advantage of any accrued interest and ensure that your funds are working for you.

In conclusion, managing outstanding deposits requires careful attention and proactive action from the customer. By monitoring your account, promptly notifying the bank of any canceled or pending deposits, and staying aware of any fees or interest, you can effectively manage and maximize the benefits of your outstanding deposits.

Tracking and Monitoring Deposits

When it comes to managing your finances, tracking and monitoring deposits is a crucial task. Whether you make a deposit with a check, at an ATM, or through an online banking platform, it is important to keep a record of each transaction to ensure that your funds are properly accounted for.

One way to effectively track and monitor your deposits is by reviewing your bank statements. These statements provide a detailed breakdown of all the deposits made into your account, including the date, amount, and source of the deposit.

In addition to reviewing your bank statements, you can also set up notifications with your bank to receive alerts whenever a deposit is made into your account. This can help you stay on top of your finances and ensure that you are aware of any outstanding deposits.

Furthermore, keeping a record of your deposits can also be helpful in reconciling your account balance. By comparing your records with the bank's records, you can identify any discrepancies or errors that may have occurred.

Monitoring your deposits is not only important for your financial security, but it can also help you avoid unnecessary fees and charges. For example, if you make a deposit to cover an outstanding loan or credit card balance, keeping track of the payment can help you avoid additional interest or late payment fees.

In summary, tracking and monitoring your deposits is an essential part of managing your finances. By keeping a record of your deposits, reviewing your bank statements, and setting up notifications with your bank, you can ensure that your funds are properly accounted for and avoid any unnecessary fees or charges.

Communication with Financial Institutions

Effective communication with financial institutions is essential for managing your account and understanding the concept of an outstanding deposit. When a deposit is made into your account, it is considered outstanding until it has been verified and cleared by the bank. During this time, the funds may not be available for withdrawal or use.

If you have any questions or concerns regarding an outstanding deposit, it is important to reach out to your financial institution. They can provide you with information about the status of the deposit and any fees or charges that may apply. It is also a good idea to keep track of your account balance and review your monthly statements to ensure that all transactions are accounted for.

When communicating with your bank or credit union, it is important to provide them with all of the necessary information, such as your account number and any relevant transaction details. This will help them assist you more efficiently and avoid any delays or misunderstandings.

Banks also communicate with their customers through various channels, including email, phone, and mail. It is important to keep your contact information up to date and notify your bank of any changes. This will ensure that you receive important notifications regarding your account, such as overdraft or security alerts.

When using an ATM or making a withdrawal, it is important to be aware of any applicable fees. Some banks charge fees for using ATMs that are outside of their network, or for making excessive withdrawals. Understanding these fees can help you avoid unnecessary charges and manage your finances more effectively.

Finally, if you have any questions or concerns about a loan or credit account, it is important to communicate with your financial institution. They can provide you with information about interest rates, repayment terms, and any fees or charges that may apply. This will help you make informed decisions and manage your debt responsibly.

Strategies for Minimizing Outstanding Deposits

Minimizing outstanding deposits is crucial for maintaining a healthy financial balance and avoiding unnecessary fees and charges. Here are some strategies that can help you effectively manage your deposits:

- Monitor your bank account regularly: Keep a close eye on your account balance and transaction history to ensure that all deposits are properly credited. This can help identify any discrepancies or outstanding deposits that need to be resolved.

- Set up alerts and notifications: Utilize your bank's notification system to receive alerts whenever there is a large deposit that needs to be verified or confirmed. These notifications can help you promptly respond to any outstanding deposits and prevent any potential issues.

- Maintain accurate records: Keep a record of all your deposit transactions, including the date, amount, and source of the deposit. This can help you easily track and reconcile any outstanding deposits that may arise.

- Deposit checks promptly: Make it a practice to deposit checks as soon as possible after receiving them. This can help ensure that the funds are credited to your account without delay and minimize the chances of outstanding deposits.

- Be cautious with ATM deposits: When making deposits at an ATM, ensure that you follow all the instructions carefully and double-check the deposit amount. Mistakes can lead to outstanding deposits and even overdrafts if your account balance is not sufficient.

- Avoid relying on pending deposits: While pending deposits may show as part of your account balance, it's important not to rely on these funds until they are fully credited. There can be delays or issues with the processing of deposits, and relying on pending amounts can lead to overdrafts or insufficient funds.

- Consider using direct deposit: Opting for direct deposit can help minimize the chances of outstanding deposits. With direct deposit, your funds are automatically credited to your account, eliminating the need for physical checks or manual deposits. It also provides added security and convenience.

- Utilize electronic funds transfer: Instead of relying on checks or cash deposits, consider using electronic funds transfer (EFT) methods for making deposits. EFT transfers are typically processed quickly and securely, reducing the chances of outstanding deposits.

By following these strategies, you can minimize the risk of outstanding deposits, maintain an accurate account balance, and avoid unwanted fees or complications.

Automated Recurring Payments

Automated recurring payments are a convenient way for customers to manage their finances without having to manually initiate each payment. These payments are set up to occur on a regular schedule, such as monthly or weekly, and are automatically deducted from the customer's bank account.

One of the benefits of automated recurring payments is that they help customers avoid overdraft fees. By setting up automatic payments, customers can ensure that they have enough funds in their account to cover their expenses, thereby avoiding the risk of overdrawing their account and incurring costly fees.

Automated recurring payments can be used for a variety of financial transactions, such as loan and credit card payments. By setting up automatic payments for these types of transactions, customers can ensure that their payments are made on time each month, helping to maintain a good credit score and avoid late payment fees.

In addition to loan and credit card payments, automated recurring payments can also be used for other regular expenses, such as utility bills, rent, and insurance premiums. By automating these payments, customers can ensure that their bills are paid on time and avoid any interruptions in service.

When setting up automated recurring payments, it is important for customers to monitor their account balance regularly. While these payments can help automate financial management, customers should still review their bank statements to ensure that all transactions are accurate and that there are no outstanding deposits or withdrawals that they are not aware of.

To ensure the security of their funds, it is also important for customers to set up notifications from their bank. These notifications can alert customers to any suspicious activity or unauthorized transactions that may occur, helping to prevent fraud and protect their account.

Overall, automated recurring payments are a convenient and efficient way for customers to manage their finances. By automating regular payments, customers can save time, avoid late fees, and ensure that their bills are paid on time. However, it is important for customers to monitor their account balance and set up security notifications to ensure the safety of their funds.

Utilizing Electronic Fund Transfers

Electronic Fund Transfers have revolutionized the way we handle our finances. Instead of relying on traditional methods such as cash or checks, individuals can now conveniently transfer funds between their accounts with just a few clicks. One of the most commonly used electronic fund transfer methods is through ATMs.

ATMs, or Automated Teller Machines, allow customers to perform a variety of transactions, including withdrawing cash, depositing checks or cash, and transferring funds between accounts. These transactions are processed electronically, ensuring quick and secure transfers.

Credit cards are also widely used for electronic fund transfers. Customers can make purchases at various merchants using their credit card, and the transaction is processed electronically. However, it is important to note that there may be fees associated with using credit cards for electronic fund transfers, such as foreign transaction fees or cash advance fees.

Another important aspect of utilizing electronic fund transfers is ensuring the security of your funds. Banks employ various security measures to protect customer accounts, such as encryption and authentication protocols. Additionally, customers should regularly review their account statements and notify the bank immediately if they notice any unauthorized transactions or suspicious activity.

Electronic fund transfers are not limited to personal accounts. Businesses and organizations can also take advantage of this convenient method to transfer funds. For example, if a company needs to make a loan payment or pay off an outstanding balance, they can initiate an electronic transfer from their business account.

Furthermore, electronic fund transfers can also help avoid overdraft fees. By setting up automatic transfers from a savings account to a checking account, customers can ensure that they always have enough funds to cover their expenses.

In addition to the convenience and security, electronic fund transfers can also offer other benefits, such as earning interest on deposited funds. Some banks may provide notification options, such as email alerts or text messages, to keep customers informed about their account activity and balance.

In conclusion, electronic fund transfers have become an essential tool for managing finances. Whether it's through ATMs or credit cards, individuals and businesses can easily and securely transfer funds between accounts. By taking advantage of these electronic methods, customers can save time, avoid fees, and have greater control over their finances.