When it comes to payroll, there are many acronyms and terms that can be confusing. One such term is GTL, which stands for Group Term Life. But what does GTL actually mean in the context of payroll?

In payroll, GTL refers to a type of life insurance coverage that is offered to employees as part of their benefits package. This coverage is typically provided by employers and is designed to provide financial protection and support to employees and their families in the event of their death. GTL coverage is often optional and may require employees to contribute a portion of their salary towards the premium.

While GTL is commonly associated with life insurance, it is important to note that there may be variations and additional benefits that can be included in a GTL policy. These can vary depending on the specific terms and conditions set by the employer and insurance provider. Some variations may include options for additional coverage, such as accidental death or dismemberment benefits, as well as coverage for dependents.

In summary, GTL in payroll refers to Group Term Life insurance coverage that is offered to employees by their employer. It is designed to provide financial protection and support to employees and their families in the event of their death. The specific terms and conditions of GTL coverage may vary depending on the employer and insurance provider.

Understanding GTL in Payroll

GTL stands for Group Term Life insurance and is a common offering in payroll benefits. It is a type of life insurance coverage that provides a lump sum payment to an employee's designated beneficiaries in the event of the employee's death while they are still an active employee.

What does GTL mean in payroll? It means that employers provide this type of life insurance coverage to their employees as part of their overall benefits package. The cost of the coverage is typically deducted from the employee's paycheck, either on a pre-tax or post-tax basis.

GTL coverage is typically offered in increments of a multiple of the employee's salary, such as one, two, or three times their annual salary. The amount of coverage provided can vary depending on factors such as the employee's age and job title.

When an employee enrolls in GTL coverage, they will typically be asked to designate one or more beneficiaries who will receive the death benefit in the event of their death. The designated beneficiaries can use the proceeds from the life insurance policy to help cover expenses such as funeral costs, outstanding debts, or to provide financial support to dependents.

In summary, GTL in payroll refers to the provision of Group Term Life insurance as part of an employee's benefits package. It offers financial protection to employees and their designated beneficiaries in the event of the employee's death, and the cost of the coverage is typically deducted from the employee's paycheck.

Definition and Explanation of GTL

GTL stands for Group Term Life insurance, and it is a type of insurance offered in payroll. In payroll, GTL refers to a benefit provided to employees by their employer, which covers a certain amount of life insurance for the employees.

GTL is often offered as a part of the employee benefits package, and it can provide financial protection for the employee's beneficiaries in the event of their death. The coverage amount of GTL can vary depending on factors such as the employee's salary and the specific terms of the insurance policy.

When an employee enrolls in GTL, they typically have the option to increase or decrease the coverage amount based on their needs. The cost of GTL is usually deducted from the employee's paycheck on a regular basis, and the insurance coverage remains in effect as long as the employee continues to meet the eligibility requirements set by the insurance provider.

GTL is an important component of payroll as it helps to provide employees and their families with a sense of security and financial protection. It is important for employees to carefully review the terms and coverage options of GTL insurance and consider their individual needs before enrolling in the program.

Importance of GTL in Payroll

In the realm of payroll, GTL stands for Gross-to-Net (GTL) calculation. This calculation is vital for ensuring accurate and timely payroll processing. But what does GTL mean in payroll?

GTL is the process of calculating an employee's net pay based on their gross earnings for a given pay period. It takes into account various deductions, such as taxes, retirement contributions, and insurance premiums, to arrive at the final net pay.

Accurate GTL calculations are crucial for both employers and employees. For employers, GTL ensures that employees are paid correctly and in compliance with labor laws. It helps prevent errors, such as miscalculations or omissions of deductions, which can lead to legal issues or employee dissatisfaction.

For employees, GTL is essential to understand how much they will actually receive in their paycheck after deductions. It allows them to budget and plan their finances accordingly. Employees can have peace of mind knowing that their net pay reflects their true earnings and deductions accurately.

To perform GTL calculations, payroll professionals rely on sophisticated software or payroll systems. These systems automate the calculation process and incorporate the necessary tax formulas and deduction rules. This automation reduces the risk of manual errors and ensures efficiency in payroll processing.

In summary, GTL plays a crucial role in payroll by accurately determining an employee's net pay. It ensures compliance with labor laws, provides transparency for employees, and streamlines payroll processing. Employers can rely on GTL calculations to maintain a fair and efficient payroll system, benefiting both the company and its workforce.

Benefits of GTL in Payroll

When it comes to payroll, GTL is an acronym that stands for "Guaranteed Time Off." But what does GTL actually mean in payroll? GTL refers to a specific policy or benefit that some companies offer to their employees.

One of the main benefits of GTL in payroll is that it provides employees with a guaranteed amount of time off. This means that employees can plan their vacations, personal appointments, or other time off knowing that they will receive their regular pay for that time. This can be especially helpful for employees who need to take extended time off for various reasons.

Another advantage of GTL in payroll is that it can help with employee retention. By offering a guaranteed amount of time off, companies can show their employees that they value work-life balance and prioritize their well-being. This can contribute to a positive work culture and increase job satisfaction, leading to higher retention rates.

GTL in payroll also has financial benefits for both employees and employers. For employees, it ensures that they do not have to sacrifice their pay when taking time off. This can be particularly important for those who rely on their paycheck to cover their expenses. For employers, offering GTL can help reduce the financial burden of overtime pay by allowing employees to use their guaranteed time off instead.

In summary, GTL in payroll provides several benefits for both employees and employers. It ensures that employees have a guaranteed amount of time off with pay, contributes to employee retention, and has financial advantages for both parties involved. Implementing a GTL policy can be a valuable addition to any company's payroll system.

Financial Protection for Employees

In the world of payroll, it is important for employees to understand what GTL means and how it can provide financial protection for them. GTL, which stands for Guaranteed Term Life Insurance, is a type of insurance that offers coverage for a specific period of time. This coverage is designed to provide financial support to the employee's family in the event of their untimely death.

With GTL, employees can have peace of mind knowing that their loved ones will be taken care of financially in case of a tragedy. This can include expenses such as funeral costs, mortgage payments, and education expenses for children. By having GTL coverage, employees can ensure that their family members are not burdened with financial difficulties during an already difficult time.

One of the key benefits of GTL is that it is usually offered as a part of an employee's benefits package, meaning that the employer typically pays for the premiums. This means that employees can obtain this financial protection without having to pay out of their own pocket, making it an extremely valuable benefit to have.

Furthermore, GTL coverage is often customizable, allowing employees to choose the coverage amount that best suits their individual needs. This flexibility ensures that employees can feel confident in their financial protection and have peace of mind knowing that their loved ones will be taken care of in the event of the unexpected.

In conclusion, GTL is a valuable aspect of payroll that provides financial protection for employees and their families. By understanding what GTL means and taking advantage of this benefit, employees can ensure that they have the necessary financial support and peace of mind in the face of any unexpected circumstances.

Attracting and Retaining Talent

Payroll is an essential aspect of any business, and one of the key factors in attracting and retaining talent. Employees want to be compensated fairly and on time, and a well-managed payroll system can help fulfill these expectations.

When it comes to attracting talented individuals to your organization, offering competitive salaries is crucial. Potential employees want to know that their hard work and skills will be rewarded appropriately. By having a comprehensive payroll system in place, you can ensure that you are able to offer competitive salaries and attract top-tier candidates.

In addition to competitive salaries, having a reliable and efficient payroll system can also help in retaining talent. Employees value consistency and trust in the workplace, and knowing that they will be paid accurately and on time is a major factor in their job satisfaction. A payroll system that is able to handle calculations, deductions, and taxes accurately can build trust and loyalty among your workforce.

It is also important to consider the various benefits and incentives that can be included in your payroll system. These could include health insurance, retirement plans, paid time off, and other perks. By offering a comprehensive benefits package, you can make your organization more attractive to potential employees and increase employee retention.

Furthermore, a well-organized payroll system can help in creating a positive work environment. By ensuring that employees are paid fairly and on time, you can reduce stress and conflicts related to compensation. This can contribute to a more harmonious workplace and ultimately aid in attracting and retaining talented individuals.

In conclusion, a well-managed payroll system plays a crucial role in attracting and retaining talent. Competitive salaries, accurate payments, comprehensive benefits, and a positive work environment are all factors that can be facilitated by a reliable payroll system. By investing in a strong payroll system, businesses can enhance their ability to attract and retain skilled professionals who can contribute to their growth and success.

How GTL Works in Payroll

GTL stands for Group Term Life insurance and it is a type of insurance coverage provided by employers to their employees. In the context of payroll, GTL refers to the deduction made from an employee's paycheck to cover the cost of this insurance.

Group Term Life insurance is a benefit that provides financial protection to employees and their families in the event of the employee's death. It is typically offered as part of a broader employee benefits package and is often provided at no cost to the employee. However, in some cases, the employee may be required to contribute a portion of the premium towards the coverage.

The amount of the GTL deduction in payroll is based on several factors, including the employee's salary, age, and the coverage amount. The deduction is usually a fixed percentage of the employee's salary, and it is taken out of their paycheck on a regular basis, typically monthly or bi-weekly.

It's important to note that GTL coverage is generally only in effect for as long as the employee remains employed with the company. If the employee leaves the company, their coverage may end unless they choose to convert the policy or purchase an individual life insurance policy.

In summary, GTL in payroll refers to the deduction made from an employee's paycheck to cover the cost of Group Term Life insurance. It provides financial protection to employees and their families in the event of the employee's death, and the deduction amount is based on various factors.

Setting Up GTL Deductions

When it comes to payroll, setting up GTL deductions is an important task that employers need to understand. But what exactly does GTL mean in payroll and how does it work?

GTL stands for Group Term Life insurance, and it refers to a type of life insurance coverage that employers can offer to their employees. This coverage provides a death benefit to the employee's beneficiaries in the event of their death. The premiums for GTL insurance are typically deducted from the employee's paycheck on a regular basis.

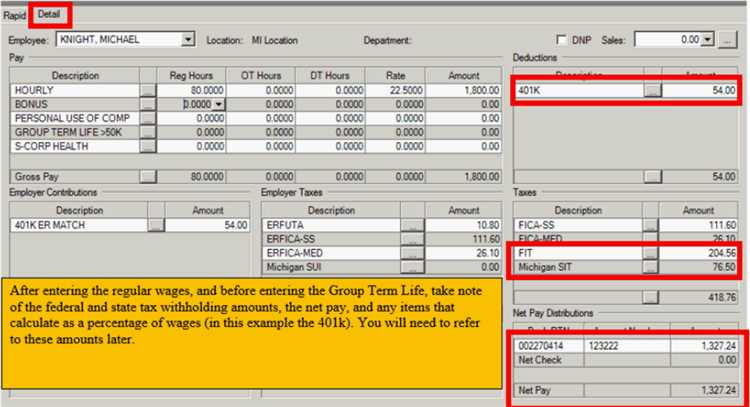

In order to set up GTL deductions, employers first need to determine the amount of coverage they want to offer and the associated premium rates. This information is typically provided by the insurance company offering the GTL policy. Employers also need to communicate the details of the GTL coverage and deductions to their employees, so that they understand how much will be deducted from their paycheck and for what purpose.

Once the coverage and premium rates are determined, employers can set up the GTL deductions in their payroll system. This usually involves adding a new payroll deduction code specifically for GTL, and entering the appropriate deduction amount based on the employee's coverage level. The payroll system will then calculate the deduction for each pay period and deduct it from the employee's paycheck accordingly.

To ensure accuracy, it's important for employers to regularly review and update the GTL deduction information in their payroll system. This includes making any necessary changes to coverage levels, premium rates, or employee status that may affect the deduction amount. Employers should also keep track of any changes in the GTL policy or provider, and adjust the deductions accordingly.

Setting up GTL deductions in payroll requires careful attention to detail and proper communication with employees. By understanding what GTL means in payroll and following the necessary steps to set up and maintain the deductions, employers can provide valuable life insurance coverage to their employees while ensuring accurate and consistent payroll processing.

Calculating GTL Premiums

In payroll, GTL (Group Term Life) refers to a type of insurance coverage provided by employers to their employees. It is often offered as part of a benefits package and helps to protect employees and their families in the event of death.

When calculating GTL premiums, several factors need to be taken into consideration. These factors can include the employee's age, salary, and the level of coverage they desire. Generally, the higher the salary and the older the employee, the higher the premium will be.

To calculate the premium, the employer will typically use a rate per thousand dollars of coverage. This rate is often based on the employee's age and is provided by the insurance company. The employer will then multiply the rate by the employee's salary to determine the annual premium amount.

For example, let's say an employee has a salary of $50,000 and their insurance company provides a rate of $0.50 per thousand dollars of coverage for someone in their age group. The employer would calculate the premium by multiplying $0.50 by $50 (the thousands of dollars in the employee's salary) to get a premium amount of $25 per year.

It's important to note that the premium for GTL insurance is often deducted from the employee's paycheck on a pre-tax basis. This means that the premium amount is taken out of their salary before taxes are applied, which can help lower their taxable income.

In summary, calculating GTL premiums in payroll involves considering factors such as the employee's age, salary, and desired coverage level. Using a rate provided by the insurance company, the employer can determine the annual premium amount by multiplying the rate by the employee's salary. This premium is typically deducted from the employee's paycheck on a pre-tax basis, providing them with financial protection and potential tax benefits.

GTL vs. Other Payroll Deductions

When it comes to payroll deductions, it's important to understand what GTL means and how it compares to other deductions. GTL stands for "Group Term Life," which is a type of life insurance coverage offered through an employer. This deduction is typically taken out of an employee's paycheck on a regular basis, similar to other deductions such as taxes and retirement contributions.

Unlike other payroll deductions, GTL specifically provides life insurance coverage to employees. It is designed to provide financial protection for an employee's beneficiaries in the event of their death. This means that if an employee were to pass away while covered under GTL, their beneficiaries would receive a payout from the insurance policy.

On the other hand, other common payroll deductions such as taxes and retirement contributions serve different purposes. Taxes are deducted from an employee's paycheck to fund government programs and services. Retirement contributions, on the other hand, are deducted to help employees save for their future retirement. These deductions do not provide life insurance coverage like GTL.

It's important for employees to understand what GTL means and how it compares to other payroll deductions. While GTL provides life insurance coverage, other deductions serve different purposes such as funding government programs or helping employees save for retirement. Employees should carefully review their payroll deductions to ensure they understand what they are paying for and what benefits they are receiving.

Comparing GTL to Health Insurance Deductions

When it comes to payroll deductions, it's important to understand what GTL and health insurance mean. GTL stands for Group Term Life insurance, while health insurance refers to coverage for medical expenses. Although both deductions come out of your paycheck, they serve different purposes.

GTL is a type of life insurance that provides a death benefit to your beneficiary in the event of your death. This benefit is typically based on a multiple of your annual salary. On the other hand, health insurance deductions cover the cost of medical expenses such as doctor visits, hospital stays, and medications. The amount deducted from your paycheck for health insurance is usually determined by the level of coverage you choose and the premium set by the insurance provider.

Unlike health insurance, GTL is typically a fixed deduction based on a certain percentage of your annual salary. Its purpose is to provide financial support to your loved ones in case of your untimely demise. Health insurance, on the other hand, helps cover the cost of medical care and treatment, ensuring that you have access to necessary healthcare services.

When comparing GTL to health insurance deductions, it's important to consider your individual needs and priorities. If you have dependents or want to provide financial protection for your loved ones, GTL may be a valuable addition to your payroll deductions. On the other hand, if you prioritize access to medical care and want to be prepared for unexpected healthcare expenses, health insurance deductions are essential.

Ultimately, the decision between GTL and health insurance deductions depends on your personal circumstances. It's important to review the coverage and benefits offered by each option and choose the one that aligns with your financial and healthcare needs.

GTL vs. Retirement Contributions

When it comes to understanding your payroll, it is important to know what GTL means and how it differs from retirement contributions. GTL stands for "Group Term Life" insurance, which is a type of life insurance offered by employers to their employees as part of their benefits package. Retirement contributions, on the other hand, refer to the amount of money that an employee sets aside from their paycheck to save for their retirement.

Both GTL and retirement contributions serve different purposes. GTL provides a death benefit to the employee's beneficiaries in the event of their untimely death, while retirement contributions help employees save for their future after they stop working. GTL is typically based on a multiple of the employee's salary, while retirement contributions may be determined by the employee's chosen contribution rate or a percentage of their salary.

While GTL is primarily a form of life insurance, retirement contributions are focused on long-term financial planning. GTL policies often have a limited term and may require renewal or conversion if the employee leaves their job. Retirement contributions, on the other hand, are typically invested in retirement savings accounts, such as 401(k) plans, and grow over time with investment returns. These contributions are often tax-advantaged, allowing employees to save for retirement with potentially lower tax liabilities.

In summary, understanding the difference between GTL and retirement contributions is vital for employees to make informed decisions about their financial well-being. GTL offers protection for beneficiaries in the event of an employee's death, while retirement contributions allow employees to save for their future. Both options have their own unique benefits and considerations, and it is crucial for employees to evaluate their individual needs and goals when making choices regarding their payroll and benefits.

Considerations for Employers

When it comes to payroll, understanding what GTL means is crucial for employers. GTL stands for Guaranteed Time Loss, which refers to a certain type of deduction from an employee's paycheck. This deduction is made when an employee is absent from work due to an authorized reason, such as illness, jury duty, or bereavement.

Employers need to be aware of the specific GTL policies in their organization and ensure that they are applied consistently and fairly. This includes clearly communicating these policies to employees and providing them with a clear understanding of what to expect in terms of GTL deductions.

In addition, employers should consider the impact of GTL on employees' morale and motivation. While GTL deductions are a necessary part of managing payroll, it is important to create a positive workplace culture that supports employees during times of absence.

Another important consideration for employers is compliance with labor laws and regulations. Employers must ensure that GTL deductions are in accordance with applicable laws and that appropriate records are maintained. This includes keeping track of the reasons for absences and ensuring that deductions are accurately reflected in employees' paychecks.

Finally, employers should also consider the potential impact of GTL deductions on employees' overall financial wellbeing. For some employees, these deductions may have a significant impact on their take-home pay and their ability to meet their financial obligations. Employers may want to provide resources, such as financial education or employee assistance programs, to support employees in managing their finances.

Employer Responsibilities with GTL

When it comes to payroll, GTL stands for Group Term Life insurance, which is a type of coverage provided by the employer to its employees. GTL is a valuable benefit that offers financial protection to employees by providing a death benefit in case of the individual's untimely demise.

As an employer, it is essential to understand your responsibilities regarding GTL. One of the primary responsibilities is to accurately calculate and deduct the premiums from your employees' wages. This is typically done on a pre-tax basis, meaning that the premiums are deducted from the employee's gross pay before taxes are calculated.

In addition to deducting premiums, employers also have the responsibility to ensure timely payment of the premiums to the insurance provider. This involves setting up a system to collect the deducted premiums from employees and remitting them to the insurance company within the specified timeframe.

Another key responsibility of employers is to provide employees with the necessary information about GTL coverage. This includes explaining the benefits and coverage details, as well as any exclusions or limitations that may apply. Employers should also make sure that employees understand the process for filing a claim and provide them with the necessary forms or resources.

Furthermore, employers should keep accurate records of employees' GTL coverage, including enrollment details, premium payments, and any changes in coverage (such as additions or terminations). These records are essential for tracking the status of employees' coverage and ensuring compliance with any reporting requirements.

Overall, employers play a crucial role in administering GTL coverage and ensuring that employees have access to this important benefit. By fulfilling their responsibilities, employers can support their employees' financial well-being and help protect their families in times of need.

Ensuring Compliance

In the world of payroll, it is crucial to ensure compliance with labor laws and regulations in order to avoid legal penalties. This is where GTL, or Guaranteed Time Loss, comes into play.

GTL is a method used by employers to track and calculate hours worked by employees. It stands for Guaranteed Time Loss because it guarantees that employees will receive payment for the time they have worked, regardless of any unforeseen circumstances that may cause a loss of time.

So what exactly does GTL mean in payroll? It means that employers need to accurately record and calculate the hours worked by their employees to ensure that they are being paid for every minute they spend on the job. This is especially important for hourly employees who are paid based on the number of hours they work.

To ensure compliance, employers may use various methods to track employee hours, such as time clocks, manual timesheets, or electronic systems. Regardless of the method, it is essential that the process is accurate and reliable.

Employers should also be aware of any applicable labor laws and regulations regarding overtime pay, breaks, and other working conditions. These laws vary from country to country and even from state to state, so it is important to stay informed and updated on the legal requirements.

Communicating GTL Benefits to Employees

When it comes to payroll, employees often wonder what GTL means and what it entails for them. It is important for employers to effectively communicate the benefits of GTL (Group Term Life) insurance to their employees.

GTL stands for Group Term Life insurance, which is a type of coverage offered by employers to their employees. This insurance provides a lump-sum payment to the designated beneficiary in the event of the employee’s death.

Employers can communicate the benefits of GTL to employees through various methods. One effective way is to provide a detailed presentation during employee orientation or onboarding. This presentation can explain the coverage amount, eligibility criteria, and the process for designating beneficiaries.

Additionally, employers can create informational materials such as brochures or handouts that outline the features and benefits of GTL coverage. These materials can be distributed to employees or made available on the company intranet.

Employers should also consider conducting training sessions or webinars where employees can ask questions and gain a better understanding of GTL benefits. This interactive approach allows employees to actively engage in the learning process and ensures that they have a clear understanding of the coverage.

Moreover, employers can utilize online platforms or intranet pages to provide access to frequently asked questions, policy documents, and contact information for GTL providers. This allows employees to easily access information and seek assistance whenever needed.

In conclusion, effective communication is key when it comes to informing employees about the benefits of GTL insurance. By providing thorough explanations, informative materials, and interactive training opportunities, employers can ensure that their employees understand the value of GTL coverage and can make informed decisions regarding their financial well-being and the protection of their loved ones.