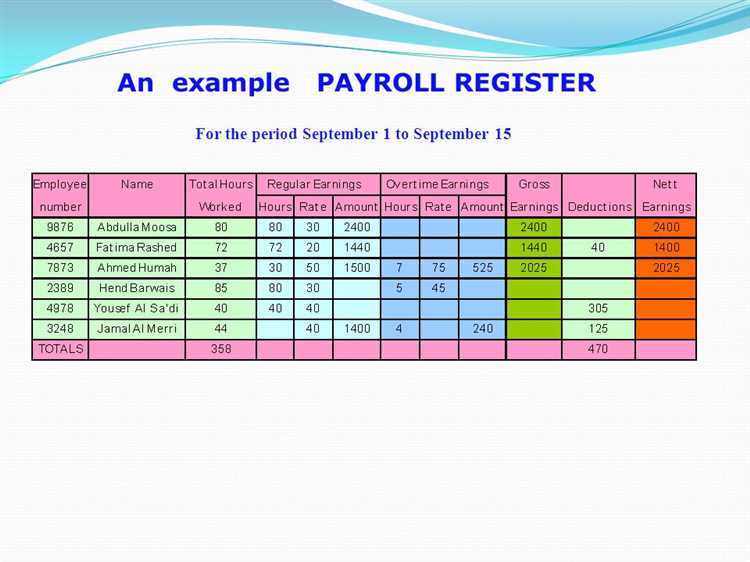

A payroll register is a document that records every detail related to an employee's compensation. It encompasses various components like wages, salary, overtime, benefits, taxes, and deductions. The purpose of a payroll register is to provide a comprehensive breakdown of an employee's pay, ensuring accuracy and transparency in the payroll process.

One of the key elements of a payroll register is the pay period. This refers to the specific timeframe for which an employee's wages are calculated, typically on a weekly, biweekly, or monthly basis. The register also includes the number of hours worked by each employee during the pay period, along with their hourly rate or salary.

Another important aspect of a payroll register is the calculation of gross pay. Gross pay is the total amount of money an employee is owed before any deductions are made. It includes the regular wages earned as well as any overtime or additional compensation. The register also takes into account any applicable taxes, including income tax, social security tax, and Medicare tax.

Furthermore, the payroll register includes information about various deductions that may be taken from an employee's paycheck. These deductions can include contributions to retirement plans, health insurance premiums, and other benefits. The register also keeps track of any other deductions, such as garnishments or child support payments, that may be required by law.

At the end of the pay period, the payroll register is used to calculate the net pay, which is the amount an employee actually receives in their paycheck. Net pay is determined by subtracting the total deductions from the gross pay. This allows employees to see a clear breakdown of how their wages are calculated and understand the impact of various deductions on their take-home pay.

In conclusion, a payroll register is a vital tool in managing the compensation of employees. It provides a detailed record of an employee's wages, deductions, and net pay, ensuring accuracy and transparency in the payroll process.

Understanding Payroll Register

A payroll register is a vital tool for managing the financial aspects of a business and ensuring accurate compensation for employees. It is a comprehensive record that contains essential information about employee earnings and deductions, providing an overview of the payroll process.

The payroll register includes details of gross pay, net pay, and taxes, along with hours worked, pay period dates, and other employee information. Gross pay refers to the total amount earned by an employee before deductions, while net pay is the amount an employee receives after deductions such as taxes and other withholdings.

Hours worked are recorded in the payroll register to calculate wages and, if applicable, overtime. The register also contains information about employee benefits and deductions, such as social security contributions or health insurance premiums. These details help maintain accurate records and ensure compliance with legal requirements.

Organizing payroll information in a register allows businesses to track employee compensation, understand wage expenses, and generate accurate paychecks. By keeping a record of each employee's earnings and deductions, businesses can easily verify the accuracy of payments and detect any discrepancies.

Additionally, the payroll register aids in generating reports and financial statements that provide crucial insights into overall labor costs and employee compensation. This information is essential for budgeting, forecasting, and making informed decisions regarding employee salaries and benefits.

In conclusion, a payroll register serves as a centralized and detailed record of employee compensation, hours worked, deductions, and other essential information. It plays a crucial role in managing payroll processes, ensuring accuracy, and facilitating financial analysis for businesses.

Definition of Payroll Register

A payroll register is a document or record that contains all the necessary information related to employee wages and compensation. It serves as a comprehensive account of an employee's pay, including their gross pay, net pay, hours worked, and any deductions or taxes that have been applied.

The payroll register typically includes details such as the employee's name, employee ID, job title, hourly rate or salary, hours worked during the pay period, and any overtime hours. It also includes information on taxes, deductions, and other withholdings, such as social security contributions or healthcare deductions.

The purpose of a payroll register is to ensure accurate record-keeping and facilitate the proper calculation and payment of wages to employees. It helps employers keep track of each employee's compensation, and it provides a reference for both the employer and the employee when reviewing paycheck details.

Using a payroll register allows businesses to maintain an organized and systematic approach to payroll management. It helps in documenting and verifying hours worked, ensuring that overtime is properly accounted for and compensated. The register also provides a basis for calculating taxes and other deductions accurately and can serve as a helpful tool during audits or when resolving any discrepancies.

Overall, a payroll register is an essential component of a company's payroll process. It ensures the accurate tracking and reporting of employee wages and provides a detailed record of each employee's compensation, including hours worked, wages earned, taxes, and deductions.

Purpose of Payroll Register

The purpose of a payroll register is to provide a comprehensive record of employee wages, deductions, and net pay for each pay period. It is a document that tracks information about employees, such as their hours worked, wages, overtime, and benefits. The register serves as a tool for employers to ensure accuracy in payroll processing and to maintain compliance with tax regulations.

The payroll register includes information about each employee's gross pay, which is the total amount earned before any deductions are made. This can include regular wages, overtime pay, and bonuses. The register also lists deductions, such as taxes, social security, and other benefits that are withheld from an employee's paycheck.

By using a payroll register, employers can track the hours worked by each employee, ensuring that they are compensated accurately. This helps to prevent errors and disputes related to wages. The register also provides a record of employee information, such as contact details and job titles, which can be helpful for administrative purposes.

Additionally, the payroll register can be used for tax reporting purposes. It contains the necessary information to calculate and report taxes withheld from employee wages. This helps employers to fulfill their legal obligations and stay in compliance with tax laws.

In summary, the purpose of a payroll register is to accurately track and record employee wages, deductions, and net pay for each pay period. It serves as a valuable tool for employers to ensure accuracy in payroll processing, maintain compliance with tax regulations, and provide comprehensive employee information.

Benefits of Using Payroll Register

Using a payroll register has several benefits for businesses. First and foremost, it helps ensure accurate and timely payment of employee wages. The register provides a clear overview of each employee's hours worked, gross pay, and deductions, allowing employers to calculate net pay more efficiently.

Additionally, the payroll register helps businesses track and record various important employee information. This includes employee names, identification numbers, and job titles. By maintaining this information in the register, employers can easily access and update employee records as needed.

The payroll register also helps businesses comply with legal requirements. It provides a detailed breakdown of various taxes withheld from employee wages, such as social security and income tax. This information is essential for accurately reporting and paying these taxes to the relevant authorities.

Furthermore, the register allows businesses to track and manage overtime hours and compensation more effectively. By documenting the hours worked and the corresponding rates, employers can ensure that employees are properly compensated for their extra efforts.

The payroll register can also serve as a reference tool for employees. Having a clear and transparent record of their hours worked, wages, and deductions can help employees understand their pay and address any discrepancies or concerns.

In summary, the benefits of using a payroll register include accurate and timely payment of wages, efficient tracking of employee information, compliance with legal requirements, proper management of overtime hours, and increased transparency for employees.

How to Create a Payroll Register

Creating a payroll register involves several steps to ensure accurate record-keeping and compliance with employment laws and regulations. Here is a step-by-step guide on how to create a payroll register:

- Collect employee information: Gather all necessary information about your employees, including their names, addresses, Social Security numbers, and employment status.

- Calculate gross pay: Determine the gross pay for each employee by multiplying their hourly wage or salary by the number of hours worked during the pay period. Include any additional compensation, such as overtime pay, bonuses, or commissions.

- Calculate deductions: Subtract applicable deductions from the gross pay, such as federal and state income tax, Social Security tax, and any voluntary deductions like healthcare premiums or retirement contributions.

- Calculate net pay: Subtract the total deductions from the gross pay to calculate the net pay, which is the amount the employee will receive on their paycheck.

- Record employee hours and wages: Keep track of the hours worked by each employee and their corresponding wages on a timecard or spreadsheet. Update this information for each pay period.

- Create a payroll register: Compile all employee information, gross pay, deductions, and net pay into a payroll register. This document serves as a comprehensive record of each employee's compensation and tax obligations.

- Review for accuracy: Double-check all calculations and verify that the information entered in the payroll register is accurate. This step is crucial to avoid errors in employee pay and ensure compliance with tax laws.

- Store and maintain records: Store the payroll register securely and maintain it for the required period, typically at least three years. This allows for easy access in case of audits or employee inquiries.

By following these steps, you can create an organized and accurate payroll register that effectively tracks employee wages, benefits, deductions, and taxes. This helps ensure that your employees are paid correctly and that you maintain compliance with relevant employment laws and regulations.

Gather Employee Information

In order to accurately process payroll, it is important to gather employee information. This includes details such as their wages, hours worked, and compensation. Each employee's information should be recorded in the payroll register, which serves as a comprehensive record of all payroll-related transactions.

When collecting employee information, it is crucial to note their work hours, including any overtime worked. This information will be used to calculate their gross pay, which is the total amount earned before any deductions. Additionally, employee information should include their social security number, tax filing status, and any applicable deductions or withholdings.

It is important to ensure that all employee information is accurate and up to date. Any changes to an employee's salary, tax information, or benefits should be promptly recorded in the payroll register. This can be done by updating the employee's record in the register or by adding a separate entry for the changes.

The payroll register may also be used to track other payroll-related information, such as vacation or sick time. This can be recorded as part of the employee's regular hours or as a separate category. By keeping track of this additional information, employers can ensure that employees are compensated accurately for their time.

In conclusion, gathering employee information is a crucial step in the payroll process. It allows employers to accurately calculate wages, taxes, and deductions, and ensures that employees receive the correct net pay. By maintaining a comprehensive payroll register, employers can easily track and manage their payroll transactions, providing transparency and accuracy in the payment of employees.

Calculate Wages and Deductions

Calculating wages and deductions is a crucial step in the payroll process. The payroll register is the central document used to record employee information, hours worked, and compensation details for each pay period.

To determine an employee's wages, you need to gather relevant data such as the employee's timecards or hours worked. The register then organizes this information, making it easier to calculate the employee's gross pay.

Gross pay includes the employee's regular salary or hourly rate, as well as any applicable overtime pay. The register helps track these different components, ensuring accurate calculations for each employee.

In addition to wages, the register is also used to track various deductions from an employee's paycheck. This includes taxes, such as federal income tax and state tax, as well as mandatory deductions like social security and Medicare contributions.

The register can also account for voluntary employee benefits or deductions, such as health insurance premiums or retirement plan contributions. These deductions are subtracted from the employee's gross pay to arrive at the net pay, or the amount the employee will receive in their paycheck.

By using a payroll register, businesses can ensure proper calculation of employee wages and deductions, reducing the risk of errors or discrepancies. The register serves as a detailed record of each employee's compensation, providing a clear overview of their total earnings and deductions for each pay period.

Organize Employee Records

Keeping employee records organized is crucial for efficient payroll management. A payroll register is a valuable tool that helps you maintain and track important information about your employees, such as their wages, hours worked, and deductions. By utilizing a payroll register, you can easily access and update employee information whenever necessary.

The payroll register allows you to record employee details, including their name, address, social security number, and compensation type. It keeps track of the hours worked by each employee, distinguishing between regular hours and any overtime. This information is essential for accurately calculating wages and overtime payments.

In addition to tracking wages, a payroll register also enables you to monitor employee benefits and deductions. Whether it's analyzing tax withholdings, healthcare contributions, or retirement savings, the register provides a comprehensive view of each employee's net pay and the deductions that affect it.

By using the payroll register, you can ensure that employee records stay organized and up-to-date. It allows you to easily search for specific employee information, such as pay rates, hours worked, or pay periods, without the need to sift through piles of paperwork. The register also provides a clear overview of your payroll expenses, including gross pay and net pay for each employee, helping you stay on top of your budget.

Overall, the payroll register simplifies the management of employee records. It streamlines the process of calculating payroll, efficiently tracks hours worked, helps in tax reporting, and ensures accurate compensation for employees. By maintaining an organized and detailed payroll register, you can ensure smooth functioning of your payroll system and maintain compliance with legal requirements.

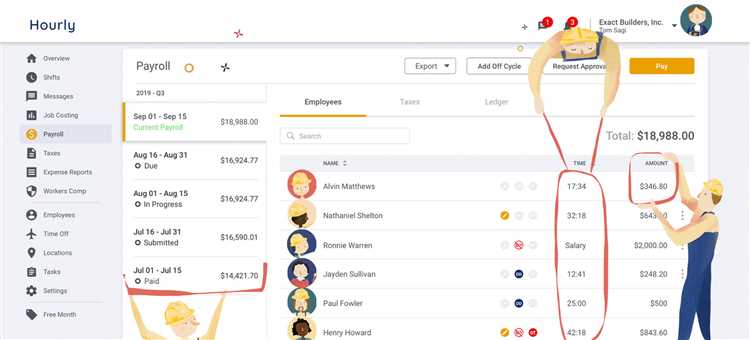

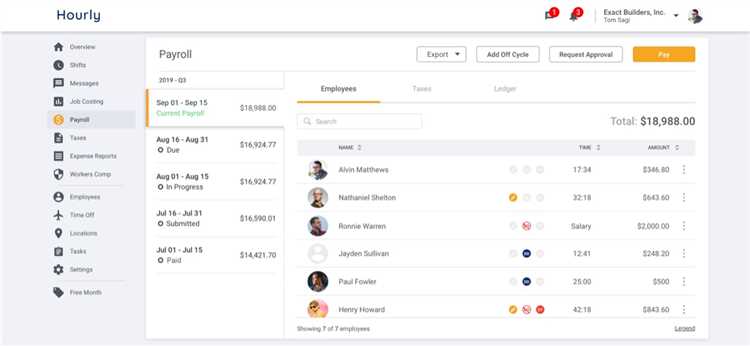

Using the Payroll Register

When using the payroll register, the first step is to gather all relevant employee information, such as their timecards and hours worked. This includes recording the number of hours each employee has worked during the pay period.

Next, the gross pay for each employee must be calculated by multiplying their hourly wage by the number of hours worked. This is the total amount of money the employee has earned before any deductions or taxes are withheld.

After determining the gross pay, it is important to calculate the appropriate taxes and deductions for each employee. This may include federal and state income taxes, social security taxes, and any other deductions that the employee has authorized. These deductions are subtracted from the gross pay to arrive at the net pay, which is the amount the employee will actually receive in their paycheck.

The payroll register also allows for the tracking of employee benefits and compensation. This can include any additional payments or benefits that an employee is entitled to, such as bonuses, overtime pay, or vacation time. These amounts can be added to the gross pay to calculate the total compensation for each employee.

By using the payroll register, employers can effectively manage their payroll process and ensure that employees are paid accurately and on time. It provides a comprehensive overview of each employee's wages, deductions, and net pay, making it easier to track and record payroll information.

Recording Employee Hours and Wages

When it comes to managing payroll, one of the most important aspects is recording employee hours and wages accurately. This involves keeping track of the number of hours worked by each employee, as well as their compensation for those hours.

To record employee hours, employers typically use timecards or electronic timekeeping systems. These tools allow employees to clock in and out and provide an accurate record of the hours worked. It is important for employees to accurately record their hours, as this information is used to calculate their wages and any additional compensation such as overtime pay.

Once the hours worked are recorded, employers can calculate the employee's gross pay. This includes the regular hourly wage multiplied by the number of hours worked, as well as any additional compensation for overtime hours. Overtime pay is typically calculated as time and a half, meaning employees receive one and a half times their regular hourly wage for each hour worked beyond the standard hours in a pay period.

From the employee's gross pay, various deductions are made to determine their net pay. These deductions may include taxes, such as income tax and social security, as well as any withholdings for benefits or other relevant deductions. The net pay is the amount the employee ultimately takes home in their paycheck.

Recording employee hours and wages accurately is crucial for both employers and employees. It ensures that employees are paid correctly and in accordance with labor laws, and provides an accurate record for tax purposes. Additionally, it helps employers manage their payroll expenses and budget effectively.

Tracking Employee Benefits and Deductions

When it comes to managing payroll, tracking employee benefits and deductions is a crucial component. Understanding and maintaining accurate records of these aspects of compensation is essential for both employers and employees.

Employee benefits encompass a range of additional forms of compensation beyond wages. These can include health insurance, retirement plans, paid time off, and more. It is important to keep track of the specific benefits each employee is entitled to, as well as any changes or updates that may occur over time.

Similarly, tracking deductions is necessary to ensure accurate payroll calculations. Deductions can include taxes, insurance premiums, retirement contributions, and other withholdings. By accurately tracking these deductions, employers can calculate an employee's net pay, which is the amount they actually receive after deductions have been taken out.

There are various tools and methods available to track employee benefits and deductions. One common approach is to maintain a payroll register, which is a detailed record of employee information, wages, hours worked, and other relevant data. This register can be updated on a regular basis, such as at the end of each pay period, to reflect any changes or additions to benefits or deductions.

Another helpful tool for tracking employee benefits and deductions is a timecard or timesheet. This allows employees to document the hours they have worked, including any overtime, which can impact their compensation. Employers can then use this information to calculate wages and apply any necessary deductions.

In addition to tracking benefits and deductions, it is also important for employers to stay compliant with relevant tax laws and regulations. This includes accurately reporting and remitting payroll taxes, such as social security and Medicare taxes, on behalf of employees.

In conclusion, carefully tracking employee benefits and deductions is essential for managing payroll effectively. By maintaining accurate records and utilizing tools such as payroll registers and timecards, employers can ensure that employees are properly compensated and that deductions are processed correctly. This contributes to a fair and transparent payroll system for both employers and employees.

Generating Payroll Reports

Generating payroll reports is an essential part of managing the financial aspect of a business. These reports provide valuable insights into the company's payroll expenses and help ensure accurate and timely payment to employees. Payroll reports can encompass a wide range of information, including employee names, wages, hours worked, benefits, taxes, and more.

One key component of a payroll report is the employee information, which includes details such as name, position, and employee ID. This information helps track individual employee salaries and ensures that the correct compensation is provided for each employee.

The report also includes details about wages and salary. It outlines the gross pay, which is the total amount an employee earns before deductions such as taxes and benefits. The report may also include overtime hours and pay, providing a comprehensive view of the employee's compensation.

Additionally, payroll reports often include tax information. This includes details on federal, state, and local taxes deducted from an employee's paycheck, as well as contributions to social security and Medicare. These tax details are crucial for both the employee and the employer to ensure compliance with tax laws and regulations.

Payroll reports can be generated for a specific pay period, typically a week or a month. This allows businesses to track payroll expenses over time and compare them to budget projections. The reports can also be customized to provide specific details or summaries, such as department-level breakdowns or overall company payroll costs.

Overall, generating payroll reports helps businesses effectively manage their payroll expenses and maintain accurate records of employee compensation. It ensures that employees are paid accurately and provides insights into the company's financial status. By regularly reviewing and analyzing payroll reports, businesses can make informed decisions regarding employee compensation and budget allocation.

Compliance and Legal Requirements

In order to ensure compliance with all applicable laws and regulations, businesses must maintain accurate records and adhere to legal requirements when it comes to payroll. This includes accurately tracking hours worked, salary, and gross pay for each employee. Employers must also maintain employee information, such as timecards and tax withholding details, to ensure accurate calculations of net pay.

One key aspect of compliance is accurately calculating and withholding taxes from employee paychecks. This can include federal, state, and local taxes, as well as deductions for benefits and compensation programs. Employers must stay informed of changes to tax laws and ensure that payroll calculations are in line with current legal requirements.

In addition to tax requirements, employers must also comply with social security and wage laws. This includes accurately reporting wages and deductions, as well as ensuring proper payment of overtime and adherence to minimum wage laws. Failure to comply with these regulations can result in penalties and legal repercussions for the business.

Payroll registers play a crucial role in maintaining compliance with these legal requirements. By accurately recording and tracking all relevant payroll information for each employee, businesses can ensure that they are meeting their obligations and avoiding potential legal issues. Payroll registers provide a comprehensive record of each employee's compensation, deductions, and tax contributions over a specified pay period, making it easier for employers to stay in compliance with all applicable laws and regulations.

Ensuring Payroll Accuracy and Compliance

Accurate and compliant payroll is crucial for businesses to maintain financial stability and legal compliance. A payroll register is a valuable tool that helps in ensuring payroll accuracy and compliance. This register contains detailed employee information and tracks various payroll components such as salary, overtime, social security, compensation, deductions, and benefits.

One of the key aspects of ensuring payroll accuracy is accurately recording the hours worked by each employee. This is done by tracking the hours worked through timecards or other timekeeping systems. The payroll register helps to consolidate this information and calculate the gross pay for each employee based on their hourly wages and the hours worked.

In addition to tracking hours worked, the payroll register also keeps a record of various deductions such as taxes, retirement contributions, and insurance premiums. These deductions are subtracted from the gross pay to arrive at the net pay, which is the amount that the employee receives in their paycheck.

It is important for businesses to comply with all relevant labor laws and regulations when processing payroll. The payroll register provides a centralized platform where all relevant information is stored, making it easier to ensure compliance with legal requirements. This includes adhering to minimum wage laws, accurately calculating overtime, and properly applying tax rates.

By maintaining an accurate and compliant payroll register, businesses can avoid legal and financial issues. The register serves as a comprehensive record of payroll transactions, allowing businesses to easily keep track of employee wages, benefits, and deductions. It also provides a historical record that can be used for auditing purposes or resolving any disputes that may arise.

In summary, a payroll register is an essential tool for businesses to ensure payroll accuracy and compliance. It helps in recording and calculating various payroll components, tracking employee hours, deductions, and benefits. By maintaining an accurate and compliant payroll register, businesses can avoid risks and maintain financial stability.

Meeting Tax Reporting Obligations

When it comes to meeting tax reporting obligations, a payroll register plays a crucial role in ensuring accuracy and compliance. By keeping a detailed record of employee information, compensation, and deductions, the register serves as a comprehensive source of data for calculating and reporting taxes.

In the payroll register, each employee's wages, benefits, and deductions are recorded. This includes information such as their salary or hourly rate, hours worked, gross pay, and net pay. Additionally, any overtime hours and corresponding pay are also documented to accurately calculate taxes owed.

One important aspect of tax reporting is the withholding of payroll taxes, including federal income tax, social security tax, and Medicare tax. The payroll register helps monitor and track these deductions for each employee, ensuring that the correct amount is withheld and reported to the relevant tax authorities.

Another tax reporting obligation is the filing of tax forms, such as W-2s and 1099s. The payroll register provides the necessary data to complete these forms, including employee wages, withholding amounts, and any other required information. By maintaining an accurate and up-to-date register, employers can fulfill their tax reporting obligations efficiently.

The payroll register can also be used for tax audits or inquiries from tax authorities. Having a detailed record of employee compensation and deductions makes it easier to respond to any inquiries or provide supporting documentation if needed.

In conclusion, a payroll register is a valuable tool for businesses in meeting their tax reporting obligations. It ensures accuracy in calculating and withholding taxes, provides necessary data for tax forms, and helps respond to tax inquiries or audits. By utilizing a payroll register effectively, businesses can stay compliant with tax regulations and avoid any penalties or fines.

Understanding Employee Rights and Privacy

Employee rights and privacy are important considerations in the workplace. Employers need to understand their obligations to protect employee information, pay wages accurately, and respect employee privacy.

When it comes to payroll, employers should ensure that they maintain accurate records of employee information, such as hours worked, gross pay, and deductions. This information should be securely stored in a payroll register, which serves as a comprehensive record of employee earnings and deductions over a specific pay period.

Employees have the right to receive accurate and timely information about their pay. This includes details about their net pay, which is the amount they receive after deductions such as taxes, benefits, and other withholdings. Employers should provide employees with a detailed paycheck that outlines their wages, deductions, and any additional compensation, such as overtime pay.

It is important for employers to handle employee information with utmost care and respect their privacy. Personal information, such as social security numbers and salary details, should be kept confidential and protected from unauthorized access. Employers should also ensure that employees' personal information is only used for legitimate business purposes, such as payroll processing and tax reporting.

Employers should also be aware of legal requirements when it comes to payroll deductions. Certain deductions, such as taxes and social security contributions, are required by law. However, employers should not make deductions from an employee's wages without their consent, unless it is required by law or court order.

In conclusion, understanding employee rights and privacy is crucial for employers to create a fair and respectful work environment. By maintaining accurate payroll records, protecting employee information, and respecting privacy, employers can ensure compliance with legal requirements and foster a positive employee-employer relationship.