ABN, which stands for Australian Business Number, is a unique 11-digit number issued by the Australian government to identify businesses and other entities for various purposes. It is an essential identification number for any individual or entity carrying out business activities in Australia.

The ABN is used for various purposes, including tax registration, goods and services tax (GST) registration, and as a sole trader or partnership identification. The ABN is also used by the Australian Securities and Investments Commission (ASIC) to identify companies and other registered business entities.

Individuals who operate a business as a sole trader or partnership are required to obtain an ABN. This number allows the individual or partnership to register for GST if their business turnover exceeds the threshold set by the government. Having an ABN also enables sole traders and partnerships to establish their business as a separate legal entity for tax and other business purposes.

Companies in Australia are also required to have an ABN. The ABN serves as the primary identification number for companies registered with ASIC. In addition to an ABN, companies also have an Australian Company Number (ACN) to further distinguish their legal entity from other business structures.

Entities such as trusts and government organizations also need to have an ABN. The ABN allows trusts to register for tax purposes and ensures government organizations are appropriately identified for business transactions and reporting.

In summary, the ABN is a crucial requirement for any individual or entity operating a business in Australia. It serves as a unique identification number for tax, registration, and business purposes, ensuring that businesses are properly identified by the government and other entities.

What is ABN in Australia: Explained All You Need to Know

The ABN, or Australian Business Number, is a unique identification number that is used by the government of Australia to identify businesses and other entities for tax purposes. It is a crucial requirement for any business or entity that wants to operate in Australia.

The ABN serves as a central registration number for businesses and entities, allowing them to register for Goods and Services Tax (GST), among other things. It is a way for the government to track and monitor business activities and ensure compliance with tax laws.

Obtaining an ABN is necessary for various types of entities, including sole traders, companies, partnerships, trusts, and other organizations. Each entity must apply for an ABN through the Australian Business Register (ABR) and meet certain criteria to be eligible for registration.

For individuals operating as sole traders, the ABN serves as both a business and tax identification number. It allows them to separate their personal finances from their business activities and ensures that they can claim tax deductions and credits related to their business.

Companies, on the other hand, have a separate identification number called the Australian Company Number (ACN). The ACN is unique to each registered company and is used for legal and administrative purposes, while the ABN is used primarily for tax-related matters.

Any entity that is registered for GST must also have an ABN. The ABN is linked to the entity's GST registration and is used to report and remit GST to the Australian Taxation Office (ATO). It is essential for businesses to maintain accurate and up-to-date ABN information to ensure proper compliance with GST laws.

In summary, the ABN is a crucial identification number for businesses and entities operating in Australia. It ensures proper tax compliance and allows the government to track and monitor business activities. Whether you are a sole trader, company, partnership, or trust, obtaining an ABN is an essential step in establishing and operating a business in Australia.

Understanding ABN

The Australian Business Number (ABN) is a unique identification number assigned to each business entity in Australia. It serves as a way to identify businesses for various tax and government purposes.

An ABN is issued by the Australian Business Register (ABR), which is operated by the Australian Taxation Office (ATO). In order to obtain an ABN, an individual or company must meet certain criteria and complete the registration process.

Businesses that need an ABN include sole traders, partnerships, companies, and trusts. An ABN is required for performing activities such as registering for Goods and Services Tax (GST), applying for certain government licenses and permits, or dealing with other businesses.

The ABN consists of 11 digits and is unique to each business. It is used by government agencies, businesses, and other organizations to identify a particular entity when conducting transactions or carrying out business-related activities.

When applying for an ABN, it is important to provide accurate and up-to-date information about the business or individual. The information provided during the registration process may be cross-checked with other government databases, such as the Australian Securities and Investments Commission (ASIC) or the Australian Business Register (ABR).

Having an ABN is essential for businesses operating in Australia, as it enables them to establish their identity, meet their tax obligations, and engage in various commercial activities. It is an important tool for both businesses and the government to ensure transparency and compliance in the business environment.

What is ABN

ABN stands for Australian Business Number. It is a unique 11-digit number that serves as a registration and identification number for businesses and other entities in Australia.

An ABN is required for any individual, partnership, trust, or company that wants to conduct business in Australia.

Having an ABN allows the Australian government to track and regulate business activities and ensures that businesses meet their tax obligations.

A sole trader, which is an individual running a business on their own, must have an ABN to operate legally.

An ABN is also necessary for a partnership, which is an arrangement where two or more individuals or entities share ownership of a business.

In addition to the ABN, businesses that have a GST (Goods and Services Tax) turnover of $75,000 or more per year must also register for the GST.

The ABN, along with the GST registration number, allows businesses to claim GST credits and comply with tax regulations.

The ABN is administered by the Australian Securities and Investments Commission (ASIC) and is used to identify a business or entity across various government systems and processes.

It is important for businesses to ensure their ABN details are kept up to date to avoid any issues with taxation or government regulations.

Purpose of ABN

The Australian Business Number (ABN) serves as a unique identifier for a business or entity in Australia. It is a 11-digit number issued by the Australian government to identify different entities and transactions for tax purposes. Unlike the Australian Company Number (ACN) which is issued by the Australian Securities and Investments Commission (ASIC) for proprietary companies, the ABN is used for a broader range of entities including sole traders, partnerships, trusts, and government entities.

The primary purpose of the ABN is for businesses and entities to register under the Australian Business Register. By having an ABN, a business can easily identify itself when dealing with other businesses and government agencies. It also allows businesses to apply for the Goods and Services Tax (GST) registration, which is a tax imposed on the supply of most goods and services in Australia.

For individuals operating as a sole trader or partnership, obtaining an ABN is mandatory in order to operate legally. The ABN acts as an identification number for these individuals and allows them to carry out business activities and transactions in their own name.

For companies, having an ABN is not mandatory, but it is often required for certain business activities and transactions. It provides a way for the government and other businesses to identify the company and its associated operations.

The ABN is an essential tool for conducting business in Australia. It enables businesses and entities to operate legally, engage in transactions with other entities, and comply with tax obligations. It plays a crucial role in the identification and registration of businesses, helping to ensure the integrity and transparency of the Australian business environment.

ABN Registration

ABN registration is the process of obtaining an Australian Business Number (ABN) for your business. An ABN is a unique 11-digit number that identifies your business to the government and other entities. It is a requirement for any sole trader, individual, partnership, company, or trust entity operating a business in Australia.

To register for an ABN, you need to complete an application form with the Australian Taxation Office (ATO). The registration process is free, and you can apply online, by phone, or by mail. When applying, you will be asked to provide details about your business, such as the legal structure, trading name, and type of activities.

Having an ABN has several benefits. Firstly, it is essential for tax purposes, as it enables you to claim Goods and Services Tax (GST) credits, lodge activity statements, and comply with tax obligations. Additionally, many government agencies, as well as other businesses, require an ABN to enter into contracts or receive payments.

It's important to note that an ABN is different from an Australian Company Number (ACN). While an ACN is issued to companies registered with the Australian Securities and Investments Commission (ASIC), an ABN is used by all types of businesses, including sole traders and partnerships.

| Step | Description |

|---|---|

| 1 | Decide on the legal structure of your business, such as sole trader, partnership, company, or trust. |

| 2 | Gather the necessary information, such as your Tax File Number (TFN), Australian Business Number (ABN), and Australian Company Number (ACN) if applicable. |

| 3 | Complete the ABN application form, providing accurate details about your business. |

| 4 | Submit the application to the Australian Taxation Office (ATO) online, by phone, or by mail. |

| 5 | Wait for the ABN to be processed, which usually takes around 28 days. |

| 6 | Receive your ABN and start using it for business transactions and dealings. |

How to Register for ABN

To register for an ABN (Australian Business Number), you must first determine the type of entity you are registering. ABN registration is available for various types of businesses, including sole traders, partnerships, proprietary limited companies, and trusts. Each entity type has specific requirements for ABN registration.

If you are a sole trader or individual operating a business, you can register for an ABN online through the Australian government's Australian Business Register (ABR) website. The registration process requires you to provide personal details, business name, address, and other relevant information.

If you are registering a partnership, the process is similar to the sole trader registration. Each partner needs to provide their individual details and the partnership's business details. It is important to note that each partner must have their own individual tax file number (TFN).

For a proprietary limited company, the ABN registration is done through the Australian Securities and Investments Commission (ASIC). Companies will need to obtain an Australian Company Number (ACN) before they can apply for an ABN. The ACN serves as the unique identifier for the company.

Trusts also require an ABN registration if they conduct business activities. The trustee or administrator of the trust needs to provide their details as well as the trust's business information. It is important to ensure the trust is legally established before applying for an ABN.

Once you have completed the registration process and obtained your ABN, it is important to keep your information up to date. Any changes in your business details, such as address or contact information, should be updated in the Australian Business Register. This will ensure accurate identification and proper communication from the government, including for tax purposes, goods and services tax (GST), and other relevant obligations.

Eligibility for ABN

To be eligible for an ABN (Australian Business Number), an entity or individual must meet certain criteria.

- Sole traders: Sole traders are eligible for an ABN if they are carrying on a business in Australia.

- Partnerships: Partnerships are eligible for an ABN if they are carrying on a business in Australia.

- Companies: Companies are eligible for an ABN if they are registered with the Australian Securities and Investments Commission (ASIC) and are carrying on a business in Australia.

- Trusts: Trusts are eligible for an ABN if they are carrying on a business in Australia and meet certain identification requirements.

In addition to the above, entities and individuals may also need an ABN for tax purposes. And they may also need an ABN to register for Goods and Services Tax (GST) purposes.

When applying for an ABN, entities and individuals are required to provide details such as their Australian Company Number (ACN) or Australian Business Number (ABN), depending on their entity type.

It is important to note that the eligibility criteria for an ABN are determined by the Australian government and may be subject to change. Therefore, it is important to always check the latest requirements before applying for an ABN.

Documents Required for ABN Registration

When applying for an ABN (Australian Business Number) registration in Australia, you will need to provide certain documents and information. This is to ensure that the Australian government can accurately identify and register your business entity. Here are the key documents required for ABN registration:

- Identification Documents: You will need to provide identification documents for the individual or entity applying for the ABN. This may include a passport, driver's license, or other form of government-issued identification.

- ASIC Documents: If you are registering as a sole trader, partnership, or company, you will need to provide documentation from the Australian Securities and Investments Commission (ASIC). This may include an Australian Company Number (ACN) or other ASIC-generated documents.

- Tax and GST Registration: If you are registering for an ABN, it is likely that you will also need to register for other tax obligations, such as Goods and Services Tax (GST). You may be required to provide documentation related to your tax and GST registration.

- Business and Entity Information: The ABN registration process will also require you to provide information about your business entity, such as the business name, address, and type of entity (sole trader, company, partnership, trust, etc.).

It is important to have these documents and information ready when applying for an ABN in Australia. Failure to provide the required documentation may result in delays or difficulties in obtaining the ABN. Make sure to double-check the specific requirements and documentation needed based on your business type and circumstances.

ABN Benefits

Trust: An ABN allows a trust to be registered as a separate entity for taxation purposes. This helps to distinguish the trust from its beneficiaries.

Sole Trader: Registering for an ABN is essential for a sole trader as it allows them to identify themselves as a business, separate from their personal finances.

GST: An ABN is required if a business wants to register for the Goods and Services Tax (GST). Having an ABN enables businesses to comply with tax obligations related to GST.

Company: When registering a company, obtaining an ABN is necessary to identify the company as a separate legal entity.

Individual: Even as an individual, having an ABN can be beneficial as it allows freelancers and contractors to invoice clients and claim business-related expenses.

Identification: An ABN provides a unique number for businesses or entities, which is often required for various transactions or dealings with government agencies.

Proprietary: If a proprietary (private) company wishes to take advantage of the simplified GST reporting option, having an ABN is necessary.

Tax: Having an ABN simplifies the process of lodging tax returns and fulfilling other tax-related obligations.

Government: Many government departments and agencies require businesses to have an ABN in order to conduct transactions or apply for permits/licenses.

ASIC: When registering a company, the Australian Securities and Investments Commission (ASIC) requires an ABN as part of the registration process.

Australia: An ABN is unique to Australia and is a distinct identifier for businesses operating in the country.

Number: An ABN is a unique number issued by the Australian Business Register (ABR) to identify businesses and entities.

Partnership: Registering for an ABN is necessary for partnerships as it helps to identify the partnership as a separate entity for tax and legal purposes.

ABN Register: The ABN Register is a publicly available database where businesses and entities can search and verify the ABN details of other registered entities.

ACN: The Australian Company Number (ACN) is a nine-digit number issued to companies by ASIC, and having an ABN is a requirement for companies to obtain an ACN.

Registration: Registering for an ABN is a straightforward process that can be done online, and it is a necessary step for businesses and entities operating in Australia.

Benefits for Businesses

Having an ABN (Australian Business Number) offers numerous benefits for businesses operating in Australia. Here are some key advantages:

- Entity Identification: An ABN serves as a unique identifier for your business, allowing you to distinguish it from other entities.

- Tax Registration: An ABN is required for tax registration purposes. It enables your business to legally operate for income tax and other tax-related purposes.

- Sole Trader Registration: If you are a sole trader, obtaining an ABN is essential as it is required to register as a sole trader.

- Company Registration: For companies and proprietary limited companies, having an ABN is a prerequisite for company registration.

- Partnership Registration: Partnerships are also required to have an ABN for registration purposes.

- Trust Registration: Trusts, including discretionary and unit trusts, need to have an ABN for registration with the Australian Securities and Investments Commission (ASIC).

- GST Registration: If your business has a turnover of $75,000 or more per year, an ABN is necessary for Goods and Services Tax (GST) registration.

- Government Recognition: Having an ABN shows that your business is recognized by the Australian government and allows you to interact with government agencies, banks, and other institutions.

By obtaining an ABN, businesses in Australia gain numerous benefits related to identification, tax registration, company and partnership registrations, GST, and government recognition. It is an essential requirement for businesses operating in Australia.

Benefits for Individuals

Individuals in Australia can benefit from having an ABN (Australian Business Number) in a number of ways. Here are some of the benefits:

- Tax Identification: An ABN is a unique identifier for tax purposes. By having an ABN, individuals can easily manage their tax obligations with the Australian Taxation Office (ATO).

- Registering as a Sole Trader: If an individual wants to run a business as a sole trader, they will need to register for an ABN. This is a simple process that can be done online, and it allows individuals to legally operate and trade in Australia.

- Identification for Government Services: Having an ABN can also serve as a form of identification when dealing with government services and agencies. It can simplify processes such as applying for grants or accessing certain public resources.

- Working with Companies and Partnerships: If an individual plans to enter into a business relationship with a company or partnership, having an ABN may be required. It allows for easier identification and communication between parties.

- Registering a Trust: For individuals who operate or manage a trust, having an ABN is necessary for the registration process. This ensures that the trust is recognized as a separate legal entity.

- Business Credibility: Having an ABN can enhance an individual's credibility as a business entity. It shows that they are registered with the Australian Securities and Investments Commission (ASIC) and are a legal entity in Australia.

- Access to Goods and Services Tax (GST): By having an ABN, individuals can register for GST if their business activities meet the requirements. This allows them to charge and claim GST on eligible goods and services.

Overall, having an ABN in Australia provides individuals with various benefits, including easier tax management, legal recognition, and access to government services. It is an essential requirement for those looking to engage in business activities or operate as a sole trader, company, partnership, or trust.

ABN Responsibilities

When it comes to the Australian Business Number (ABN), there are several responsibilities that individuals and entities, such as a partnership, business, trust, or sole trader, need to be aware of.

First and foremost, obtaining an ABN is crucial for the identification and registration of your business or entity. The ABN serves as a unique identification number for tax purposes and helps in managing your tax obligations.

One of the main responsibilities of having an ABN is the requirement to register for and remit Goods and Services Tax (GST) if your business or entity meets the threshold. This ensures that you comply with the tax regulations and contribute to the Australian economy.

It's important to note that an ABN is separate from the Australian Company Number (ACN) and does not automatically register you as a proprietary company. If you wish to operate as a company, you must register with the Australian Securities and Investments Commission (ASIC).

As an individual, if you operate as a sole trader, you are required to apply for an ABN to conduct your business activities. This allows you to report your business income and expenses correctly and facilitates the preparation of your personal tax return.

Overall, whether you are an individual or an entity, obtaining and maintaining an ABN comes with various responsibilities, including accurate reporting, tax compliance, and meeting the obligations set by the Australian Taxation Office (ATO).

Reporting Obligations

When you have an ABN in Australia, there are certain reporting obligations that you need to be aware of. These obligations are set by the government to ensure transparency and compliance with tax laws. Failure to meet these obligations can result in penalties and legal consequences.

One of the main reporting obligations for entities with an ABN is the requirement to register for goods and services tax (GST). This applies to businesses that have an annual turnover of $75,000 or more. GST is a tax on the supply of goods and services in Australia and it is important for businesses to collect and remit this tax to the Australian Taxation Office (ATO).

In addition to GST registration, entities with an ABN also have reporting obligations related to their business structure. For example, if you operate as a sole trader, you must report your business income and expenses on your individual tax return. Similarly, if you have a partnership, trust, or proprietary limited company, you must provide annual reports and financial statements to the Australian Securities and Investments Commission (ASIC).

Another reporting obligation for entities with an ABN is the requirement to update their registration details. It is important to keep your ABN details up to date, including any changes to your business name, address, or contact information. This ensures that government agencies, customers, and suppliers can easily identify and communicate with your business.

To meet your reporting obligations, it is important to understand the specific requirements for your business structure and industry. The ATO provides resources and guidance to help businesses comply with their reporting obligations. It is also a good idea to seek professional advice from a tax accountant or business advisor to ensure that you are meeting all of your obligations.

Changes to ABN Details

If your business entity undergoes any changes to its details after registering for an Australian Business Number (ABN), it is important to update the information in the ABN register. This ensures that accurate and up-to-date information is available for government and regulatory purposes.

When making changes to your ABN details, it is crucial to notify the Australian Securities and Investments Commission (ASIC). This applies to all types of entities, including sole traders, partnerships, trusts, proprietary companies, and other business structures.

Some of the changes that need to be reported include changes to the legal name of the entity, changes to the business address, changes to the nature of the business activities, changes to the Australian Company Number (ACN) or Australian Registered Body Number (ARBN), changes to the authorized representatives, and changes to the business structure.

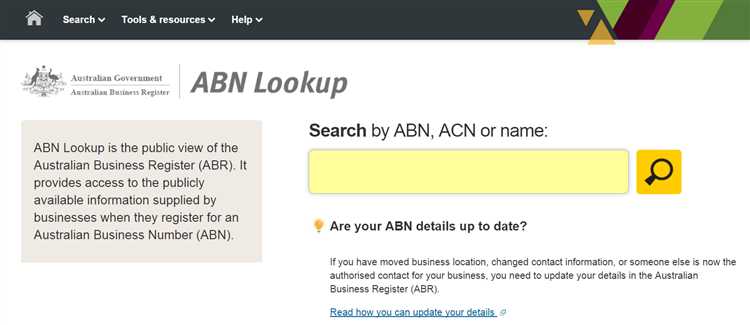

To update your ABN details, you can do so using the Australian Business Register (ABR) online portal. This platform allows you to make changes and updates to your ABN information easily and efficiently. It is important to ensure that the registered details are accurate and always reflect the current state of your business.

Failing to update your ABN details can have serious implications, including potential penalties and difficulties with taxation. Therefore, it is highly recommended to keep your ABN information up to date and notify the relevant authorities of any changes to your business entity.

ABN Renewal

ABN Renewal is the process of renewing or updating your Australian Business Number (ABN). The ABN is a unique identifier issued by the Australian government to entities such as individuals, companies, partnerships, and trusts. It is used for identification and registration purposes.

The ABN Renewal process is overseen by the Australian Securities and Investments Commission (ASIC). It is important to renew your ABN to ensure that your business remains legally recognized and compliant with Australian tax and regulatory requirements.

During the ABN Renewal process, you may need to update your business details, such as your business name, address, or legal structure. This is important to ensure accurate and up-to-date information is registered with the government.

If you are an individual or a sole trader, you can renew your ABN online through the Australian Business Register (ABR) website. Companies, partnerships, and trusts can also renew their ABN online by providing relevant documentation and information to ASIC.

Renewing your ABN also ensures that your business maintains its links with other government registrations, such as the Goods and Services Tax (GST) or Australian Company Number (ACN). It is important to note that the ABN does not replace these registrations, but rather works in conjunction with them.

How to Renew ABN

Renewing your ABN (Australian Business Number) registration is an important step in maintaining your business's legal compliance. The Australian Securities and Investments Commission (ASIC) is the government authority responsible for the registration of ABNs.

There are different types of entities that can register for an ABN, such as individuals, sole traders, companies (ACN), partnerships, trusts, and government entities. Each entity type has its own requirements and eligibility criteria.

To renew your ABN, you will need your ABN number and other identification details. You can renew your ABN online through the Australian Business Register (ABR) website. It is important to ensure that all the information provided during the renewal process is accurate and up to date.

During the renewal process, you may need to update your business details, such as changes in your business structure, contact information, or GST (Goods and Services Tax) registration. If you are a sole trader or a partnership, you may need to provide additional information, such as your name and tax file number.

If your business is a proprietary company with an Australian Company Number (ACN), you will need to lodge your annual review with ASIC to maintain your ABN registration. This review includes updating your company details, such as changes in officeholders or shareholders.

It is important to renew your ABN before the expiry date to ensure that your business remains registered and compliant with the Australian tax laws. Failure to renew your ABN may result in the cancellation of your ABN and potential penalties.

In conclusion, renewing your ABN is a necessary process to maintain your business's registration and compliance in Australia. It can be done online through the ABR website, and it is important to provide accurate and up-to-date information during the renewal process.

Renewal Process

Renewing an ABN (Australian Business Number) is an important process for all businesses operating in Australia. The ABN is a unique 11-digit number used for tax and other business purposes.

Every business entity, whether it is a sole trader, partnership, company, proprietary, or trust, must register for an ABN with the Australian Government. The ABN serves as a unique identification number for GST (Goods and Services Tax) purposes.

The renewal process for an ABN involves updating the information associated with the business. This includes providing details about the business structure, such as whether it is a sole trader, partnership, company, proprietary, or trust entity. Additionally, the renewal process may require providing the Australian Company Number (ACN) or the Australian Registered Body Number (ARBN) if applicable.

During the renewal process, businesses must also update their contact information, including the business address, phone number, and email address. This ensures that the Australian government can maintain accurate records and effectively communicate with businesses regarding their ABN status.

It is important for businesses to be proactive in renewing their ABN before the expiration date, as failing to do so can result in the cancellation of the ABN. If the ABN is canceled, the business may need to go through the registration process again, which can be time-consuming and may incur additional fees.

To facilitate the renewal process, the Australian government provides online registration services through the Australian Business Register (ABR) website. This allows businesses to easily update their ABN information and ensure compliance with the government's requirements.

In summary, the renewal process for an ABN in Australia is a crucial step for every business entity. It involves updating the business information, contact details, and ensuring compliance with government regulations. By staying up to date with their ABN renewal, businesses can continue to operate smoothly and avoid any unnecessary complications.