A user ID is a unique identifier that is assigned to an individual user of a bank. It is a combination of letters, numbers, or both, and serves as a virtual identity for the user within the bank's system. The user ID allows the bank to distinguish and authenticate the user, ensuring that only authorized individuals have access to their accounts and financial information.

Having a user ID is crucial for accessing online banking services. It acts as a key that unlocks the user's account, granting them access to a variety of banking features and functionalities. With a user ID, individuals can securely log in to their accounts, view their balances, transfer funds, pay bills, and perform other banking transactions from the comfort of their own devices.

Furthermore, a user ID plays a vital role in safeguarding the user's financial information. By requiring a unique identifier for each user, the bank can ensure that only authorized individuals have access to sensitive data. This helps prevent fraudulent activities and unauthorized access to the user's accounts, providing an added layer of security and peace of mind.

What is a bank user ID and why is it important?

A bank user ID is a unique identifier that is assigned to an individual when they create an account with a bank. It serves as a username or login credential for accessing online banking services. The user ID is typically a combination of letters, numbers, or a combination of both, chosen by the user during the registration process.

The bank user ID is an important piece of information as it helps the bank verify the identity of the individual accessing their account online. It acts as a security measure to prevent unauthorized access to the account and protect the customer's financial information.

When logging into their online banking account, the user will need to enter their user ID along with a password or other authentication credentials. This two-step verification process helps ensure that the person accessing the account is the authorized user. It adds an extra layer of security to protect against identity theft and fraudulent activities.

In addition, the bank user ID allows the customer to easily manage their banking transactions and access various online banking services, such as checking their account balance, transferring funds, paying bills, and viewing transaction history. It provides a convenient way for users to interact with their bank and carry out financial activities from the comfort of their own home or on the go.

Overall, the bank user ID plays a crucial role in securing online banking services and facilitating convenient access to account information and transactions. It is important for users to keep their user ID confidential and choose a strong password to further enhance the security of their online banking experience.

Understanding the concept of a user ID

A user ID is a unique identifier assigned to an individual user of a bank's online banking system. It serves as a way to authenticate and verify the identity of the user when accessing their bank account online. The user ID is usually created by the user themselves during the registration process.

The user ID plays a crucial role in ensuring the security and privacy of a user's financial information. By using a unique user ID, banks can authenticate the user and grant them access to their account, while keeping unauthorized individuals from gaining access.

When logging into an online banking system, the user ID is one of the pieces of information that the user must enter, along with their password. This two-factor authentication process adds an extra layer of security by requiring both something the user knows (password) and something the user has (user ID).

It is important for users to choose a strong and secure user ID to protect their account from unauthorized access. This includes avoiding using easily guessable information such as birthdates or names, and using a combination of uppercase and lowercase letters, numbers, and special characters.

Overall, the user ID is an essential component of online banking security, allowing banks to verify the identity of their users and protect their financial information. By understanding the concept of a user ID and taking steps to create a strong and secure one, users can ensure a higher level of safety when managing their finances online.

Definition of a user ID

A user ID, also known as a username, is a unique identifier that is used to distinguish one user from another in a bank's system. It allows the bank to identify and authenticate the individual accessing their online banking services.

When a user creates an account with a bank, they are assigned a user ID, which may be selected by the user or generated by the bank. This user ID is often required in combination with a password to log in to the bank's online banking portal or mobile app.

The user ID serves as a personalized access code that allows the user to securely access their bank accounts and perform various transactions, such as checking account balances, making transfers, paying bills, and viewing transaction history.

It is important for users to keep their user ID private and not share it with anyone else. This ensures that only authorized individuals can access their bank accounts and helps prevent unauthorized access or fraudulent activities.

In some cases, banks may require additional security measures, such as two-factor authentication, to further protect the user's account and enhance the security of their online banking experience.

How a user ID is created

A user ID is a unique identifier that is assigned to each customer of a bank. It is created to ensure the security and confidentiality of the customer's banking information. When a customer opens an account with a bank, they will be asked to provide certain personal information such as their name, address, and contact details.

This information is used by the bank to create a unique user ID for the customer. The bank may also use additional security measures such as creating a password or PIN to further protect the customer's account.

The process of creating a user ID involves several steps. First, the bank will verify the customer's identity using the information provided. This may include checking the customer's identification documents such as a passport or driver's license.

Once the customer's identity has been verified, the bank will generate a unique user ID for the customer. This ID will be linked to the customer's account and will be used to access their online banking services.

It is important for customers to keep their user ID confidential and not share it with anyone else. By doing so, they can help to ensure the security of their banking information and protect themselves against fraud or unauthorized access to their account.

Unique characteristics of a user ID

A user ID, also known as a username or login ID, is a unique identifier that distinguishes one user from another on a system or platform. It is an essential component of user authentication and access control systems, especially in the banking industry.

Identification: The primary purpose of a user ID is to identify an individual user within a system. It allows the system to track and manage user-specific information, such as account details and transaction history, ensuring accurate and personalized user experiences.

Security: A user ID plays a crucial role in ensuring the security of a user's personal and financial information. By requiring a unique identifier, banks can prevent unauthorized access to accounts and reduce the risk of identity theft or fraud. User IDs are often paired with strong passwords or additional security measures to enhance protection.

Uniqueness: Each user ID is distinct, meaning that no two users can have the same identifier within a given system. This uniqueness is essential for maintaining data integrity and preventing conflicts that could arise if multiple users were assigned the same user ID.

Accessibility: Along with a password, a user ID grants access to a user's account and services. Banks usually provide user IDs that are easy to remember and enter, allowing customers to access their accounts quickly and conveniently while still maintaining security.

Convenience: User IDs often offer users the convenience of accessing their accounts from various devices and platforms. With the same user ID, individuals can log in to their bank accounts using a web browser, mobile app, or through other channels, making banking more accessible and user-friendly.

Purpose and importance of a user ID for a bank

The user ID is a unique identifier that allows individuals to access their personal bank accounts and perform various banking activities. It is a crucial component of online banking and ensures the security and privacy of a customer's financial information.

The primary purpose of a user ID is to authenticate the identity of the user and grant them access to their bank account. This helps prevent unauthorized individuals from accessing sensitive financial data and conducting fraudulent transactions.

When logging in to their online banking account, users are typically required to provide their user ID along with a password or other security measures. This two-factor authentication adds an extra layer of protection to ensure that only authorized individuals can access the account.

In addition to providing access to accounts, a user ID also enables banks to track and monitor their customers' activities. This helps detect any suspicious or unusual transactions, providing an early warning system for potentially fraudulent activities.

The user ID is also important for providing personalized services to customers. It allows banks to customize the online banking experience and provide targeted offers and promotions based on individual preferences and transaction history.

In summary, a user ID is essential for the security, privacy, and convenience of online banking. It verifies the identity of the user, protects against unauthorized access, enables monitoring of activities, and facilitates personalized services for customers.

Ensuring security and authentication

When it comes to banking, security and authentication are of utmost importance. Banks handle sensitive and confidential information, such as personal and financial data, which makes them an attractive target for cybercriminals. To protect their customers and their own reputation, banks have implemented various security measures, including the use of user IDs.

A user ID is a unique identifier that allows a bank to verify and authenticate the identity of its customers. It serves as a username or login credential that grants access to a user's account. Each user is assigned a unique ID that is linked to their specific account and is used in combination with a password or other authentication factors, such as fingerprint or facial recognition, to ensure only authorized users can access their accounts.

What makes the user ID crucial for the security of online banking is its role in the authentication process. When a user logs in to their bank's online platform using their user ID, the bank's system verifies if the entered ID matches the one stored in its database. If it does, the user is granted access to their account. If not, the system denies the login attempt, preventing unauthorized access.

Additionally, the user ID also helps banks keep track of their customers' activities and transactions. By associating each transaction with a specific user ID, banks can monitor and detect any suspicious or unusual activities. This allows them to quickly respond to potential security breaches and protect their customers' funds and sensitive information.

In conclusion, the user ID is a vital component of ensuring the security and authentication in online banking. It serves as a unique identifier that verifies and authenticates the identity of users, enabling banks to protect their customers' accounts and data. By implementing user IDs, banks can enhance security measures and provide their customers with a safe and reliable online banking experience.

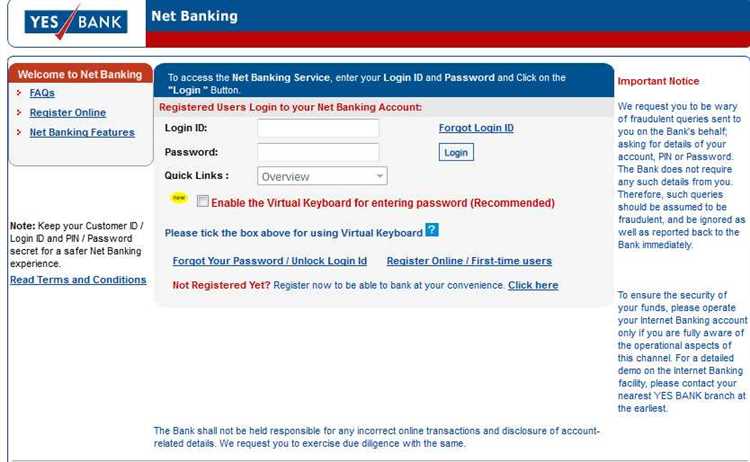

Access to online banking services

Access to online banking services allows customers to manage their bank accounts and conduct various financial transactions from the convenience of their own homes or on the go. Online banking provides a convenient and efficient way for users to access their accounts and perform a wide range of actions without visiting a physical bank branch.

When using online banking services, users typically need to create a user ID and password to log into their bank's online portal. The user ID is a unique identifier that helps the bank verify the identity of the customer and ensure the security of their account. It acts as a digital key to access the online banking platform, allowing users to view their account balance, make transfers, pay bills, and more.

The user ID is an essential component of online banking security. It helps protect against unauthorized access to a user's account by requiring them to provide a unique identifier along with a password. By using a strong and secure user ID, customers can help ensure that their personal and financial information remains protected from potential hackers or cybercriminals.

In addition to the user ID, banks may also implement additional security measures, such as two-factor authentication, to further protect their customers' accounts. This could involve using a separate authentication method, such as a mobile device or biometric verification, to confirm the user's identity before granting access to their online banking services.

Overall, having a user ID for online banking is important for both the bank and the customer. It allows users to securely access their accounts and perform financial transactions with ease, while also providing banks with a reliable means of ensuring the security and integrity of their online banking platforms.

Tracking and monitoring transactions

When it comes to banking, one of the most important aspects is tracking and monitoring transactions. This is where a user ID plays a crucial role. A user ID is a unique identification that is assigned to each individual banking customer. It serves as a way for the bank to distinguish one customer from another.

With a user ID, the bank is able to keep a record of every transaction that a customer makes. This includes deposits, withdrawals, transfers, and any other financial activity. The bank can then use this information to monitor the customer's account and ensure that all transactions are legitimate and authorized by the account holder.

Aside from monitoring transactions for security purposes, tracking transactions also allows the bank to provide better customer service. For example, if a customer has a question or concern about a specific transaction, the bank can easily locate the transaction using the customer's user ID and provide the necessary assistance. This saves both the customer and the bank time and effort.

In addition, tracking and monitoring transactions can help detect and prevent fraudulent activities. By keeping a close eye on the transactions made using a user ID, the bank can identify any suspicious or unauthorized transactions and take immediate action to protect the customer's account and finances. This level of monitoring is crucial in today's digital age where cybersecurity threats are becoming increasingly sophisticated.

In summary, a user ID is a vital tool for tracking and monitoring transactions in a bank. It allows the bank to keep a detailed record of financial activities, provide efficient customer service, and enhance security measures against fraud. Without a user ID, it would be much more challenging for a bank to perform these essential functions.

Protecting your user ID

Your user ID is a unique identifier that is used to access your bank account online. It plays a crucial role in maintaining the security of your account and protecting your personal information.

One of the most important things you can do to protect your user ID is to keep it confidential. Avoid sharing your user ID with anyone, including family members, friends, or even bank employees. Remember, your user ID is like a password and should be kept private at all times.

It is also recommended to create a strong and unique user ID. Avoid using common combinations such as your name, date of birth, or any other easily guessable information. Instead, consider using a combination of letters, numbers, and special characters to make it more difficult for unauthorized individuals to guess or crack.

Furthermore, be cautious of phishing attempts that aim to trick you into revealing your user ID. Always double-check the website address before entering your user ID to ensure you are on the official bank website. Banks will never ask you to provide your user ID through email or phone calls, so be wary of any such requests.

Regularly monitoring your account for any suspicious activity is also a good practice to protect your user ID. If you notice any unauthorized transactions or any signs of potential security breaches, contact your bank immediately to report the issue and take necessary actions.

In summary, protecting your user ID is of utmost importance to maintain the security of your bank account and personal information. By keeping it confidential, creating a strong user ID, being cautious of phishing attempts, and monitoring your account regularly, you can minimize the risk of unauthorized access and ensure the safety of your online banking experience.

Importance of a strong password

A strong password is essential for protecting your personal information and online accounts. It is the first line of defense against unauthorized access and potential hackers. A strong password is a combination of unique characters, including letters (both uppercase and lowercase), numbers, and special symbols. It should not be easily guessable or contain personal information such as your name or date of birth.

What makes a strong password even more important is the increasing number of data breaches and identity theft incidents. Hackers use sophisticated techniques to crack weak passwords and gain unauthorized access to user accounts. Once they have access, they can steal sensitive information, perform fraudulent activities, or even impersonate the user.

A user ID is another important element of online security. It is a unique identifier assigned to each user and is used to log in to their accounts. A strong password should always be paired with a unique user ID to provide an added layer of protection. This prevents unauthorized individuals from guessing both the user ID and password combination to gain unauthorized access.

Creating a strong password can be challenging, but it's worth the effort to protect your personal and financial information. Using a mix of uppercase and lowercase letters, numbers, and special characters can greatly increase the complexity of a password. It is also important to avoid using common words, phrases, or patterns. Additionally, regularly updating passwords and avoiding reuse across multiple accounts further enhances online security.

In summary, a strong password is crucial for safeguarding your online accounts and personal information. It should be unique, complex, and not easily guessable. Pairing a strong password with a unique user ID adds an extra layer of protection against unauthorized access. Taking the time to create and regularly update strong passwords can help ensure the security of your online presence.

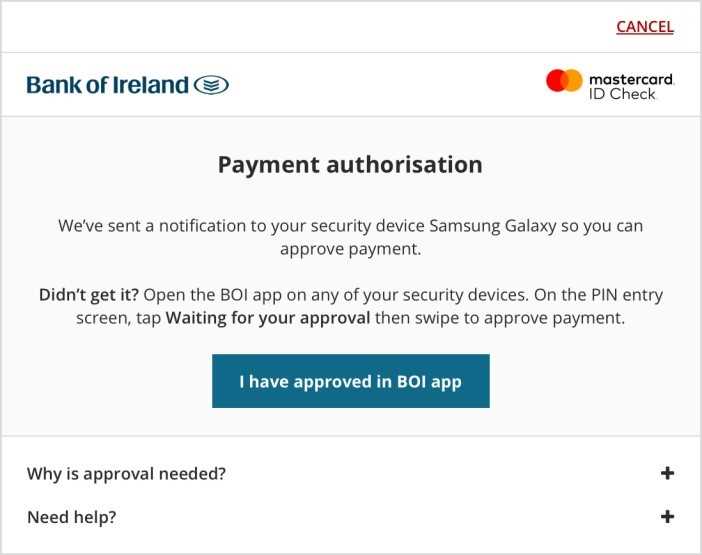

Two-factor authentication

Two-factor authentication is an additional layer of security that helps protect user accounts. It requires users to provide two different types of identification to verify their identity.

The first factor is usually something the user knows, such as a password or a PIN. This is the user ID, a unique identifier that is associated with their account. The user ID is important because it allows the bank to differentiate between different users and ensure that the correct person is accessing the account.

The second factor is typically something the user has, such as a mobile device or a security token. This adds an extra level of security as it requires the user to physically possess a specific item in order to access their account.

When logging into a bank account, the user will first enter their user ID and password, which serves as the first factor. Then, they will be prompted to provide the second factor, such as a unique code sent to their mobile device. This combination of factors makes it more difficult for unauthorized users to gain access to the account.

By implementing two-factor authentication, banks can greatly enhance the security of their customers' accounts and protect against identity theft and fraud. It provides an additional layer of defense against hackers and unauthorized access, ensuring that only the authorized user can access their financial information.

Avoiding sharing user IDs

When it comes to banking, user IDs play a crucial role in maintaining the security of your account. A user ID is a unique identifier that is assigned to each individual user, allowing them to access their bank account online.

It is important to avoid sharing your user ID with anyone, including friends, family members, or even bank employees. Sharing your user ID can put your account at risk and compromise the security of your personal information.

One of the main reasons to avoid sharing your user ID is to ensure that you are the only one who has access to your bank account. By keeping your user ID private, you can prevent unauthorized individuals from logging into your account and potentially making unauthorized transactions.

Sharing your user ID can also make it difficult to track and trace any suspicious activities on your bank account. If multiple individuals have access to the same user ID, it can be challenging to identify who performed certain transactions or made specific changes to your account.

To safeguard your account, it is recommended to create a strong and unique user ID that is not easily guessable. Avoid using personal information, such as your name or date of birth, as part of your user ID. Instead, opt for a combination of letters, numbers, and symbols to make it more secure.

Furthermore, it is advisable to regularly monitor your bank account for any unusual activities or transactions. Reporting any suspicious activities to your bank immediately can help prevent further unauthorized access and protect your financial assets.

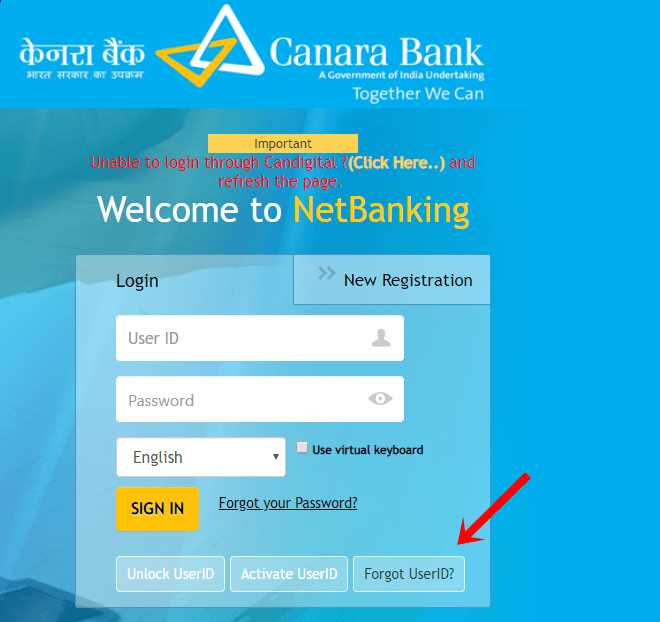

Recovering a lost user ID

When you forget or misplace your user ID for your bank account, it can be a stressful situation. However, there are steps you can take to recover your lost user ID and regain access to your account.

The first thing you should do is contact your bank's customer support. They will be able to assist you in recovering your user ID and provide guidance on the necessary steps. Be prepared to provide personal information to verify your identity, such as your full name, address, and any other relevant details.

Another option is to check any emails or correspondence from your bank. Your user ID may be mentioned in past emails or documents related to your account. Be sure to search your inbox, spam folder, and any other folders where you store important information.

If you cannot find your user ID through these methods, consider checking any physical documents you may have received from your bank, such as account statements or welcome letters. These documents often contain important account information, including the user ID.

In some cases, you may also be able to recover your user ID by logging into your bank's online banking platform. Look for an option to recover a forgotten user ID or password and follow the prompts. This may involve answering security questions or receiving a temporary user ID via email or text message.

If all else fails, visit your local bank branch and speak with a representative. They will be able to assist you in person and provide the necessary help and support to recover your lost user ID.

Contacting the bank for assistance

If you encounter any issues or have questions regarding your bank account, it is important to contact the bank for assistance. The bank's customer service team can provide guidance and support to help resolve any concerns you may have.

When reaching out to the bank, be prepared to provide your user ID or account number. This unique identifier allows the bank to access your account information and ensure they are assisting the correct customer. It is important to keep your user ID secure and not share it with anyone else.

Before contacting the bank, it is helpful to have a clear understanding of what the issue or question is. This will allow the bank representative to better assist you and provide a solution. If possible, write down any relevant details or questions before making the call or sending an email.

Most banks offer multiple channels for contacting their customer service team, including phone, email, and live chat. Check your bank's website or mobile app for contact information and availability. It is always recommended to contact the bank directly rather than relying on third-party sources for assistance.

When interacting with the bank's customer service team, it is important to remain patient and polite. Clearly explain your issue or question and provide any necessary details. Follow any instructions given by the bank representative and keep track of any case or reference numbers provided for future reference.

Contacting the bank for assistance is a valuable step in resolving any issues or concerns you may have with your account. The bank's customer service team is there to provide support and ensure you have a positive banking experience.

Verification process for user ID recovery

To ensure the security of user accounts, banks have implemented a verification process for user ID recovery. This process is designed to confirm the identity of the user and protect confidential financial information. It typically involves several steps to ensure that only authorized individuals can retrieve their user ID.

Step 1: Request for user ID recovery

The first step in the verification process is to submit a request for user ID recovery. This can usually be done through the bank's website or by contacting their customer service. The user will be required to provide personal information such as their full name, date of birth, and any supporting identification documents.

Step 2: Verification of personal information

Once the request is submitted, the bank will proceed with the verification of the provided personal information. This may include cross-referencing the details with their records and conducting further checks to ensure the accuracy of the information. This step is crucial in confirming the identity of the user.

Step 3: Security questions or additional verification

Depending on the bank's policies, the user may be asked to answer security questions or provide additional verification. These security measures are in place to add an extra layer of protection and prevent unauthorized access. The user may need to provide information about their account, recent transactions, or other sensitive details to verify their identity.

Step 4: Issuance of user ID recovery

Once the verification process is completed, and the user's identity is confirmed, the bank will issue the user ID recovery. This may be sent through email or via mail depending on the bank's procedures. The user can then use the recovered user ID to access their account and perform necessary banking operations.

Overall, the verification process for user ID recovery is essential in ensuring the security and privacy of bank customers. It helps prevent unauthorized access to user accounts and provides a safe and reliable way for users to regain access to their financial information.